Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED ANSWERS OF THAT DAIRYLAND CASE QUESTIONS ANSWERS ON SECOND LAST SNAP. COURSE NAME: Selling and salesmanship (Marketing 410) PARTNERING STRATEGIES IN varieties that

I NEED ANSWERS OF THAT DAIRYLAND CASE QUESTIONS ANSWERS ON SECOND LAST SNAP.

COURSE NAME: Selling and salesmanship (Marketing 410)

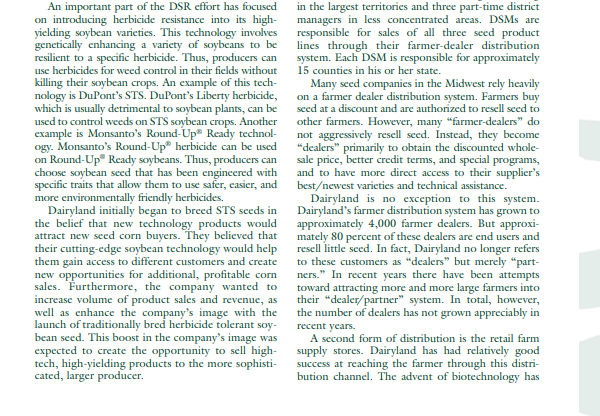

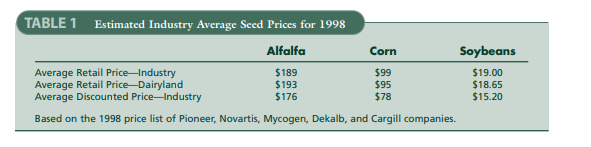

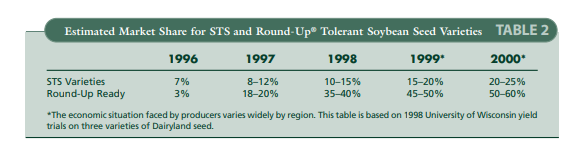

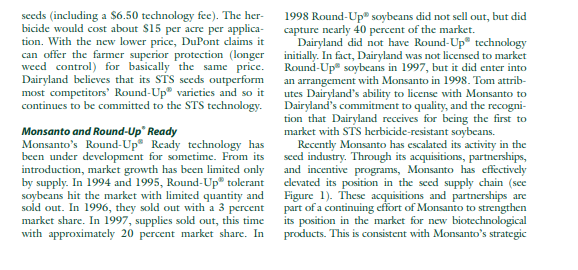

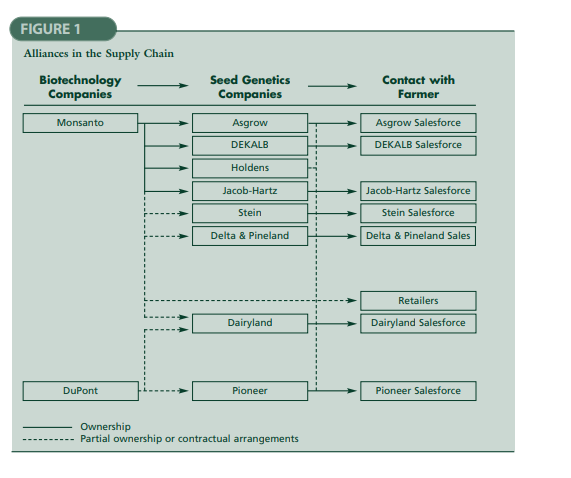

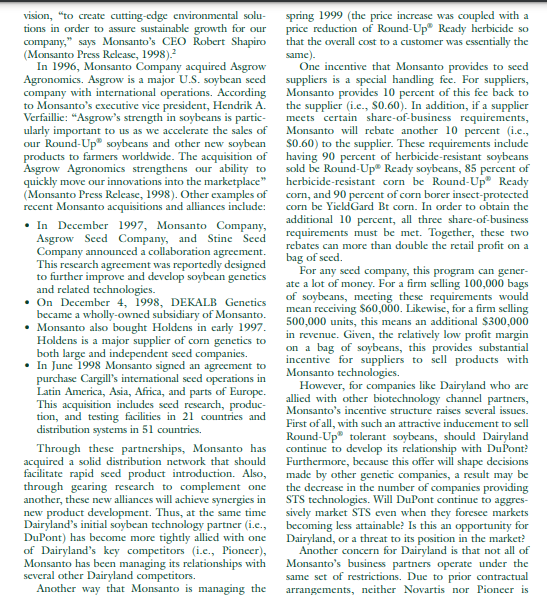

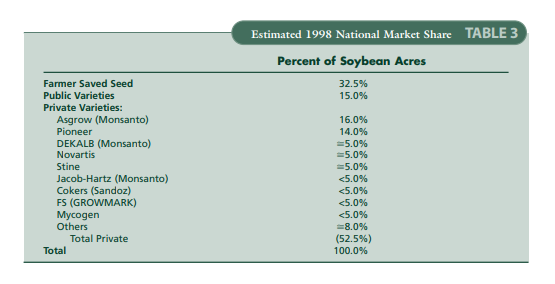

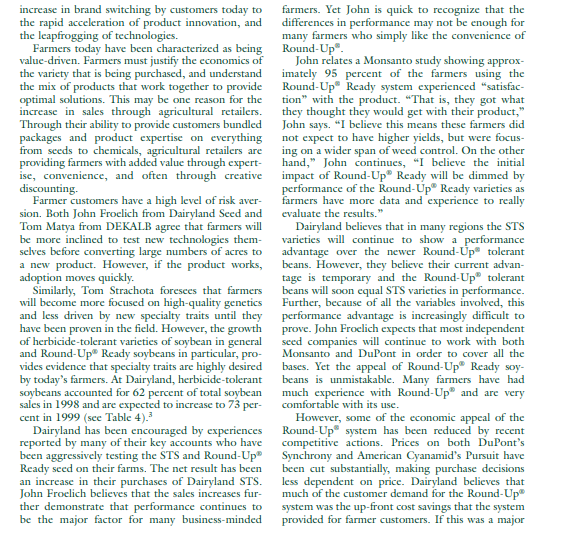

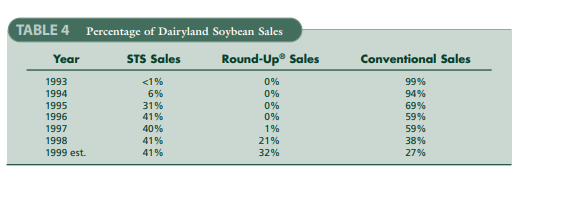

PARTNERING STRATEGIES IN varieties that have faired extremely well in state yield A BIOTECH WORLD: THE CASE trials and in the marketplace this year. OF DAIRYLAND SEED COMPANY Combined, Dairyland's STS and Round-Up tolThe morning sun was shining brightly as Tom erant varieties account for over 60 percent of Strachota, Chief Executive Officer for Dairyland Dairyland's soybean sales. This is remarkable given Seed, drove up Highway 45 in southeast Wisconsin that STS traits entered the market in 1993, and in late February 1999. Because of the snow cover on Round-Up in 1996. However, the growing imporeither side of the road, it was not immediately appar- tance of these varieties brings with it new challenges ent that these fields were the sites of research plots for Dairyland. By marketing both STS and Roundthat have generated some of the most cutting-edge Up tolerant varieties, Dairyland is in a position biotechnologies in the seed industry. Tom couldn't where Tom must manage business relationships with help but smile as he reflected on the past few years' competitors in the chemical and biotechnology maraccomplishments. He was particularly pleased with ket, namely DuPont and Monsanto. With the market the success of their line of soybean varieties tolerant demands for Round-Up tolerant technology, how to the DuPont Chemical Company's Sulfonylurea closely should he establish his business relationship herbicides. Dairyland had pioneered the technol- with Monsanto? He wondered what the impact of ogya credit to Dairyland's long-standing commit- partnering with Monsanto might be on his carefully ment to research and development. developed alliance with DuPont. However, a lot had happened in the soybean mar- Adding to Tom's new challenges, agricultural ket since the introduction of the Sulfonylurea chemical and biotechnology companies have chosen Tolerant Soybean (STS) varieties five years ago. to become further committed to the seed industry Competition in the STS seed market had intensified by acquiring or establishing joint ventures with as competitors developed and promoted their own larger seed firms. Of particular interest to Tom were varieties. While Tom believed Dairyland still enjoyed DuPont's 20 percent ownership position in some advantage in the expanding enhanced trait Pioneer, and Monsanto's recent acquisitions of soybean seed business, other seed companies were Asgrow and DEKALB - two major seed companies. making rapid progress in many of the same markets. These mergers have caused these two major tech- The market share growth of Round-UP tolerant nology suppliers to become more tightly allied with soybean varieties was one of the newest challenges. Dairyland's direct competitors. What might this These new varieties enabled Monsanto, manufac- mean to Dairyland's access to future technologies? turer of the well-known Round-UP herbicide, to Success had certainly brought a new set of probcompete directly with DuPont's STS. Initially, lems, and positioning was going to be especially limited amounts of Round-Up P tolerant seeds con- important for Dairyland to ensure continuity of its strained growth, but Monsanto has taken major role as a cutting-edge seed producer. steps to ensure greater supplies in each of the past two years. As a result, Round-Up tolerant seeds Company Background captured between 35-40 percent market share in Simon and Andrew Strachota founded the 1998 and projections are that Round-Up tolerant Dairyland Seed Company in 1907. In 1920, seeds will command as much as 50 percent of the Andrew retired, leaving his brother Simon to head market this year. the company. When Simon died unexpectedly in Dairyland had not been caught off guard by the 1940, his son Orville left college and returned Round-Up w tolerant technology, of course. In fact, home to run the company. At 79, Orville Strachota Dairyland had acquired a license to develop its own continues to be active in the business and serves as Round-Up tolerant soybean varieties. Dairyland Chairman of Dairyland's Board. However, his researchers have been successful in developing several three sons, Steve, Tom, and John Strachota have managed day-to-day operations of the company for The Marketing Mix at Dairyland over 10 years. Product Dairyland began as Strachota Seeds. The company Dairyland has worked hard to build its image operated out of the Strachota family's general store in around quality products, its high standards of busieastern Wisconsin. White Dutch Clover Seed was ness ethics, and as a successful family-run business. their primary product. But when the market for This message is intentionally promoted in a mynad White