i need help eith 17-22

i meed help making these transactions into journal entries

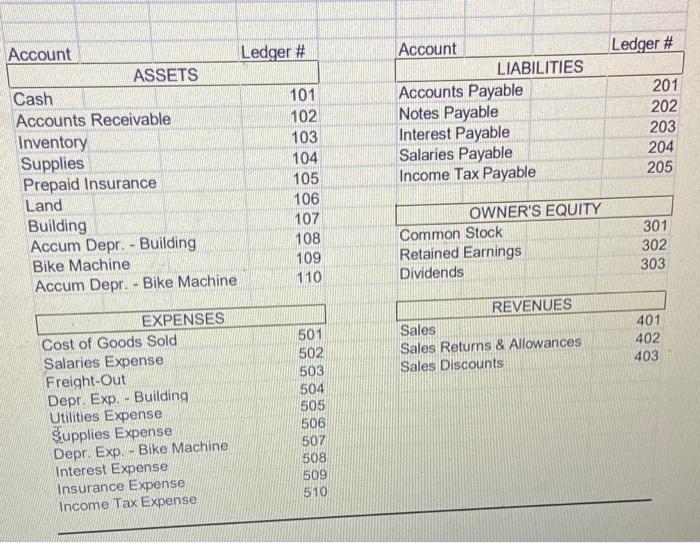

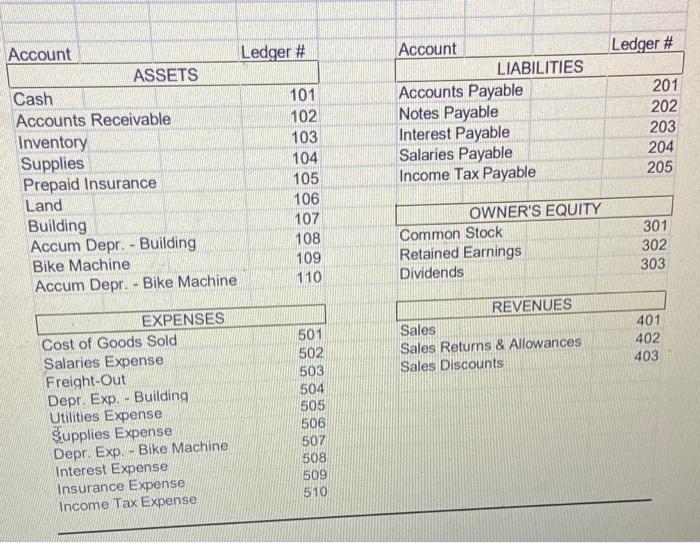

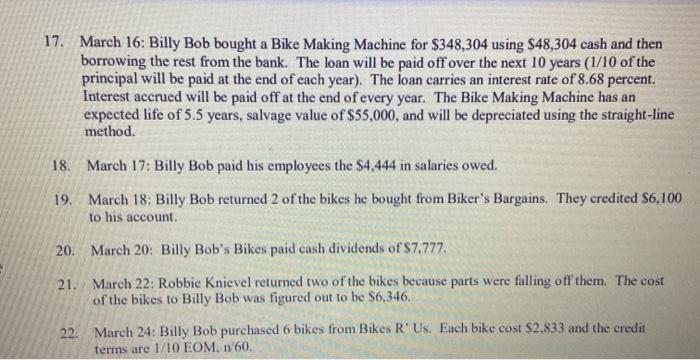

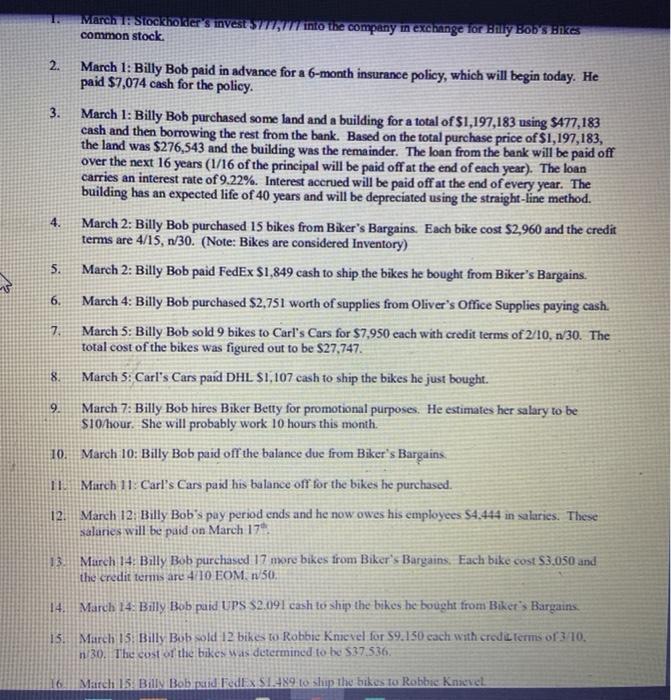

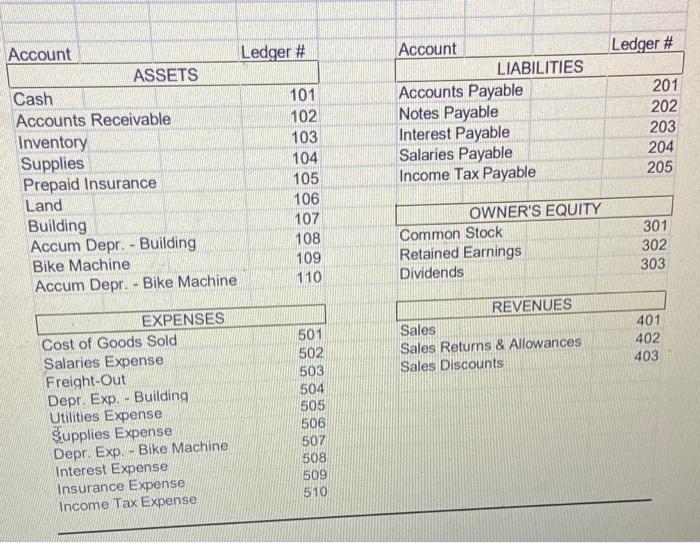

Ledger # Account Ledger # ASSETS Cash 101 Accounts Receivable 102 Inventory 103 Supplies 104 Prepaid Insurance 105 Land 106 Building 107 Accum Depr. - Building 108 Bike Machine 109 Accum Depr. - Bike Machine 110 Account LIABILITIES Accounts Payable Notes Payable Interest Payable Salaries Payable Income Tax Payable 201 202 203 204 205 OWNER'S EQUITY Common Stock Retained Earnings Dividends 301 302 303 501 502 REVENUES Sales Sales Returns & Allowances Sales Discounts 401 402 403 503 EXPENSES Cost of Goods Sold Salaries Expense Freight-Out Depr. Exp. - Building Utilities Expense Supplies Expense Depr. Exp. - Bike Machine Interest Expense Insurance Expense Income Tax Expense 504 505 506 507 508 509 510 17. March 16: Billy Bob bought a Bike Making Machine for $348,304 using S48,304 cash and then borrowing the rest from the bank. The loan will be paid off over the next 10 years (1/10 of the principal will be paid at the end of each year). The loan carries an interest rate of 8.68 percent. Interest accrued will be paid off at the end of every year. The Bike Making Machine has an expected life of 5.5 years, salvage value of $55,000, and will be depreciated using the straight-line method. 18. March 17: Billy Bob paid his employees the $4.444 in salaries owed. 19. March 18: Billy Bob returned 2 of the bikes he bought from Biker's Bargains. They credited $6,100 to his account 20. March 20: Billy Bob's Bikes paid cash dividends of S7.777. 21. March 22: Robbie Knievel returned two of the bikes because parts were falling off them. The cost of the bikes to Billy Bob was figured out to be $6.346. 22 March 24: Billy Bob purchased 6 bikes from Bikes R' Us. Each bike cost $2.833 and the credit terms are 1/10 EOM. n/60. March i Stockho ker's invest Tinto the company m exchange for Baby BOB'S BAKES common stock 2. 3. S. 6. 