I need help finishing out the rest, not sure if my numbers are correct.

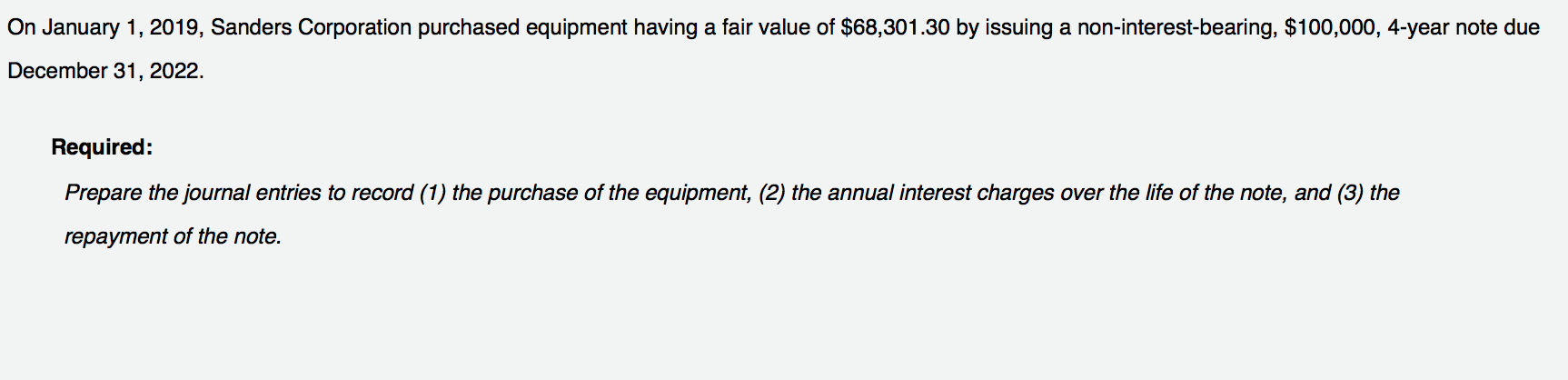

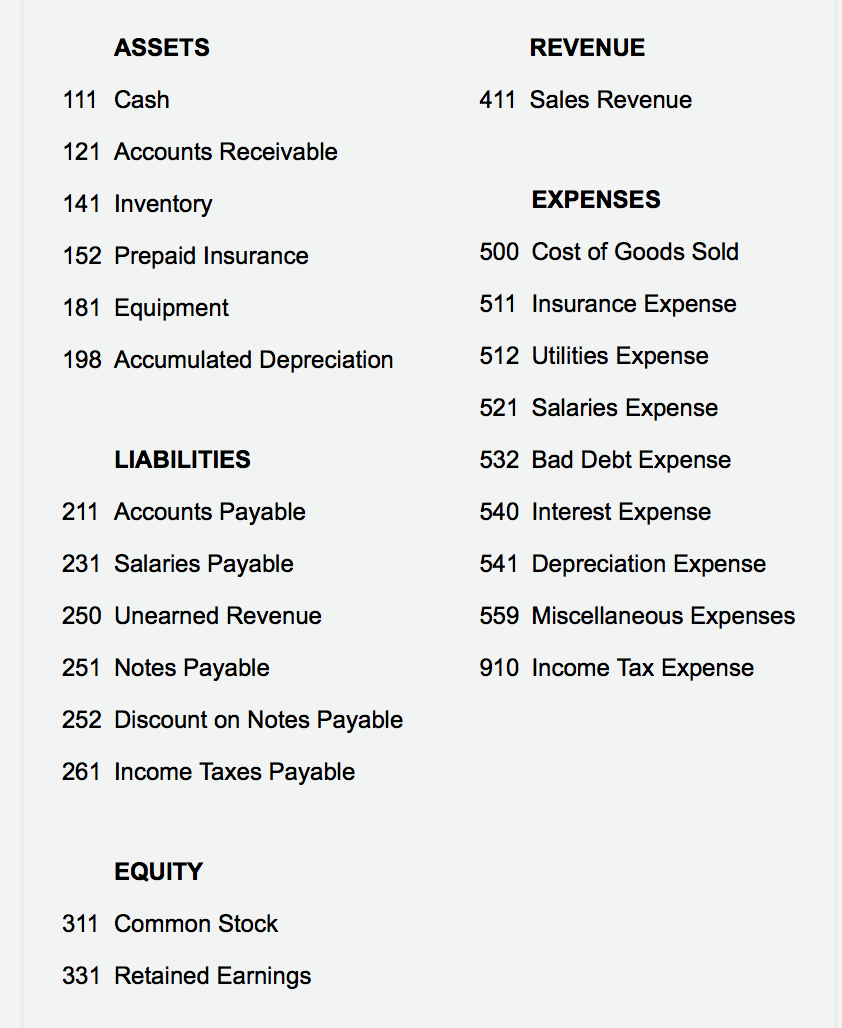

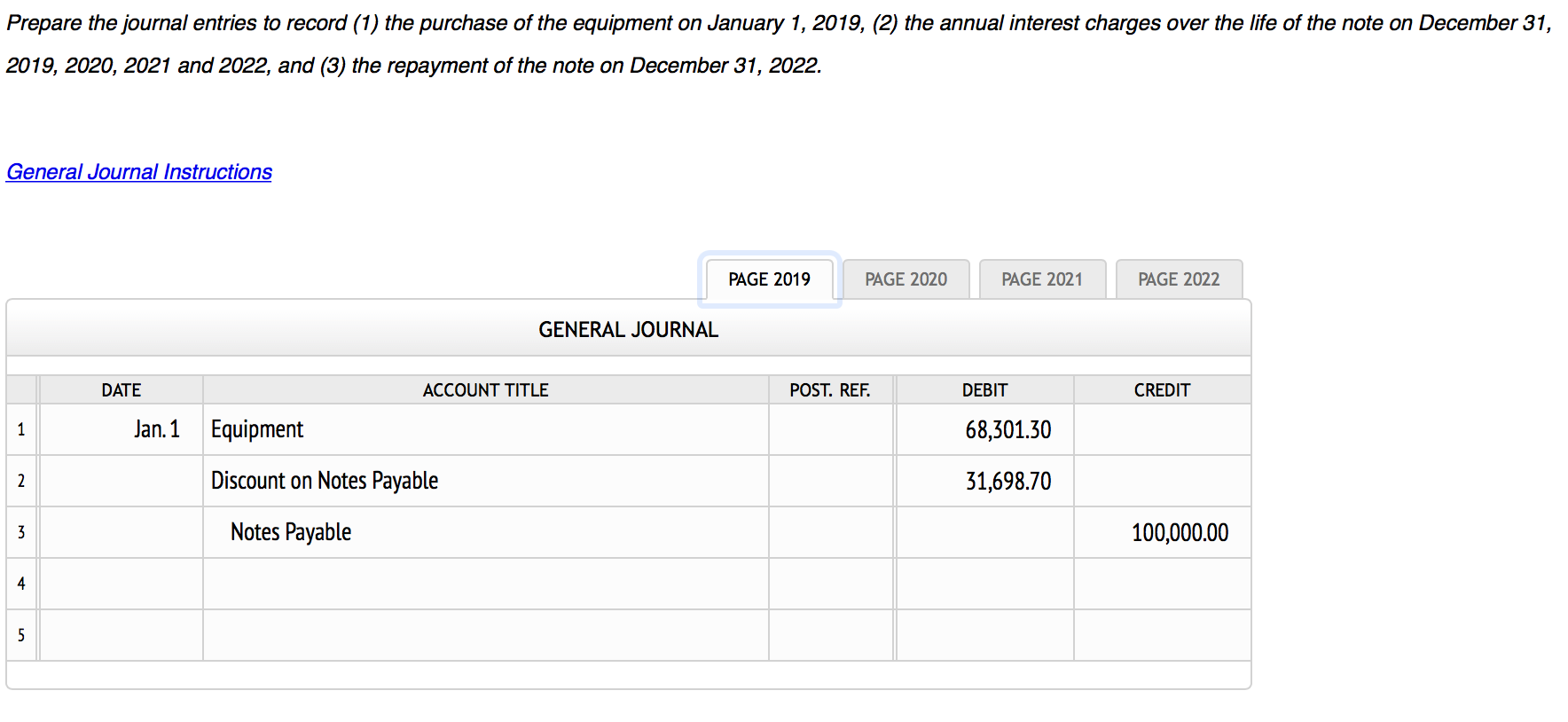

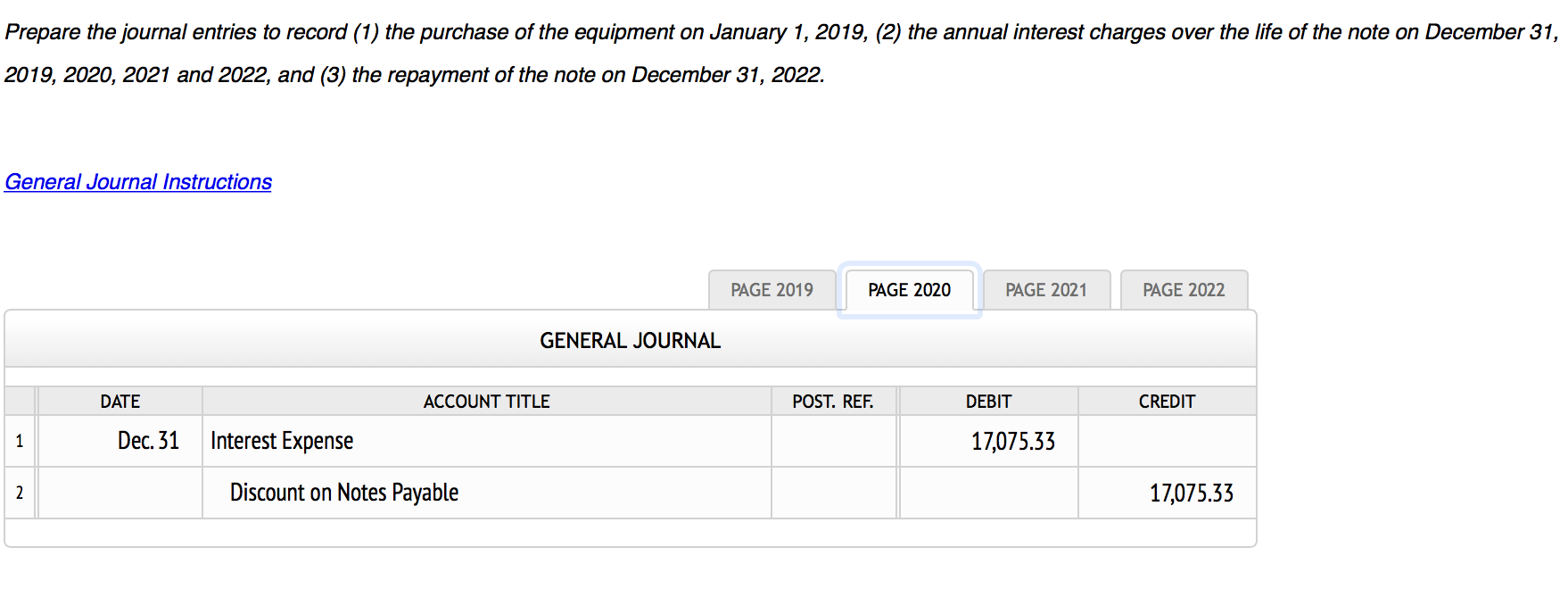

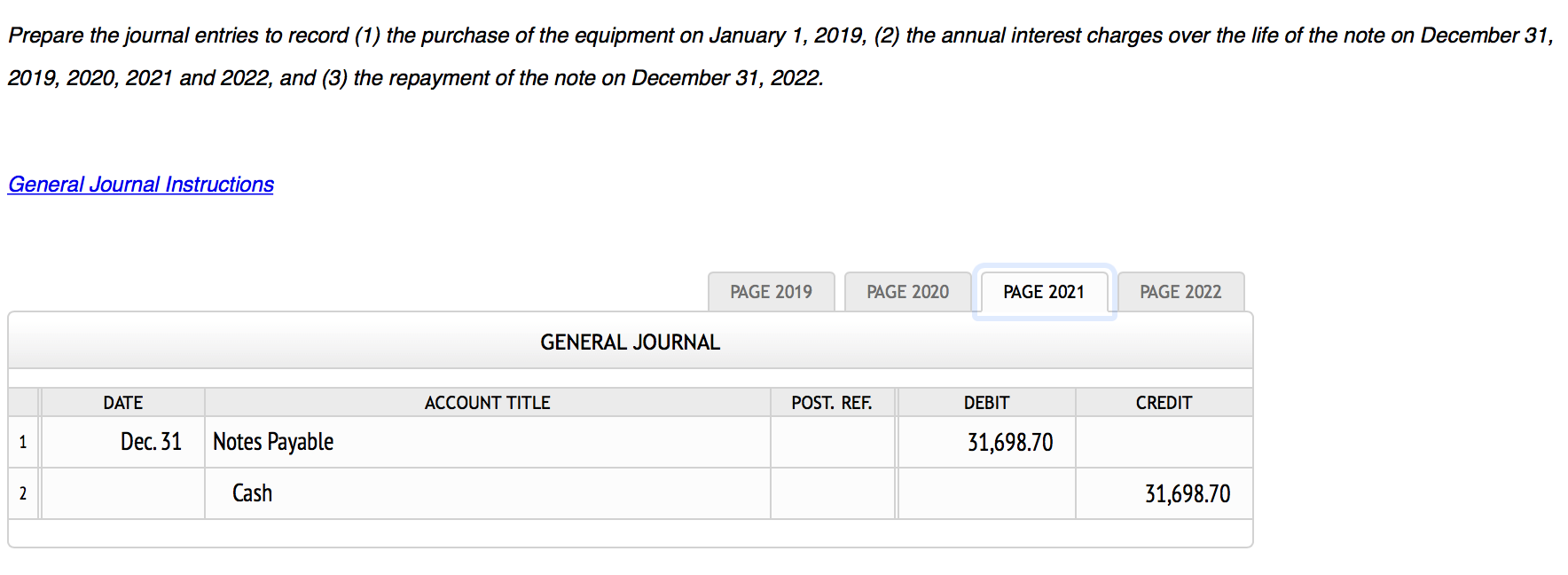

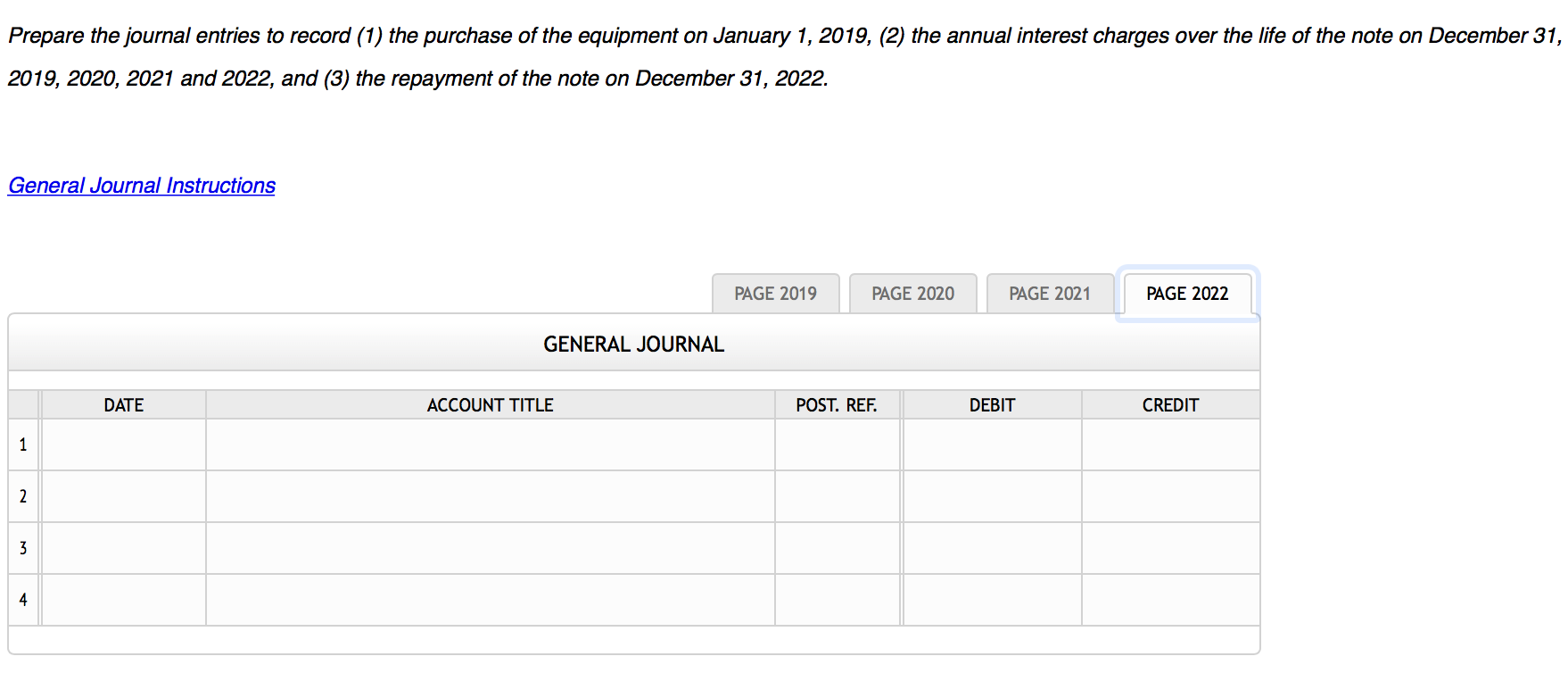

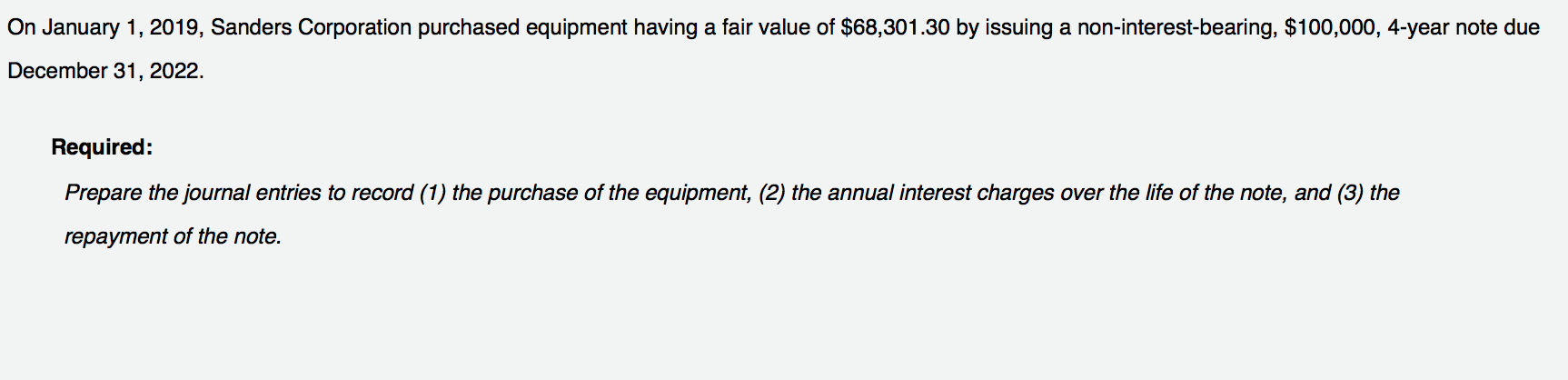

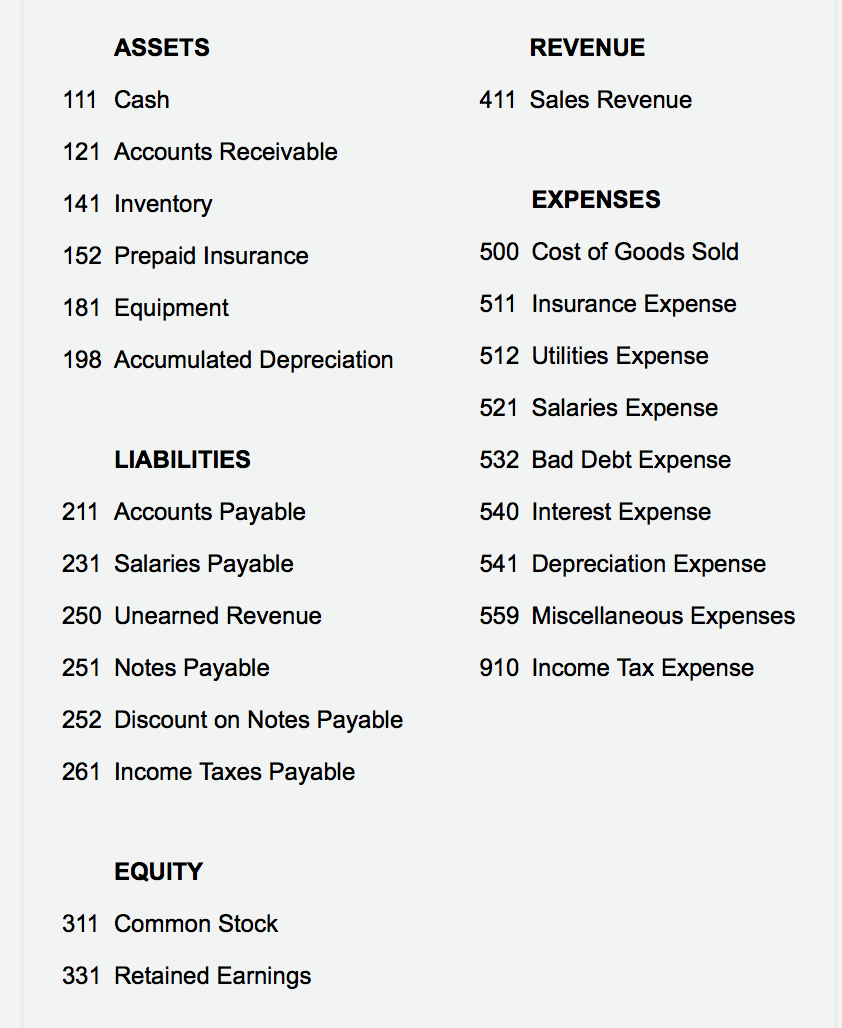

