Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help filling this out Required information [The following information applies to the questions displayed below.] Pratt is ready to graduate and leave College

I need help filling this out

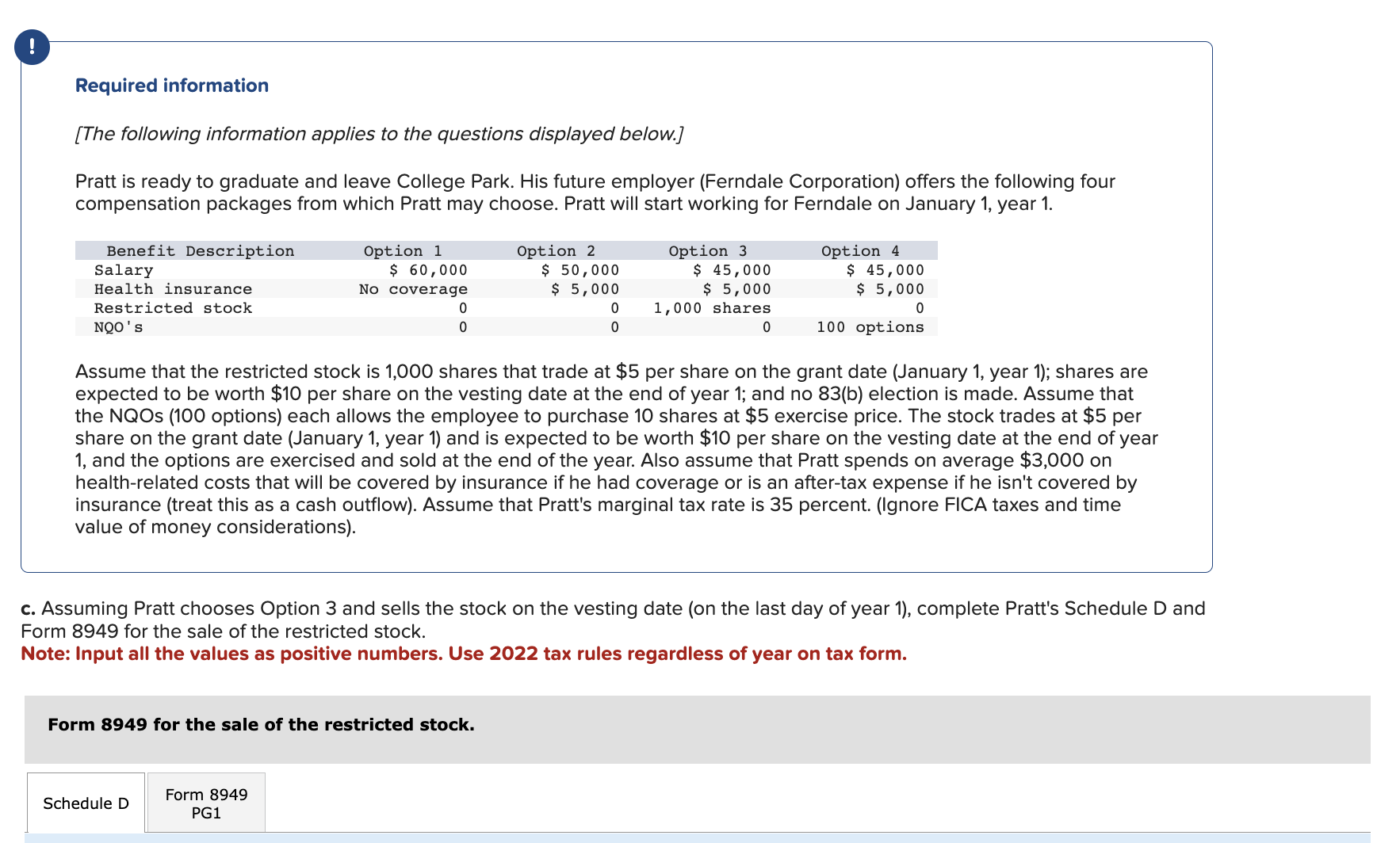

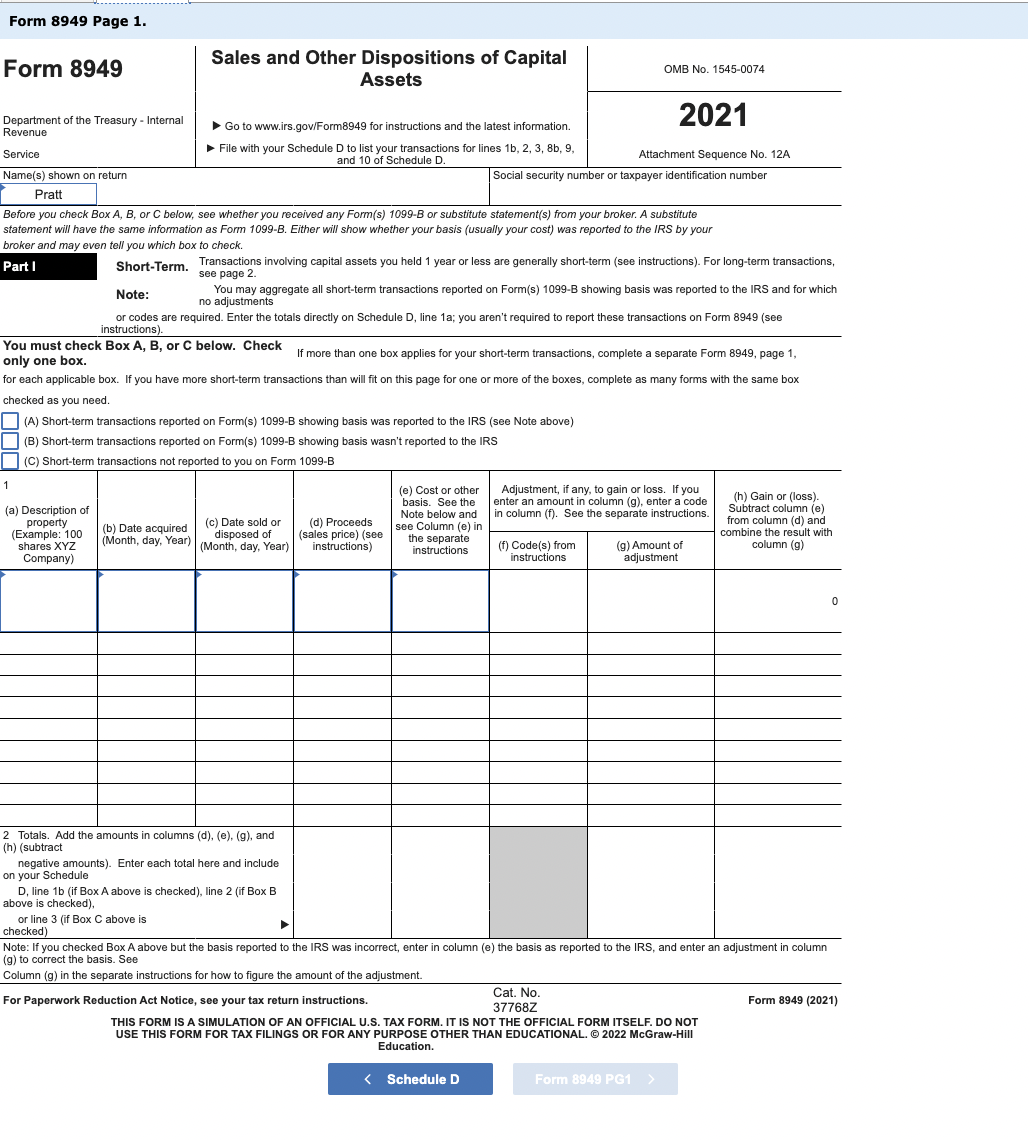

Required information [The following information applies to the questions displayed below.] Pratt is ready to graduate and leave College Park. His future employer (Ferndale Corporation) offers the following four compensation packages from which Pratt may choose. Pratt will start working for Ferndale on January 1, year 1. Assume that the restricted stock is 1,000 shares that trade at $5 per share on the grant date (January 1, year 1); shares are expected to be worth $10 per share on the vesting date at the end of year 1 ; and no 83(b) election is made. Assume that the NQOs (100 options) each allows the employee to purchase 10 shares at $5 exercise price. The stock trades at $5 per share on the grant date (January 1, year 1) and is expected to be worth $10 per share on the vesting date at the end of year 1, and the options are exercised and sold at the end of the year. Also assume that Pratt spends on average $3,000 on health-related costs that will be covered by insurance if he had coverage or is an after-tax expense if he isn't covered by insurance (treat this as a cash outflow). Assume that Pratt's marginal tax rate is 35 percent. (Ignore FICA taxes and time value of money considerations). c. Assuming Pratt chooses Option 3 and sells the stock on the vesting date (on the last day of year 1), complete Pratt's Schedule D and Form 8949 for the sale of the restricted stock. Note: Input all the values as positive numbers. Use 2022 tax rules regardless of year on tax form. Form 8949 for the sale of the restricted stock. (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment. THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. (5) 2022 McGraw-Hill Education

