Question

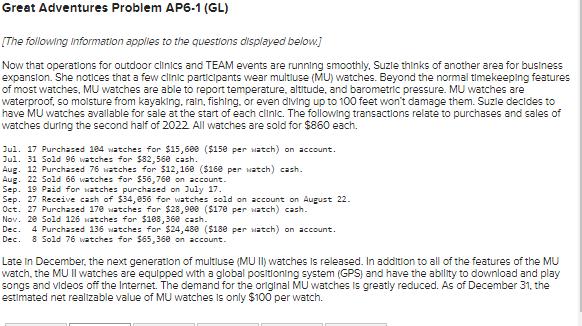

I need assistance correcting the following mistakes: General Journal information: 7/17 - Purchased 104 watches for $15,600 ($150 per watch) on account. Record the purchase

I need assistance correcting the following mistakes:

General Journal information:

7/17 - Purchased 104 watches for $15,600 ($150 per watch) on account. Record the purchase of inventory on account.

7/31 - Sold 96 watches for $82,560 cash. Record the sale of inventory on account.

7/31 - Sold 96 watches for $82,560 cash. Record the cost of inventory sold.

8/02 - Purchased 76 watches for $12,160 ($160 per watch) cash. Record the purchase of inventory for cash.

8/22 - Sold 66 watches for $56,760 on account. Record the sale.

8/22 - Sold 66 watches for $56,760 on account. Record the cost of the sale.

9/19 - Paid for watches purchased on July 17. Record the payment of cash.

9/27 - Receive cash of $34,056 for watches sold on account on August 22. Record the receipt of cash for the sale.

10/27 - Purchased 170 watches for $28,900 ($170 per watch) cash. Record the purchase of inventory for cash.

11/20 - Sold 126 watches for $108,360 cash. Record the sale of inventory for cash.

11/20 - Sold 126 watches for $108,360 cash. Record the cost of inventory sold.

12/04 - Purchased 136 watches for $24,480 ($180 per watch) on account. Record the purchase of inventory on account.

12/08 - Sold 76 watches for $65,360 on account. Record the sale of inventory on account.

12/08 - Sold 76 watches for $65,360 on account. Record the cost of inventory sold.

12/31 - Record the write-down of inventory to net realizable value.

12/31 - Record the closure of revenue accounts.

12/31 - Record the closure of expense accounts.