Dutch Clover suddenly dropped off in 1955, of ways including a highly visible commitment to Orville shifted to the production of alfalfa seed- research, maintaining a first-class physical plant, a product with rapidly growing demand driven by demonstrating employee pride in the organization, Wisconsin dairy farmers searching for better forages and the active involvement of Orville and three for their cows. Dairy continued to grow in impor- third-generation principals. Tom Strachota believes tance in their region. In 1963, Orville decided to the positioning effort over the years has resulted in change the name of the company to Dairyland Seed a positive and consistent image of Dairyland among Company to reflect its commitment to the market. customers and competitors alike. Tom believes that Dairyland continued to respond to challenges this image is very important and valuable. and opportunities in the seed industry as they arose. The focus of Dairyland has been on high-yielding They began to produce and market seed corn on a genetics rather than on specific traits. This commitlarge scale in 1961. As soybeans began to develop ment to high-performance genetics is captured in in the United States in the 1960s, Dairyland also their statement of values: added soybean seed to their product line. Today, Orville Strachota's three sons, Steve 1. Dairyland has a responsibility to its customers to (President), Tom (Chief Executive Officer), and deliver consistently high-performing products. John (Vice President) jointly manage Dairyland 2. New traits are of value only if they add to the Seed. The company is privately held, with majority consistency of performance or bring more profit stock owned by the Strachota family. Of the over to the farmer. 800 companies listed by the American Seed Trade 3. No single genetic trait is of value by itself. Association, Dairyland is the only American family- Tom Strachota puts it this way; "It is better to owned seed company with proprietary research in have high-yielding genetics with no specialty traits, alfalfa, corn, and soybeans. Dairyland's board of than to have specialty traits with poor genetics." directors, which includes family stockholders and Guided by these values, researchers at Dairyland outside directors, meets quarterly to review busi- have developed a product mix that consists of variness strategy and plans. eties of alfalfa, corn, and soybean seed. The company is divided into seven functional operating areas: management, finance, research, Alfalfa production, distribution, marketing, and sales. Dairyland is especially proud of its success with alfalDairyland employs approximately 100 people plus fa varieties. According to company executives, seasonal help. Executive management is located at Dairyland has the world's largest alfalfa breeding Dairyland's headquarters in West Bend, Wisconsin, program. Dairyland's alfalfa lineup includes several while research, sales, and production employees are specialty alfalfa varieties from which the farmer can located throughout the company's market and pro- choose to match their particular needs (e.g., varieties duction area. Dairyland's production/processing suited for wet soil conditions, other varieties for high plants are in Mt. Hope and West Bend, Wisconsin. traffic fields, etc.). Strachota is quick to mention In addition, five research stations are located in recent successful innovations Dairyland has made in Otterbein, Indiana; Sloughhouse, California; the release of patented Sequential Maturity Alfalfa TM Gibson City, Illinois; Clinton, Wisconsin; and products that provide farmers with more high qualGilbert, Iowa. ity forage. The company is divided into seven functional operating areas: management, finance, research, Alfalfa production, distribution, marketing, and sales. Dairyland is especially proud of its success with alfalDairyland employs approximately 100 people plus fa varieties. According to company executives, seasonal help. Executive management is located at Dairyland has the world's largest alfalfa breeding Dairyland's headquarters in West Bend, Wisconsin, program. Dairyland's alfalfa lineup includes several while research, sales, and production employees are specialty alfalfa varieties from which the farmer can located throughout the company's market and pro- choose to match their particular needs (e.g., varieties duction area. Dairyland's production/processing suited for wet soil conditions, other varieties for high plants are in Mt. Hope and West Bend, Wisconsin. traffic fields, etc.). Strachota is quick to mention In addition, five research stations are located in recent successful innovations Dairyland has made in Otterbein, Indiana; Sloughhouse, California; the release of patented Sequential Maturity Alfalfa su Gibson City, Illinois; Clinton, Wisconsin; and products that provide farmers with more high qualGilbert, Iowa. ity forage. Dairyland has built its image around new product development and is well known in the upper- Corn Midwest for innovation. Orville Strachota established Dairyland's seed corn business has grown steadily a commitment to research early in the company's since hybrid corn was first introduced into their history. Today, over 40 percent of the company's product line in 1961 . Seed corn now plays an employees work in research and development, mak- important role in their overall