Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Tax Treatment of Business Entities Introduction: Understanding the tax treatment of different business entities is essential for entrepreneurs and business owners to make

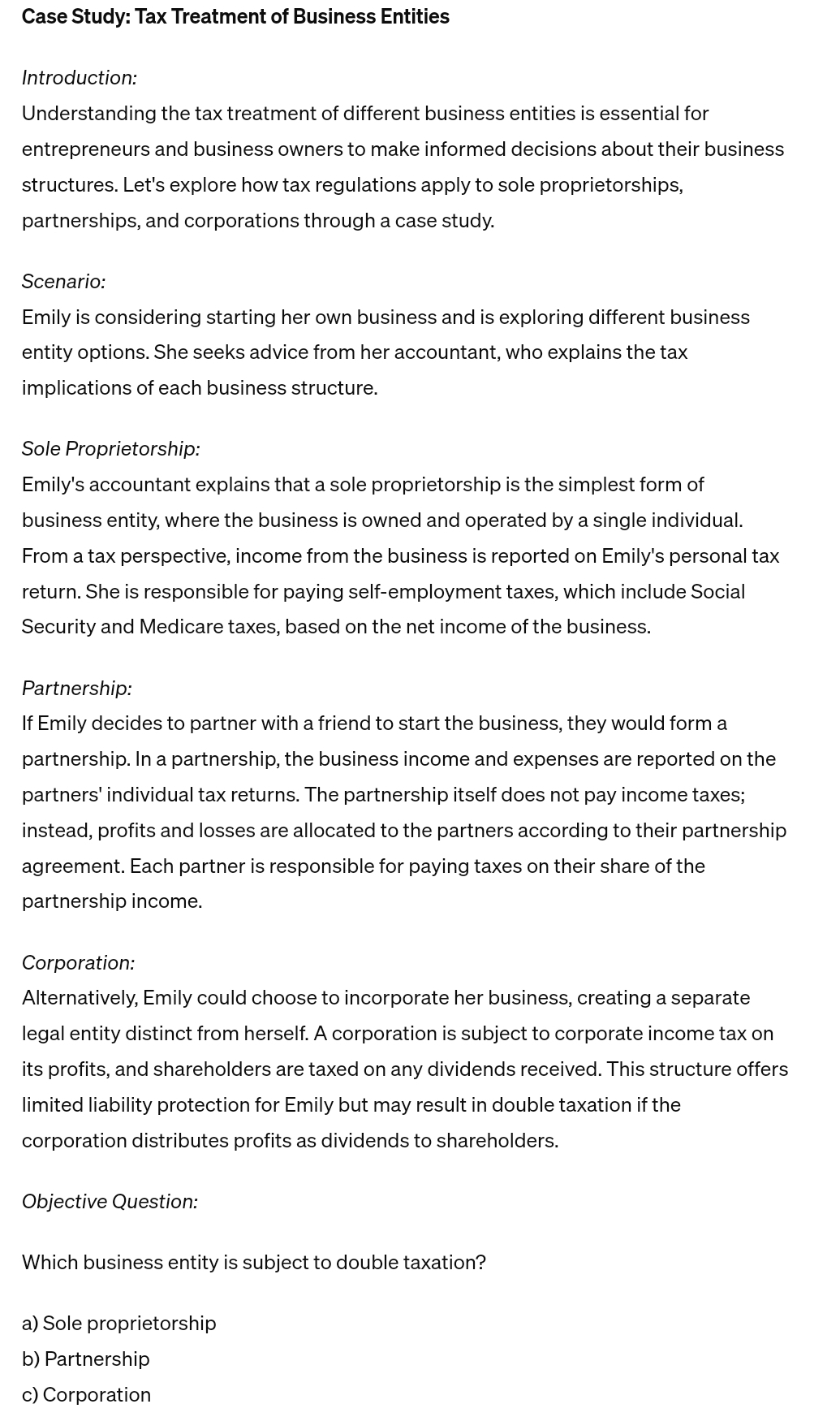

Case Study: Tax Treatment of Business Entities

Introduction:

Understanding the tax treatment of different business entities is essential for entrepreneurs and business owners to make informed decisions about their business structures. Let's explore how tax regulations apply to sole proprietorships, partnerships, and corporations through a case study.

Scenario:

Emily is considering starting her own business and is exploring different business entity options. She seeks advice from her accountant, who explains the tax implications of each business structure.

Sole Proprietorship:

Emily's accountant explains that a sole proprietorship is the simplest form of business entity, where the business is owned and operated by a single individual. From a tax perspective, income from the business is reported on Emily's personal tax return. She is responsible for paying selfemployment taxes, which include Social Security and Medicare taxes, based on the net income of the business.

Partnership:

If Emily decides to partner with a friend to start the business, they would form a partnership. In a partnership, the business income and expenses are reported on the partners' individual tax returns. The partnership itself does not pay income taxes; instead, profits and losses are allocated to the partners according to their partnership agreement. Each partner is responsible for paying taxes on their share of the partnership income.

Corporation:

Alternatively, Emily could choose to incorporate her business, creating a separate legal entity distinct from herself. A corporation is subject to corporate income tax on its profits, and shareholders are taxed on any dividends received. This structure offers limited liability protection for Emily but may result in double taxation if the corporation distributes profits as dividends to shareholders.

Objective Question:

Which business entity is subject to double taxation?

a Sole proprietorship

b Partnership

c Corporation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started