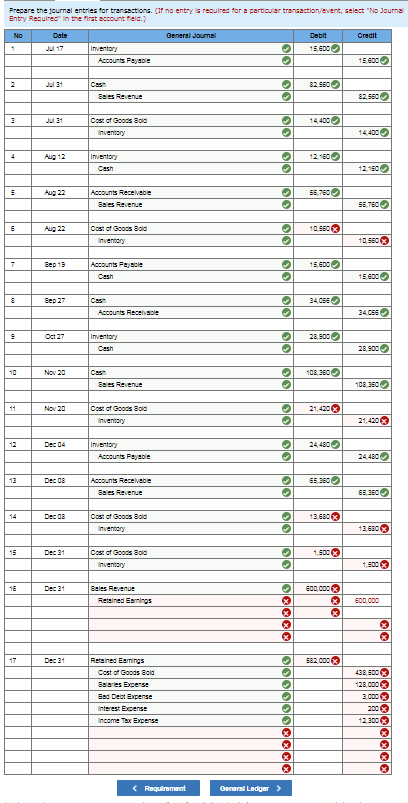

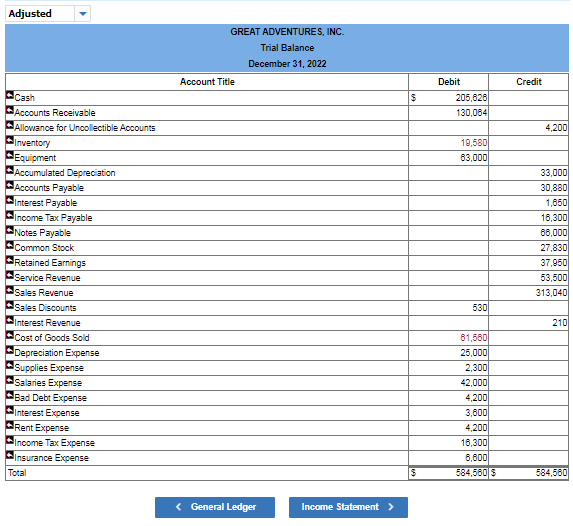

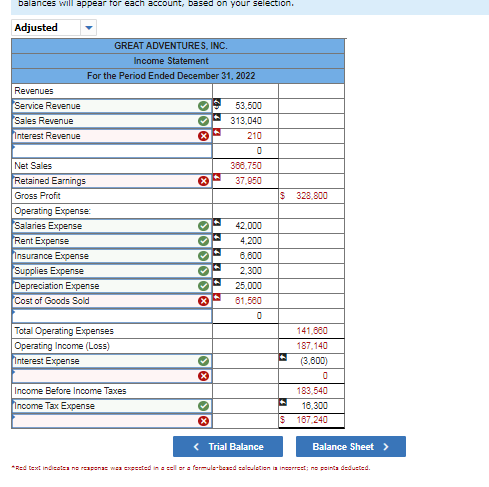

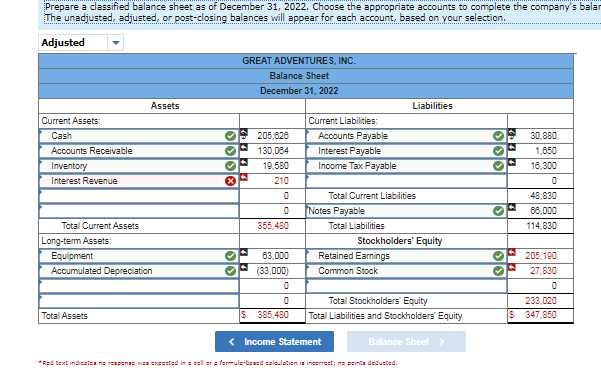

Great Adventures Problem AP6-1 (GL) [The following information applies to the questions displayed below.] Now that operations for outdoor clinics and TEAM events are running smoothly, Suzle thinks of another area for business expansion. She notices that a few clinic participants wear multluse (MU) watches. Beyond the normal timekeeping features of most watches, MU watches are able to report temperature. altitude and barometric pressure. Mu watches are waterproof, so moisture from kayaking, rain, fishing, or even diving up to 100 feet won't damage them. Suzie decides to have MU watches available for sale at the start of each clinic. The following transactions relate to purchases and sales of watches during the second half of 2022 All watches are sold for $860 each. Dul. 17 Purchased 184 watches for $15,680 ($150 per watch) on account. Jul. 31 Sold 96 watches for $82,560 cash. Aug. 12 Purchased 76 watches for $12,160 ($160 per watch) cash. Aug. 22 Sold 66 watches for $56,768 on account. Sep. 19 Paid for watches purchased on July 17. Sep. 27 Receive cash of $34,056 for watches sold on account on August 22. Oct. 27 Purchased 17e watches for $28,980 ($170 per watch) cash. Nov. 20 Sold 126 watches for $188,368 cash. Dec. 4 Purchased 136 watches for $24,480 ($180 per watch) on account. Dec. 8 Sold 76 watches for $65,360 on account. Late in December, the next generation of multluse (MU II) watches is released. In addition to all of the features of the MU watch the MU II watches are equipped with a global positioning system (GPS) and have the ability to download and play songs and videos off the Internet. The demand for the original MU watches is greatly reduced. As of December 31, the estimated net realizable value of MU watches is only $100 per watch. Prepare the journal entries for transactions. If no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account feld No Date General Journal Credit Debit 15 600 Jul 17 Inventory Accounts Payable 15.600 Jul 31 lolo 82.950 Sales Revenue 82.950 Jul 21 14.400 Cost of Goods Sold Inventory 14.400 Aug 12 12.90 Inventory Cash 12.10 Aug 22 55,750 Accounts Receivable Sales Revenue 55,750 Aug 22 10.550 Cost of Goods Sold Inventory 10.550 OOOOOOOO OOOOOOOO Sep 19 Accounts able 15.600 15.600 Sep 27 34 CSS Accounts Receivable 34 CSC Oct 27 28.900 Inventory Cesh 28.900 Nov 20 108.380 Sses Revenue 108.380 11 Nov 20 Cost of Goods Sold Inventory 21,420 Dec 04 lolol lolololo Inventory Accounts Payable 24480 24480 13 Dec s Accounts Receivable Sales Revenue ES 360 Dec 03 12.6803 Cost of Goods Sold Inventory 13.6803 in Dec 31 1.900 Cost of Goods Sold Inventory 1.500 OOOO @@@@ 16 Dec 31 600.000 Sales Revenue Retained Earnings 800.000 x x x 17 Dec 31 582.000 Retained Earnings Cost of Goods Bold Sseries Experse Bed Deot Expense Interest Expense Income Tax Expense 438.9003 128.000 3.000 2003 12 2003 x x x x x Adjusted GREAT ADVENTURES, INC. Trial Balance December 31, 2022 Account Title Credit $ Debit 205,826 130,064 4,200 19,5801 83,000 Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Equipment Accumulated Depreciation Accounts Payable Interest Payable Income Tax Payable Notes Payable Common Stock Retained Earnings Service Revenue Sales Revenue Sales Discounts Interes: Revenue Cost of Goods Sold Depreciation Expense Supplies Expense Salaries Expense Bad Debt Expense Interest Expense Rent Expense Income Tax Expense Insurance Expense 33,000 30,880 1.650 16,300 66,000 27,830 37,950 53,500 313,040 5301 2101 61,560 25,000 2,300 42,000 4,200 3,600 4,200 16,300 6,6001 584,560 5 Total 584,500 balances will appear for each account, based on your selection. Adjusted GREAT