strategy. Dairyland ing it the largest department in the company. currently offers over 40 corn varieties that have Management believes Dairyland has a competitive been bred to meet the unique needs of the upperadvantage in certain markets with its continued com- Midwestern states. The company's "Stealth" mitment to research and development. hybrid corn breeding program (which emphasizes consistency in performance) has been a major Distribution emphasis in their rapidly growing research pro- Dairyland annually provides seed for more than gram. Dairyland's current lineup includes both 1 million acres of farmland in the United States, insect resistant (i.e., Bt Hybrids) as well as herbi- Canada, South America, Europe, and Asia. cide tolerant (i.e., Round- UP ) hybrids. However, their primary market area is concentrated in the upper-Midwest with a focus on Michigan, Soybeans Minnesota, Wisconsin, South Dakota, Iowa, northDairyland entered the soybean market in the early ern Illinois, Indiana, and Ohio. The area is highly 70s. In the late 70s, Dairyland purchased an diverse agriculturally-dairy, hogs, corn, soybeans, aggressive research program-the oldest private and forages are the primary crops. The relative breeding program in the country, according to importance of each depends on local soil and cliDairyland executives. Varieties developed by matic factors. the Dairyland Soybean Research (DSR) program Dairyland pursues two primary forms of distrihave performed well in yield trials across the bution to reach its farmer customers. The first is a Midwest. Dairyland boasts a series of firsts in farmer-dealer network that had evolved to be priintroducing varieties tolerant to the soybean cyst marily a direct channel with sales managers calling nematode, brown stem rot, phytophthora root on farmer "dealers" who may or may not sell seed rot, and iron chlorosis-all significant problems to other farmers. The second is farm retail stores. for many soybean producers, especially in specific This second channel allows Dairyland to reach marlocal market areas that Dairyland refers to as kets where direct methods are not in place or do "niche" markets. Dairyland executives believe that not make economic sense. despite Dairyland's research and development of Dairyland's Director of Sales, John Froelich, alfalfa and corn seed, the company is best known heads the sales department and works closely with in the Corn Belt for its soybean research and the Tom Strachota. There are two regional managers soybean varieties it has developed for the upper- and 28 district sales managers (DSMs). In addition, Midwest market area. there are three assistant district managers working An important part of the DSR effort has focused in the largest territories and three part-time district on introducing herbicide resistance into its high- managers in less concentrated areas. DSMs are yielding soybean varieties. This technology involves responsible for sales of all three seed product genetically enhancing a variety of soybeans to be lines through their farmer-dealer distribution resilient to a specific herbicide. Thus, producers can system. Each DSM is responsible for approximately use herbicides for weed control in their fields without 15 counties in his or her state. killing their soybean crops. An example of this tech- Many seed companies in the Midwest rely heavily nology is DuPont's STS. DuPont's Liberty herbicide, on a farmer dealer distribution system. Farmers buy which is usually detrimental to soybean plants, can be seed at a discount and are authorized to resell seed to used to control weeds on STS soybean crops. Another other farmers. However, many "farmer-dealers" do example is Monsanto's Round-Up Ready technol- not aggressively resell seed. Instead, they become ogy. Monsanto's Round-UP" herbicide can be used "dealers" primarily to obtain the discounted wholechoose soybean seed that has been engineered with and to have more direct access to their supplier's specific traits that allow them to use safer, casier, and bestewest varieties and technical assistance. more environmentally friendly herbicides. Dairyland is no exception to this system. Dairyland initially began to breed STS seeds in Dairyland's farmer distribution system has grown to the belief that new technology products would approximately 4,000 farmer dealers. But approxiattract new seed corn buyers. They believed that mately 80 percent of these dealers are end users and their cutting-edge soybean technology would help resell little seed. In fact, Dairyland no longer refers An important part of the DSR effort has focused in the largest territories and three part-time district on introducing herbicide resistance into its high- managers in less concentrated areas. DSMs are yielding soybean varieties. This technology involves responsible for sales of all three seed product genetically enhancing a variety of soybeans to be lines through their farmer-dealer distribution resilient to a specific herbicide. Thus, producers can system. Each DSM is responsible for approximately use herbicides for weed control in their fields without 15 counties in his or her state. killing their soybean crops. An example of this tech- Many seed companies in the Midwest rely heavily nology is DuPont's STS. DuPont's Liberty herbicide, on a farmer dealer distribution system. Farmers buy which is usually detrimental