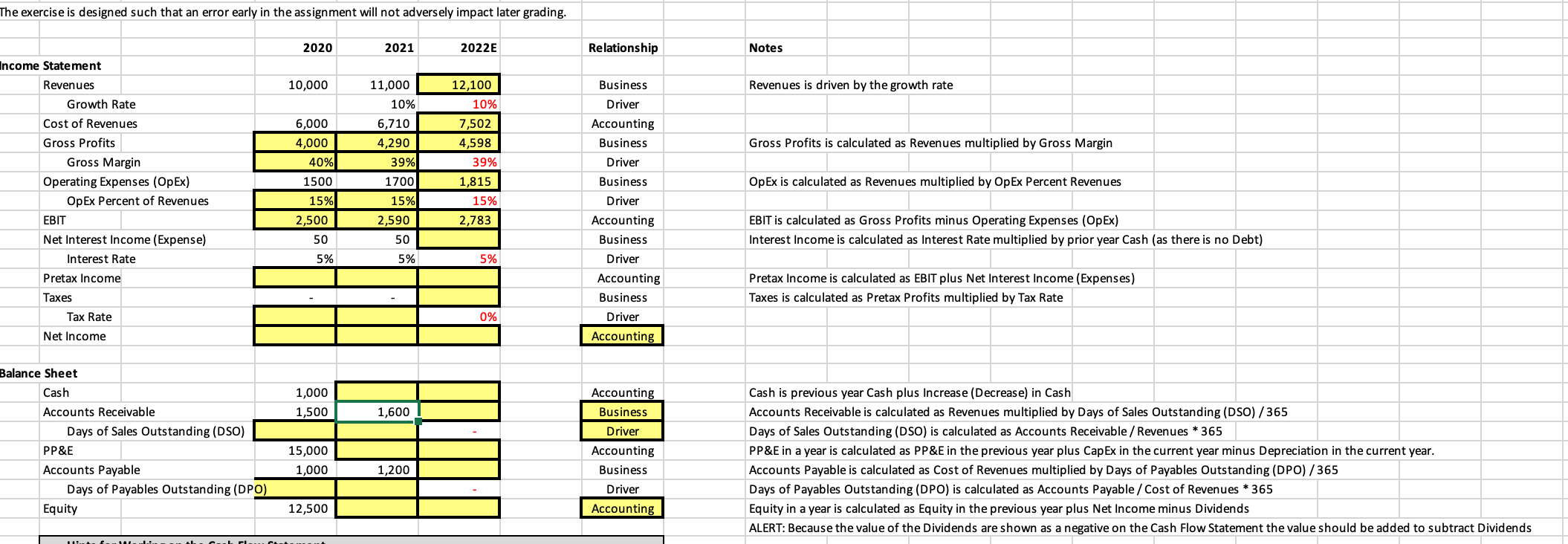

Question: i need formulas! The exercise is designed such that an error early in the assignment will not adversely impact later grading. 2020 2021 2022E Relationship

i need formulas!

i need formulas!

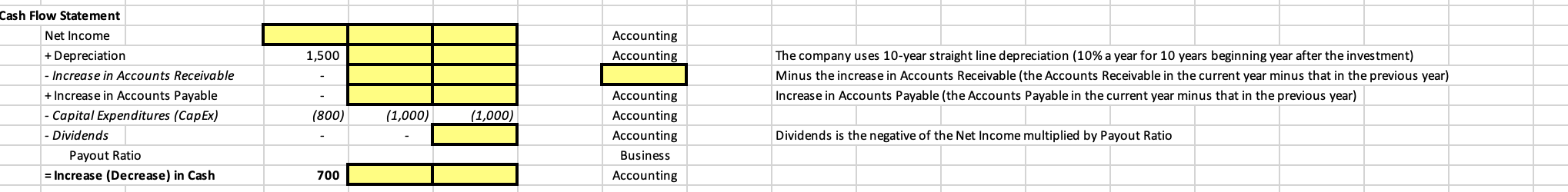

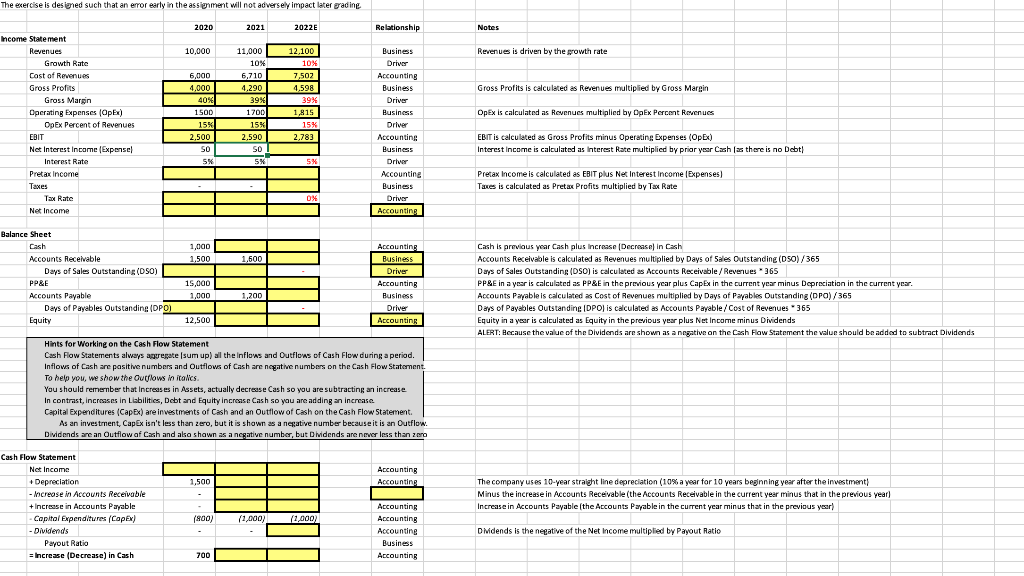

The exercise is designed such that an error early in the assignment will not adversely impact later grading. 2020 2021 2022E Relationship Notes 10,000 Revenues is driven by the growth rate 12,100 10% Business Driver Income Statement Revenues Growth Rate Cost of Revenues Gross Profits Gross Margin Operating Expenses (OpEx) Op Ex Percent of Revenues EBIT Net Interest Income (Expense) Interest Rate 6,000 4,000 40% Gross Profits is calculated as Revenues multiplied by Gross Margin 11,000 10% 6,710 4,290 39% 1700 15% 2,590 50 7,502 4,598 39% OpEx is calculated as Revenues multiplied by OpEx Percent Revenues 1500 15% 2,500 50 5% 1,815 15% 2,783 Accounting Business Driver Business Driver Accounting Business Driver Accounting Business Driver Accounting EBIT is calculated as Gross Profits minus Operating Expenses (OpEx) Interest Income is calculated as Interest Rate multiplied by prior year Cash (as there is no Debt) 5% 5% Pretax Income Pretax Income is calculated as EBIT plus Net Interest Income (Expenses) Taxes is calculated as Pretax Profits multiplied by Tax Rate Taxes Tax Rate 0% Net Income 1,000 1,500 1,600 Balance Sheet Cash Accounts Receivable Days of Sales Outstanding (DSO) PP&E Accounts Payable Days of Payables Outstanding (DPO) Equity 15,000 1,000 Accounting Business Driver Accounting Business Driver Accounting Cash is previous year Cash plus Increase (Decrease) in Cash Accounts Receivable is calculated as Revenues multiplied by Days of Sales Outstanding (DSO)/365 Days of Sales Outstanding (DSO) is calculated as Accounts Receivable / Revenues * 365 PP&E in a year is calculated as PP&E in the previous year plus CapEx in the current year minus Depreciation in the current year. Accounts Payable is calculated as Cost of Revenues multiplied by Days of Payables Outstanding (DPO)/365 Days of Payables Outstanding (DPO) is calculated as Accounts Payable / Cost of Revenues * 365 Equity in a year is calculated as Equity in the previous year plus Net Income minus Dividends ALERT: Because the value of the Dividends are shown as a negative on the Cash Flow Statement the value should be added to subtract Dividends 1,200 12,500 Accounting Accounting 1,500 Cash Flow Statement Net Income +Depreciation - Increase in Accounts Receivable + Increase in Accounts Payable - Capital Expenditures (Capex) Dividends Payout Ratio = Increase (Decrease) in Cash The company uses 10-year straight line depreciation (10% a year for 10 years beginning year after the investment) Minus the increase in Accounts Receivable (the Accounts Receivable in the current year minus that in the previous year) Increase in Accounts Payable (the Accounts Payable in the current year minus that in the previous year) (800) (1,000) (1,000) Accounting Accounting Accounting Business Accounting Dividends is the negative of the Net Income multiplied by Payout Ratio 700 The exercise is designed such that an error early in the assignment will not adversely impact later grading 2020 2021 2022E Relationship Notes 10,000 Revenues is driven by the