Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need answers please only the answer QUESTION 20 ARJAM Insurance Company has an overall operating ratio of 1.2, based on this which of the

i need answers please only the answer

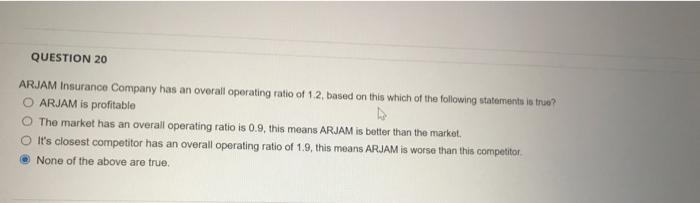

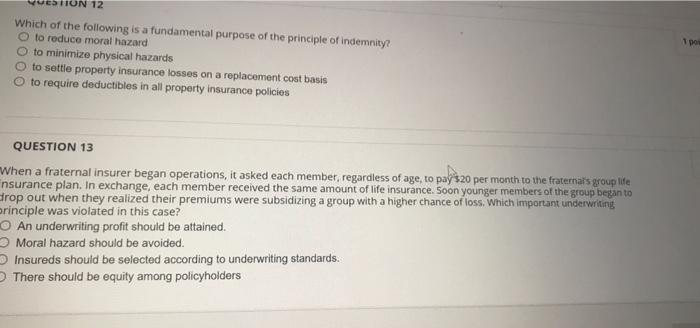

QUESTION 20 ARJAM Insurance Company has an overall operating ratio of 1.2, based on this which of the following statements is true? O ARJAM is profitable 4 O The market has an overall operating ratio is 0.9, this means ARJAM is better than the market. It's closest competitor has an overall operating ratio of 1.9, this means ARJAM is worse than this competitor. None of the above are true. TION 12 Which of the following is a fundamental purpose of the principle of indemnity? O to reduce moral hazard to minimize physical hazards to settle property insurance losses on a replacement cost basis to require deductibles in all property insurance policies QUESTION 13 When a fraternal insurer began operations, it asked each member, regardless of age, to pay $20 per month to the fraternal's group life nsurance plan. In exchange, each member received the same amount of life insurance. Soon younger members of the group began to drop out when they realized their premiums were subsidizing a group with a higher chance of loss. Which important underwriting principle was violated in this case? An underwriting profit should be attained. Moral hazard should be avoided. Insureds should be selected according to underwriting standards. O There should be equity among policyholders 1 pos

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started