to soybean plants, can be seed at a discount and are authorized to resell seed to used to control weeds on STS soybean crops. Another other farmers. However, many "farmer-dealers" do example is Monsanto's Round-Up Ready technol- not aggressively resell seed. Instead, they become ogy. Monsanto's Round-Up" herbicide can be used "dealers" primarily to obtain the discounted wholeon Round-Up Ready soybeans. Thus, producers can sale price, better credit terms, and special programs, choose soybean seed that has been engineered with and to have more direct access to their supplier's specific traits that allow them to use safer, easier, and bestewest varieties and technical assistance. more environmentally friendly herbicides. Dairyland is no exception to this system. Dairyland initially began to breed STS seeds in Dairyland's farmer distribution system has grown to the belief that new technology products would approximately 4,000 farmer dealers. But approxiattract new seed corn buyers. They believed that mately 80 percent of these dealers are end users and their cutting-edge soybean technology would help resell little seed. In fact, Dairyland no longer refers them gain access to different customers and create to these customers as "dealers" but merely "partnew opportunities for additional, profitable corn ners." In recent years there have been attempts sales. Furthermore, the company wanted to toward attracting more and more large farmers into increase volume of product sales and revenue, as their "dealer/partner" system. In total, however, well as enhance the company's image with the the number of dealers has not grown appreciably in launch of traditionally bred herbicide tolerant soy- recent years. bean seed. This boost in the company's image was A second form of distribution is the retail farm expected to create the opportunity to sell high- supply stores. Dairyland has had relatively good tech, high-yielding products to the more sophisti- success at reaching the farmer through this districated, larger producer. bution channel. The advent of biotechnology has required growers to make increasingly more com- Dairyland's three product lines. Individual award proplex decisions about inputs (seed, chemicals, and grams depend on the specific activities that Dairyland fertilizer), and the spectrum of knowledge required is attempting to promote throughout the year. has grown prohibitively large. Many farmers favor retailers that can provide more technical advice to Pricing growers and maintain superior service standards. As Dairyland's seed is priced slightly above the marsuch, a growing percentage of Dairyland's business ket average in all product lines (see Table 1). "This flows through these intermediaries, and Dairyland is a strategy designed to encourage the premium is continuing to look for appropriate resale partners quality image that is the core of our marketing with which to license. strategy, and to generate margins necessary to support an aggressive research and development proPromotion gram," says Tom Strachota. "We believe farmers Dairyland uses a wide variety of promotional are willing to pay a little higher price when we programs to communicate the benefits of its soy- deliver high quality seed, consistent performance, bean seed to farmers. The Dairyland Soybean dependability, and cutting-edge technology." Management Guide provides farmers with technical Although Dairyland seeds may not be the highest and practical advice on the best soybean production priced alternative in the market, this philosophy methods. Each year, the company produces a pocket- generally places Dairyland's average prices at 5-10 sized Dairyland seed reference guide and calendar. percent above the average in market. "The idea is There is a quarterly newsletter called "The Leader" to realize that we can't price like the market that communicates a variety of information to the leader, but we can deliver the best overall value," customer. Other promotional efforts include tours of Tom argues. research and production facilities, crop management Tom Strachota believes that this premium value clinics, field days at Dairyland test plots, and mainte- strategy is highly successful. Dairyland has enjoyed nance of "show case" quality facilities. an increase in its soybean sales for the last five years. Most of Dairyland's advertising is direct mail from This includes an increase in 1997 despite not having an extensive database maintained on all dealers and Round-Up Ready soybeans; STS accounted for customers. The internal database is supplemented over one-third of Dairyland's soybean sales in 1997. by mailing lists from other sources. In addition, the company includes ads in state farm publications, Channel Partners magazines (especially Soybean Digest), agricultural Chemical companies like DuPont and Monsanto newspapers, etc. Occasionally DSMs will prepare are using seed companies to bring their products to brief ads or radio announcements for local areas market. The developers of the biotechnology have to promote a field day or educational program in sought to use a combination of seed production that area. and distribution companies as well as licensing Dealers are offered a wide range of individual and agreements with distributors and small seed compacustomer incentives intended to promote sales. nies in order to achieve access to growers with