growth rate 11.000 10% 6,000 4.000 Gross Profits is calculated as Revenues multiplied by Gross Margin Income Statement Revenues Growth Rate Cast of Revenues Gross Profits Gross Margin Operating Expenses (Opex) OpEx Percent of Revenues EBIT Net Interest Income (Expensel Interest Rate Pretax Income Taxes Tax Rate 12.100 % 10% 7,502 4.598 39% 1,815 15% % 2.783 OpEx is calculated as Revenues multiplied by OpEx Percent Revenues 6,710 4.290 39% 1700 15% 2.590 SO 5% 40% 1500 15% 2.500 SO 5% Business Driver Accounting Business Driver Business Driver Accounting Business Driver Accounting Business Driver Accounting EBIT is calculated as Gross Profits minus Operating Expenses (OpEx) Interest Income is calculated as interest Rate multiplied by prior year Cash (as there is no Debt 5% Pretax Income is calculated as EBIT plus Net Interest Income Expenses) Taxes is calculated as Pretax Profits multiplied by Tax Rate 0% Net Income 1,000 1.500 1.500 Balance Sheet Cash Accounts Receivable Days of Sales Outstanding (DSO) PP&E Accounts Payable Days of Payables Outstanding (DPO) Equity 15,000 1,000 Accounting Business Driver Accounting Business Driver Accounting Cash is previous year Cash plus increase Decrease in Cash Accounts Receivable is calculated as Revenues multiplied by Days of Sales Outstanding (050)/365 Days of Sales Outstanding (DSO) is calculated as Accounts Receivable / Revenues 365 PP&E in a year is calculated as PP&E in the previous year plus CapEx in the current year minus Depreciation in the current year Accounts Payable is calculated as Cost of Revenues multiplied by Days of Payables Outstanding (DPO)/365 Days of Payables Outstanding (DPO) is calculated as Accounts Payable/Cost of Revenues 365 Equity in a year is calculated as Equity in the previous year plus Net Income minus Dividends ALERT:Hecause the value of the Dividends are shown as a negative on the Cash Flow Statement the value should be added to subtract Dividends 1.200 12,500 Hints for Working on the Cash Flow Statement Cash Flow Statements always aggregate sum up) all the inflows and Outflows of Cash Flow during a period. Inflows of Cash are pasithe numbers and Outflows of Cash are negative numbers on the Cash Flow Statement To help you, we show the Outflows in italics. You should remernber that increases in Assets, actually decrease Cash so you are subtracting an increase In contrast, increases in Liabilitics, Debt and Equity increase Cash so you are adding an increase Capital Expenditures (CapEx) are investments of Cash and an Outflow of Cash on the Cash Flow Statement As an investment, CapEx isn't less than zero, but it is shown as a negative number because it is an Outflow. a Dividends are an Outflow af Cash and aka shawn as a negative number, but Dividends are never less than zero Accounting Accounting 1,500 Cash Flow Statement Net Income Depreciation - Increase in Accounts Receivable +Increase in Accounts Payable Capital Expenditures (Capex) - Dividends Payout Ratio = Increase (Decrease) in Cash The company uses 10-year straight line depreciation (10% a year for 10 years beginning year after the investment Minus the increase in Accounts Receivable (the Accounts Receivable in the current year minus that in the previous year) Increase in Accounts Payable (the Accounts Payable in the current year minus that in the previous year) (800) () (2.000) (2.000) Accounting Accounting Accounting Business Accounting DMidends is the negative of the Net Income multiplied by Payout Ratio 700 The exercise is designed such that an error early in the assignment will not adversely impact later grading. 