Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need full answer please Keith Willams and Brian Adams were students when they formed a partnership several years ago for a part-time business called

i need full answer please

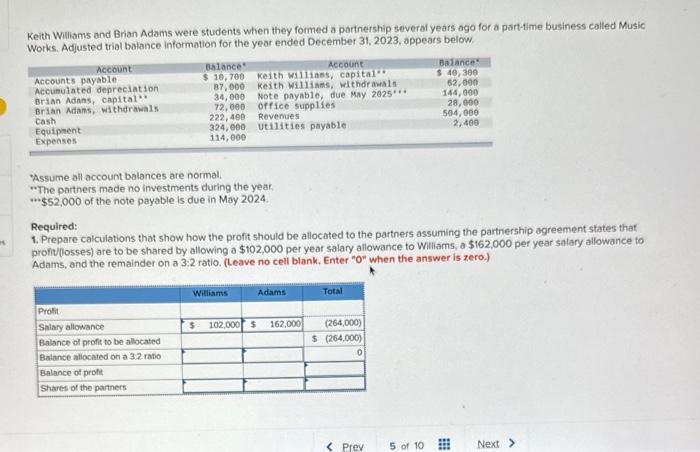

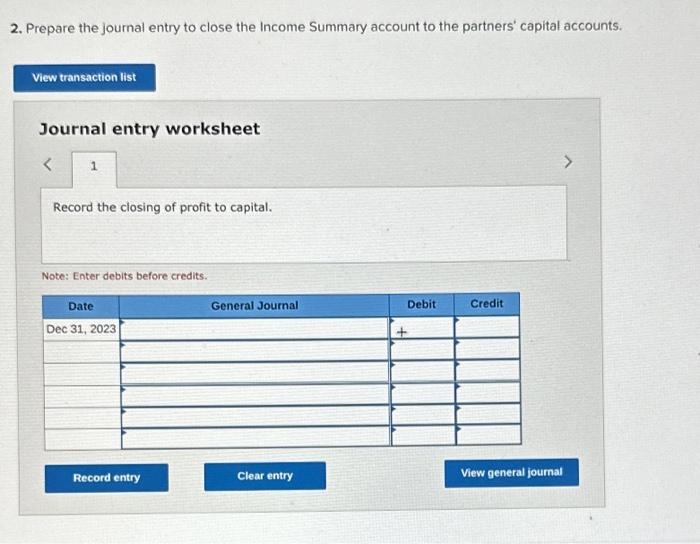

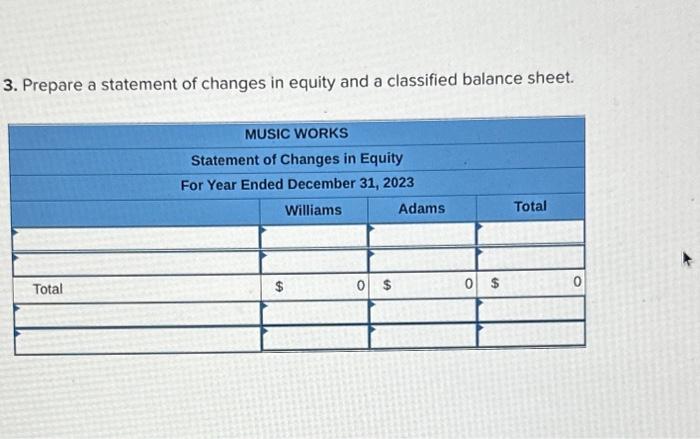

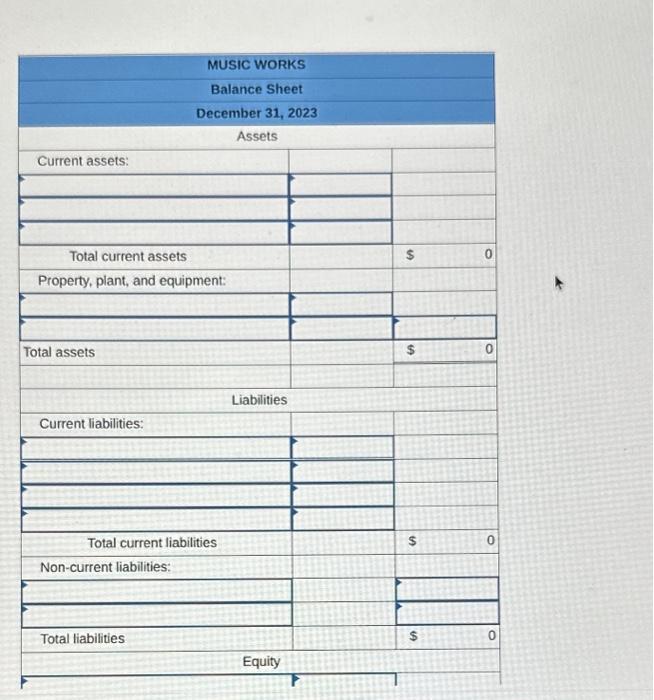

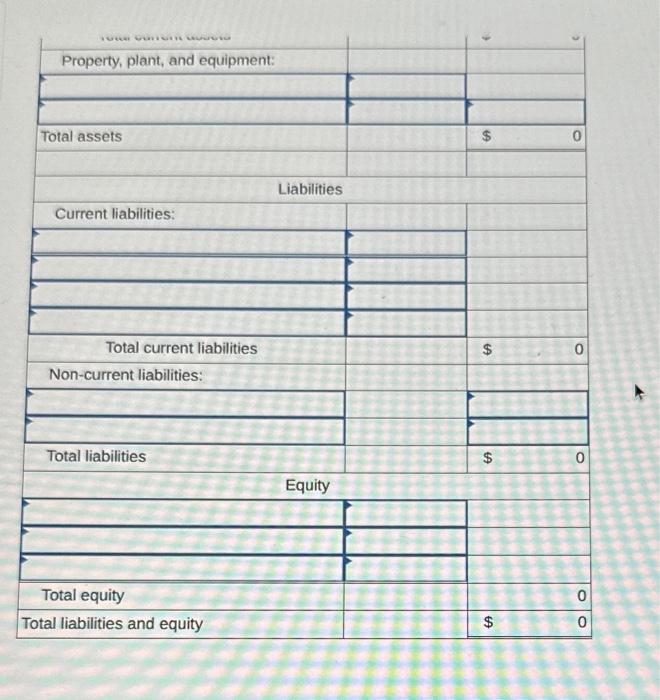

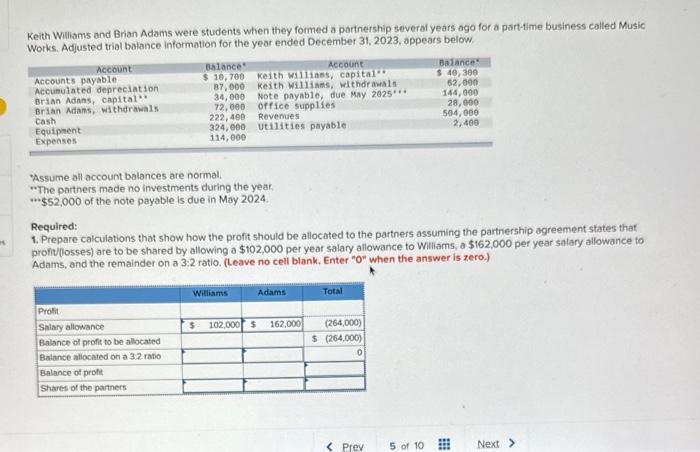

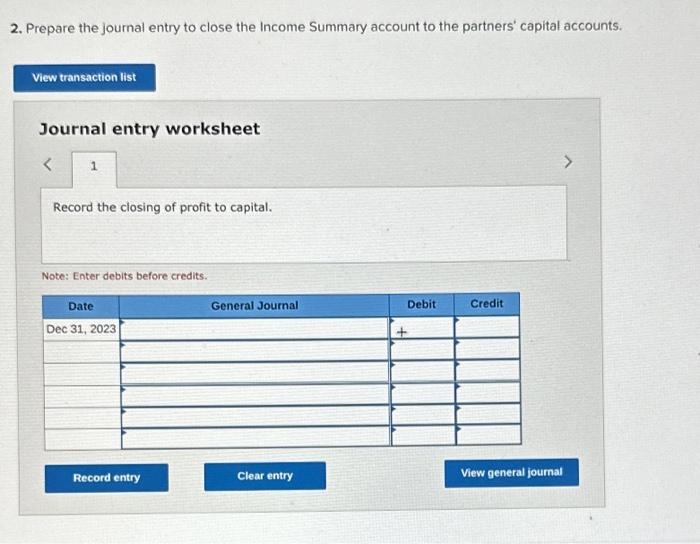

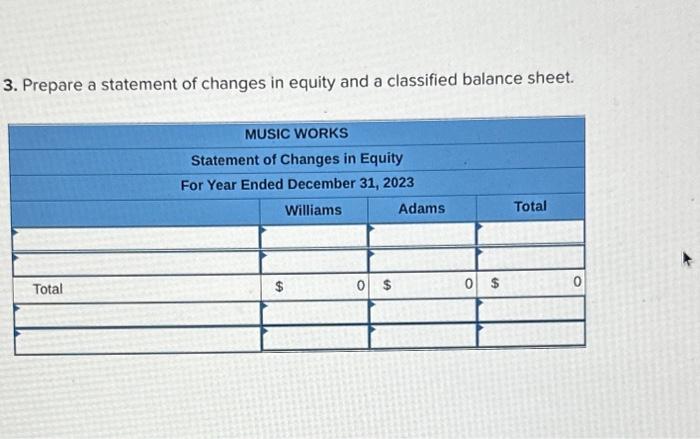

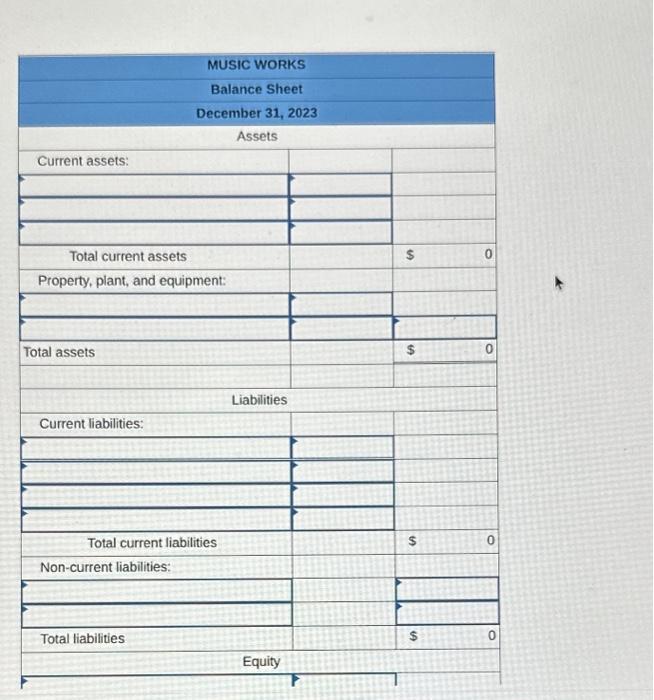

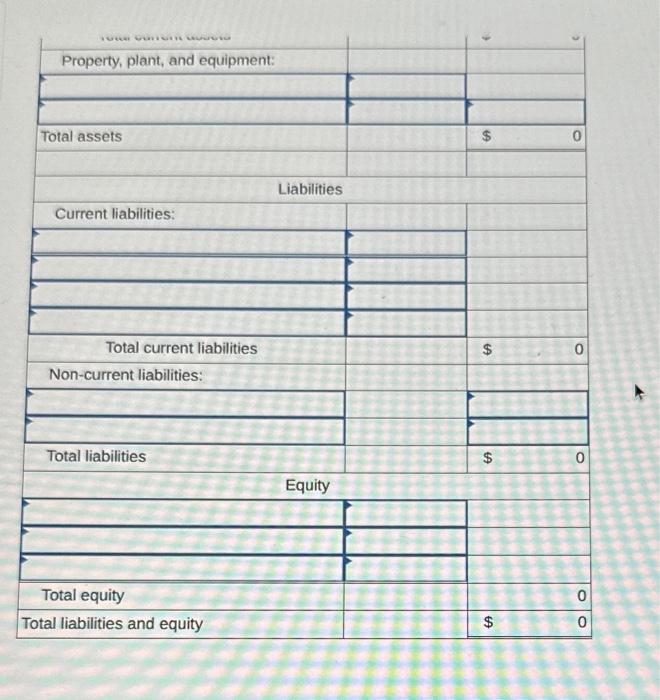

Keith Willams and Brian Adams were students when they formed a partnership several years ago for a part-time business called Music Works. Adjusted trial bolance information for the year ended December 31, 2023, appears below. "Assume