Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need an actual Cash Flow Statement. if the 7 requirements are needed to answer the wuestion then i need that as well but mostly

I need an actual Cash Flow Statement.

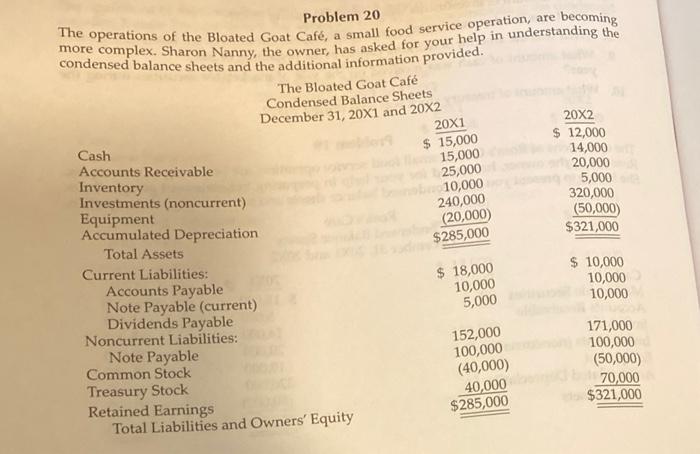

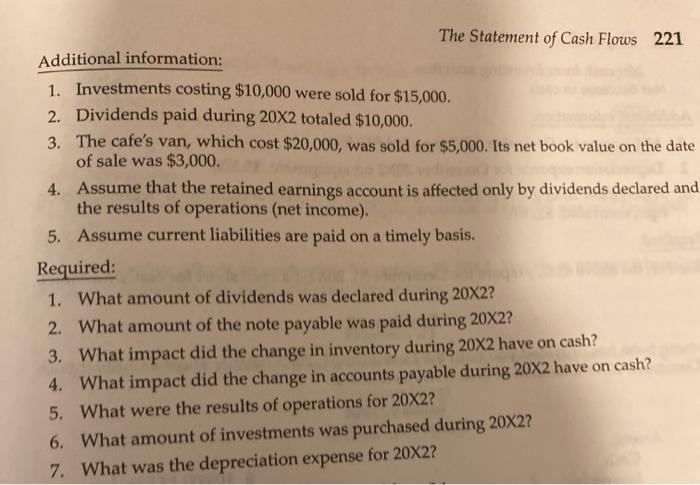

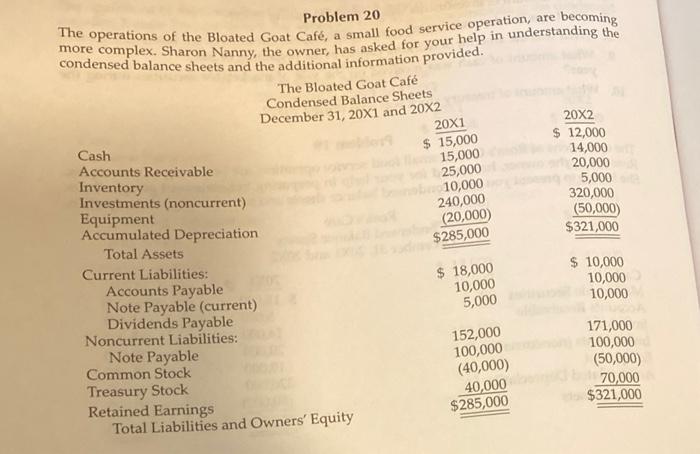

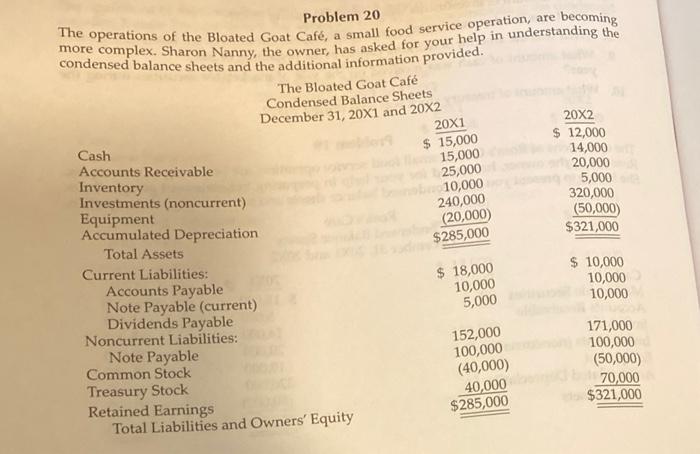

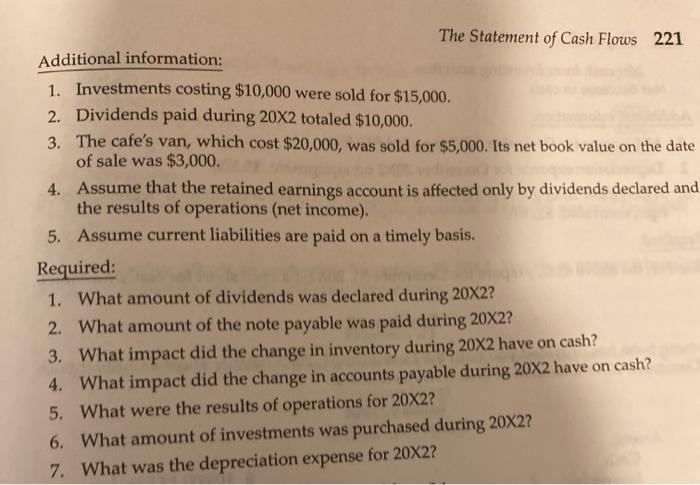

if the 7 requirements are needed to answer the wuestion then i need that as well but mostly the cashflow statement 20X1 $ 15,000 Problem 20 e becoming The operations of the Bloated Goat Caf, a small food service operation, are more complex. Sharon Nanny, the owner, has asked for your help in understanding the condensed balance sheets and the additional information provided. The Bloated Goat Caf Condensed Balance Sheets December 31, 20X1 and 20X2 20X2 $ 12,000 Cash 15,000 14,000 Accounts Receivable 20,000 Inventory 5,000 Investments (noncurrent) 320,000 Equipment (50,000) Accumulated Depreciation $321,000 Total Assets Current Liabilities: $ 10,000 Accounts Payable 10,000 10,000 Note Payable (current) Dividends Payable 171,000 Noncurrent Liabilities: 100,000 Note Payable Common Stock (50,000) Treasury Stock 70,000 $321,000 Retained Earnings Total Liabilities and Owners' Equity 25,000 10,000 240,000 (20,000) $285,000 $ 18,000 10,000 5,000 152,000 100,000 (40,000) 40,000 $285,000 The Statement of Cash Flows 221 Additional information: 1. Investments costing $10,000 were sold for $15,000. 2. Dividends paid during 20x2 totaled $10,000. 3. The cafe's van, which cost $20,000, was sold for $5,000. Its net book value on the date of sale was $3,000. 4. Assume that the retained earnings account is affected only by dividends declared and the results of operations (net income). 5. Assume current liabilities are paid on a timely basis. Required: 1. What amount of dividends was declared during 20X2? 2. What amount of the note payable was paid during 20X2? 3. What impact did the change in inventory during 20X2 have on cash? 4. What impact did the change in accounts payable during 20X2 have on cash? 5. What were the results of operations for 20X2? 6. What amount of investments was purchased during 20X2? 7. What was the depreciation expense for 20X2

