Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED AN ANSWER URGENTLY PLS (b) Syahid is a Malaysian citizen, bought an house in Jalan Inderaloka. Kuah Kedah on 1 December 2016 for

I NEED AN ANSWER URGENTLY PLS

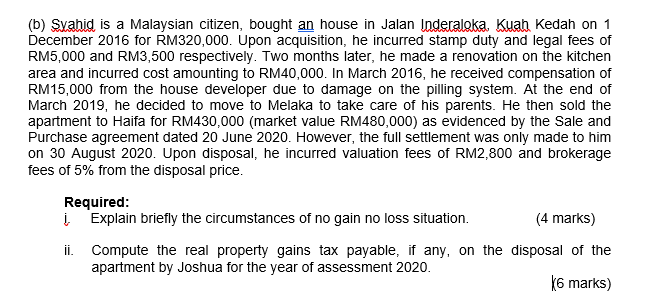

(b) Syahid is a Malaysian citizen, bought an house in Jalan Inderaloka. Kuah Kedah on 1 December 2016 for RM320,000. Upon acquisition, he incurred stamp duty and legal fees of RM5,000 and RM3,500 respectively. Two months later, he made a renovation on the kitchen area and incurred cost amounting to RM40,000. In March 2016, he received compensation of RM15,000 from the house developer due to damage on the pilling system. At the end of March 2019, he decided to move to Melaka to take care of his parents. He then sold the apartment to Haifa for RM430,000 (market value RM480,000) as evidenced by the Sale and Purchase agreement dated 20 June 2020. However, the full settlement was only made to him on 30 August 2020. Upon disposal, he incurred valuation fees of RM2,800 and brokerage fees of 5% from the disposal price. Required: Explain briefly the circumstances of no gain no loss situation. (4 marks) ii. Compute the real property gains tax payable, if any, on the disposal of the apartment by Joshua for the year of assessment 2020. K6 marks) (b) Syahid is a Malaysian citizen, bought an house in Jalan Inderaloka. Kuah Kedah on 1 December 2016 for RM320,000. Upon acquisition, he incurred stamp duty and legal fees of RM5,000 and RM3,500 respectively. Two months later, he made a renovation on the kitchen area and incurred cost amounting to RM40,000. In March 2016, he received compensation of RM15,000 from the house developer due to damage on the pilling system. At the end of March 2019, he decided to move to Melaka to take care of his parents. He then sold the apartment to Haifa for RM430,000 (market value RM480,000) as evidenced by the Sale and Purchase agreement dated 20 June 2020. However, the full settlement was only made to him on 30 August 2020. Upon disposal, he incurred valuation fees of RM2,800 and brokerage fees of 5% from the disposal price. Required: Explain briefly the circumstances of no gain no loss situation. (4 marks) ii. Compute the real property gains tax payable, if any, on the disposal of the apartment by Joshua for the year of assessment 2020. K6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started