Answered step by step

Verified Expert Solution

Question

1 Approved Answer

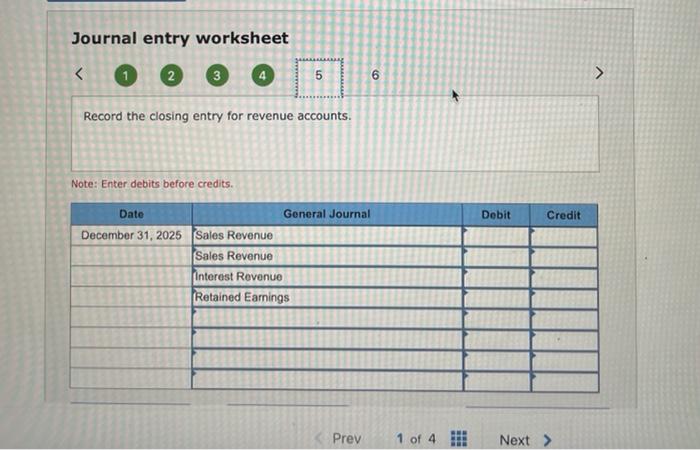

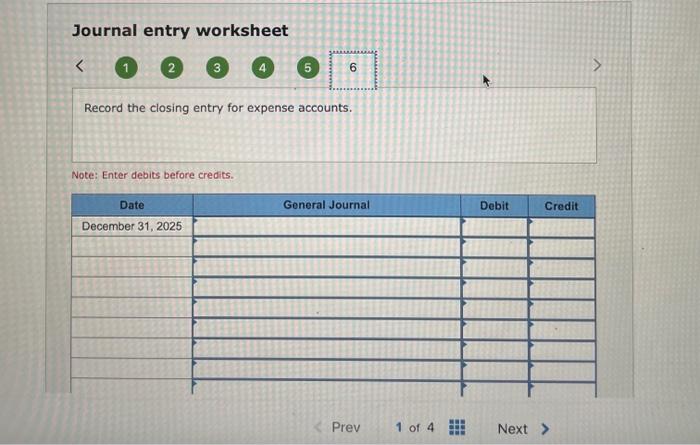

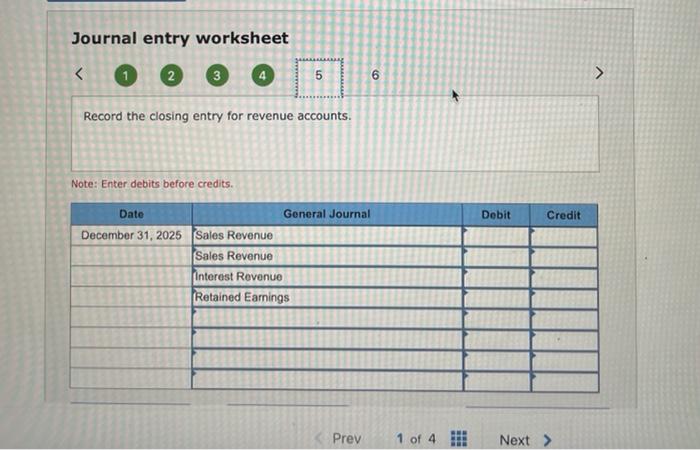

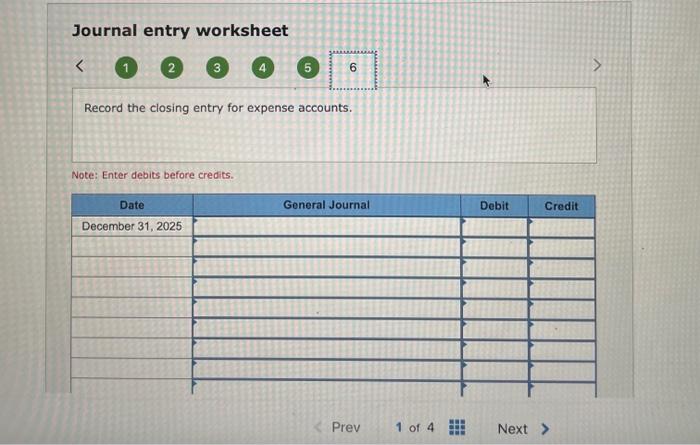

I need help finishing the question!!! I also need help on recording to close revenue and expense accounts. Journal entry worksheet Record the closing entry

I need help finishing the question!!! I also need help on recording to close revenue and expense accounts.

