Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need corrections for 6b and c only This window shows your responses and what was marked correct and incorrect from your previous attempt. Benson

I need corrections for 6b and c only

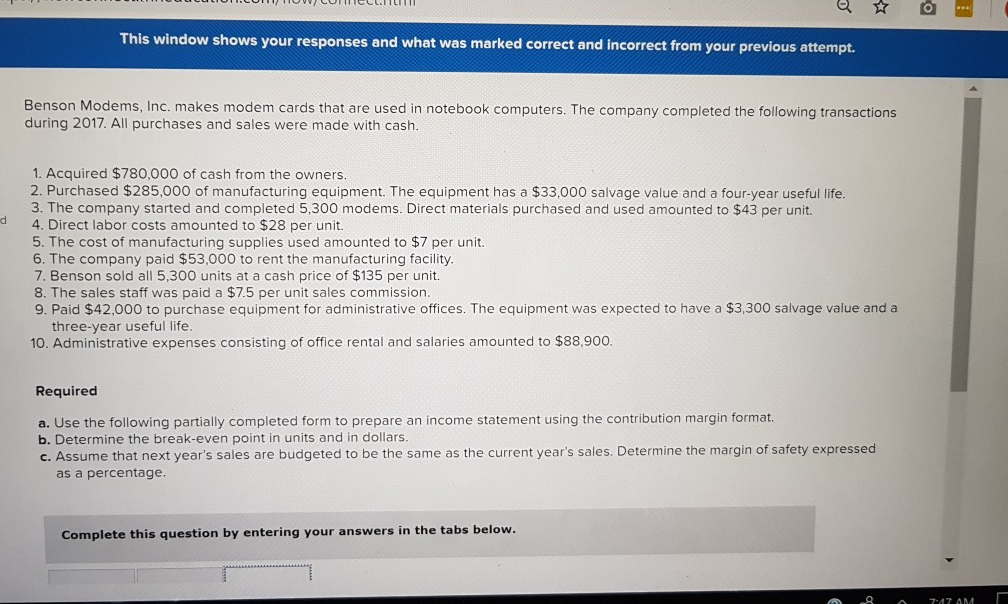

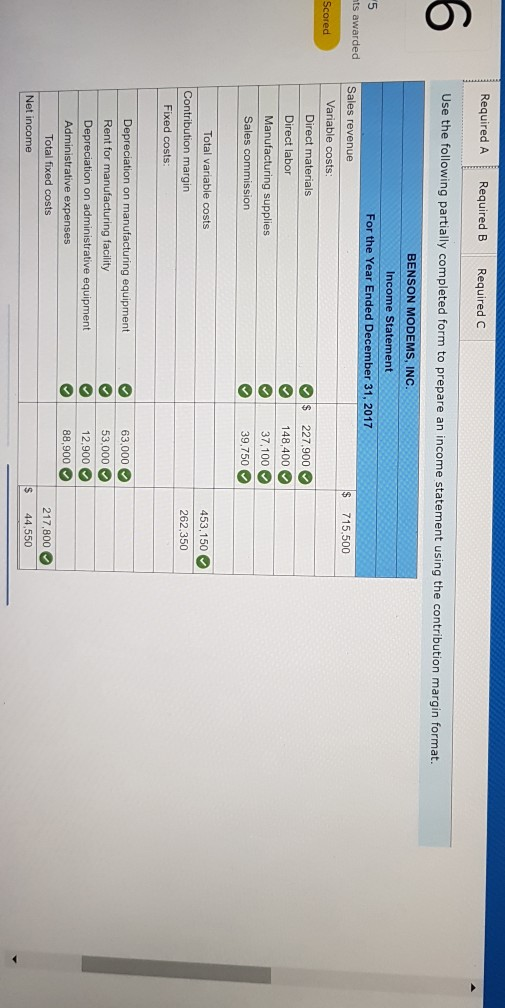

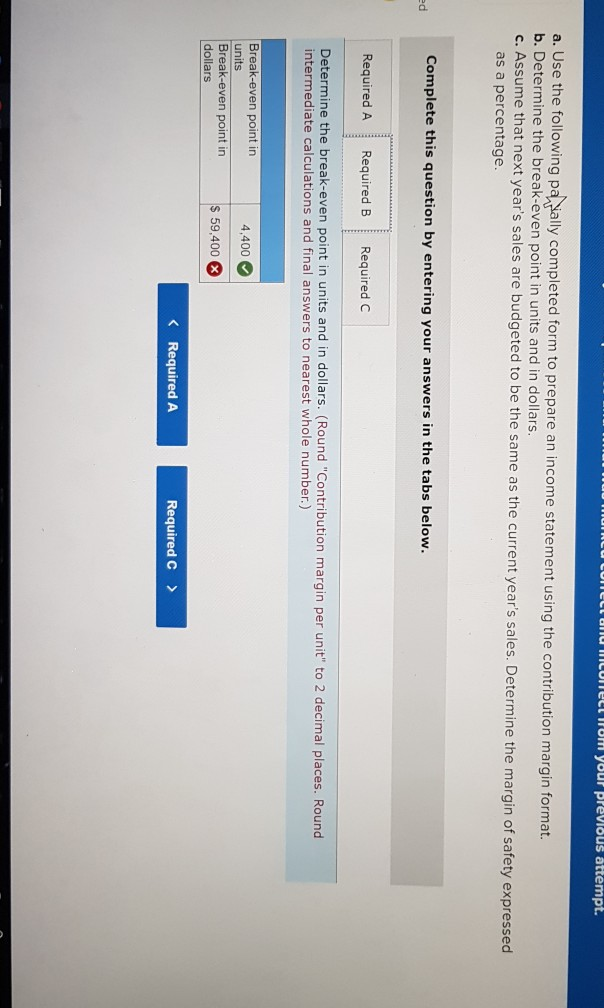

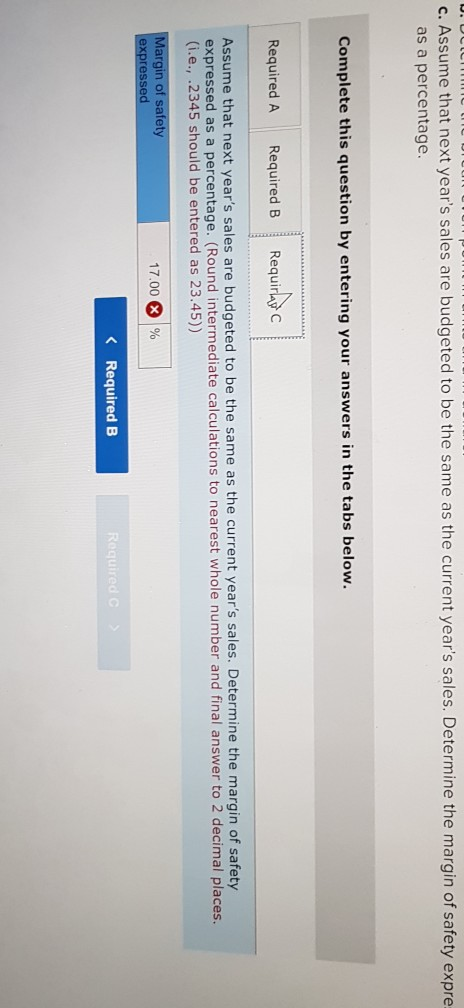

This window shows your responses and what was marked correct and incorrect from your previous attempt. Benson Modems, Inc. makes modem cards that are used in notebook computers. The company completed the following transactions during 2017. All purchases and sales were made with cash. 1. Acquired $780,000 of cash from the owners 2. Purchased $285,000 of manufacturing equipment. The equipment has a $33,000 salvage value and a four-year useful life. 3. The company started and completed 5,300 modems. Direct materials purchased and used amounted to $43 per unit. d 4. Direct labor costs amounted to $28 per unit. 5. The cost of manufacturing supplies used amounted to $7 per unit. 6. The company paid $53,000 to rent the manufacturing facility. 7. Benson sold all 5,300 units at a cash price of $135 per unit. 8. The sales staff was paid a $7.5 per unit sales commission. 9. Paid $42,000 to purchase equipment for administrative offices. The equipment was expected to have a $3,300 salvage value and a three-year useful life 10. Administrative expenses consisting of office rental and salaries amounted to $88,900. Required a. Use the following partially completed form to prepare an income statement using the contribution margin format. b. Determine the break-even point in units and in dollars. c. Assume that next year's sales are budgeted to be the same as the current year's sales. Determine the margin of safety expressed as a percentage. Complete this question by entering your answers in the tabs below Required A