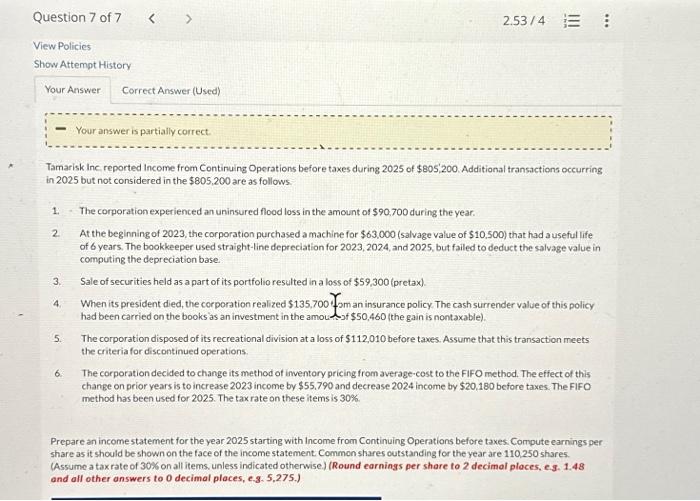

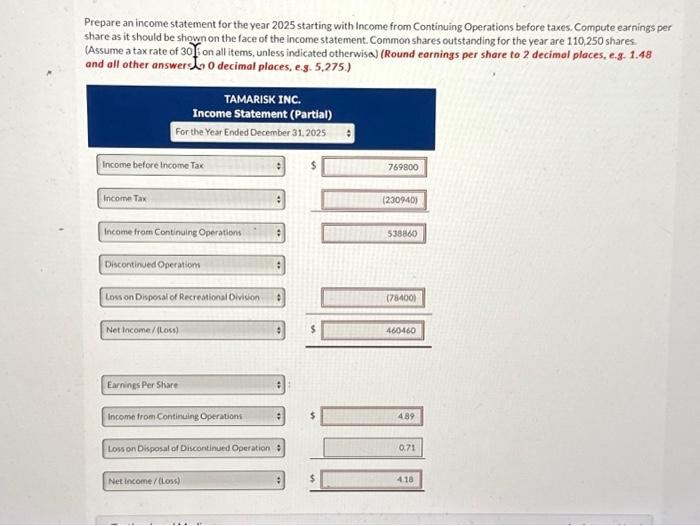

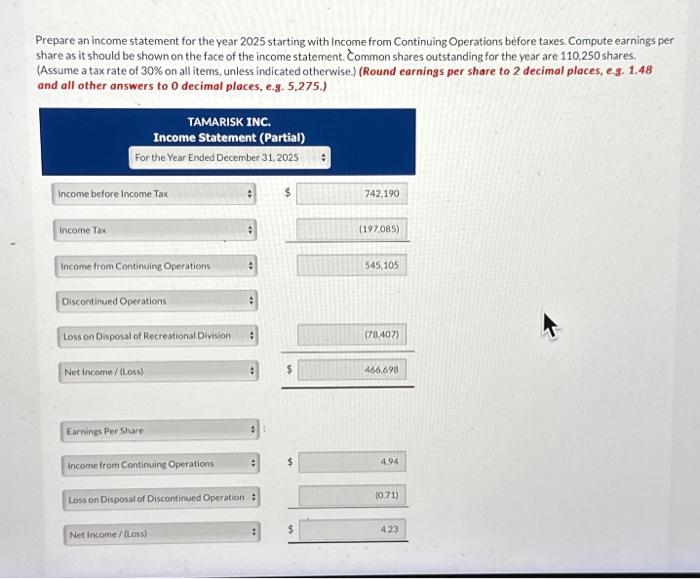

I need an entire breakdown of this question from the "Income before Income tax - Net Income/Loss" , and how we arrived at these numbers for the answers. Please provide a clear concise step by step process . Include any methods , or formulas that will simplify the accounting process for me .

FYI( the third picture has the answers ) please help !!!!!!

