Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need answere top urgent by next 30 minute asap thank you for your help Question 3 (4 points) A construction company is working on

i need answere top urgent by next 30 minute asap thank you for your help

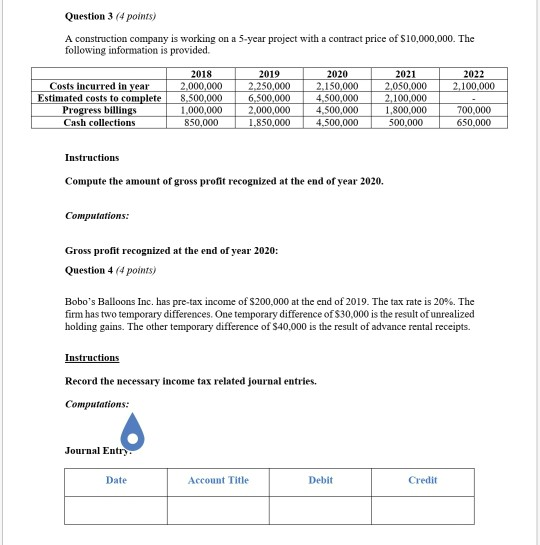

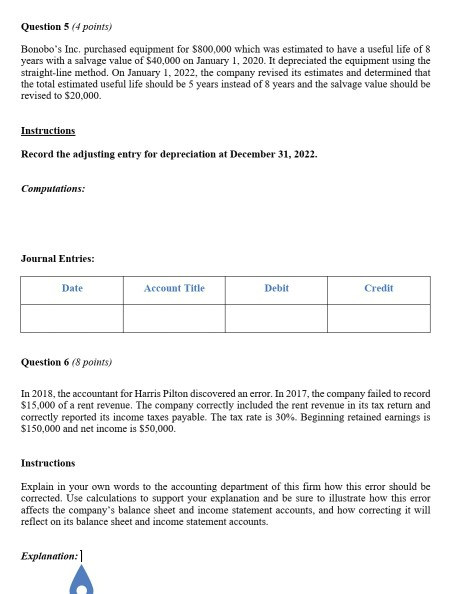

Question 3 (4 points) A construction company is working on a 5-year project with a contract price of $10,000,000. The following information is provided. 2022 2.100.000 Costs incurred in year Estimated costs to complete Progress billings Cash collections 2018 2,000,000 8,500,000 1,000,000 850,000 2019 2,250,000 6,500,000 2,000,000 1,850,000 2020 2.150,000 4,500,000 4,500,000 4,500,000 2021 2,050,000 2,100,000 1,800,000 500.000 700.000 650.000 Instructions Compute the amount of gross profit recognized at the end of year 2020. Computations: Gross profit recognized at the end of year 2020: Question 4 (4 points) Bobo's Balloons Inc. has pre-tax income of $200,000 at the end of 2019. The tax rate is 20%. The firm has two temporary differences. One temporary difference of $30,000 is the result of unrealized holding gains. The other temporary difference of $40,000 is the result of advance rental receipts. Instructions Record the necessary income tax related journal entries. Computations: Journal Entry Date Account Title Debit Credit Question 5 (4 points) Bonobo's Inc, purchased equipment for $800,000 which was estimated to have a useful life of 8 years with a salvage value of $40,000 on January 1, 2020. It depreciated the equipment using the straight-line method. On January 1, 2022, the company revised its estimates and determined that the total estimated useful life should be 5 years instead of 8 years and the salvage value should be revised to $20,000 Instructions Record the adjusting entry for depreciation at December 31, 2022. Computations: Journal Entries: Date Account Title Debit Credit Question 6 (8 points) In 2018, the accountant for Harris Pilton discovered an error. In 2017, the company failed to record $15,000 of a rent revenue. The company correctly included the rent revenue in its tax return and correctly reported its income taxes payable. The tax rate is 30%. Beginning retained earnings is $150,000 and net income is $50,000. Instructions Explain in your own words to the accounting department of this firm how this error should be corrected. Use calculations to support your explanation and be sure to illustrate how this error affects the company's balance sheet and income statement accounts, and how correcting it will reflect on its balance sheet and income statement accounts. ExplanationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started