Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need an answer for the second question P9-32A. On January 3, 2004, Jose Rojo, Inc., paid $224,000 for equipment used in manufacturing automotive supplies.

I need an answer for the second question

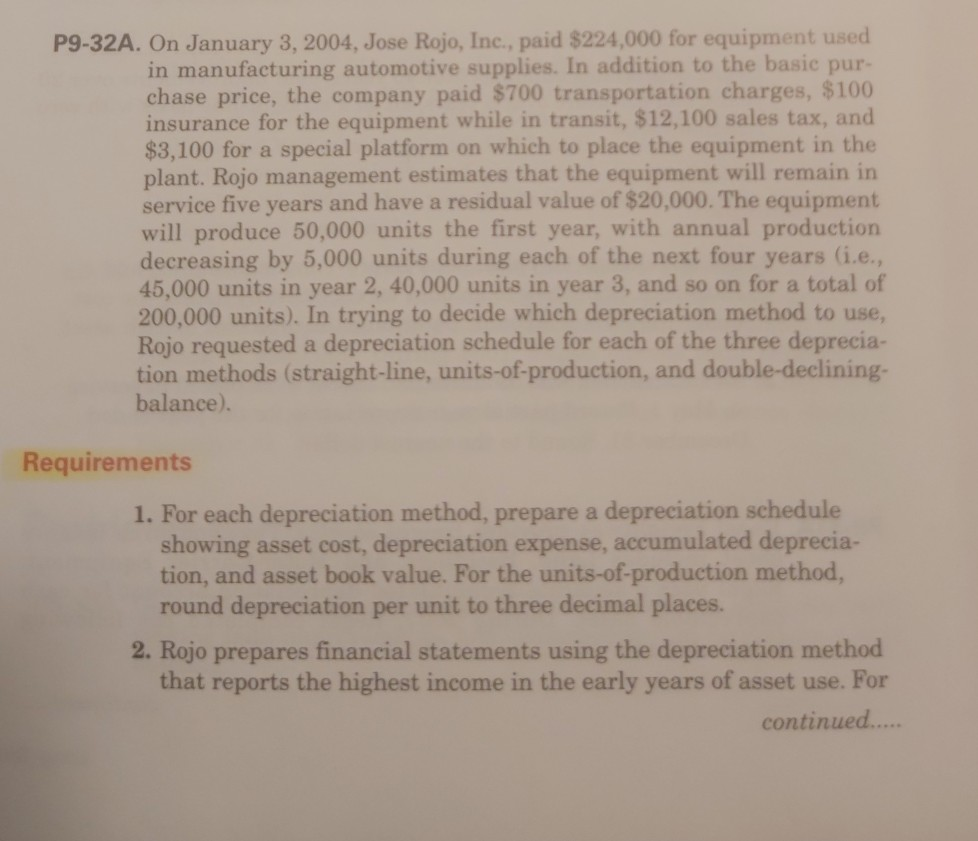

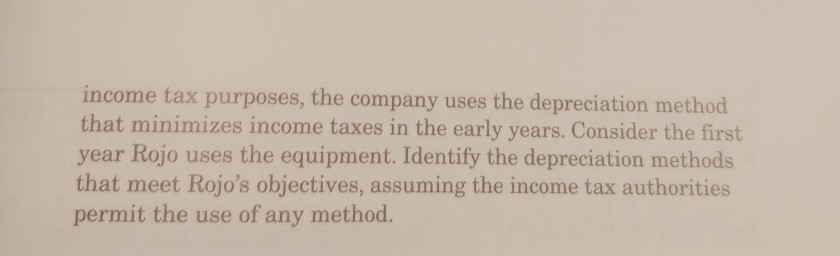

P9-32A. On January 3, 2004, Jose Rojo, Inc., paid $224,000 for equipment used in manufacturing automotive supplies. In addition to the basic pur- chase price, the company paid $700 transportation charges, $100 insurance for the equipment while in transit, $12,100 sales tax, and $3,100 for a special platform on which to place the equipment in the plant. Rojo management estimates that the equipment will remain in service five years and have a residual value of $20,000. The equipment will produce 50,000 units the first year, with annual production decreasing by 5,000 units during each of the next four years i.e., 45,000 units in year 2. 40,000 units in year 3, and so on for a total of 200,000 units). In trying to decide which depreciation method to use, Rojo requested a depreciation schedule for each of the three deprecia- tion methods (straight-line, units-of-production, and double-declining. balance). Requirements 1. For each depreciation method, prepare a depreciation schedule showing asset cost, depreciation expense, accumulated deprecia- tion, and asset book value. For the units-of-production method, round depreciation per unit to three decimal places. 2. Rojo prepares financial statements using the depreciation method that reports the highest income in the early years of asset use. For continued..... income tax purposes, the company uses the depreciation method that minimizes income taxes in the early years. Consider the first year Rojo uses the equipment. Identify the depreciation methods that meet Rojo's objectives, assuming the income tax authorities permit the use of any methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started