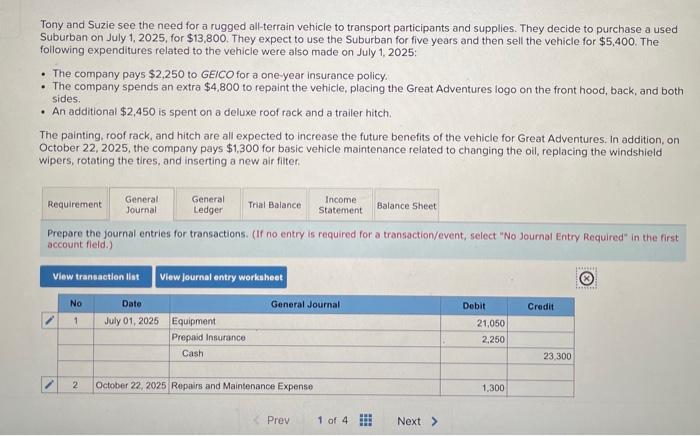

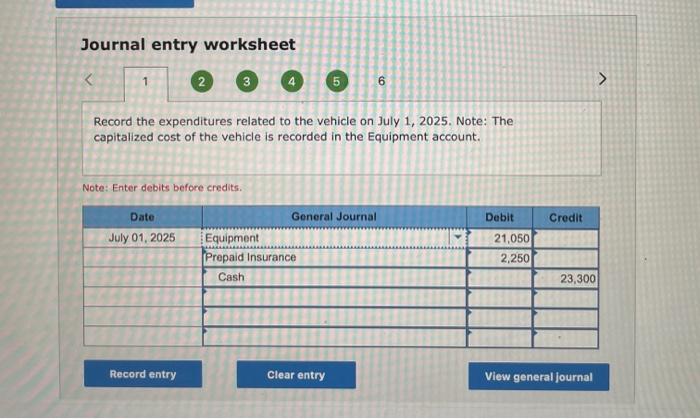

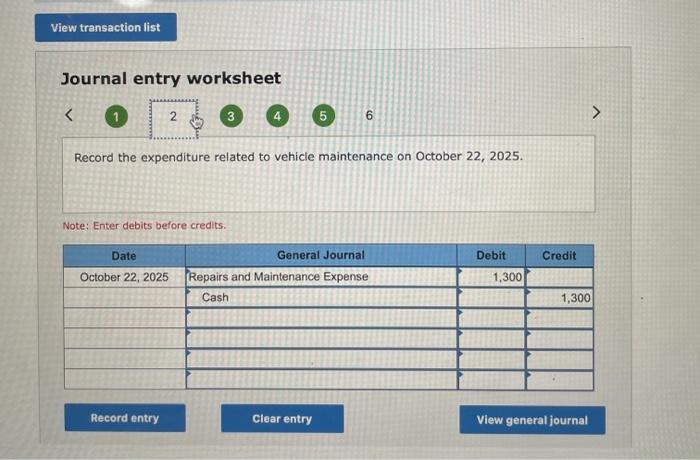

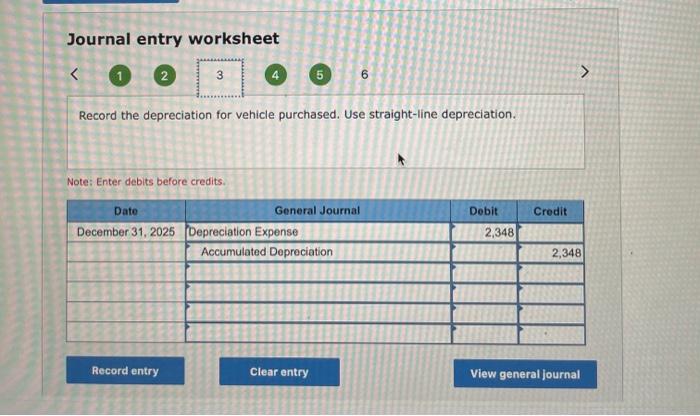

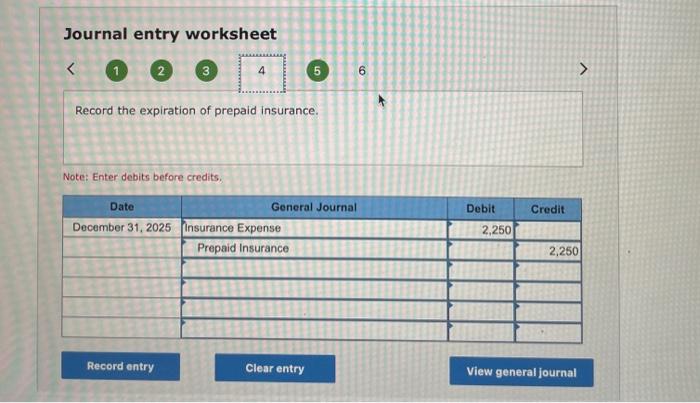

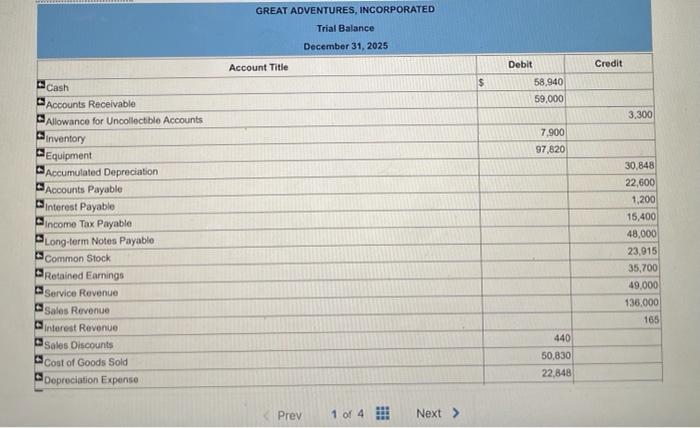

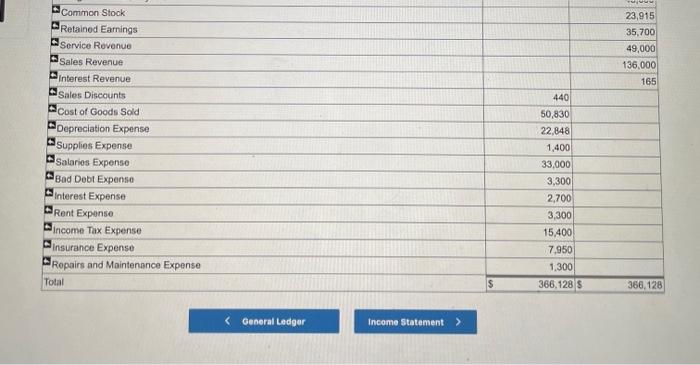

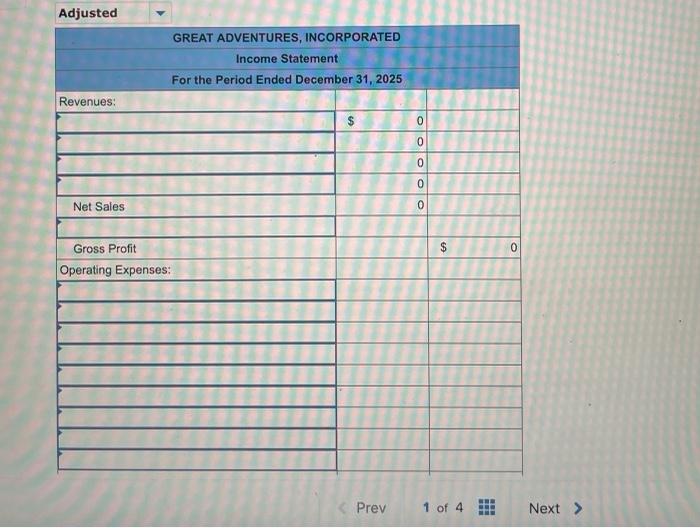

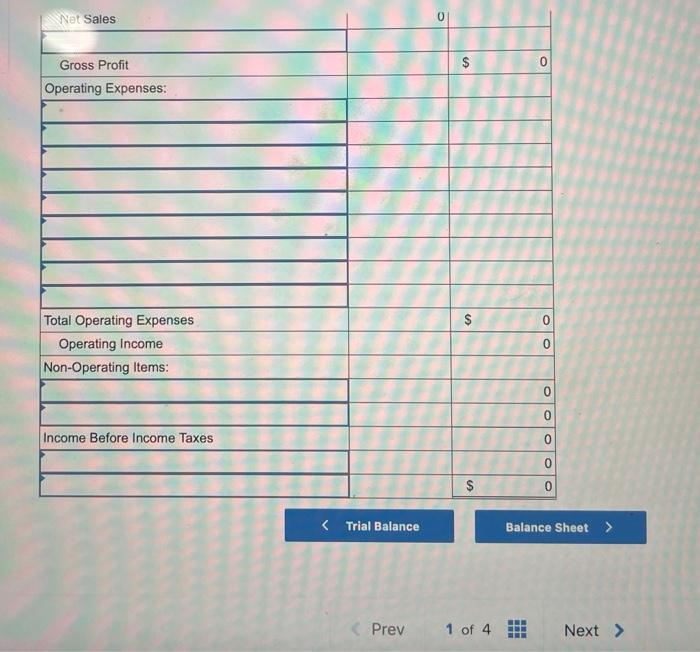

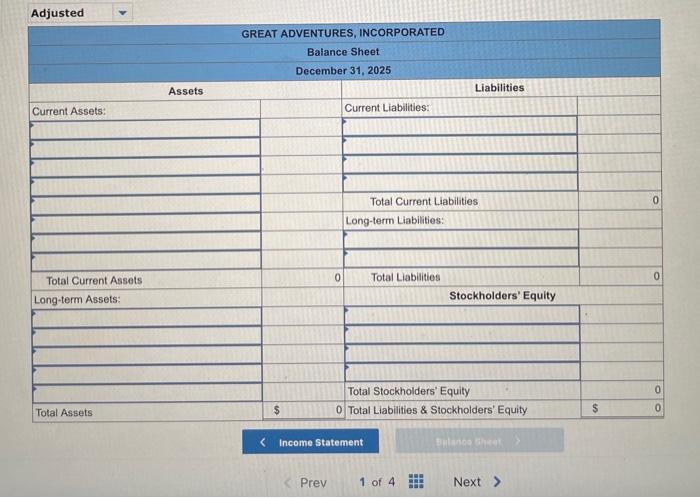

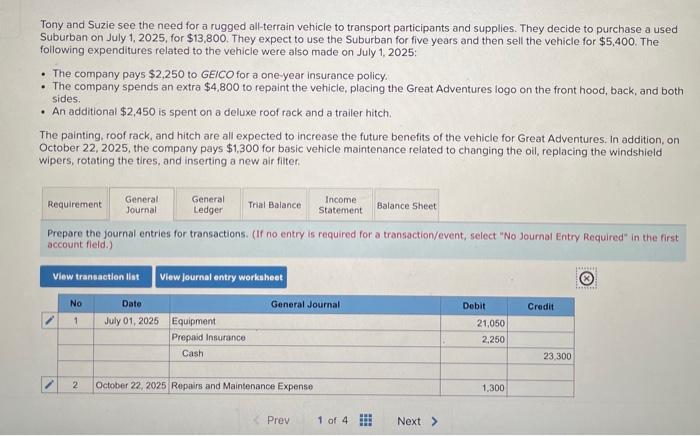

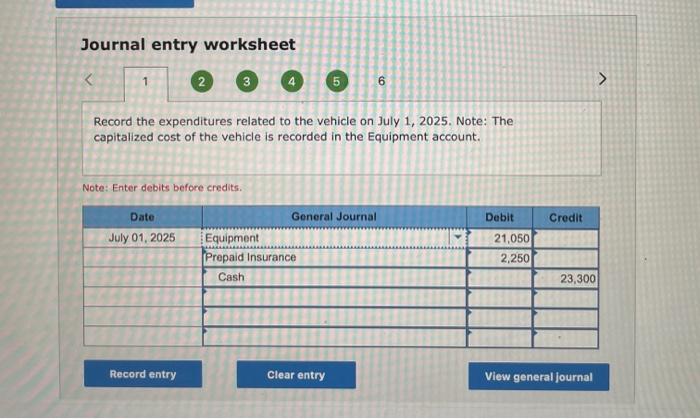

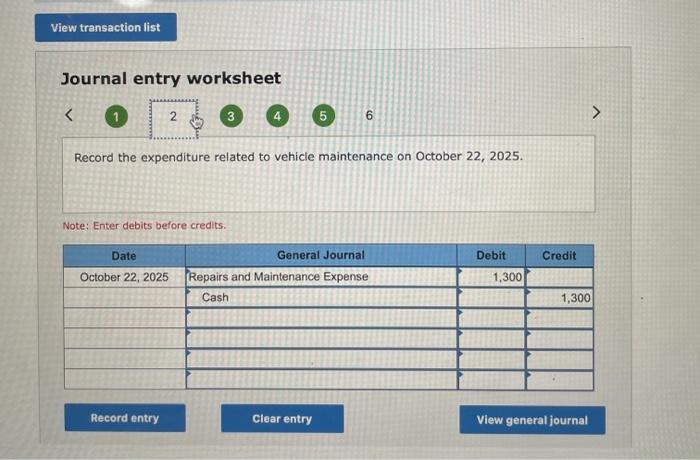

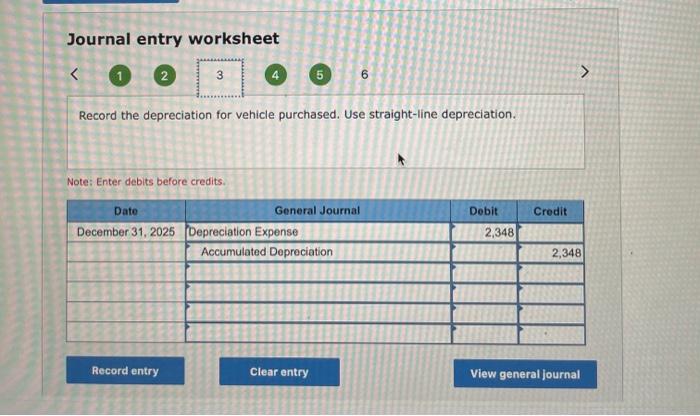

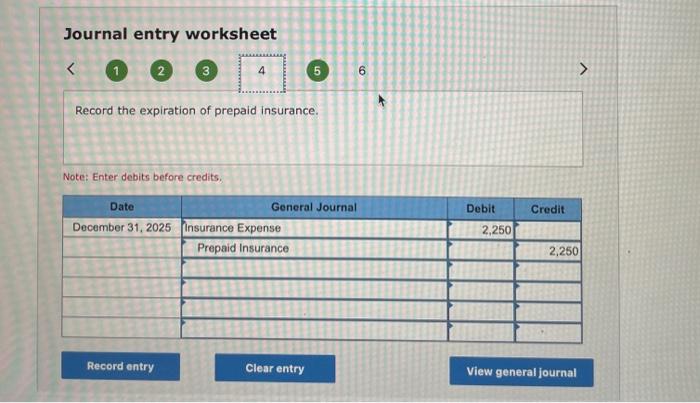

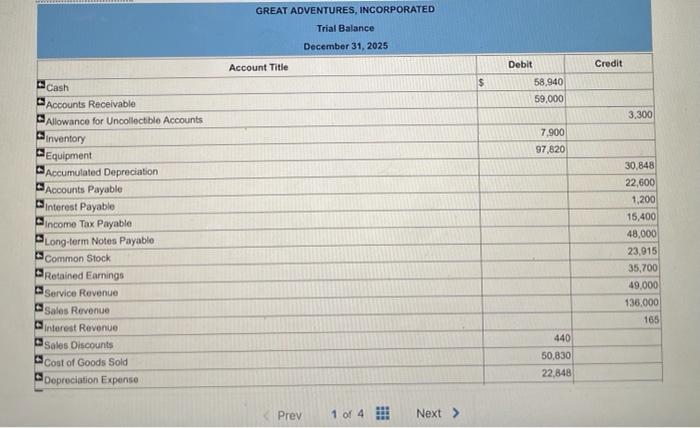

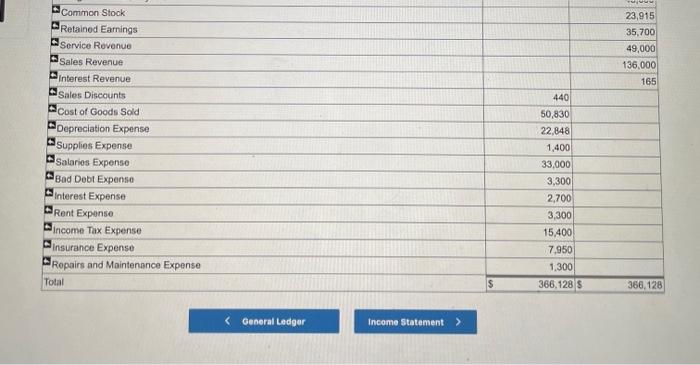