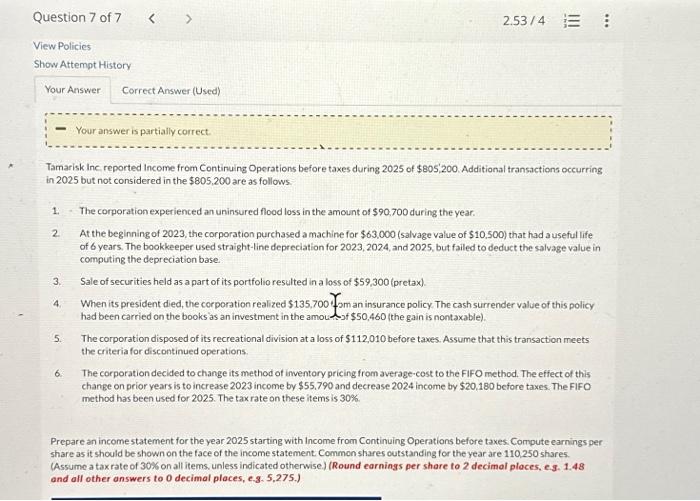

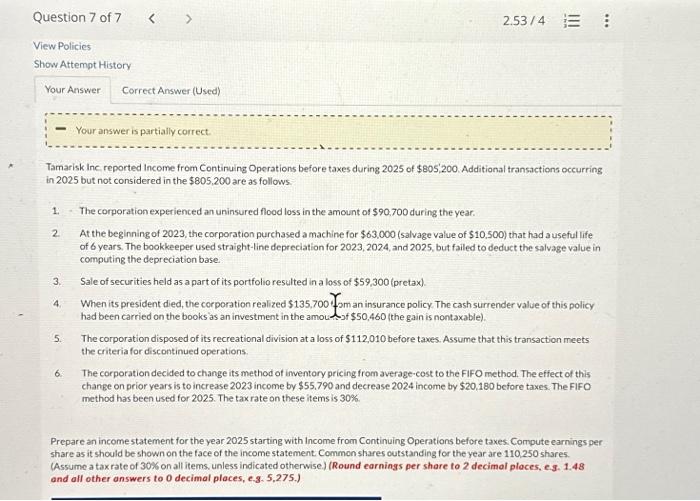

Prepare an income statement for the year 2025 starting with Income from Continuing Operations before taxes. Compute earnings per share as it should be shown on the face of the income statement. Common shares outstanding for the year are 110,250 shares. (Assume a tax rate of 30 fon all items, unless indicated otherwisa) (Round earnings per share to 2 decimal places, e.g. 1.48 and all other answers 0 decimal places, e.s. 5.275.) Prepare an income statement for the year 2025 starting with Income from Continuing Operations before taxes. Compute earnings per share as it should be shown on the face of the income statement. Common shares outstanding for the year are 110,250 shares. (Assume a tax rate of 30% on all items, unless indicated otherwise) (Round earnings per share to 2 decimal places, e.s. 1.48 Tamarisk Inc reported Income from Continuing Operations before taxes during 2025 of $805,200. Additional transactions occurring in 2025 but not considered in the $805,200 are as follows: 1. The corporation experienced an uninsured flood loss in the amount of $90,700 during the year. 2. At the beginning of 2023 , the corporation purchased a machine for $63,000 (salvage value of $10,500 ) that had a useful life of 6 years. The bookkeeper used straight-line depreciation for 2023,2024 , and 2025 , but failed to deduct the salvage value in computing the depreciation base. 3. Sale of securities held as a part of its portfolio resulted in a loss of $59,300 (pretax). 4. When its president died, the corporation realized $135,700 om an insurance policy. The cash surrender value of this policy had been carried on the books as an investment in the amou 3 if $50,460 (the gain is nontaxable). 5. The corporation disposed of its recreational division at a loss of $112,010 before taves. Assume that this transaction meets the criteria for discontinued operations. 6. The corporation decided to change its method of inventory pricing from average-cost to the FIFO method. The effect of this change on prior years is to increase 2023 income by $55,790 and decrease 2024 income by $20,180 before taxes. The FIFO method has been used for 2025 . The tax rate on these items is 30% Prepare an income statement for the year 2025 starting with Income from Continuing Operations before taxes. Compute earnings per share as it should be shown on the face of the income statement. Common shares outstanding for the year are 110,250 shares. (Assume a tax rate of 30% on all items, unless indicated otherwise) (Round earnings per share to 2 decimal places, e.3. 1.48 and all other answers to 0 decimal places, e.3.5.275.)