a Traditional caps, jackets, etc. are all available to deal- high level of service. Dairyland has among its chaners and their customers. In addition, dealers may work nel partners two main providers of biotechnology: toward larger value gifts (e.g., television sets or trips DuPont and Monsanto. Among these partners, to Florida are common, and even a car in the case of Dairyland has worked most closely in the past Dairyland's Stealth seed com program). District sales with DuPont. Through this relationship with managers are also offered sales incentives and bonus DuPont, Dairyland has marketed its seed varieties awards for achievement in increasing the sales of of STS soybeans. TABLE 1 Estimated Industry Average Seed Prices for 1998 \begin{tabular}{lccc} & Alfalfa & Corn & Soybeans \\ \hline Average Retail Price-Industry & $189 & $99 & $19.00 \\ Average Retail Price-Dairyland & $193 & $95 & $18.65 \\ Average Discounted Price-Industry & $176 & $78 & $15.20 \end{tabular} Based on the 1998 price list of Pioneer, Novartis, Mycogen, Dekalb, and Cargill companies. DuPont grams. They have executed major herbicide DuPont began licensing with several larger seed launches that include TV in major markets and companies over five years ago, giving them the right heavy print media advertising. DuPont sales repreto sublicense to other smaller seed firms. While sentatives will support local agricultural chemical Dairyland was one of the first seed companies dealers and seed companies with educational prolicensed to produce and sell STS seed, there are grams in local markets and support plot tours to now nearly 100 seed companies who have been demonstrate the new technology. DuPont has licensed to sell the STS technology. These compa- elected not to place any premium on the nies have developed more than 170 varieties of STS Sulfonylurea herbicides. seeds. The more aggressive companies include DuPont has relied heavily on media campaigns to Dairyland Seeds, Asgrow (recently purchased by successfully increase its brand name and product Monsanto), Pioneer, Stine Seed, Countrymark and awareness among users. However, they have recently GROWMARK, and Novartis Seed. Even though been forced to recognize the rapid growth of RoundAsgrow is owned by Monsanto, it still maintains a Up technology, and the potential cost savings and licensing contract with DuPont. ease of the Round-Up 8 system to the farmer. While Discussions between DuPont and Dairyland most industry experts have predicted the increase of were opened in the mid-80s. Acquisition of the Round-Up soybeans, almost no one expected Sulfonylureas germplasm by Dairyland occurred in acceptance to be as rapid as it developed in the 1997 the late 80s. DuPont selected Dairyland for its and 1998 markets (see Table 2). 1 strong reputation in soybean development and its DuPont has responded by increasing commitindependent research capability. The relationship is ment with the seed industry substantially with the not exclusive, however. Other companies received recent purchase of 20 percent of Pioneer Hybrid the germplasm and have had the opportunity to International stock and the holding of two seats develop their own tolerant varieties. on Pioneer's board of directors in 1997. Pioneer The agreement between Dairyland and DuPont and DuPont also have announced the formation stipulates formation of a "joint-commercialization" of a new joint venture called Optimum whose team to review the marketing strategies for STS. purpose is to bringing new value-added crops to Dairyland and DuPont agreed that in marketing the market, such as high-oil corn, etc. It is clear that product, DuPont would sell herbicides and help DuPont will be working more closely with farmers understand the benefits of STS, while Pioneer than with any other seed company. Dairyland would sell seed and talk about the bene- However, Dairyland feels that DuPont has not fits of STS as they relate to seed selection. The joint abandoned its STS technology or its initial seed marketing strategy was a tremendous success as industry partners. DuPont's relationship with the salesforces of each company were able to estab- other seed companies has remained the same. lish mutually supportive professional relationships. Time will tell whether DuPont's new relationship As the STS technology represents important market with Pioneer will have an impact on other seed potential for DuPont, Dairyland anticipates contin- industry firms. ued marketing support. DuPont's efforts have In addition, DuPont made a substantial change clearly helped position Dairyland as one of in its pricing strategy-announcing a 75 percent the leading developers of Sulfonylurea Tolerant price cut in August 1997 on its STS-related herbiSoybeans. cides. This price reduction was a clear attempt to DuPont has basically maintained their aggres- level the economics of the farmer's decision process sive marketing strategy to promote the use of STS in choosing which herbicide resistant technology to seed varieties in the market through programs that embrace. On an average basis, the farmer would pay include sizable advertising and incentive pro- approximately $28 per acre for Round-Up tolerant trials on three varieties of Dairyland seed. seeds (including a $6.50 technology fee). The her- 1998 Round-Up soybeans did not sell out, but did bicide would cost about $15 per acre per