Answered step by step

Verified Expert Solution

Question

1 Approved Answer

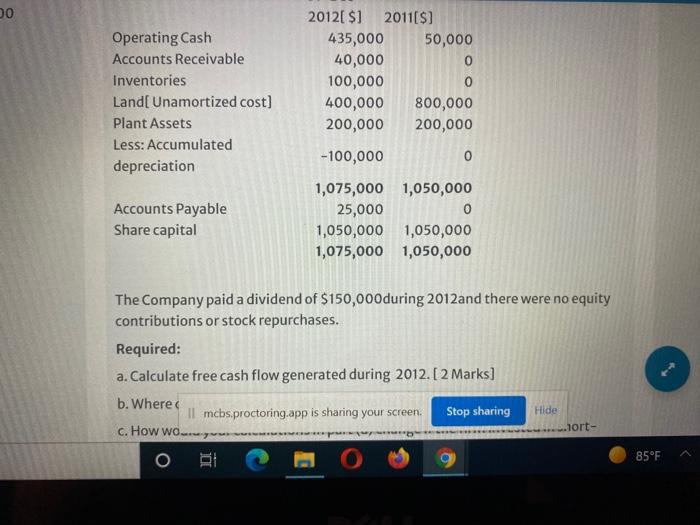

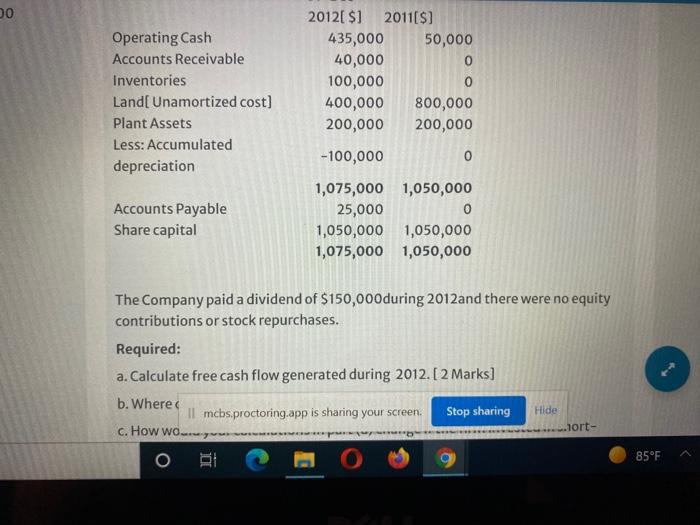

I need answers now Do Operating Cash Accounts Receivable Inventories Land[ Unamortized cost] Plant Assets Less: Accumulated depreciation 2012[ $2011[$] 435,000 50,000 40,000 0 100,000

I need answers now

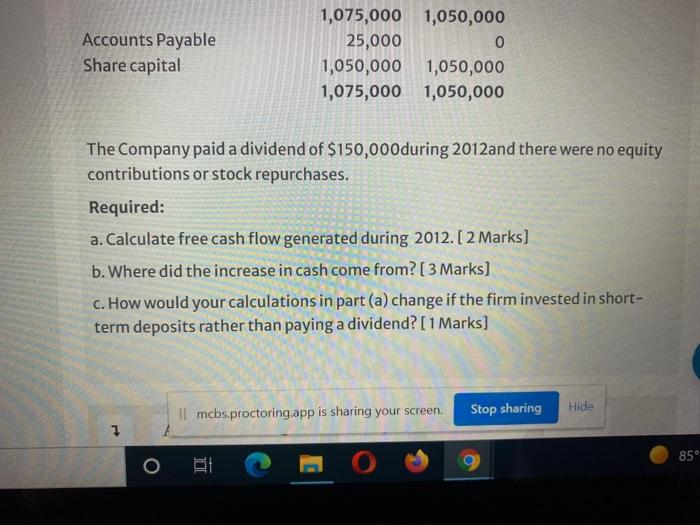

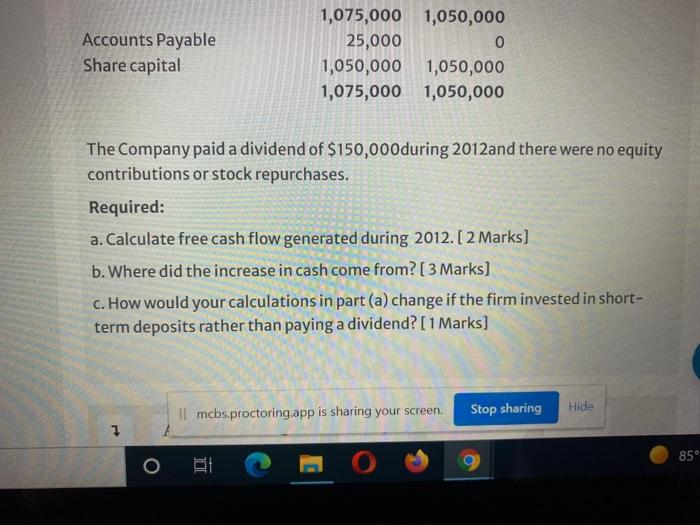

Do Operating Cash Accounts Receivable Inventories Land[ Unamortized cost] Plant Assets Less: Accumulated depreciation 2012[ $2011[$] 435,000 50,000 40,000 0 100,000 0 400,000 800,000 200,000 200,000 -100,000 1,075,000 1,050,000 25,000 1,050,000 1,050,000 1,075,000 1,050,000 Accounts Payable Share capital The Company paid a dividend of $150,000during 2012and there were no equity contributions or stock repurchases. Required: a. Calculate free cash flow generated during 2012. [ 2 Marks] b. Where Il mcbs proctoring app is sharing your screen. Stop sharing Hide c. How wo. w.lort- . 85F Accounts Payable Share capital 1,075,000 1,050,000 25,000 0 1,050,000 1,050,000 1,075,000 1,050,000 The Company paid a dividend of $150,000during 2012 and there were no equity contributions or stock repurchases. Required: a. Calculate free cash flow generated during 2012. [ 2 Marks) b. Where did the increase in cash come from? [ 3 Marks] c. How would your calculations in part(a) change if the firm invested in short- term deposits rather than paying a dividend? (1 Marks] Hide Il mcbs.proctoring app is sharing your screen. Stop sharing 1 85 LL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started