Required information [The following information applies to the questions displayed below.] Pratt is ready to graduate and leave College Park. His future employer (Ferndale Corporation) offers the following four compensation packages from which Pratt may choose. Pratt will start working for Ferndale on January 1, year 1. Assume that the restricted stock is 1,000 shares that trade at $5 per share on the grant date (January 1, year 1); shares are expected to be worth $10 per share on the vesting date at the end of year 1 ; and no 83(b) election is made. Assume that the NQOs (100 options) each allows the employee to purchase 10 shares at $5 exercise price. The stock trades at $5 per share on the grant date (January 1, year 1) and is expected to be worth $10 per share on the vesting date at the end of year 1, and the options are exercised and sold at the end of the year. Also assume that Pratt spends on average $3,000 on health-related costs that will be covered by insurance if he had coverage or is an after-tax expense if he isn't covered by insurance (treat this as a cash outflow). Assume that Pratt's marginal tax rate is 35 percent. (Ignore FICA taxes and time value of money considerations). c. Assuming Pratt chooses Option 3 and sells the stock on the vesting date (on the last day of year 1), complete Pratt's Schedule D and Form 8949 for the sale of the restricted stock. Note: Input all the values as positive numbers. Use 2022 tax rules regardless of year on tax form. Form 8949 for the sale of the restricted stock. (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment. THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. (5) 2022 McGraw-Hill Education Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started