Answered step by step

Verified Expert Solution

Question

1 Approved Answer

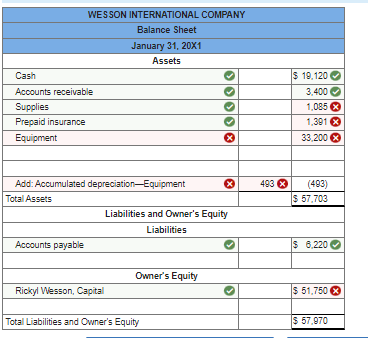

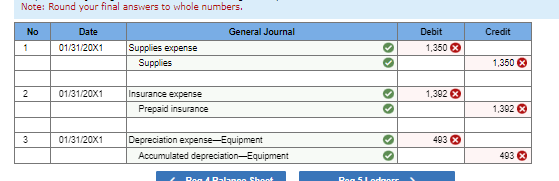

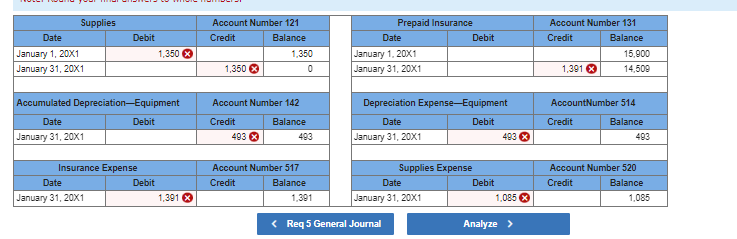

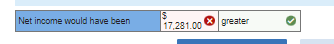

I need help correcting what is incorrect The account balances for the Wesson International Company on January 31, 20X1, follow. The balances shown are after

