Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need also : explain and a way of you your solutuion and how you are solve the question Question 1 On January 1, 2019,

i need also : explain and a way of you your solutuion and how you are solve the question

i need also : explain and a way of you your solutuion and how you are solve the question

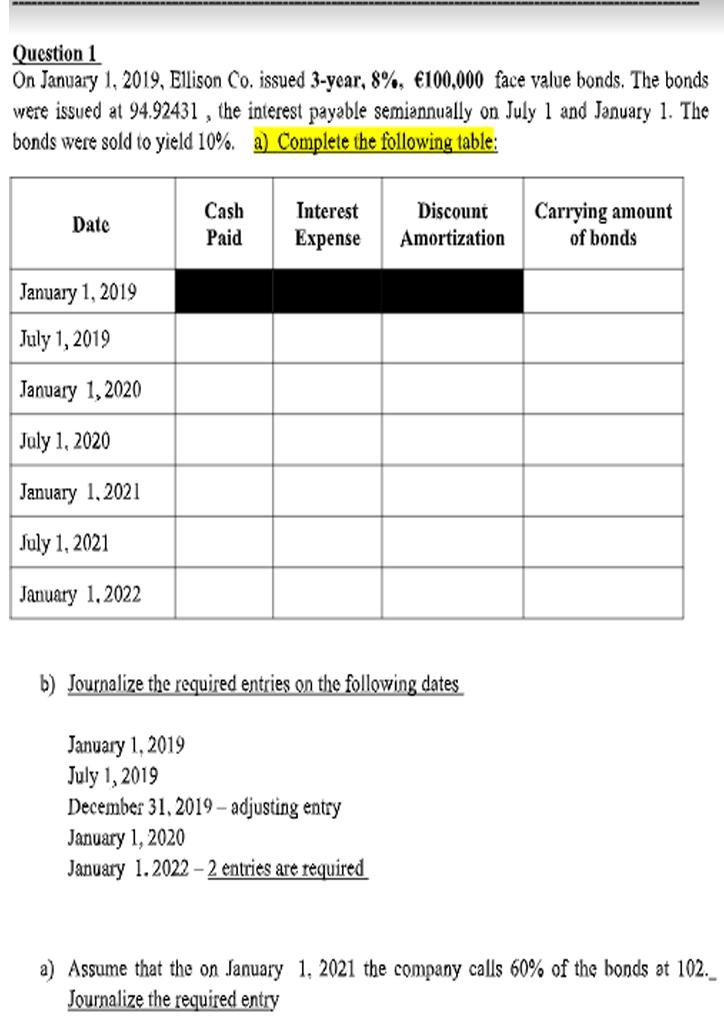

Question 1 On January 1, 2019, Ellison Co. issued 3-year, 8%, 100,000 face value bonds. The bonds were issued at 94.92431, the interest payable semiannually on July 1 and January 1. The bonds were sold to yield 10%. a) Complete the following table: Date January 1, 2019 July 1, 2019 January 1, 2020 July 1, 2020 January 1, 2021 July 1, 2021 January 1.2022 Cash Paid Interest Discount Expense Amortization b) Journalize the required entries on the following dates January 1, 2019 July 1, 2019 December 31, 2019-adjusting entry January 1, 2020 January 1.2022-2 entries are required Carrying amount of bonds a) Assume that the on January 1, 2021 the company calls 60% of the bonds at 102._ Journalize the required entry

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Q1 As the bonds were issued at 9492431 the amount received was 100000 X 9492431 100 94924...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started