Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need answers done in excel You are advising NS Shop (NSS), a leading Canadian e-commerce company, on how to estimate its cost of capital

I need answers done in excel

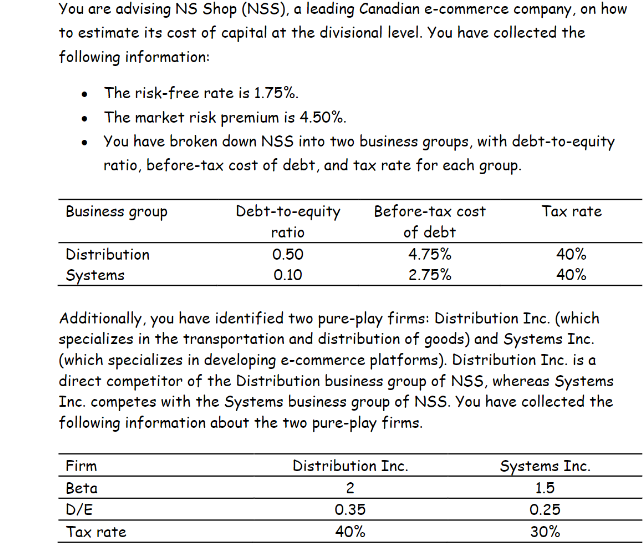

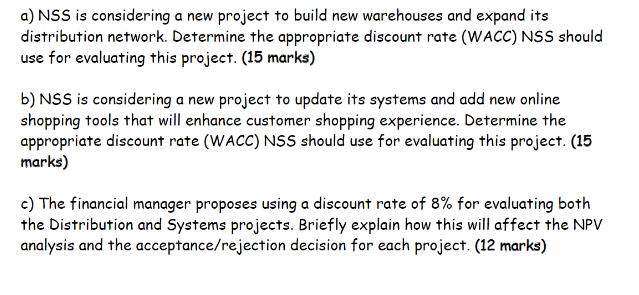

You are advising NS Shop (NSS), a leading Canadian e-commerce company, on how to estimate its cost of capital at the divisional level. You have collected the following information: The risk-free rate is 1.75%. The market risk premium is 4.50%. You have broken down NSS into two business groups, with debt-to-equity ratio, before-tax cost of debt, and tax rate for each group. Business group Tax rate Debt-to-equity ratio 0.50 0.10 Before-tax cost of debt 4.75% 2.75% Distribution Systems 40% 40% Additionally, you have identified two pure-play firms: Distribution Inc. (which specializes in the transportation and distribution of goods) and Systems Inc. (which specializes in developing e-commerce platforms). Distribution Inc. is a direct competitor of the Distribution business group of NSS, whereas Systems Inc. competes with the Systems business group of NSS. You have collected the following information about the two pure-play firms. Firm Beta D/E Tax rate Distribution Inc. 2 0.35 40% Systems Inc. 1.5 0.25 30% a) NSS is considering a new project to build new warehouses and expand its distribution network. Determine the appropriate discount rate (WACC) NSS should use for evaluating this project. (15 marks) b) NSS is considering a new project to update its systems and add new online shopping tools that will enhance customer shopping experience. Determine the appropriate discount rate (WACC) NSS should use for evaluating this project. (15 marks) c) The financial manager proposes using a discount rate of 8% for evaluating both the Distribution and Systems projects. Briefly explain how this will affect the NPV analysis and the acceptance/rejection decision for each project. (12 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started