Question

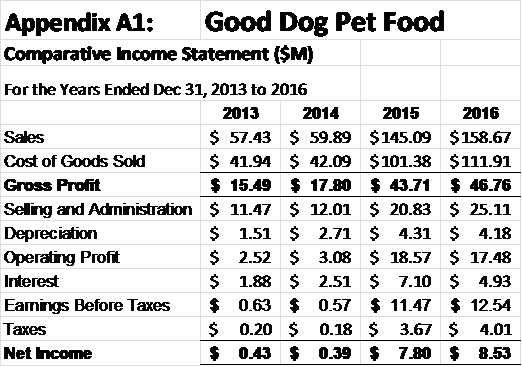

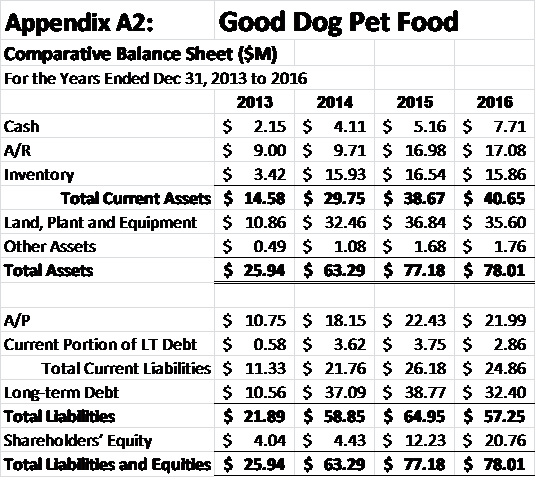

Please find attached a multi-year Income Statement (Appendix A1) and multi-year Balance Sheet (Appendix A2) for Good Dog Pet Food. This company is a (fictional)

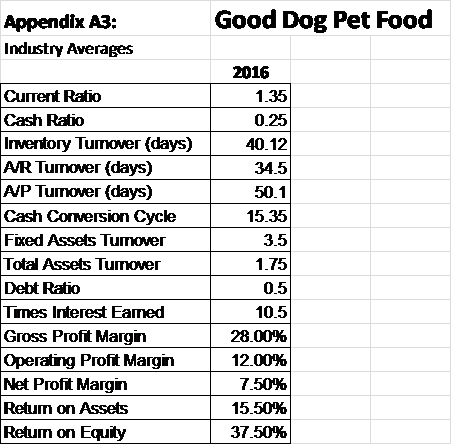

Please find attached a multi-year Income Statement (Appendix A1) and multi-year Balance Sheet (Appendix A2) for Good Dog Pet Food. This company is a (fictional) pet food retailer that brought on a new CEO in Jan 1, 2015. You have been asked to assess whether or not Good Dog is doing well under the new CEO. Your job is to calculate and interpret important financial ratios and to make comments on how things have changed since the new CEO came on board and how the company compares to peers in the industry. Appendix A3 contains industry average information which you should find useful.

Please use the information in Appendix A1 to A3 to calculate the following ratios:

- Current ratio

- Account Receivable ratio (or days receivable)

- Accounts Payable ratio (or days payable)

- Debt ratio

- Gross Profit margin

- Operating Profit margin

- Net Profit margin

- Return on Assets

- Return on Equity

For the ROA and ROE, you should use the average total assets and the average total equity in your calculations. (The average is the total across two years divided by two). Calculate these values for each of 2014, 2015 and 2016. Interpret your calculations: what does this information mean? How is the company doing under the new CEO? (You should compare things before and after the CEO came on board). How is the company doing relative to the industry?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started