Required B Required C 6 Use the fo llowing partially completed form to prepare an income statement using the contribution margin format. BENSON MODEMS, INC Income Statement For the Year Ended December 31, 2017 ts awarded Sales revenue $ 715,500 Variable costs: Scored Direct materials Direct labor Manufacturing supplies Sales commission Os 227.900 148,400 37,100 39,750 453,150 262350 Total variable costs Contribution margin Fixed costs Depreciation on manufacturing equipment Rent for manufacturing facility 63,000 ol 53,000 n on administrative equipment 88,900 217,800 S 44.550 costs a. Use the following pa tially completed form to prepare an income statement using the contribution margin format. b. Determine the break-even point in units and in dollars c. Assume that next year's sales are budgeted to be the same as the current year's sales. Determine the margin of safety expres sed as a percentage Complete this question by entering your answers in the tabs below. ed Required ARequired B Required C Determine the break-even point in units and in dollars. (Round "Contribution margin per unit" to 2 decimal places. Round intermediate calculations and final answers to nearest whole number.) Break-even point in units Break-even point in dollars 4,400 s 59,400 3 K Required A Required C> c. Assume that next year's sales are budgeted to be the same as the current year's sales. Determine the margin of safety expre as a percentage Complete this question by entering your answers in the tabs below. Required A Required B Requiray C Assume that next year's sales are budgeted to be the same as the current year's sales. Determine the margin of safety expressed as a percentage. (Round intermediate calculations to nearest whole number and final answer to 2 decimal places (i.e., .2345 should be entered as 23.45)) argin of safety expresse 17.00 % K Required B Required C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started