Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need extermily help plz i have limitted time [The following information opplies to the questions displayed below] Cane Company manufactures iwo products called Apha

i need extermily help plz i have limitted time

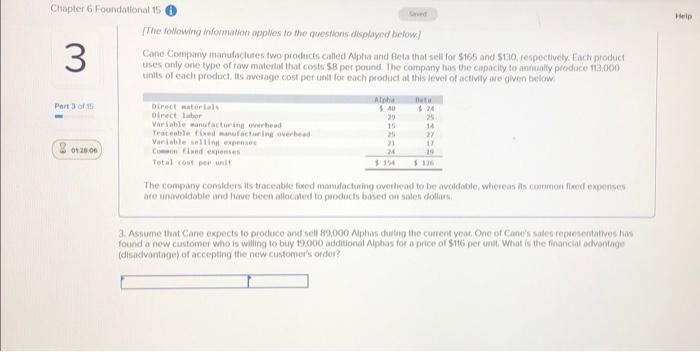

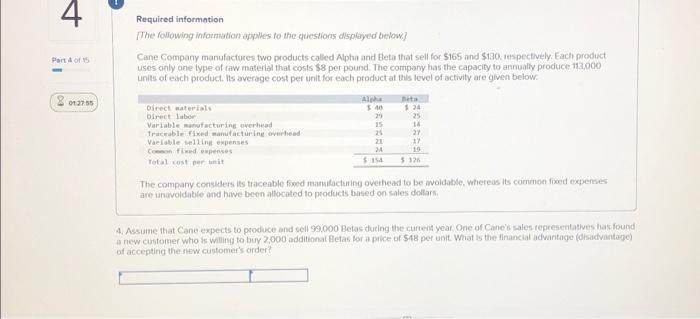

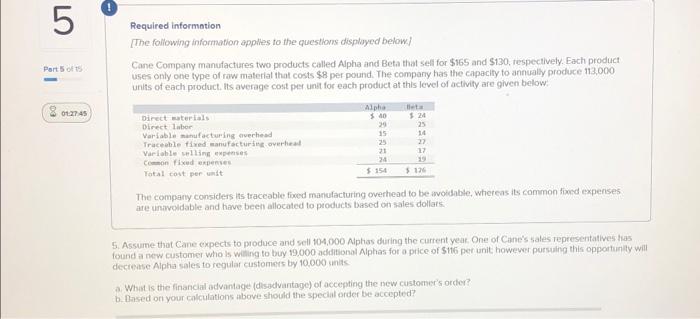

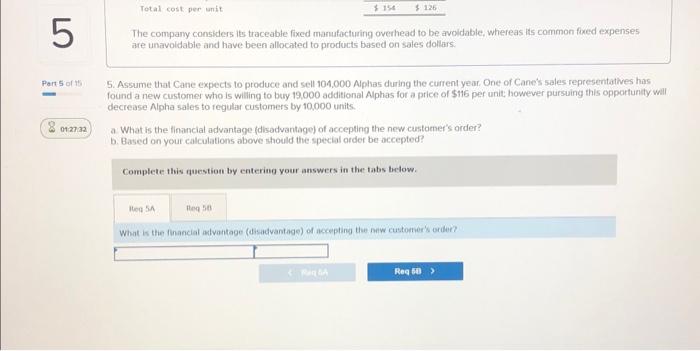

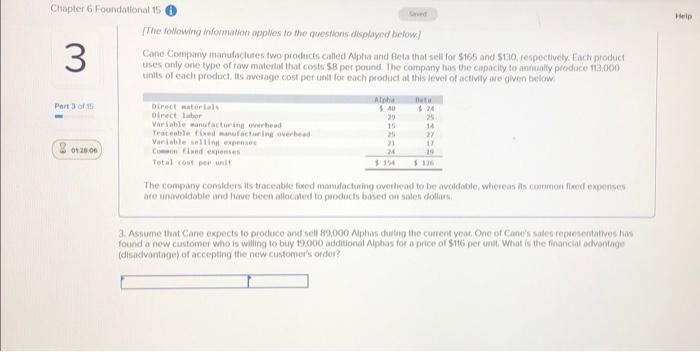

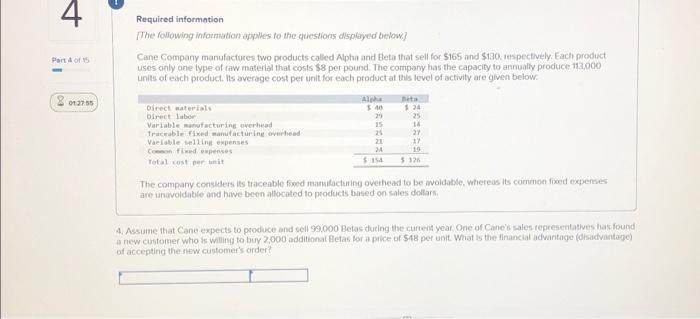

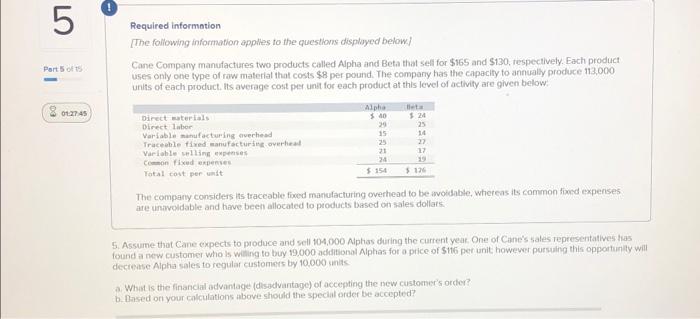

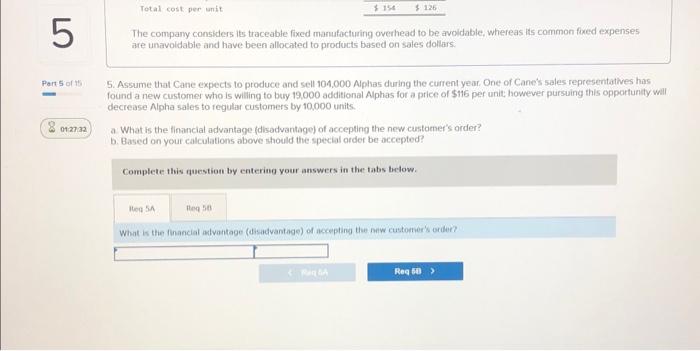

[The following information opplies to the questions displayed below] Cane Company manufactures iwo products called Apha and Beta that sell for $165 and $170, respoctively. Fach product uses only one type of raw matertal that costs $8 per pound. The compary has the capacify to annually prodiace 113,000 units of each product. Iis average cost per unit for each product at this level of activily are given below The compary considers its troceable foxed mamulacturing overthead to be avoldatile, whereas is common fined experises are unavoldable and hive been allocated to products basis on sales dollars. 3. Assume that Cane expects to produce and sell 89,000 Aphos dartig the current weat, One of Cants sales representatives han found a new customer who is willing to buy 19,000 additional Alphas for a price of $116 per unit. What is the financlat actvantage The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidabie and have been allocited to products based on sales dollars. 5. Assume that Cane expects to produce and sell 104,000 Aphas during the current year, One of Cane's sales representathes has found a new customer who is willing to buy 19,000 additional Aphas for a price of $116 per unit: however pursuing this opportunity will decrease Alpha sales to regutar customers by 10000 enits. a. What is the financial advantage (disadvantage) of accepting the new customer's order? b. Based on your calculations above thould the special order be