oll account balances are normal; "The parthers made no investments during the year w. $52,000 of the note payable is due in May 2024. Required: 1. Prepare calculations that show how the profit should be allocated to the partners assuming the partnership ogreement states that profiv(losses) are to be shared by allowing a $102,000 per year salary allowance to Williams, a $162,000 per year salary allowance to Adams, and the remainder on a 3:2 ratio. (Leave no cell blank. Enter " 0 when the answer is zero.) Prepare the journal entry to close the Income Summary account to the partners' capital accounts. Journal entry worksheet Note: Enter debits before credits. 3. Prepare a statement of changes in equity and a classified balance sheet

Keith Willams and Brian Adams were students when they formed a partnership several years ago for a part-time business called Music Works. Adjusted trial bolance information for the year ended December 31, 2023, appears below. "Assume oll account balances are normal; "The parthers made no investments during the year w. $52,000 of the note payable is due in May 2024. Required: 1. Prepare calculations that show how the profit should be allocated to the partners assuming the partnership ogreement states that profiv(losses) are to be shared by allowing a $102,000 per year salary allowance to Williams, a $162,000 per year salary allowance to Adams, and the remainder on a 3:2 ratio. (Leave no cell blank. Enter " 0 when the answer is zero.) Prepare the journal entry to close the Income Summary account to the partners' capital accounts. Journal entry worksheet Note: Enter debits before credits. 3. Prepare a statement of changes in equity and a classified balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started