I need help correcting what is incorrect

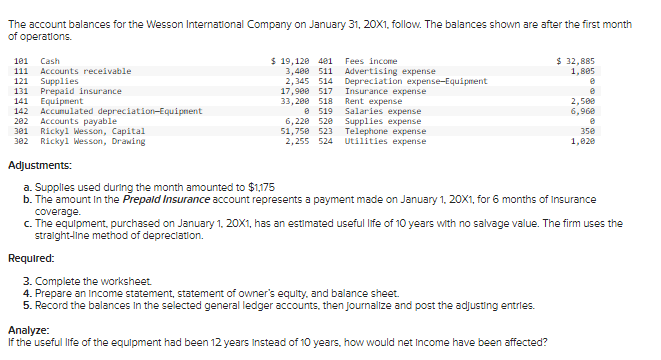

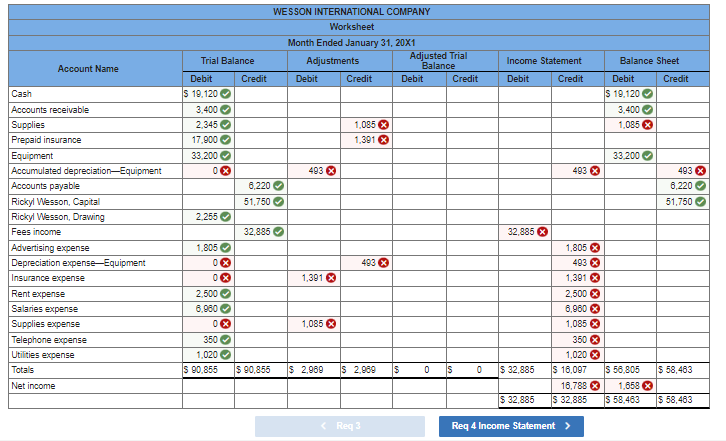

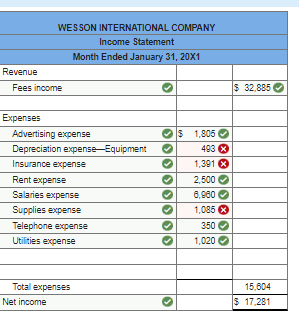

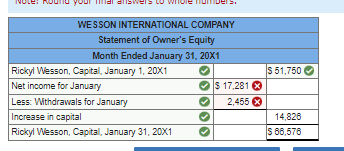

The account balances for the Wesson International Company on January 31, 20X1, follow. The balances shown are after the first month of operations. Adjustments: a. Supplies used during the month amounted to $1,175 b. The amount In the Prepald Insurance account represents a payment made on January 1,20X1, for 6 months of Insurance coverage. c. The equipment, purchased on January 1, 20X1, has an estimated useful life of 10 years with no salvage value. The firm uses the stralght-line method of depreclation. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{11}{|c|}{ WESSON INTERNATIONAL COMPANY } \\ \hline \multicolumn{11}{|c|}{ Worksheet } \\ \hline \multicolumn{11}{|c|}{ Month Ended January 31, 20X1 } \\ \hline \multirow{2}{*}{ Account Name } & \multicolumn{2}{|c|}{ Trial Balance } & \multicolumn{2}{|c|}{ Adjustments } & \multicolumn{2}{|c|}{\begin{tabular}{c} Adjusted Trial \\ Balance \end{tabular}} & \multicolumn{2}{|c|}{ Income Statement } & \multicolumn{2}{|c|}{ Balance Sheet } \\ \hline & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit \\ \hline Cash & S 19,120 & & & & & & & & $18,120 & \\ \hline Accounts receivable & 3,4000 & & & & & & & & 3,4000 & \\ \hline Supplies & 2,345 & & & 1,085x & & & & & 1,085x & \\ \hline Prepaid insurance & 17,900 & & & 1,391 & & & & & & \\ \hline Equipment & 33,200 & & & & & & & & 33,2000 & \\ \hline Accumulated depreciation-Equipment & 0 & & 493x & & & & & 493 & & 493x \\ \hline Accounts payable & & 6,2200 & & & & & & & & 6,2200 \\ \hline Rickyl Wesson, Capital & & 51,750 & & & & & & & & 51,750 \\ \hline Rickyl Wesson, Drawing & 2,255 & & & & & & & & & \\ \hline Fees income & & 32,885 & & & & & 32,885 & & & \\ \hline Advertising expense & 1,805 & & & & & & & 1,805 & & \\ \hline Depreciation expense-Equipment & 0x & & & 483x & & & & 483 & & \\ \hline Insurance expense & 0 & & 1,391 & & & & & 1,391 & & \\ \hline Rent expense & 2,500 & & & & & & & 2,500 & & \\ \hline Salaries expense & 6,960 & & & & & & & 6,960x & & \\ \hline Supplies expense & 0x & & 1,085 & & & & & 1,085 & & \\ \hline Telephone expense & 350 & & & & & & & 350 & & \\ \hline Utilities expense & 1,0200 & & & & & & & 1,020 & & \\ \hline Totals & 590,855 & $90,855 & $2,969 & 52,969 & 0 & 5 & $32,885 & $16,097 & $56,805 & $58,463 \\ \hline Net income & & & & & & & & 16,788 & 1,658 & \\ \hline & & & & & & & $32,885 & $32,885 & 558,463 & $58,463 \\ \hline \end{tabular} Req 4 Income Statement WESSON INTERNATIONAL COMPANY Income Statement \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ WESSON INTERNATIONAL COMPANY } \\ \hline \multicolumn{4}{|c|}{ Statement of Owner's Equity } \\ \hline \multicolumn{4}{|c|}{ Month Ended January 31, 20X1} \\ \hline Rickyl Wesson, Capital, January 1, 201 & 0 & & $51,7500 \\ \hline Net income for January & 0 & $17,281 & \\ \hline Less: Withdrawals for January & 0 & 2,455 & \\ \hline Increase in capital & 0 & & 14,826 \\ \hline Rickyl Wesson, Capital, January 31, 20X1 & 0 & & $66,576 \\ \hline \end{tabular} Note: Round your final answers to whole numbers. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Supplies } & \multicolumn{2}{|c|}{ Account Number 121} & \multicolumn{2}{|c|}{ Prepaid Insurance } & \multicolumn{2}{|c|}{ Account Number 131} \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline January 1,201 & 1,350 & & 1,350 & January 1,201 & & & 15,900 \\ \hline January 31,201 & & 1,350 & 0 & January 31,201 & & 1,391 & 14,508 \\ \hline \multicolumn{2}{|c|}{ Accumulated Depreciation-Equipment } & \multicolumn{2}{|c|}{ Account Number 142} & \multicolumn{2}{|c|}{ Depreciation Expense-Equipment } & \multicolumn{2}{|c|}{ AccountNumber 514} \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline January 31,201 & & 493 & 493 & January 31,201 & 483 & & 483 \\ \hline \multicolumn{2}{|c|}{ Insurance Expense } & \multicolumn{2}{|c|}{ Account Number 517} & \multicolumn{2}{|c|}{ Supplies Expense } & \multicolumn{2}{|c|}{ Account Number 520} \\ \hline Date & Debit & Credit & Balance & Date & Debit & Credit & Balance \\ \hline January 31,20X1 & 1,391x & & 1,391 & January 31,201 & 1,085 & & 1,085 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Net income & 17281.00x & greater & 0 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started