occepted? Complete this question by entering your answers in the tabs thelow. What is the financial advantage (disadvantage) of accepting the niw customer's orden? Required information The following infornation applies to the questions displayed below] Cane Company manufactures two products called Alpha and Beta that sell for $165 and $130. inspectively. Each product uses only one type of raw material that costs $8 per pound. The compony has the capacity to annually produce 113,000 units of eisch product. its orerege cost per init for each product at this level of activity are oiven below The company considers its traceable frsed manulacturing overhead to be moidable, whereas its common fixed expenses are unavoldatie and have been allocated to products based on sales dollars: 4. Assime that Cane expects to produce and sell 99,000 Betas during the curtent year. One of Cane's sales representatives has found a new custorier who is wiling to buy 2,000 additionat Bletas for a pilice of $48 per unit What is the financiat advaritage (disadvantape) of arcenting the stew customer's order? Required information The following information applites to the questlons displisyed betow) Cane Company manufactures two products called Alpha and Beta that self for $165 and $130, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacily to annually produce 113,000 units of each product. Its average cost per unit for each product at this level of activity are given below: The company considers its traceable fixed manufacturing overhead to be ivoidable, whereas its common fixnd expenses are unwoldable and have been allocated to products based on sales dollars. 5. Assume that Cane expects to produce and sell 104,000 Aphas during the current yeak, One of Cane's sales representatives thas decrease. Alpha sales to regular customers by 10,000 units. a Whit is the financial advantage (disadvantage) of accepting the new customer's order? b. Dased on your calculations above should the special order be accepted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started