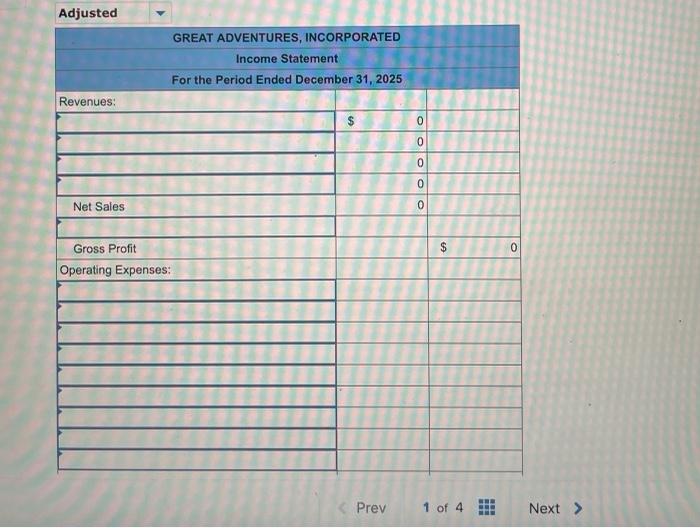

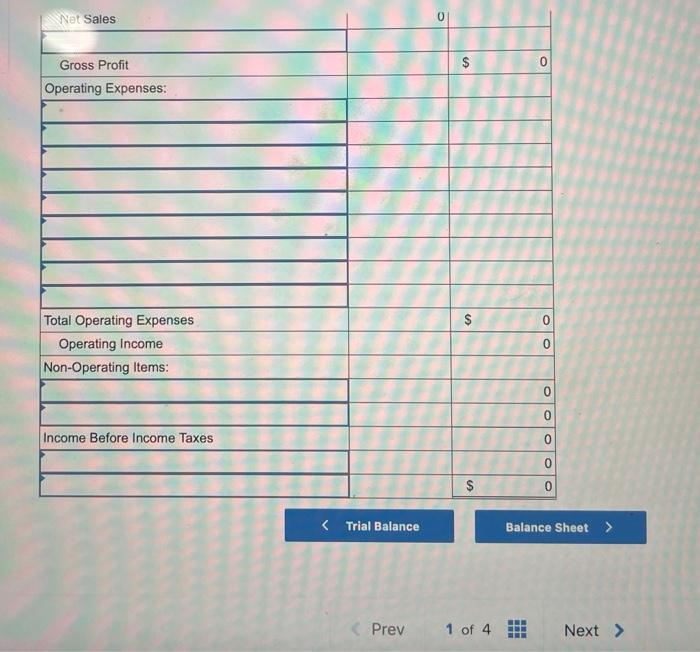

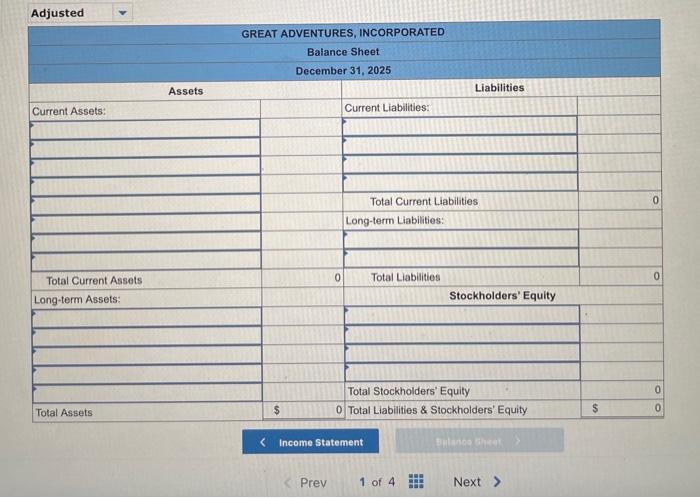

Journal entry worksheet Record the closing entry for revenue accounts. Note: Enter debits before credits. Journal entry worksheet (5) 6 Record the expenditure related to vehicle maintenance on October 22, 2025. Note: Enter debits before credits. Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1,2025 , for $13,800. They expect to use the Suburban for five years and then sell the vehicle for $5,400. The following expenditures related to the vehicle were also made on July 1,2025: - The company pays $2,250 to GEICO for a one-year insurance policy. - The company spends an extra $4,800 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,450 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22,2025 , the company pays $1,300 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No Joumal Entry Required" in the first account field.) Adjusted \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ GREAT ADVENTURES, INCORPORATED } \\ \hline \multicolumn{4}{|c|}{ Income Statement } \\ \hline \multicolumn{4}{|c|}{ For the Period Ended December 31, 2025} \\ \hline Revenues: & & & 4 \\ \hline & \$ & 0 & \\ \hline 5 & & 0 & 12 \\ \hline & & 0 & \\ \hline & & 0 & \\ \hline Net Sales & & 0 & \\ \hline & & & \\ \hline Gross Profit & & & $0 \\ \hline Operating Expenses: & & & \\ \hline ? & & & \\ \hline & & & \\ \hline 8 & & & \\ \hline & & & \\ \hline 5 & & & \\ \hline 5 & & & \\ \hline 7 & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Prev 1 of 4 Next Journal entry worksheet Record the expiration of prepaid insurance. Note: Enter debits before credits. Journal entry worksheet Record the closing entry for expense accounts. Note: Enter debits before credits. \begin{tabular}{|c|c|c|} \hline B Common Stock & & 23,915 \\ \hline QRetainedEamings & & 35,700 \\ \hline A Service Revenue & & 49,000 \\ \hline A Sales Revenue & & 136,000 \\ \hline Q Interest Revenue & & 165 \\ \hline W Sales Discounts & 440 & \\ \hline Cost of Goods Sold & 50,830 & \\ \hline Depreciation Expense & 22,848 & \\ \hline S Supplies Expense & 1,400 & \\ \hline - Salaries Expense & 33,000 & \\ \hline EBadDebtExpenso & 3,300 & \\ \hline WInterestExpense & 2,700 & \\ \hline WRentExpanse & 3,300 & \\ \hline Q income Tax Expense & 15,400 & \\ \hline Pinsurance Expense & 7,950 & \\ \hline Aropairs and Maintenance Expense & 1.300 & \\ \hline Total & 366,128 & 366,128 \\ \hline \end{tabular} General Ledger Income statement Journal entry worksheet 1 Record the depreciation for vehicle purchased. Use straight-line depreciation. Note: Enter debits before credits. Journal entry worksheet 2 3 4 (5) 6 Record the expenditures related to the vehicle on July 1, 2025. Note: The capitalized cost of the vehicle is recorded in the Equipment account. Note: Enter debits before credits. Adjusted GREAT ADVENTURES, INCORPORATED Income statement Prev 1 of 4 Next \begin{tabular}{|l|l|l|} \hline Not Sales & \multicolumn{2}{|c|}{} \\ \hline Gross Profit & & $ \\ \hline Operating Expenses: & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Total Operating Expenses & & \\ \hline Operating Income & & \\ \hline Non-Operating Items: & & \\ \hline & & \\ \hline & & \\ \hline Income Before Income Taxes & & \\ \hline & & 0 \\ \hline & & 0 \\ \hline \end{tabular} Trial Balance Balance Sheet Prev 1 of 4 Next GREAT ADVENTURES, INCORPORATED Trial Balance December 31,2025 Prev 1 of 4 Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started