if the 7 requirements are needed to answer the wuestion then i need that as well but mostly the cashflow statement 20X1 $ 15,000 Problem 20 e becoming The operations of the Bloated Goat Caf, a small food service operation, are more complex. Sharon Nanny, the owner, has asked for your help in understanding the condensed balance sheets and the additional information provided. The Bloated Goat Caf Condensed Balance Sheets December 31, 20X1 and 20X2 20X2 $ 12,000 Cash 15,000 14,000 Accounts Receivable 20,000 Inventory 5,000 Investments (noncurrent) 320,000 Equipment (50,000) Accumulated Depreciation $321,000 Total Assets Current Liabilities: $ 10,000 Accounts Payable 10,000 10,000 Note Payable (current) Dividends Payable 171,000 Noncurrent Liabilities: 100,000 Note Payable Common Stock (50,000) Treasury Stock 70,000 $321,000 Retained Earnings Total Liabilities and Owners' Equity 25,000 10,000 240,000 (20,000) $285,000 $ 18,000 10,000 5,000 152,000 100,000 (40,000) 40,000 $285,000 The Statement of Cash Flows 221 Additional information: 1. Investments costing $10,000 were sold for $15,000. 2. Dividends paid during 20x2 totaled $10,000. 3. The cafe's van, which cost $20,000, was sold for $5,000. Its net book value on the date of sale was $3,000. 4. Assume that the retained earnings account is affected only by dividends declared and the results of operations (net income). 5. Assume current liabilities are paid on a timely basis. Required: 1. What amount of dividends was declared during 20X2? 2. What amount of the note payable was paid during 20X2? 3. What impact did the change in inventory during 20X2 have on cash? 4. What impact did the change in accounts payable during 20X2 have on cash? 5. What were the results of operations for 20X2? 6. What amount of investments was purchased during 20X2? 7. What was the depreciation expense for 20X2

I need an actual Cash Flow Statement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started