Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need answer with calculation as well Q9 What would be the weighted average cost of capital with the following details; cost of equity is

I need answer with calculation as well

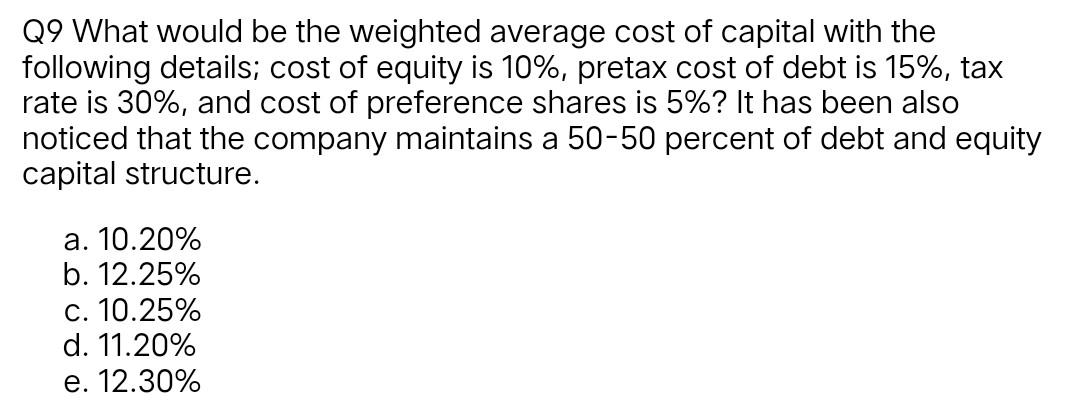

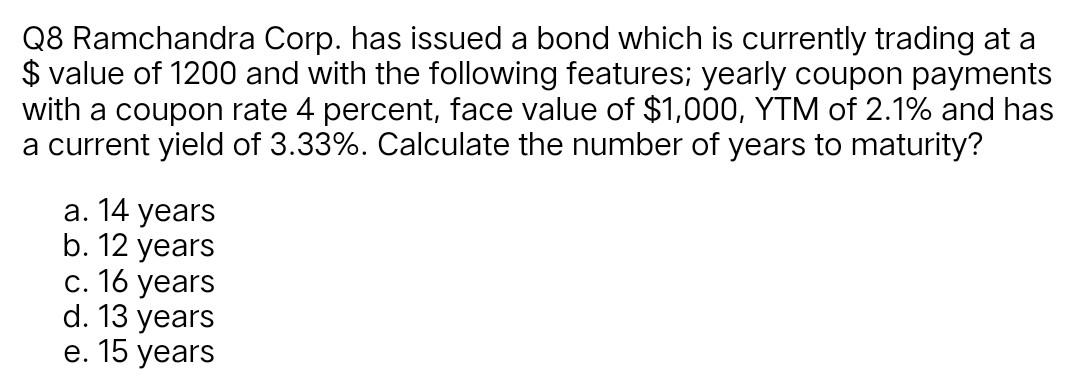

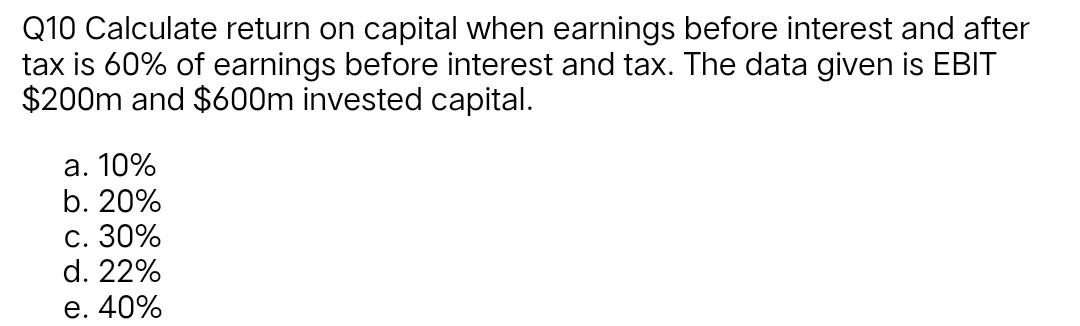

Q9 What would be the weighted average cost of capital with the following details; cost of equity is 10%, pretax cost of debt is 15%, tax rate is 30%, and cost of preference shares is 5% ? It has been also noticed that the company maintains a 50-50 percent of debt and equity capital structure. a. 10.20% b. 12.25% c. 10.25% d. 11.20% e. 12.30% Q8 Ramchandra Corp. has issued a bond which is currently trading at a $ value of 1200 and with the following features; yearly coupon payments with a coupon rate 4 percent, face value of $1,000, YTM of 2.1% and has a current yield of 3.33%. Calculate the number of years to maturity? a. 14 years b. 12 years c. 16 years d. 13 years e. 15 years Q10 Calculate return on capital when earnings before interest and after tax is 60% of earnings before interest and tax. The data given is EBIT $200m and $600m invested capital. a. 10% b. 20% c. 30% d. 22% e. 40%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started