7 March 1: Billy Bob paid in advance for a 6-month insurance policy, which will begin today. He paid $7,074 cash for the policy. March 1: Billy Bob purchased some land and a building for a total of $1,197,183 using $477,183 cash and then borrowing the rest from the bank. Based on the total purchase price of $1,197,183, the land was $276,543 and the building was the remainder. The loan from the bank will be paid off over the next 16 years (1/16 of the principal will be paid off at the end of each year). The loan carries an interest rate of 9.22%. Interest accrued will be paid off at the end of every year. The building has an expected life of 40 years and will be depreciated using the straight-line method. March 2: Billy Bob purchased 15 bikes from Biker's Bargains. Each bike cost $2,960 and the credit terms are 4/15, 1/30. (Note: Bikes are considered Inventory) March 2: Billy Bob paid FedEx S1,849 cash to ship the bikes he bought from Biker's Bargains. March 4: Billy Bob purchased $2.751 worth of supplies from Oliver's Office Supplies paying cash. March 5: Billy Bob sold 9 bikes to Carl's Cars for $7,950 each with credit terms of 2/10, 1/30. The total cost of the bikes was figured out to be $27,747. March 5: Carl's Cars paid DHL S1,107 cash to ship the bikes he just bought. March 7: Billy Bob hires Biker Betty for promotional purposes. He estimates her salary to be $10/hour. She will probably work 10 hours this month. March 10: Billy Bob paid off the balance due from Biker's B Bargains March 11: Carl's Cars paid his balance off for the bikes be purchased. March 12: Billy Bob's pay period ends and he now owes his employees 54.444 in salaries. These salanes will be paid on March 17 Murch 14. Billy Bob purchased 17 more bikes from Biker's Bargains. Each bike cost $3.050 and the credit terms are 4/10 EOM. n 50. March 14 Billy Bob paid UPS $2.091 cash to ship the bikes he bought from Biket's Bargains March 15. Billy Bob sold 12 bikes to Robbie Knievel for $9.130 each with credil Terms of 3 10. 1:30. The cost of the bikes was determined to be $37.536, 8. 9 10. 11 12 13 14. 13 16 Mitch 15. Bill Bob puid FedEx S1.489 to ship the bikes to Robbie Knevet