Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need all these questioned filled out for my assignment: FSA 4 : Ratios: accounts receivable turnover and days sales in receivables Ratio: accounts receivable

I need all these questioned filled out for my assignment: FSA : Ratios: accounts receivable turnover and days sales in receivables

Ratio: accounts receivable turnover

You will use the NIKE financial statements in appendix C for this ratio.

The formula for accounts receivable turnover is

Sales average accounts receivable

Nike uses the account name revenues for their sales.

Average accounts receivable is the sum of the beginning and ending accounts receivable added together and then divided by The beginning accounts receivable for is the ending accounts receivable from The beginning accounts receivable for is Round the average accounts receivable to the nearest tenth before dividing into the sales. Then round the ratio to the nearest tenth.

This ratio measures the number of times accounts receivable is turned over during the year. The higher the number, the more efficiently the company is collecting the accounts receivable and managing its accounts receivable well.

Comment on the accounts receivable turnover

Ratio: # of days sale in receivables

You will use the NIKE financial statements in appendix C for this ratio. They are also located under the FSA module under the content tab in Cobra.

The formula for number of days sales in receivables is:

Average accounts receivable

Average daily sales

Average accounts receivable is the sum of the beginning and ending accounts receivable added together and then divided by The beginning accounts receivable for is the ending accounts receivable from The beginning accounts receivable for is Round the average accounts receivable to the nearest tenth.

The average daily sales is equal to sales Revenues Round the average daily sales to the nearest tenth before dividing into the average accounts receivable. Then round the ratio to the nearest tenth

ratio

ratio

This ratio is an estimate of the number of days the receivables have been outstanding. The ratio is compared to the credit terms to see how well the company is doing with collection. If the terms are net you would want this number to be close to

Comment on NIKEs accounts receivable collection and management between the two years.

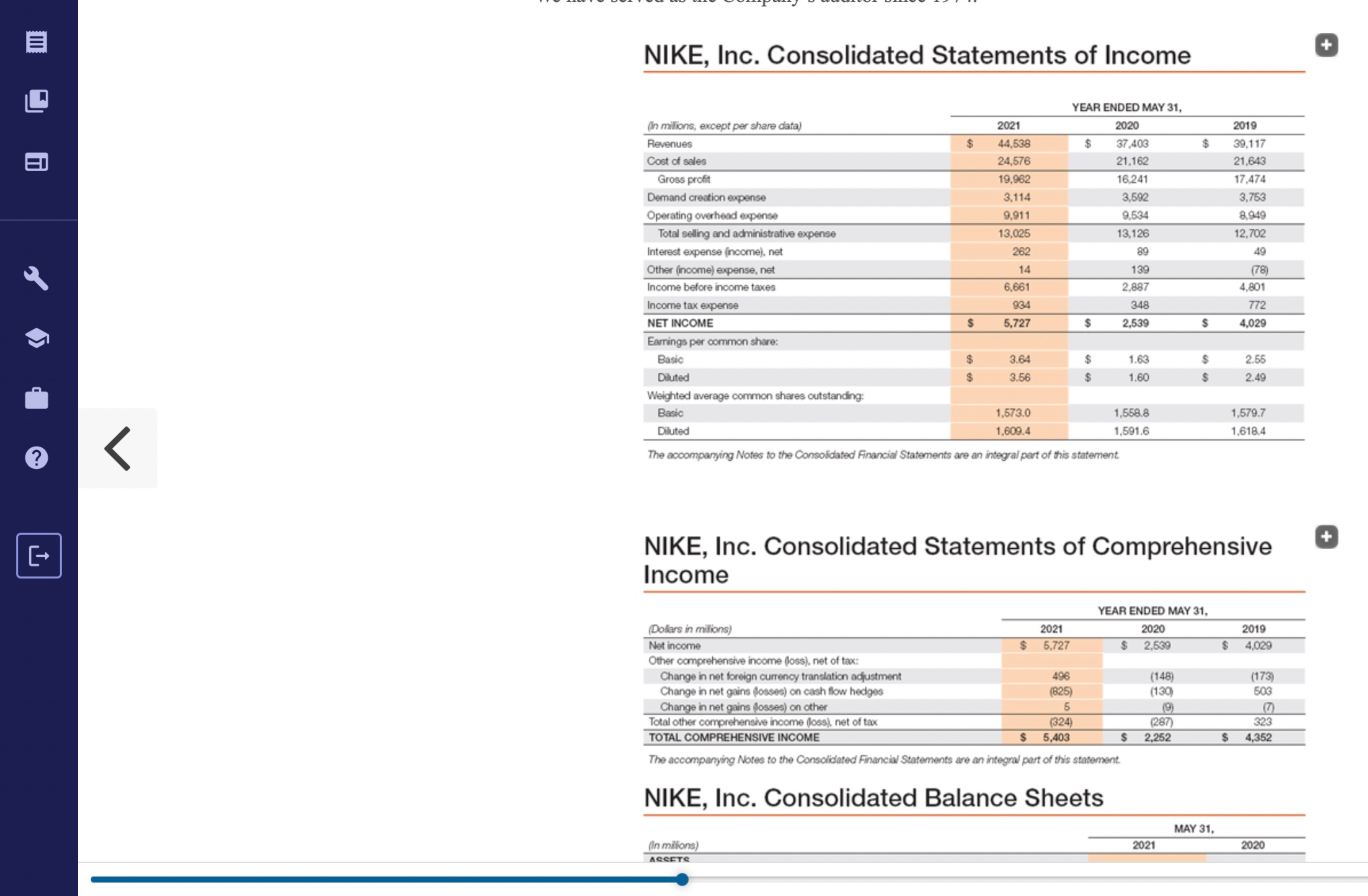

NIKE, Inc. Consolidated Statements of Income

YEAR ENDED MAY

The accomparying Notes to the Consoldated Financial Statements are an integra pert of this statement

NIKE, Inc. Consolidated Statements of Comprehensive

Income

The accompanying Notes to the Consolidated Financial Statements are an integral pert of this statement.

NIKE, Inc. Consolidated Balance Sheets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started