Answered step by step

Verified Expert Solution

Question

1 Approved Answer

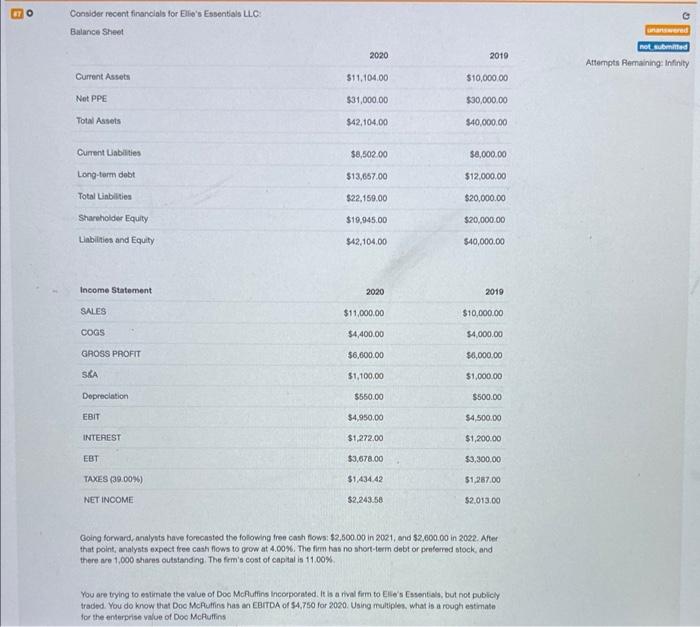

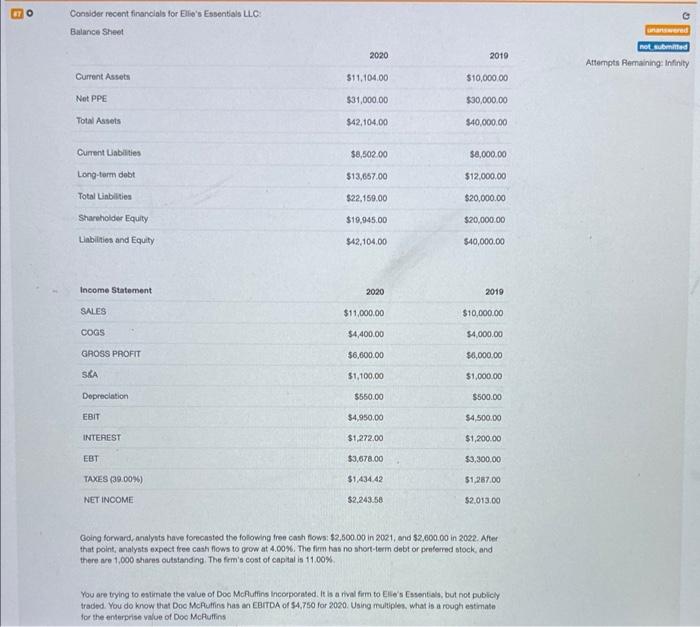

i need and answer and explaination with this finace problem. Consider recent financials for Elie's Essentials LLC: Bulance Sheet Attempts Remaining: infinity Going forward, analysts

i need and answer and explaination with this finace problem.

Consider recent financials for Elie's Essentials LLC: Bulance Sheet Attempts Remaining: infinity Going forward, analysts have forecasted the folowing free cash flows: $2,500.00 in 2021, and \$2,600.00 in 2022. After that point, analysts expect free cash flows to grow at 4.00%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The frrm's cost of capital is 11.00%. You are trying to estimate the value of Doo McAuffins incorporated. It is a rival fim to Elle's Essentials, but not publicy traded. You do know that Doo McFutfins has an EBrTDA of \$4,750 for 2020. Using multiples, what is a rough estimate for the entarprise vilue of Dos McRultins

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started