ADVENTURES, INC. Income Statement For the Period Ended December 31, 2022 Revenues Service Revenue Sales Revenue Interest Revenue lololol 53,500 313,040 210 8 366.750 37.950 $ 328.800 Net Sales Retained Earnings Gross Profit Operating Expense: Salaries Expense Rent Expense Insurance Expense Supplies Expense Depreciation Expense Cost of Goods Sold OOOOO 2 2 2 2 42.000 4,200 6.000 2.300 25,000 61,560 Total Operating Expenses Operating Income (Loss) Interest Expense 141.680 187.140 (3.600) O Income Before Income Taxes Income Tax Expense xol 183.540 16,300 $ 167 240 *Red text indicata ne rapenas mea exsected in sesler a ferle-beaed callation is ineret; me point deducted. Prepare a classified balance sheet as of December 31, 2022. Choose the appropriate accounts to complete the company's balar The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Adjusted GREAT ADVENTURES, INC. Balance Sheet December 31, 2022 Assets Liabilities Current Assets: Cash Accounts Receivable Inventory Interest Revenue OOOO 205,620 130.084 19,580 Current Liabilities: Accounts Payable Interest Payable Income Tax Payable lololo 30.880 1,650 18,300 210 o 48,830 68,000 114,830 366.480 Total Current Assets Long-term Assets Equipment Accumulated Depreciation Total Current Liabilities Notes Payable Total Liabilities Stockholders' Equity Retained Earnings Common Stock olol 63.000 (33,000) 0 205,190 27,830 Total Stockholders' Equity Total Liabilities and Stockholders' Equity 233.020 $ 347,850 Total Assets $ 385.480 Adjusted GREAT ADVENTURES, INC. Trial Balance December 31, 2022 Account Title Credit $ Debit 205,826 130,064 4,200 19,5801 83,000 Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Equipment Accumulated Depreciation Accounts Payable Interest Payable Income Tax Payable Notes Payable Common Stock Retained Earnings Service Revenue Sales Revenue Sales Discounts Interes: Revenue Cost of Goods Sold Depreciation Expense Supplies Expense Salaries Expense Bad Debt Expense Interest Expense Rent Expense Income Tax Expense Insurance Expense 33,000 30,880 1.650 16,300 66,000 27,830 37,950 53,500 313,040 5301 2101 61,560 25,000 2,300 42,000 4,200 3,600 4,200 16,300 6,6001 584,560 5 Total 584,500 balances will appear for each account, based on your selection. Adjusted GREAT ADVENTURES, INC. Income Statement For the Period Ended December 31, 2022 Revenues Service Revenue Sales Revenue Interest Revenue lololol 53,500 313,040 210 8 366.750 37.950 $ 328.800 Net Sales Retained Earnings Gross Profit Operating Expense: Salaries Expense Rent Expense Insurance Expense Supplies Expense Depreciation Expense Cost of Goods Sold OOOOO 2 2 2 2 42.000 4,200 6.000 2.300 25,000 61,560 Total Operating Expenses Operating Income (Loss) Interest Expense 141.680 187.140 (3.600) O Income Before Income Taxes Income Tax Expense xol 183.540 16,300 $ 167 240 *Red text indicata ne rapenas mea exsected in sesler a ferle-beaed callation is ineret; me point deducted. Prepare a classified balance sheet as of December 31, 2022. Choose the appropriate accounts to complete the company's balar The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Adjusted GREAT ADVENTURES, INC. Balance Sheet December 31, 2022 Assets Liabilities Current Assets: Cash Accounts Receivable Inventory Interest Revenue OOOO 205,620 130.084 19,580 Current Liabilities: Accounts Payable Interest Payable Income Tax Payable lololo 30.880 1,650 18,300 210 o 48,830 68,000 114,830 366.480 Total Current Assets Long-term Assets Equipment Accumulated Depreciation Total Current Liabilities Notes Payable Total Liabilities Stockholders' Equity Retained Earnings Common Stock olol 63.000 (33,000) 0 205,190 27,830 Total Stockholders' Equity Total Liabilities and Stockholders' Equity 233.020 $ 347,850 Total Assets $ 385.480

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started