Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help 4. The stock of question 1 has a price of $13, which can later be S15 or S11 with different probabilities. The

I need help

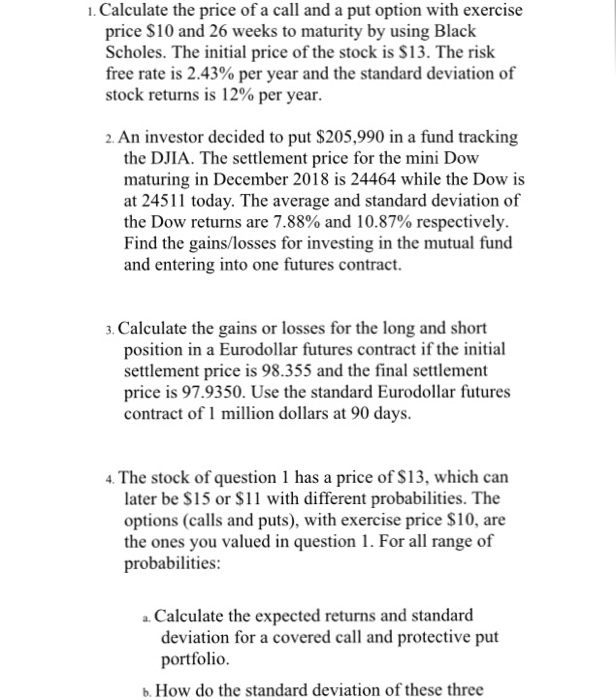

4. The stock of question 1 has a price of $13, which can later be S15 or S11 with different probabilities. The options (calls and puts), with exercise price S10, are the ones you valued in question 1. For all range of probabilities: a. Calculate the expected returns and standard deviation for a covered call and protective put portfolio alternatives compare? alternative have a positive return? b. How do the standard deviation of these three c. For which combination of probabilities each Copy/paste the table with results and necessary graphs, or just staple them.. . Calculate the price of a call and a put option with exercise price S10 and 26 weeks to maturity by using Black Scholes. The initial price of the stock is S13. The risk free rate is 2.43% per year and the standard deviation of stock returns is 12% per year 2. An investor decided to put $205,990 in a fund tracking the DJIA. The settlement price for the mini Dow maturing in December 2018 is 24464 while the Dow is at 24511 today. The average and standard deviation of the Dow returns are 7.88% and 10.87% respectively Find the gains/losses for investing in the mutual fund and entering into one futures contract. 3. Calculate the gains or losses for the long and short position in a Eurodollar futures contract if the initial settlement price is 98.355 and the final settlement price is 97.9350. Use the standard Eurodollar futures contract of1 million dollars at 90 days 4. The stock of question 1 has a price of S13, which can later be $15 or $11 with different probabilities. The options (calls and puts), with exercise price $10, are the ones you valued in question 1. For all range of probabilities: a. Calculate the expected returns and standard deviation for a covered call and protective put portfolio b. How do the standard deviation of these three 4. The stock of question 1 has a price of $13, which can later be S15 or S11 with different probabilities. The options (calls and puts), with exercise price S10, are the ones you valued in question 1. For all range of probabilities: a. Calculate the expected returns and standard deviation for a covered call and protective put portfolio alternatives compare? alternative have a positive return? b. How do the standard deviation of these three c. For which combination of probabilities each Copy/paste the table with results and necessary graphs, or just staple them.. . Calculate the price of a call and a put option with exercise price S10 and 26 weeks to maturity by using Black Scholes. The initial price of the stock is S13. The risk free rate is 2.43% per year and the standard deviation of stock returns is 12% per year 2. An investor decided to put $205,990 in a fund tracking the DJIA. The settlement price for the mini Dow maturing in December 2018 is 24464 while the Dow is at 24511 today. The average and standard deviation of the Dow returns are 7.88% and 10.87% respectively Find the gains/losses for investing in the mutual fund and entering into one futures contract. 3. Calculate the gains or losses for the long and short position in a Eurodollar futures contract if the initial settlement price is 98.355 and the final settlement price is 97.9350. Use the standard Eurodollar futures contract of1 million dollars at 90 days 4. The stock of question 1 has a price of S13, which can later be $15 or $11 with different probabilities. The options (calls and puts), with exercise price $10, are the ones you valued in question 1. For all range of probabilities: a. Calculate the expected returns and standard deviation for a covered call and protective put portfolio b. How do the standard deviation of these three

4. The stock of question 1 has a price of $13, which can later be S15 or S11 with different probabilities. The options (calls and puts), with exercise price S10, are the ones you valued in question 1. For all range of probabilities: a. Calculate the expected returns and standard deviation for a covered call and protective put portfolio alternatives compare? alternative have a positive return? b. How do the standard deviation of these three c. For which combination of probabilities each Copy/paste the table with results and necessary graphs, or just staple them.. . Calculate the price of a call and a put option with exercise price S10 and 26 weeks to maturity by using Black Scholes. The initial price of the stock is S13. The risk free rate is 2.43% per year and the standard deviation of stock returns is 12% per year 2. An investor decided to put $205,990 in a fund tracking the DJIA. The settlement price for the mini Dow maturing in December 2018 is 24464 while the Dow is at 24511 today. The average and standard deviation of the Dow returns are 7.88% and 10.87% respectively Find the gains/losses for investing in the mutual fund and entering into one futures contract. 3. Calculate the gains or losses for the long and short position in a Eurodollar futures contract if the initial settlement price is 98.355 and the final settlement price is 97.9350. Use the standard Eurodollar futures contract of1 million dollars at 90 days 4. The stock of question 1 has a price of S13, which can later be $15 or $11 with different probabilities. The options (calls and puts), with exercise price $10, are the ones you valued in question 1. For all range of probabilities: a. Calculate the expected returns and standard deviation for a covered call and protective put portfolio b. How do the standard deviation of these three 4. The stock of question 1 has a price of $13, which can later be S15 or S11 with different probabilities. The options (calls and puts), with exercise price S10, are the ones you valued in question 1. For all range of probabilities: a. Calculate the expected returns and standard deviation for a covered call and protective put portfolio alternatives compare? alternative have a positive return? b. How do the standard deviation of these three c. For which combination of probabilities each Copy/paste the table with results and necessary graphs, or just staple them.. . Calculate the price of a call and a put option with exercise price S10 and 26 weeks to maturity by using Black Scholes. The initial price of the stock is S13. The risk free rate is 2.43% per year and the standard deviation of stock returns is 12% per year 2. An investor decided to put $205,990 in a fund tracking the DJIA. The settlement price for the mini Dow maturing in December 2018 is 24464 while the Dow is at 24511 today. The average and standard deviation of the Dow returns are 7.88% and 10.87% respectively Find the gains/losses for investing in the mutual fund and entering into one futures contract. 3. Calculate the gains or losses for the long and short position in a Eurodollar futures contract if the initial settlement price is 98.355 and the final settlement price is 97.9350. Use the standard Eurodollar futures contract of1 million dollars at 90 days 4. The stock of question 1 has a price of S13, which can later be $15 or $11 with different probabilities. The options (calls and puts), with exercise price $10, are the ones you valued in question 1. For all range of probabilities: a. Calculate the expected returns and standard deviation for a covered call and protective put portfolio b. How do the standard deviation of these three

I need help

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started