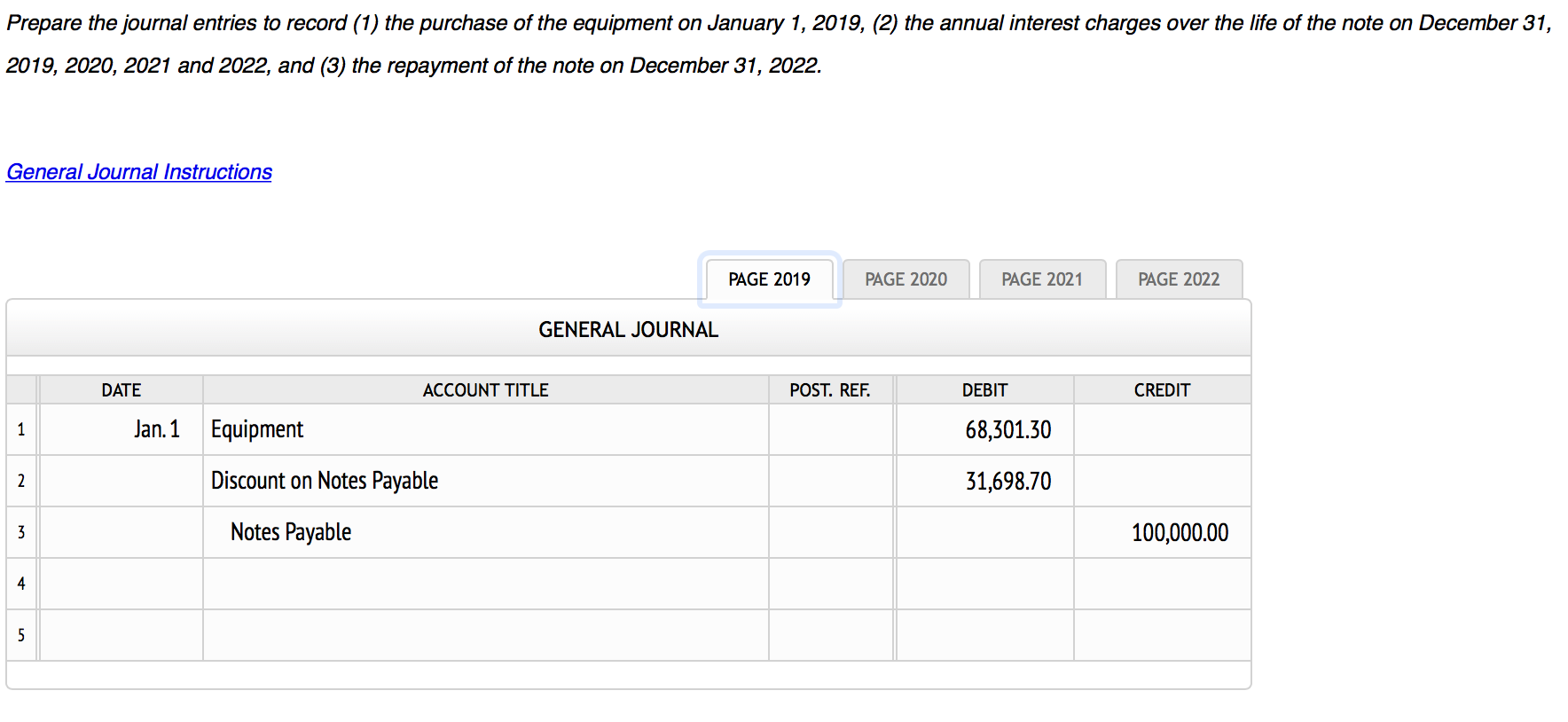

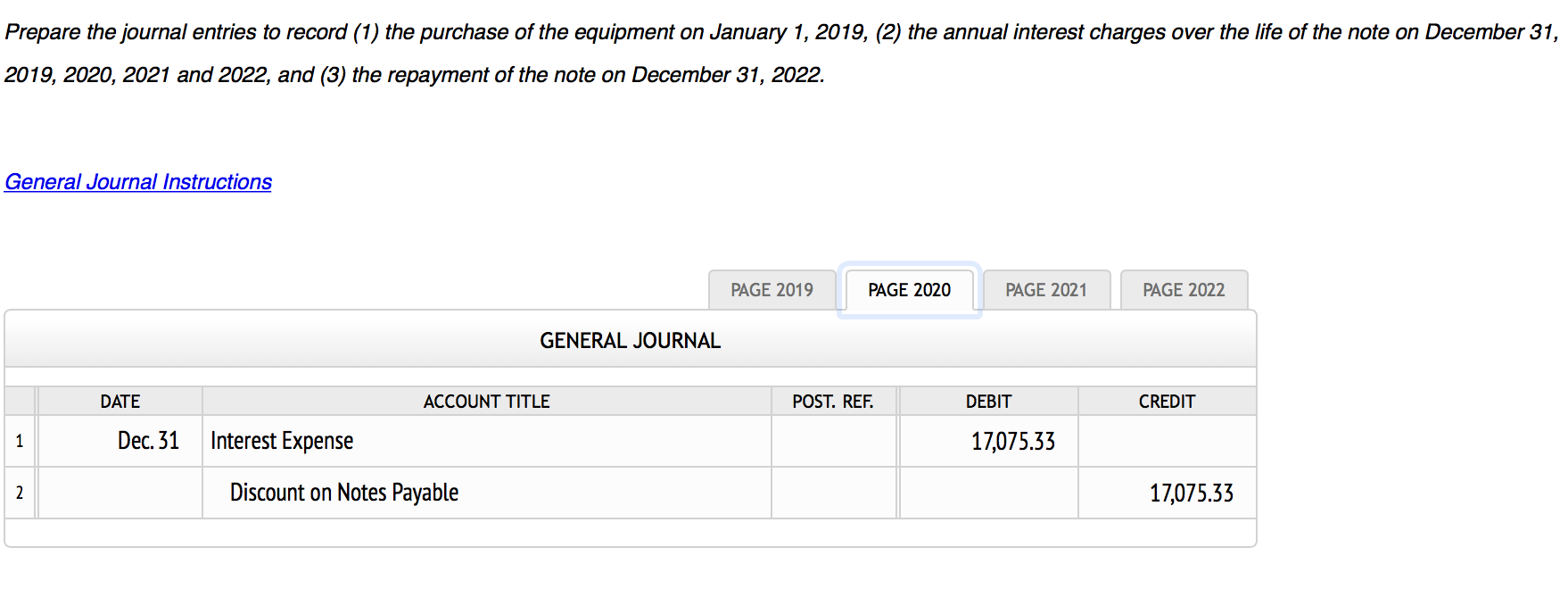

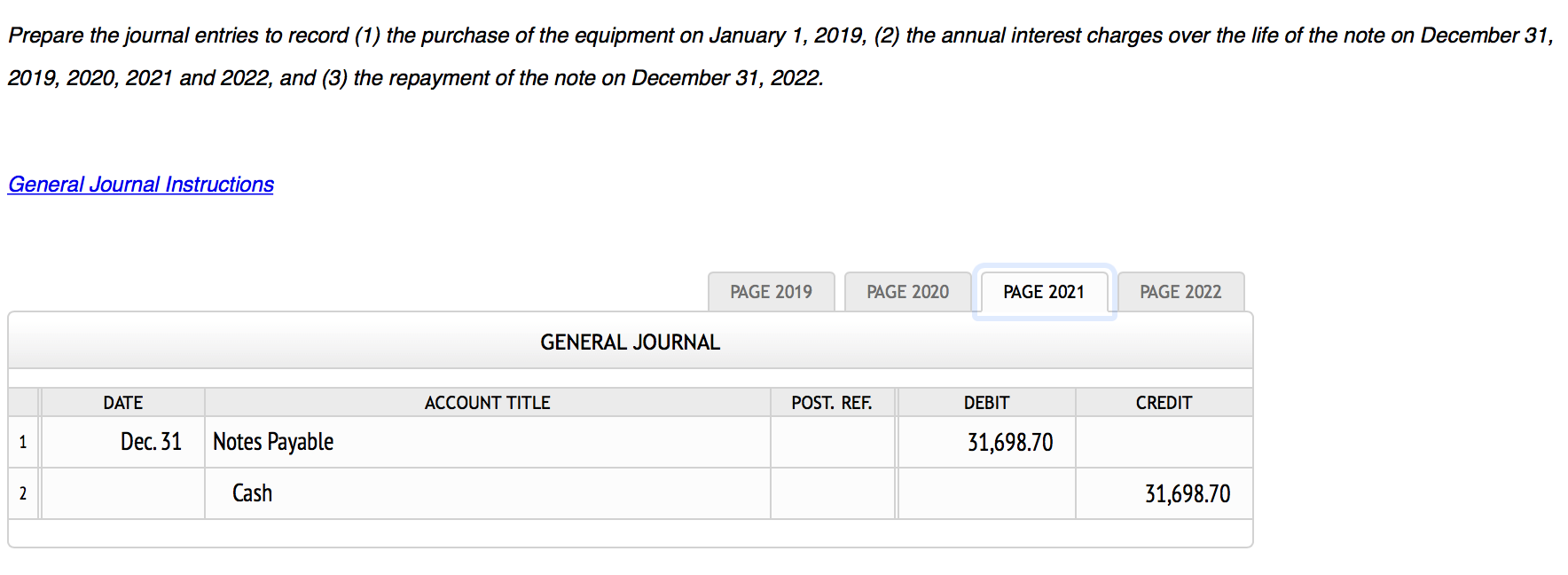

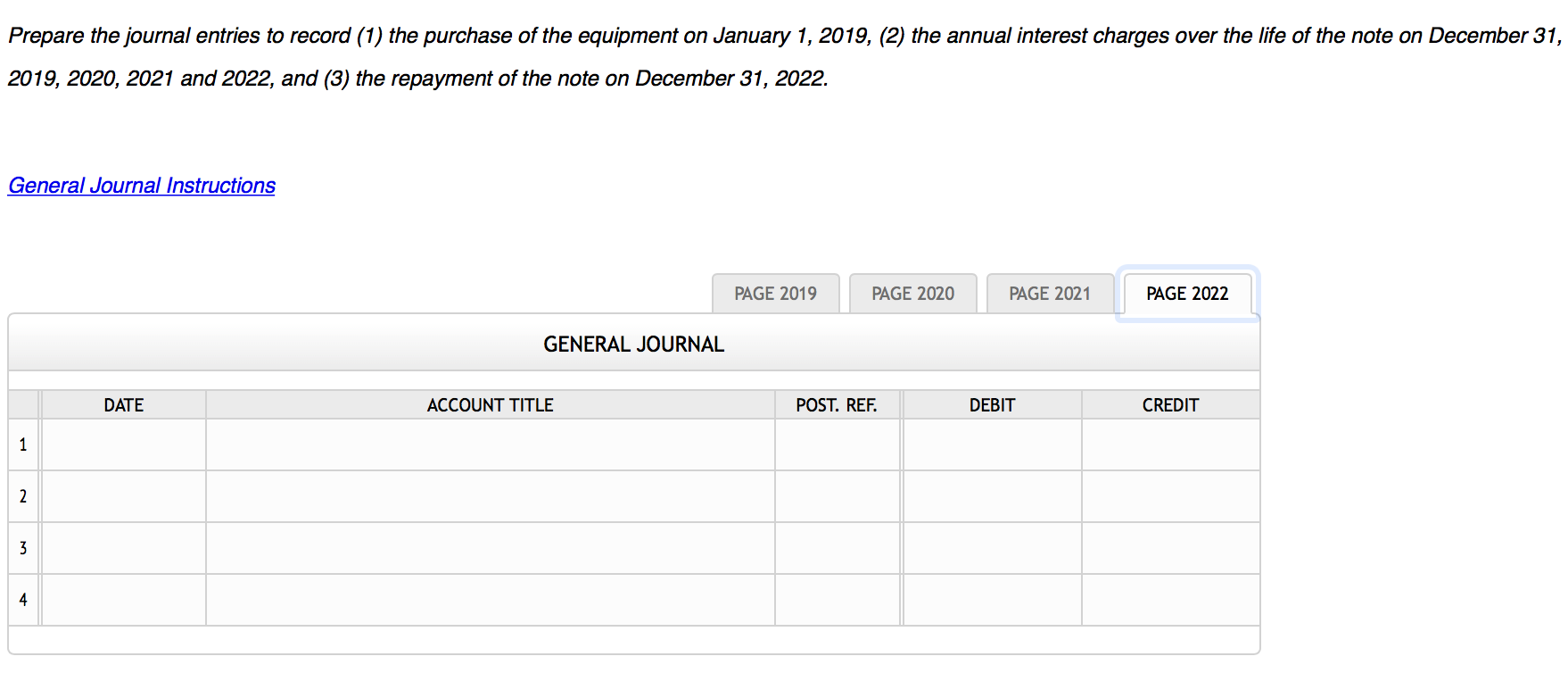

On January 1, 2019, Sanders Corporation purchased equipment having a fair value of $68,301.30 by issuing a non-interest-bearing, $100,000, 4-year note due December 31, 2022. Required: Prepare the journal entries