applica- capture nearly 40 percent of the market. tion. With the new lower price, DuPont claims it Dairyland did not have Round-Up technology can offer the farmer superior protection (longer initially. In fact, Dairyland was not licensed to market weed control) for basically the same price. Round-Up soybeans in 1997 , but it did enter into Dairyland believes that its STS seeds outperform an arrangement with Monsanto in 1998 . Tom attribmost competitors' Round-Up varieties and 2 o it utes Dairyland's ability to license with Monsanto to continues to be committed to the STS technology. Dairyland's commitment to quality, and the recognition that Dairyland receives for being the first to Monsanto and Round-Up" Ready market with STS herbicide-resistant soybeans. Monsanto's Round-Up 'Ready technology has Recently Monsanto has escalated its activity in the been under development for sometime. From its seed industry. Through its acquisitions, partnerships, introduction, market growth has been limited only and incentive programs, Monsanto has effectively soybeans hit the market with limited quantity and Figure 1). These acquisitions and partnerships are sold out. In 1996 , they sold out with a 3 percent part of a continuing effort of Monsanto to strengthen market share. In 1997, supplies sold out, this time its position in the market for new biotechnological with approximately 20 percent market share. In products. This is consistent with Monsanto's strategic FIGURE 1 Alliances in the Supply Chain vision, "to create cutting-edge environmental solu- spring 1999 (the price increase was coupled with a tions in order to assure sustainable growth for our price reduction of Round-Up Readyherbicideso company," says Monsanto's CEO Robert Shapiro that the overall cost to a customer was essentially the (Monsanto Press Release, 1998). 2 same). In 1996, Monsanto Company acquired Asgrow One incentive that Monsanto provides to seed Agronomics. Asgrow is a major U.S. soybean seed suppliers is a special handling fee. For suppliers, company with international operations. According Monsanto provides 10 percent of this fee back to to Monsanto's executive vice president, Hendrik A. the supplier (i.e., $0.60 ). In addition, if a supplier Verfaillie: "Asgrow's strength in soybeans is partic- meets certain share-of-business requirements, ularly important to us as we accelerate the sales of Monsanto will rebate another 10 percent (i.e., our Round-Up $ soybeans and other new soybean $0.60 ) to the supplier. These requirements include products to farmers worldwide. The acquisition of having 90 percent of herbicide-resistant soybeans Asgrow Agronomics strengthens our ability to sold be Round-Up Ready soybeans, 85 percent of quickly move our innovations into the marketplace" herbicide-resistant corn be Round-Up Ready (Monsanto Press Release, 1998). Other examples of corn, and 90 percent of corn borer insect-protected recent Monsanto acquisitions and alliances include: corn be YieldGard Bt corn. In order to obtain the - In December 1997, Monsanto Company, additional 10 percent, all three share-of-business Asgrow Seed Company, and Stine Seed requirements must be met. Together, these two Company announced a collaboration agreement. rebates can more than double the retail profit on a This research agreement was reportedly designed bag of seed. to further improve and develop soybean genetics . For any seed company, this program can generand related technologies. ate a lot of money. For a firm selling 100,000 bags - On December 4, 1998, DEKALB Genetics of soybeans, meeting these requirements would became a wholly-owned subsidiary of Monsanto. mean receiving $60,000. Likewise, for a firm selling - Monsanto also bought Holdens in early 1997. 500,000 units, this means an additional $300,000 Holdens is a major supplier of corn genetics to in revenue. Given, the relatively low profit margin both large and independent seed companies. On a bag of soybeans, this provides substantial - In June 1998 Monsanto signed an agreement to incentive for suppliers to sell products with purchase Cargill's intemational seed operations in Monsanto technologies. Latin America, Asia, Africa, and parts of Europe. However, for companies like Dairyland who are This acquisition includes seed research, produc- allied with other biotechnology channel partners, tion, and testing facilities in 21 countries and Monsanto's incentive structure raises several issues. distribution systems in 51 countries. First of all, with such an attractive inducement to sell acquired a solid destionue to develop its relationship with DuPont? Furthermore, because this offer will shape decisions new product development. Thus, at the same time sively market STS even when they foresee markets Dairyland's initial soybean technology partner (i.e., becoming less attainable? Is this an opportunity for DuPont) has become more tightly allied with one Dairyland, or a threat to its position in the market? of Dairyland's key competitors (i.e., Pioneer), Another concern for Dairyland is that not all of Monsanto has been managing its relationships with Monsanto's business partners operate under the several other Dairyland competitors. same set of restrictions. Due to prior contractual Another way that Monsanto is managing the arrangements, neither Novartis nor Pioneer is - In December 1997, Monsanto Company, additional 10 