Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED ANSAWER OF ALL PARTS URGENT THANKS I GIVE YOU THUMBS UP A) Suppose the expected return on the market is 15% and the

I NEED ANSAWER OF ALL PARTS URGENT THANKS I GIVE YOU THUMBS UP

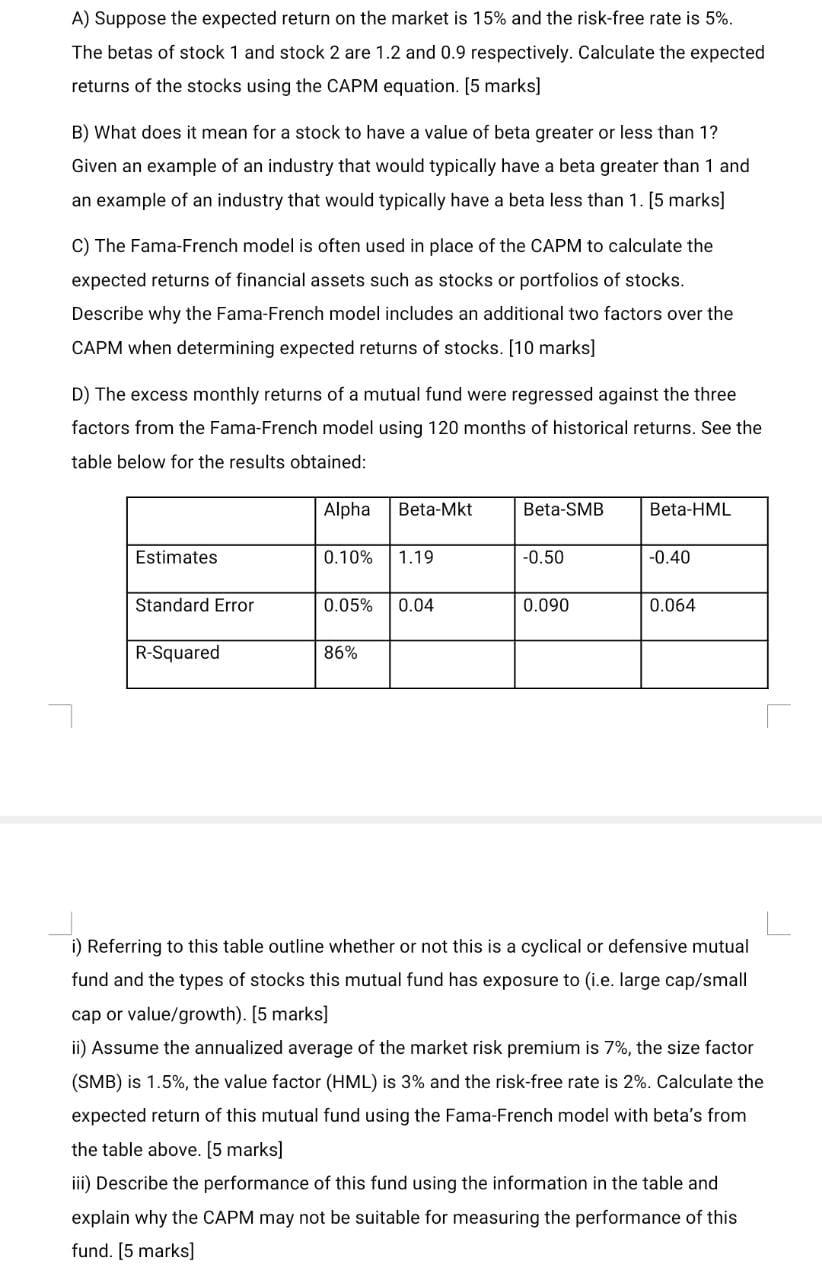

A) Suppose the expected return on the market is 15% and the risk-free rate is 5%. The betas of stock 1 and stock 2 are 1.2 and 0.9 respectively. Calculate the expected returns of the stocks using the CAPM equation. (5 marks) B) What does it mean for a stock to have a value of beta greater or less than 1? Given an example of an industry that would typically have a beta greater than 1 and an example of an industry that would typically have a beta less than 1. [5 marks) C) The Fama-French model is often used in place of the CAPM to calculate the expected returns of financial assets such as stocks or portfolios of stocks, Describe why the Fama-French model includes an additional two factors over the CAPM when determining expected returns of stocks. [10 marks] D) The excess monthly returns of a mutual fund were regressed against the three factors from the Fama-French model using 120 months of historical returns. See the table below for the results obtained: Alpha Beta-Mkt Beta-SMB Beta-HML Estimates 0.10% 1.19 -0.50 -0.40 Standard Error 0.05% 0.04 0.090 0.064 R-Squared 86% i) Referring to this table outline whether or not this is a cyclical or defensive mutual fund and the types of stocks this mutual fund has exposure to (i.e. large cap/small cap or value/growth). [5 marks] ii) Assume the annualized average of the market risk premium is 7%, the size factor (SMB) is 1.5%, the value factor (HML) is 3% and the risk-free rate is 2%. Calculate the expected return of this mutual fund using the Fama-French model with beta's from the table above. [5 marks] iii) Describe the performance of this fund using the information in the table and explain why the CAPM may not be suitable for measuring the performance of this fund. [5 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started