Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need an answer for each question and I know what's wrong with each choice. 1. If revenues are $270,000, expenses are $220,000 and dividends

I need an answer for each question and I know what's wrong with each choice.

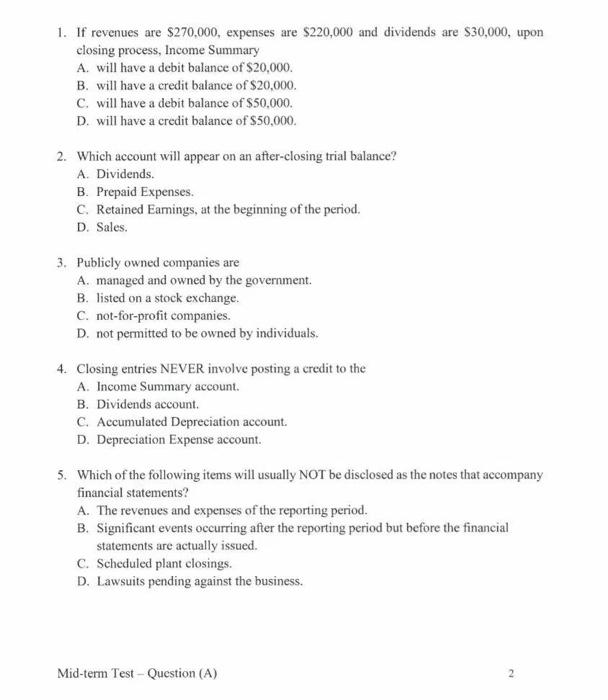

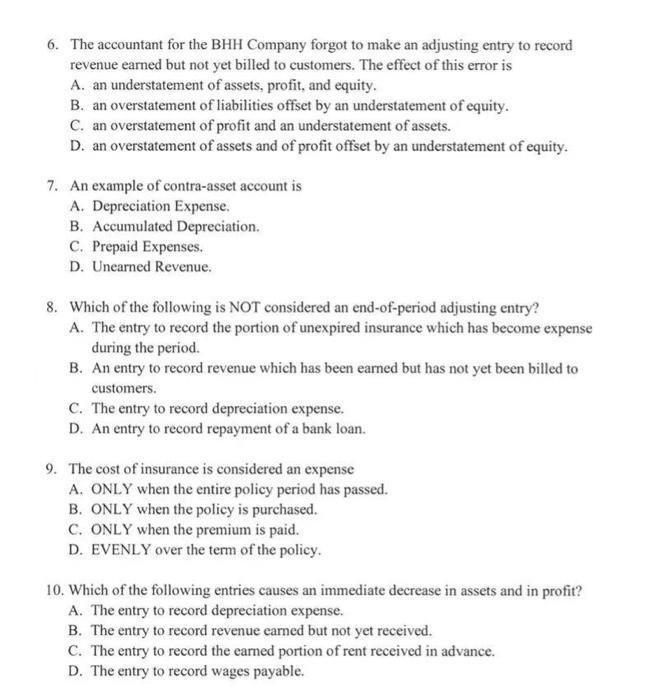

1. If revenues are $270,000, expenses are $220,000 and dividends are $30,000, upon closing process, Income Summary A. will have a debit balance of $20,000. B. will have a credit balance of $20,000. C. will have a debit balance of $50,000. D. will have a credit balance of $50,000. 2. Which account will appear on an after-closing trial balance? A. Dividends. B. Prepaid Expenses. C. Retained Eamings, at the beginning of the period. D. Sales. 3. Publicly owned companies are A. managed and owned by the government. B. listed on a stock exchange. C. not-for-profit companies. D. not permitted to be owned by individuals. 4. Closing entries NEVER involve posting a credit to the A. Income Summary account. B. Dividends account. C. Accumulated Depreciation account. D. Depreciation Expense account. 5. Which of the following items will usually NOT be disclosed as the notes that accompany financial statements? A. The revenues and expenses of the reporting period. B. Significant events occurring after the reporting period but before the financial statements are actually issued. C. Scheduled plant closings. D. Lawsuits pending against the business. 6. The accountant for the BHH Company forgot to make an adjusting entry to record revenue earned but not yet billed to customers. The effect of this error is A. an understatement of assets, profit, and equity. B. an overstatement of liabilities offset by an understatement of equity. C. an overstatement of profit and an understatement of assets. D. an overstatement of assets and of profit offset by an understatement of equity. 7. An example of contra-asset account is A. Depreciation Expense. B. Accumulated Depreciation. C. Prepaid Expenses. D. Unearned Revenue. 8. Which of the following is NOT considered an end-of-period adjusting entry? A. The entry to record the portion of unexpired insurance which has become expense during the period. B. An entry to record revenue which has been earned but has not yet been billed to customers. C. The entry to record depreciation expense. D. An entry to record repayment of a bank loan. 9. The cost of insurance is considered an expense A. ONLY when the entire policy period has passed. B. ONLY when the policy is purchased. C. ONLY when the premium is paid. D. EVENLY over the term of the policy. 10. Which of the following entries causes an immediate decrease in assets and in profit? A. The entry to record depreciation expense. B. The entry to record revenue earned but not yet received. C. The entry to record the earned portion of rent received in advance. D. The entry to record wages payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started