Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need explanations Problem 2.9 Chinese Yuan Revaluation Many experts believe that the Chinese currency should not only be revalued against the U.S. dollar as

I need explanations

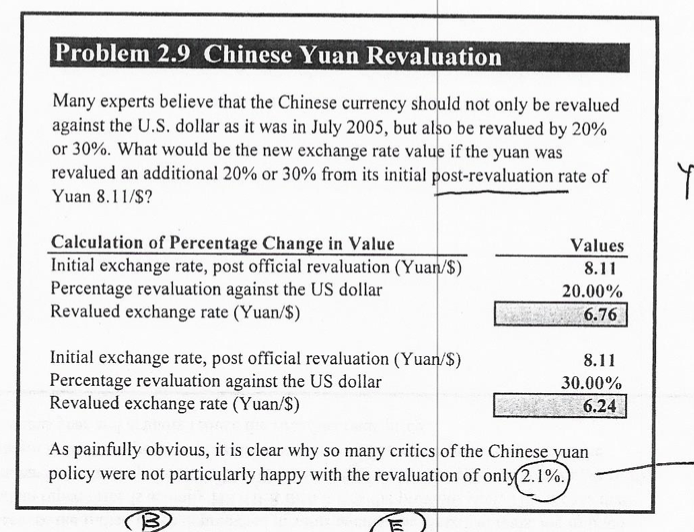

Problem 2.9 Chinese Yuan Revaluation Many experts believe that the Chinese currency should not only be revalued against the U.S. dollar as it was in July 2005, but also be revalued by 20% or 30%. What would be the new exchange rate value if the yuan was revalued an additional 20% or 30% from its initial post-revaluation rate of Yuan 8.11/$? T Calculation of Percentage Change in Value Initial exchange rate, post official revaluation (Yuan/$) Percentage revaluation against the US dollar Revalued exchange rate (Yuan/$) Values 8.11 20.00% 6.76 Initial exchange rate, post official revaluation (Yuan/$) Percentage revaluation against the US dollar Revalued exchange rate (Yuan/$) 8.11 30.00% 6.24 As painfully obvious, it is clear why so many critics of the Chinese yuan policy were not particularly happy with the revaluation of only 2.1%. Problem 2.9 Chinese Yuan Revaluation Many experts believe that the Chinese currency should not only be revalued against the U.S. dollar as it was in July 2005, but also be revalued by 20% or 30%. What would be the new exchange rate value if the yuan was revalued an additional 20% or 30% from its initial post-revaluation rate of Yuan 8.11/$? T Calculation of Percentage Change in Value Initial exchange rate, post official revaluation (Yuan/$) Percentage revaluation against the US dollar Revalued exchange rate (Yuan/$) Values 8.11 20.00% 6.76 Initial exchange rate, post official revaluation (Yuan/$) Percentage revaluation against the US dollar Revalued exchange rate (Yuan/$) 8.11 30.00% 6.24 As painfully obvious, it is clear why so many critics of the Chinese yuan policy were not particularly happy with the revaluation of only 2.1%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started