to record (1) the purchase of the equipment, (2) the annual interest charges over the life of the note, and (3) the repayment of the note. ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 141 Inventory EXPENSES 500 Cost of Goods Sold 152 Prepaid Insurance 181 Equipment 511 Insurance Expense 198 Accumulated Depreciation 512 Utilities Expense 521 Salaries Expense LIABILITIES 532 Bad Debt Expense 540 Interest Expense 211 Accounts Payable 231 Salaries Payable 250 Unearned Revenue 541 Depreciation Expense 559 Miscellaneous Expenses 910 Income Tax Expense 251 Notes Payable 252 Discount on Notes Payable 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings Prepare the journal entries to record (1) the purchase of the equipment on January 1, 2019, (2) the annual interest charges over the life of the note on December 31, 2019, 2020, 2021 and 2022, and (3) the repayment of the note on December 31, 2022. General Journal Instructions PAGE 2019 PAGE 2020 PAGE 2021 PAGE 2022 GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT Jan.1 Equipment 68,301.30 Discount on Notes Payable 31,698.70 Notes Payable 100,000.00 Prepare the journal entries to record (1) the purchase of the equipment on January 1, 2019, (2) the annual interest charges over the life of the note on December 31, 2019, 2020, 2021 and 2022, and (3) the repayment of the note on December 31, 2022. General Journal Instructions PAGE 2019 PAGE 2020 PAGE 2021 PAGE 2022 GENERAL JOURNAL ACCOUNT TITLE POST. REF. DEBIT CREDIT DATE Dec. 31 Interest Expense 17,075.33 Discount on Notes Payable 17,075.33 Prepare the journal entries to record (1) the purchase of the equipment on January 1, 2019, (2) the annual interest charges over the life of the note on December 31, 2019, 2020, 2021 and 2022, and (3) the repayment of the note on December 31, 2022. General Journal Instructions PAGE 2019 PAGE 2020 PAGE 2021 PAGE 2022 GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT Dec. 31 Notes Payable 31,698.70 Cash 31,698.70 Prepare the journal entries to record (1) the purchase of the equipment on January 1, 2019, (2) the annual interest charges over the life of the note on December 31, 2019, 2020, 2021 and 2022, and (3) the repayment of the note on December 31, 2022. General Journal Instructions PAGE 2019 PAGE 2020 PAGE 2021 PAGE 2022 GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT