Question

I need help finishing the below problem. I have done what I can but cannot figure out what is wrong or the remaining blanks. Jones

I need help finishing the below problem. I have done what I can but cannot figure out what is wrong or the remaining blanks.

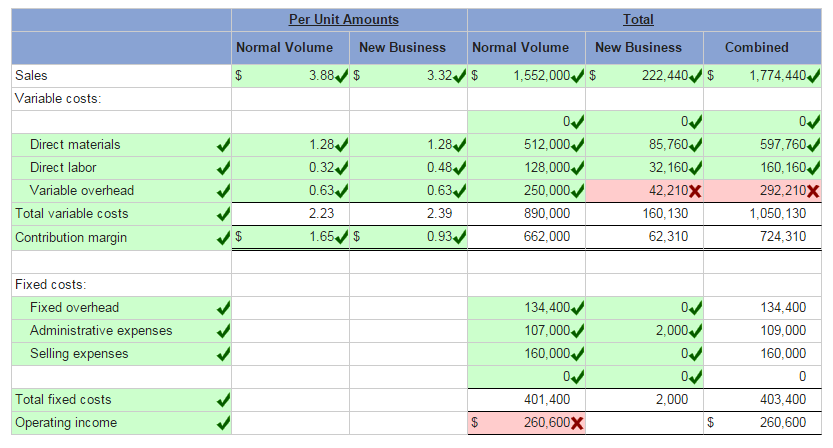

| Jones Products manufactures and sells to wholesalers approximately 400,000 packages per year of underwater markers at $3.88 per package. Annual costs for the production and sale of this quantity are shown in the table. |

| Direct materials | $ | 512,000 |

| Direct labor | 128,000 | |

| Overhead | 384,000 | |

| Selling expenses | 160,000 | |

| Administrative expenses | 107,000 | |

| Total costs and expenses | $ | 1,291,000 |

| A new wholesaler has offered to buy 67,000 packages for $3.32 each. These markers would be marketed under the wholesalers name and would not affect Jones Products sales through its normal channels. A study of the costs of this additional business reveals the following: |

| Direct materials costs are 100% variable. | |

| Per unit direct labor costs for the additional units would be 50% higher than normal because their production would require overtime pay at 1 times the usual labor rate. | |

| 35% of the normal annual overhead costs are fixed at any production level from 350,000 to 500,000 units. The remaining 65% of the annual overhead cost is variable with volume. | |

| Accepting the new business would involve no additional selling expenses. | |

| Accepting the new business would increase administrative expenses by a $2,000 fixed amount. |

| Required: |

| Complete the three-column comparative income statement that shows the following (Round your intermediate calculations and per unit cost answers to 2 decimals) |

| 1. | Annual operating income without the special order. |

| 2. | Annual operating income received from the new business only. |

| 3. | Combined annual operating income from normal business and the new business. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started