percent, all three share-of-business Asgrow Seed Company, and Stine Seed requirements must be met. Together, these two Company announced a collaboration agreement. rebates can more than double the retail profit on a This research agreement was reportedly designed bag of seed. to further improve and develop soybean genetics For any seed company, this program can generand related technologies. ate a lot of money. For a firm selling 100,000 bags - On December 4, 1998, DEKALB Genetics of soybeans, mecting these requirements would became a wholly-owned subsidiary of Monsanto. mean receiving $60,000. Likewise, for a firm selling - Monsanto also bought Holdens in early 1997.500,000 units, this means an additional $300,000 Holdens is a major supplier of corn genetics to in revenue. Given, the relatively low profit margin both large and independent seed companies. on a bag of soybeans, this provides substantial - In June 1998 Monsanto signed an agreement to incentive for suppliers to sell products with purchase Cargill's international seed operations in Monsanto technologies. Latin America, Asia, Africa, and parts of Europe. However, for companies like Dairyland who are This acquisition includes seed research, produc- allied with other biotechnology channel partners, tion, and testing facilities in 21 countries and Monsanto's incentive structure raises several issues. distribution systems in 51 countries. First of all, with such an attractive inducement to sell Through these partnerships, Monsanto has Round-Up tolerant soybeans, should Dairyland acquired a solid distribution network that should Furthermore, because this offer will shape decisions facilitate rapid seed product introduction. Also, made by other genetic companies, a result may be through gearing research to complement one the decrease in the number of companies providing another, these new alliances will achieve synergies in STS technologies. Will DuPont continue to aggresnew product development. Thus, at the same time sively market STS even when they foresee markets Dairyland's initial soybean technology partner (i.e., becoming less attainable? Is this an opportunity for DuPont) has become more tightly allied with one Dairyland, or a threat to its position in the market? of Dairyland's key competitors (i.e., Pioneer), Another concern for Dairyland is that not all of Monsanto has been managing its relationships with Monsanto's business partners operate under the several other Dairyland competitors. same set of restrictions. Due to prior contractual Another way that Monsanto is managing the arrangements, neither Novartis nor Pioneer is supply-chain of its Round-Up 2 Ready technology is required to pay Monsanto the $6.50/ bag technolthrough incentive programs. Monsanto has estab- ogy fee. However, each of these firms charges this lished an incentive structure for seed manufactures, fee to customers. This raises concerns of the equity for agricultural retailing, and for growers. For of Monsanto business relationships, as this money example, growers who use both Round-Up Ready may provide a source of funds for research and soybeans and Monsanto's YieldGard Bt corn on a development that is not available to most Roundhigh percentage of acres are given a rebate. Up tolerant soybean suppliers, or allow a significant Given the demand for Round-Up U Ready soy- disparity in dealer or retail pricing. beans, Monsanto has been able to charge a Danny Kennedy, Co-President of Asgrow Seed, technology fee to growers. This fee was originally believes Monsanto's success stems from its ability to $5 per 50 -pound bag, but was increased to $6 for add value to the farmer by capitalizing on the synergies from its portfolio of companies and which is used with nonherbicide-tolerant soybean technologies representing several sectors in agricul- varieties. Recently, they have cut prices approximately ture. He states that Monsanto considers its involve- 40 percent so that its use is competitively priced with ment in agricultural business to be a core part of the Round-Up Ultra and Dupont's Symphony. Thus, overall technology platform. This view is consistent American Cyanamid continues to represent a major with the strategic actions of Monsanto. Since head- market challenge for DuPont/STS and Monsanto ing up the company in 1995 , Robert Shapiro has Round-Up products. If DuPont is to be successful, spun off the core chemical business to focus on it will be necessary to demonstrate a significant being the "main provider of the agricultural advantage over this and other traditional herbicide biotechnology ..." (Monsanto Press Release, alternatives. Another relatively new release is 1998). Flexstar by Zeneca, a formulation intended for With regard to herbicide-resistance technology, broadleaf weed control in soybeans. Monsanto executives see both seed and biotechnology as key ingredients to their long-term strategy. Danny Kennedy realizes that seed is the distribution Competitive Environment in the system by which Monsanto technologies reach the Soybean Seed Industry farmer. He believes that seed will drive farmers' deci- Dairyland faces a wide range of competitors in their sions in the future, and states that, "Farmers will buy diverse market area (see Table 3). Some competitors seed that is specialized genetically to suit their own are large international companies such as Pioneer, feed stock needs, grain market needs, consumer DEKALB, and Novartis Seeds that have broad needs, etc." Asgrow and DEKALB have competitive product lines that parallel Dairyland's. Furthermore, advantages in some regions, however, because small there are a large number of regional and local seed firms can have a strong presence in certain regions companies who offer all or part of the seed products and market niches, he believes that Monsanto cannot sold by Dairyland. Some of Dairyland's competiafford not to license other seed firms with its new tors develop and sell proprietary products, while technologies. As an example of the commitment of others sell public varieties that are genetically identiMonsanto to licensing its technology to the broad cal to each other, but carry the producer's own market (family and small firms), as of February 1999 label. Many of these smaller companies are aggresMonsanto has already agreed to licensing its technol- sive and have strong loyalties within their own local ogy to more than 200 seed firms. market areas. Competition is intense in all three product lines. Pioneer is the clear industry leader in the seed corn Other Providers of Herbicide-Tolerant market with an estimated market share of about Soybean Technology 42 percent. There is no dominant supplier in alfalfa Although Dairyland has business partnerships with although alfalfa has always been one of Dairyland's DuPont and Monsanto, there are several other strengths. Pioneer has become aggressive in the chemical and biotechnical firms that operate in soybean market with an estimated 14 percent share. this market. AgrEvo, is the third player in the Asgrow recently announced that it was the leader in herbicide-resistant seed market. AgrEvo's herbicide, soybean share with 16 percent. Accurate market Liberty, targets a broad spectrum of broad leaf share information is difficult to obtain and to weeds. The Liberty technology was late to enter the interpret since many seed companies are privately market. Early efforts of AgrEvo to bring its herbi- held and the market is so geographically fractured. cide-resistance technology to the seed market Aggregate market share information is also often were through Asgrow and Holdens. This strategy misleading because it varies dramatically among has proven to be problematic, especially since local market areas. For example, while Dairyland Monsanto now owns both. AgrEvo has been licens- Seed does not have a large market share on a ing its technology to other seed companies, though national basis (i.e., less than 2 percent), in some Competition is intense in all three product lines. Pioneer is the clear industry leader in the seed corn Other Providers of Herbicide-Tolerant market with an estimated market share of about Soybean Technology 42 percent. There is no dominant supplier in alfalfa Although Dairyland has business partnerships with although alfalfa has always been one of Dairyland's DuPont and Monsanto, there are several other strengths. Pioneer has become aggressive in the chemical and biotechnical firms that operate in soybean market with an estimated 14 percent share. this market. AgrEvo, is the third player in the Asgrow recently announced that it was the leader in herbicide-resistant seed market. AgrEvo's herbicide, soybean share with 16 percent. Accurate market Liberty, targets a broad spectrum of broad leaf share information is difficult to obtain and to weeds. The Liberty technology was late to enter the interpret since many seed companies are privately market. Early efforts of AgrEvo to bring its herbi- held and the market is so geographically fractured. cide-resistance technology to the seed market Aggregate market share information is also often were through Asgrow and Holdens. This strategy misleading because it varies dramatically among has proven to be problematic, especially since local market areas. For example, while Dairyland Monsanto now owns both. AgrEvo has been licens- Seed does not have a large market share on a ing its technology to other seed companies, though national basis (i.e., less than 2 percent), in some it has been less successful than Monsanto and core market areas, their market share may run as DuPont to bring its technology to the market. high as 30 percent. While pricing of the AgrEvo product is not yet Most soybean seed companies are marketing clear, it appears that AgrEvo may choose a premium some STS varieties. However, these companies differ price strategy rather than a licensing fee as basically in their enthusiasm and commitment to the Monsanto has chosen. Liberty is faster-acting than technology. Among the major players, a few of them Round-Up but has about the same kill spectrum are worth mentioning. Asgrow has had STS prodfor weeds and grasses as Round-Up. ucts developed since 1993 . Asgrow has not priced American Cyanamid has maintained a significant their STS varieties at a premium relative to their share of the soybean herbicide market with Pursuit ", non-STS varieties. Cenex, a major cooperative in the Estimated 1998 National Market Share TABLE 3 Percent of Soybean Acres \begin{tabular}{ll} \hline Farmer Saved Seed & 32.5% \\ Public Varieties & 15.0% \\ Private Varieties: & 16.0% \\ Asgrow (Monsanto) & 14.0% \\ Pioneer & =5.0% \\ DEKALB (Monsanto) & =5.0% \\ Novartis & =5.0% \\ Stine &

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started