2020 2021 2022E Relationship Notes 10,000 Revenues is driven by the growth rate 12,100 10% Business Driver Income Statement Revenues Growth Rate Cost of Revenues Gross Profits Gross Margin Operating Expenses (OpEx) Op Ex Percent of Revenues EBIT Net Interest Income (Expense) Interest Rate 6,000 4,000 40% Gross Profits is calculated as Revenues multiplied by Gross Margin 11,000 10% 6,710 4,290 39% 1700 15% 2,590 50 7,502 4,598 39% OpEx is calculated as Revenues multiplied by OpEx Percent Revenues 1500 15% 2,500 50 5% 1,815 15% 2,783 Accounting Business Driver Business Driver Accounting Business Driver Accounting Business Driver Accounting EBIT is calculated as Gross Profits minus Operating Expenses (OpEx) Interest Income is calculated as Interest Rate multiplied by prior year Cash (as there is no Debt) 5% 5% Pretax Income Pretax Income is calculated as EBIT plus Net Interest Income (Expenses) Taxes is calculated as Pretax Profits multiplied by Tax Rate Taxes Tax Rate 0% Net Income 1,000 1,500 1,600 Balance Sheet Cash Accounts Receivable Days of Sales Outstanding (DSO) PP&E Accounts Payable Days of Payables Outstanding (DPO) Equity 15,000 1,000 Accounting Business Driver Accounting Business Driver Accounting Cash is previous year Cash plus Increase (Decrease) in Cash Accounts Receivable is calculated as Revenues multiplied by Days of Sales Outstanding (DSO)/365 Days of Sales Outstanding (DSO) is calculated as Accounts Receivable / Revenues * 365 PP&E in a year is calculated as PP&E in the previous year plus CapEx in the current year minus Depreciation in the current year. Accounts Payable is calculated as Cost of Revenues multiplied by Days of Payables Outstanding (DPO)/365 Days of Payables Outstanding (DPO) is calculated as Accounts Payable / Cost of Revenues * 365 Equity in a year is calculated as Equity in the previous year plus Net Income minus Dividends ALERT: Because the value of the Dividends are shown as a negative on the Cash Flow Statement the value should be added to subtract Dividends 1,200 12,500 Accounting Accounting 1,500 Cash Flow Statement Net Income +Depreciation - Increase in Accounts Receivable + Increase in Accounts Payable - Capital Expenditures (Capex) Dividends Payout Ratio = Increase (Decrease) in Cash The company uses 10-year straight line depreciation (10% a year for 10 years beginning year after the investment) Minus the increase in Accounts Receivable (the Accounts Receivable in the current year minus that in the previous year) Increase in Accounts Payable (the Accounts Payable in the current year minus that in the previous year) (800) (1,000) (1,000) Accounting Accounting Accounting Business Accounting Dividends is the negative of the Net Income multiplied by Payout Ratio 700 The exercise is designed such that an error early in the assignment will not adversely impact later grading 2020 2021 2022E Relationship Notes 10,000 Revenues is driven by the growth rate 11.000 10% 6,000 4.000 Gross Profits is calculated as Revenues multiplied by Gross Margin Income Statement Revenues Growth Rate Cast of Revenues Gross Profits Gross Margin Operating