Question

I need help ASAP please: Here is the trial balance before adjustments of Valcourt Recovery Services, a company specializing in waste recovery, owned by Jose

I need help ASAP please:

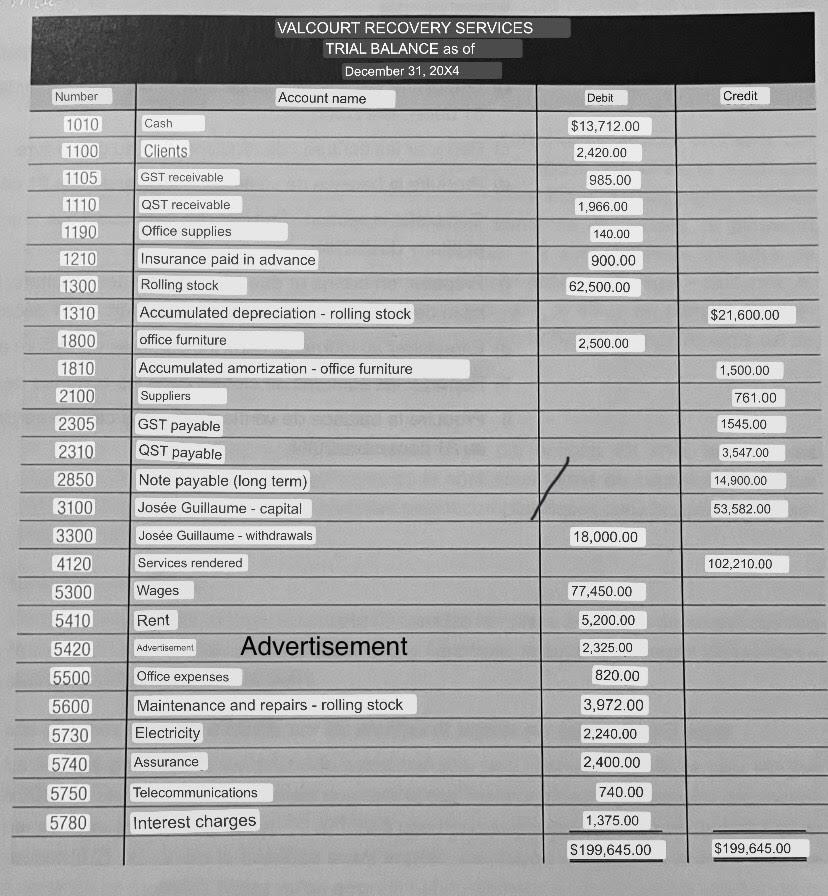

Here is the trial balance before adjustments of Valcourt Recovery Services, a company specializing in waste recovery, owned by Jose Guillaume, for the year ended December 31, 20X4:

-The count of office supplies indicates that the company owns a total of $335 (before taxes), as of December 31, 20X4.

-The insurance premium was renewed for one year on June 1; tax is included in this amount.

-Rolling stock is depreciated using the usage-based method based on mileage. The company plans to sell the truck after 300,000 kilometers for $8,500; the truck traveled 62,340 kilometers during the fiscal year.

-office furniture is depreciated using the straight-line method over a period of five years; no residual value has been expected at the end of this period.

- Valcourt Recovery Services has agreed, under a five-year lease expiring on December 31, 20X8, to pay a monthly rent of $400 (before tax); the payments were debited from the Rent account.

-The note payable contracted on March 31, 20X3 is repayable in full on October 31, 20X6. The interest, calculated at the rate of 10%, has not all been paid.

-The three employees, whose daily salary is $150, worked two days and this salary was not recorded as of December 31, 20X4.

Question: Work to do

a) Enter the trial balance as of December 31, 20X4 in the spreadsheet.

b) Record in the general journal and in the spreadsheet the adjustment entries as of December 31, 20X4.

c) Post adjusting entries to the general ledger.

d) Produce the regularized trial balance as of December 31, 20X4 in the spreadsheet.

e) Complete the "Statement of income" section as well as the "Statement of equity and balance sheet" section of the spreadsheet.

f) Prepare, in due form, the statement of operations, the statement of equity and the

Valcourt Recovery Services balance sheet as at December 31, 20X4.

g) Record closing entries as of December 31, 20X4 in the general journal.

h) Post closing entries in general ledger accounts.

i) Produce Valcourt Recovery Services' post-closing trial balance as of December 31, 20X4.

VALCOURT RECOVERY SERVICES TRIAL BALANCE as of December 31, 20X4 Account name Number Debit Credit Cash $13,712.00 2,420.00 985.00 1,966.00 1010 1100 1105 1110 1190 1210 1300 1310 1800 140.00 900.00 Clients GST receivable OST receivable Office supplies Insurance paid in advance Rolling stock Accumulated depreciation - rolling stock office furniture Accumulated amortization - Office furniture Suppliers GST payable 62,500.00 $21,600.00 2,500.00 1,500.00 1810 2100 761.00 2305 1545.00 QST payable 3,547.00 2310 2850 3100 14,900.00 53,582.00 Note payable (long term) Jose Guillaume - capital Jose Guillaume - withdrawals Services rendered Wages 18,000.00 102,210.00 77,450.00 5,200.00 3300 4120 5300 5410 5420 5500 5600 5730 Advertisement 2,325.00 820.00 Rent Advertisement Office expenses Maintenance and repairs - rolling stock Electricity Assurance 3,972.00 2.240.00 2,400.00 5740 5750 740.00 Telecommunications Interest charges 5780 1,375.00 S199,645.00 $199,645.00 VALCOURT RECOVERY SERVICES TRIAL BALANCE as of December 31, 20X4 Account name Number Debit Credit Cash $13,712.00 2,420.00 985.00 1,966.00 1010 1100 1105 1110 1190 1210 1300 1310 1800 140.00 900.00 Clients GST receivable OST receivable Office supplies Insurance paid in advance Rolling stock Accumulated depreciation - rolling stock office furniture Accumulated amortization - Office furniture Suppliers GST payable 62,500.00 $21,600.00 2,500.00 1,500.00 1810 2100 761.00 2305 1545.00 QST payable 3,547.00 2310 2850 3100 14,900.00 53,582.00 Note payable (long term) Jose Guillaume - capital Jose Guillaume - withdrawals Services rendered Wages 18,000.00 102,210.00 77,450.00 5,200.00 3300 4120 5300 5410 5420 5500 5600 5730 Advertisement 2,325.00 820.00 Rent Advertisement Office expenses Maintenance and repairs - rolling stock Electricity Assurance 3,972.00 2.240.00 2,400.00 5740 5750 740.00 Telecommunications Interest charges 5780 1,375.00 S199,645.00 $199,645.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started