Expenses (Opex) OpEx Percent of Revenues EBIT Net Interest Income (Expensel Interest Rate Pretax Income Taxes Tax Rate 12.100 % 10% 7,502 4.598 39% 1,815 15% % 2.783 OpEx is calculated as Revenues multiplied by OpEx Percent Revenues 6,710 4.290 39% 1700 15% 2.590 SO 5% 40% 1500 15% 2.500 SO 5% Business Driver Accounting Business Driver Business Driver Accounting Business Driver Accounting Business Driver Accounting EBIT is calculated as Gross Profits minus Operating Expenses (OpEx) Interest Income is calculated as interest Rate multiplied by prior year Cash (as there is no Debt 5% Pretax Income is calculated as EBIT plus Net Interest Income Expenses) Taxes is calculated as Pretax Profits multiplied by Tax Rate 0% Net Income 1,000 1.500 1.500 Balance Sheet Cash Accounts Receivable Days of Sales Outstanding (DSO) PP&E Accounts Payable Days of Payables Outstanding (DPO) Equity 15,000 1,000 Accounting Business Driver Accounting Business Driver Accounting Cash is previous year Cash plus increase Decrease in Cash Accounts Receivable is calculated as Revenues multiplied by Days of Sales Outstanding (050)/365 Days of Sales Outstanding (DSO) is calculated as Accounts Receivable / Revenues 365 PP&E in a year is calculated as PP&E in the previous year plus CapEx in the current year minus Depreciation in the current year Accounts Payable is calculated as Cost of Revenues multiplied by Days of Payables Outstanding (DPO)/365 Days of Payables Outstanding (DPO) is calculated as Accounts Payable/Cost of Revenues 365 Equity in a year is calculated as Equity in the previous year plus Net Income minus Dividends ALERT:Hecause the value of the Dividends are shown as a negative on the Cash Flow Statement the value should be added to subtract Dividends 1.200 12,500 Hints for Working on the Cash Flow Statement Cash Flow Statements always aggregate sum up) all the inflows and Outflows of Cash Flow during a period. Inflows of Cash are pasithe numbers and Outflows of Cash are negative numbers on the Cash Flow Statement To help you, we show the Outflows in italics. You should remernber that increases in Assets, actually decrease Cash so you are subtracting an increase In contrast, increases in Liabilitics, Debt and Equity increase Cash so you are adding an increase Capital Expenditures (CapEx) are investments of Cash and an Outflow of Cash on the Cash Flow Statement As an investment, CapEx isn't less than zero, but it is shown as a negative number because it is an Outflow. a Dividends are an Outflow af Cash and aka shawn as a negative number, but Dividends are never less than zero Accounting Accounting 1,500 Cash Flow Statement Net Income Depreciation - Increase in Accounts Receivable +Increase in Accounts Payable Capital Expenditures (Capex) - Dividends Payout Ratio = Increase (Decrease) in Cash The company uses 10-year straight line depreciation (10% a year for 10 years beginning year after the investment Minus the increase in Accounts Receivable (the Accounts Receivable in the current year minus that in the previous year) Increase in Accounts Payable (the Accounts Payable in the current year minus that in the previous year) (800) () (2.000) (2.000) Accounting Accounting Accounting Business Accounting DMidends is the negative of the Net Income multiplied by Payout Ratio 700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts