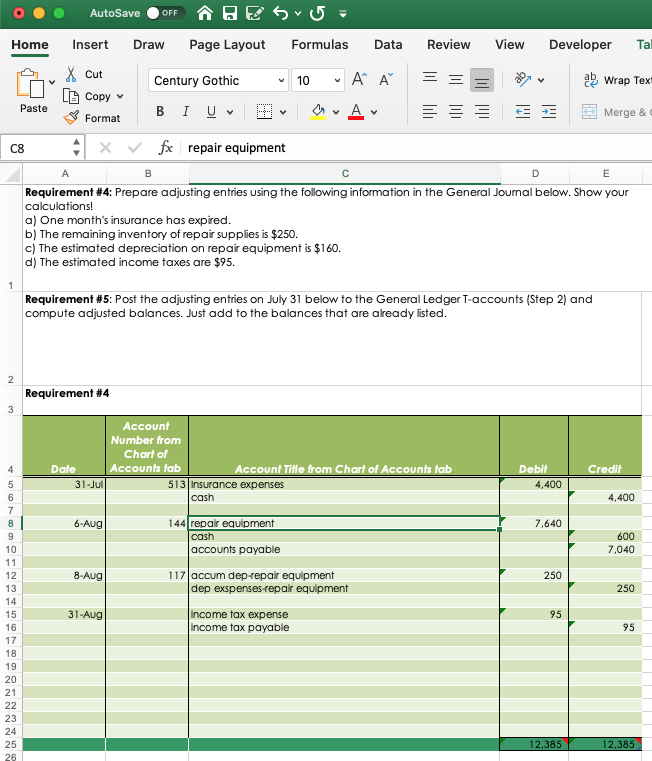

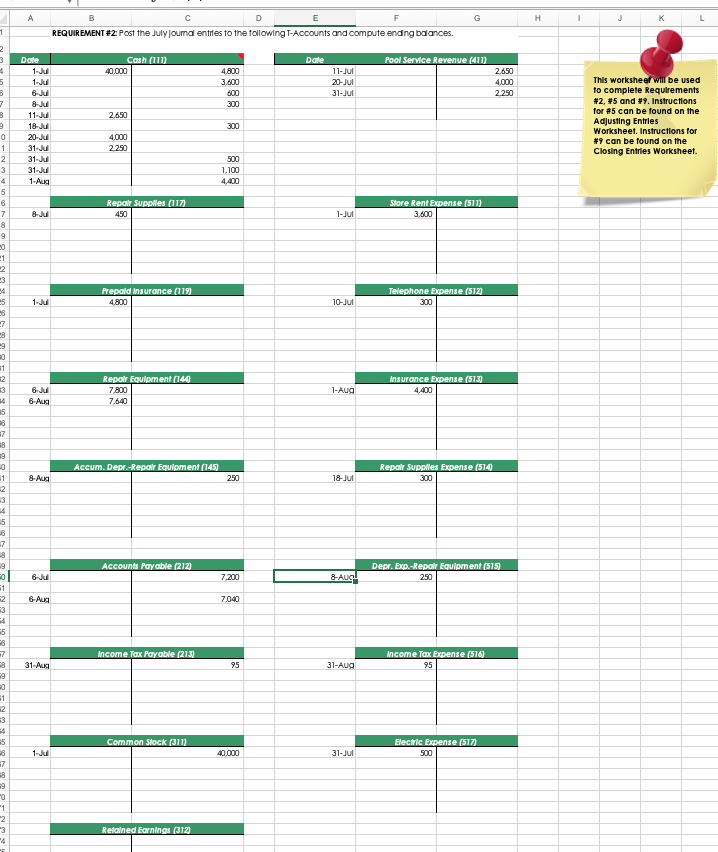

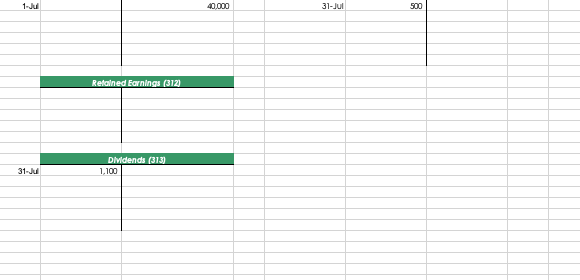

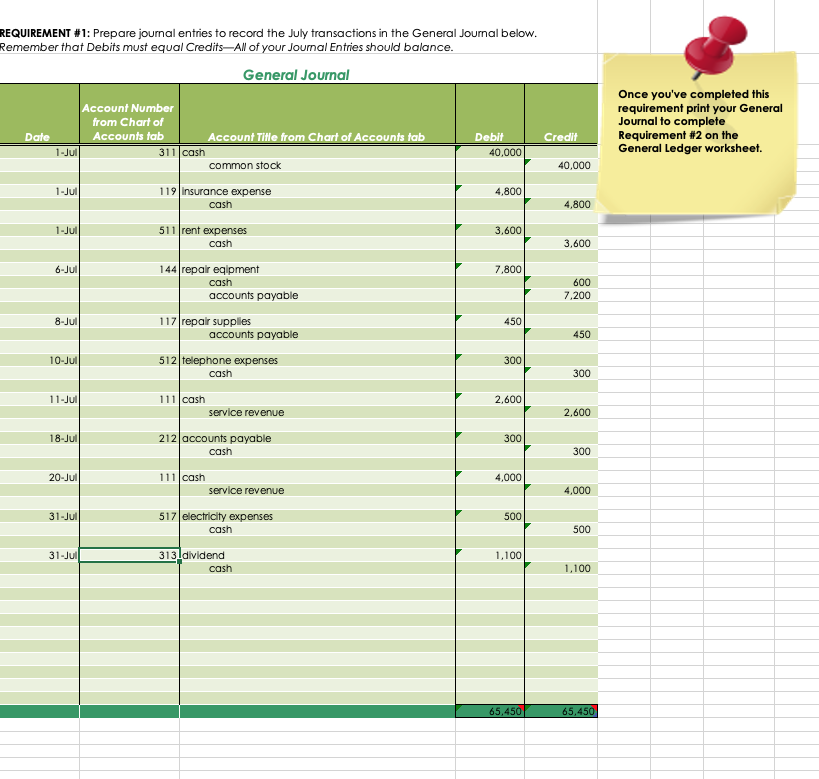

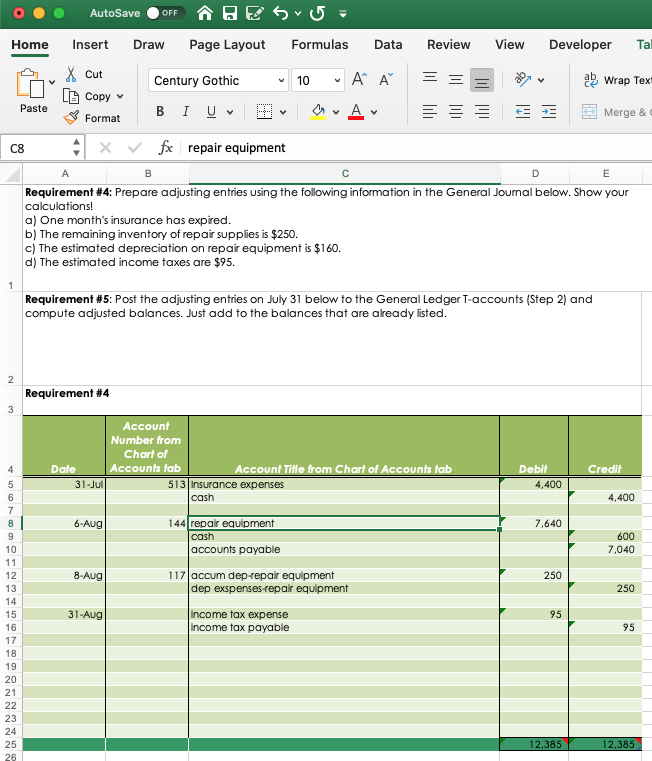

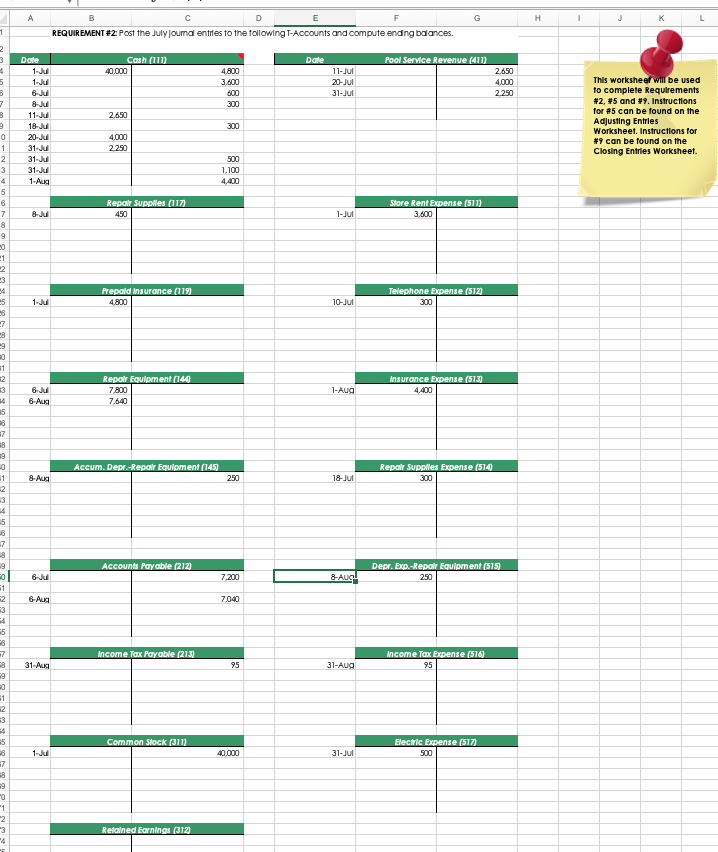

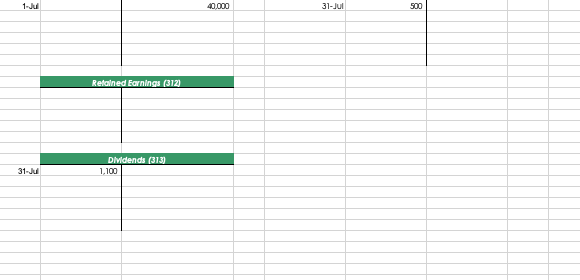

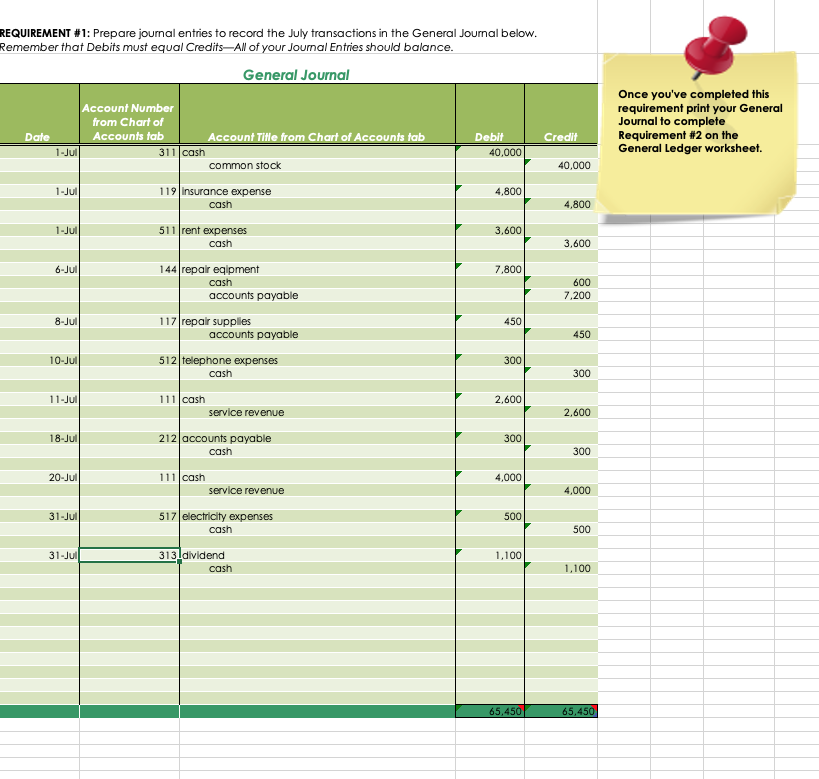

I need help finishing these sheets I have posted all of the steps. starting at step 4 & 5 its filled out but not sure if I started it right and the general ledger needs to be corrected please if someone could help.

I need help finishing these sheets I have posted all of the steps. starting at step 4 & 5 its filled out but not sure if I started it right and the general ledger needs to be corrected please if someone could help.

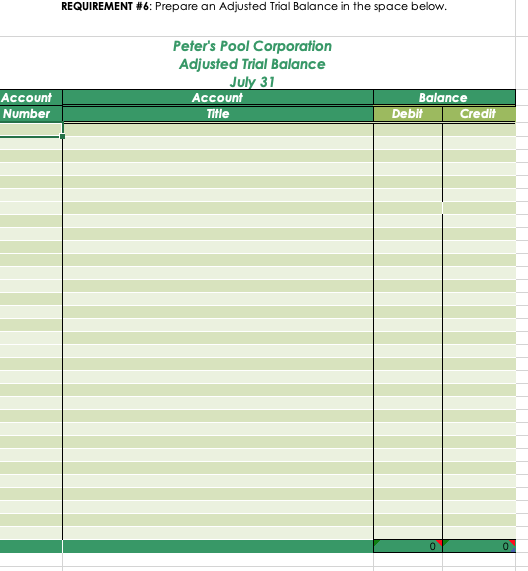

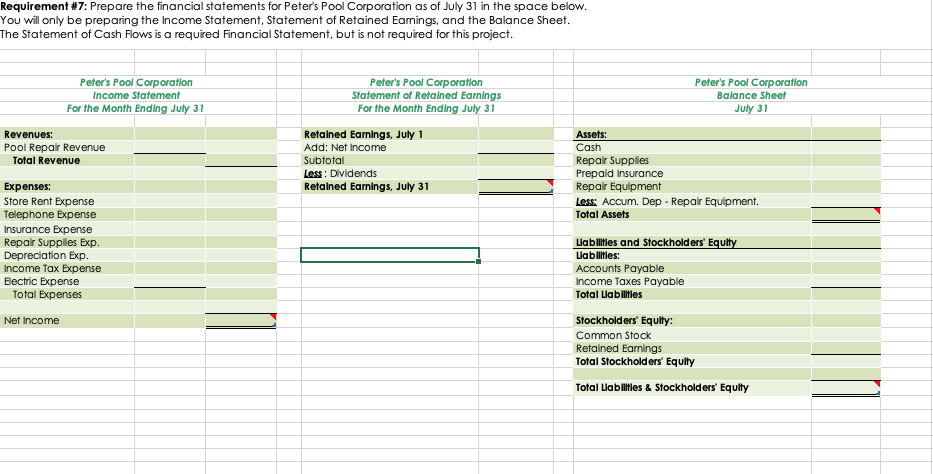

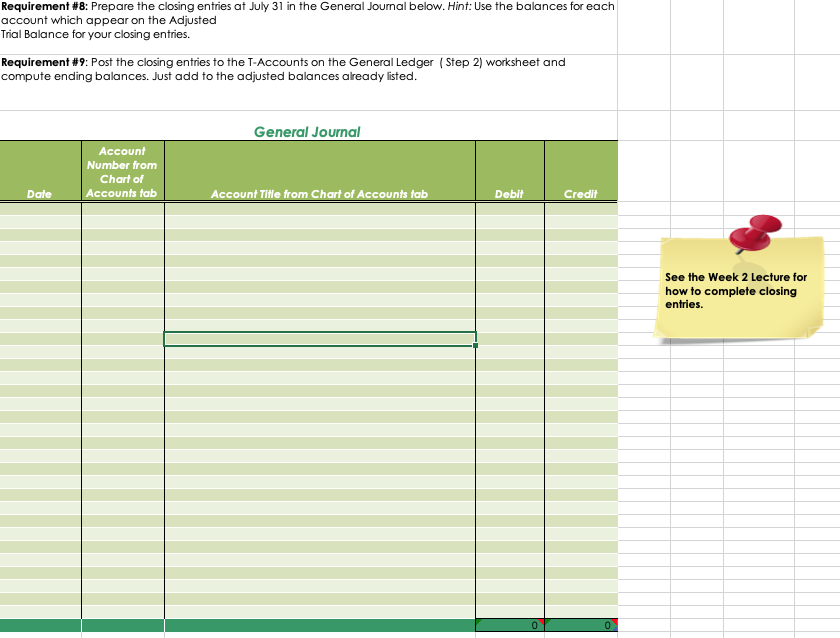

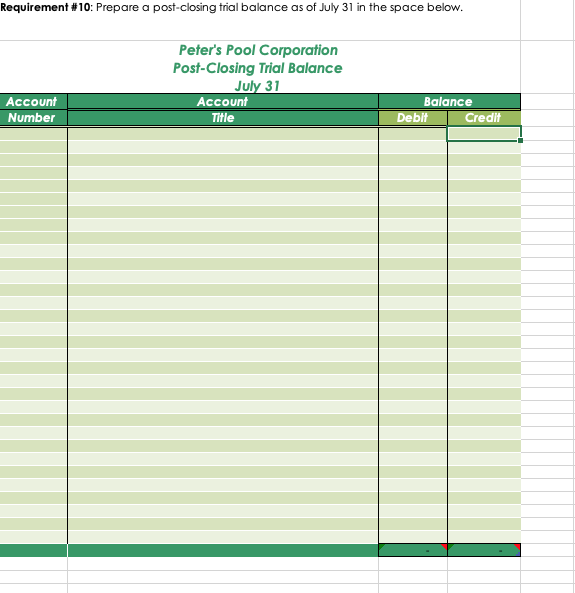

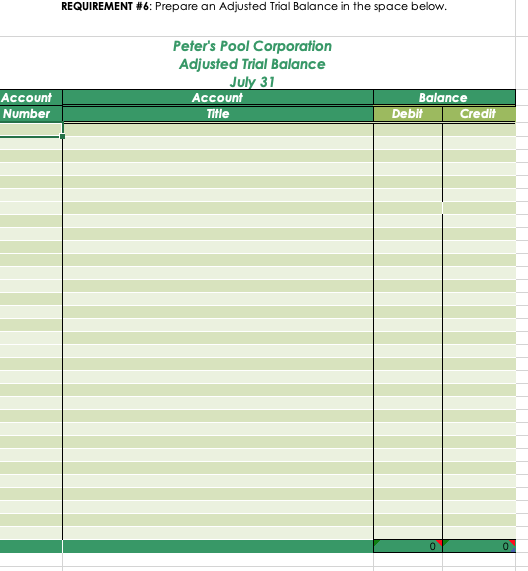

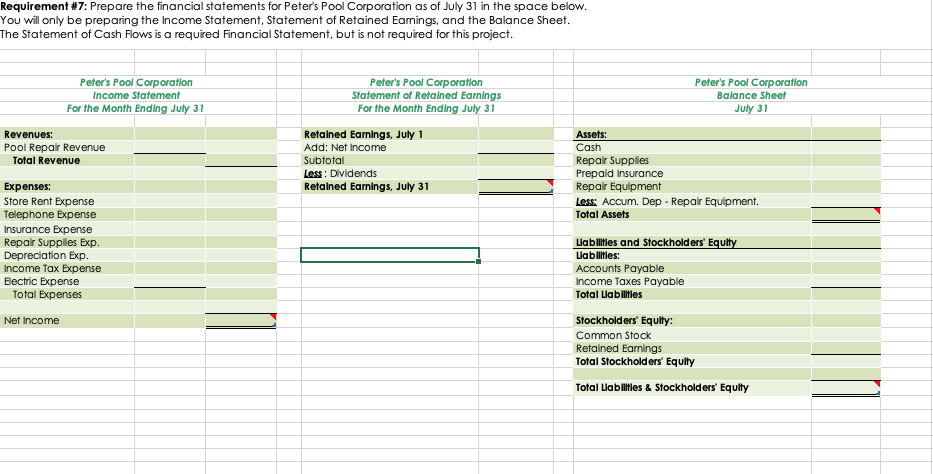

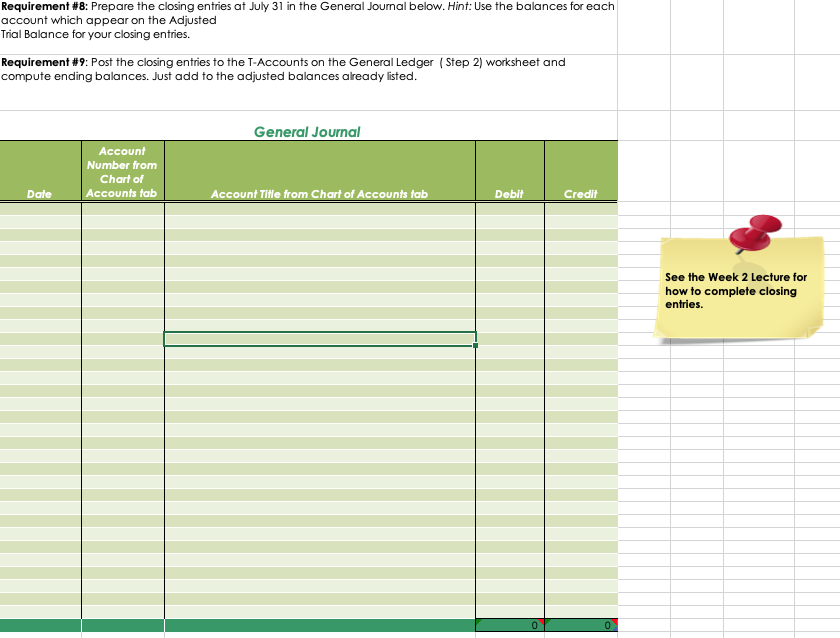

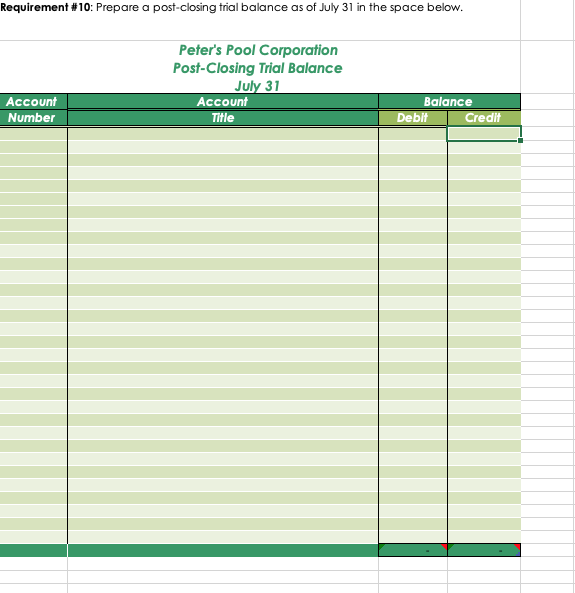

ooo AutoSave OFF HE S U Home Insert Draw Page Layout Formulas Data Review View Developer Tal X Cut Century Gothic 10 A A = = = a v alle Wrap Tex (6 Copy Paste Format B IU A E Merge & C8 x fx repair equipment AB Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $250. c) The estimated depreciation on repair equipment is $160. d) The estimated income taxes are $95. Requirement #5: Post the adjusting entries on July 31 below to the General Ledger T-accounts (Step 2) and compute adjusted balances. Just add to the balances that are already listed. Requirement #4 Account Number from Chart of Date Accounts tab Account Title from Chart of Accounts tab 31-Jul 513 Insurance expenses cash Credit Debit 4,400 4,400 6-Aug 7,640 144 repair equipment cash accounts payable 600 7,040 8-Aug| 250 117 |accum dep-repair equipment dep exspenses-repair equipment 250 31-Aug 95 income tax expense income tax payable 95 12,385 12,385 _REQUIREMENT #2: Post the Julyjournal entries to the following T-Accounts and compute ending balances. Cash (111) Date Pool Service Revenue (411 1-Jul 0.000 4.800 2.650 3.600 11-Jul 20-Jul 31-Jul 600 2250 NOUN 6- 8-Jul 11- 18. Ju 2.650 This worksheer will be used to complete Requirements #2. #5 ond y, instructions for #5 can be found on the Adlusting Entries Worksheet, Instructions for #9 can be found on the Closing Entries Worksheet 20 Jul 4.000 2.250 31-Ju 31- 31-Jul 1-Aug 500 1.100 4400 Repar Suppiles (117) Store Rent Expense (511) Telephone Expense (512) * Prepaid Insurance (119) dam 10-JUI Repair Equipment (144) insurance Expense (513) TANTO S 1-Aug Bu 6 Aug 7640 Accum. Dep-Repair Equipment (145 Repair Supplies Expense (514 8-Aug 290 Accounts Payable (212) Depr. Exp.-Repair Equipment (515) 6-Jul 7.200 - Aucl TRANYOS 6-Aug 7040 income Tax Payable (213) Income Tax Expense (516) 3 31-Aug 31-Aug 8 R U Common Stock (311) Electric Expense (517) 1-Jul 40.000 31-Jul HANI Retained Earnings (312) 1-Jul 40.000 31-Jul Retained Earnings (312) Didends (313) 1.100 REQUIREMENT #1: Prepare journal entries to record the July transactions in the General Journal below. Remember that Debits must equal Credits-All of your Journal Entries should balance. General Journal Once you've completed this requirement print your General Journal to complete Requirement #2 on the General Ledger worksheet. Date Account Number from Chart of Accounts tab Account Title from Chart of Accounts tab 1-Jul 311 cash common stock Credit Debit 40,000 40,000 1-Jul 4,800 119 Insurance expense cash 4,800 1-Jul 3,600 511 rent expenses cash 3,600 6-Jul 7,800 144 repair egipment cash accounts payable 600 7.200 8-Jul 450 117 repair supplies accounts payable 450 10-Jul 300 512 telephone expenses cash 300 11-Jul 2,600 111 cash service revenue 2,600 18-Jul 300 212 accounts payable cash 300 20-Jul 4,000 111 cash service revenue 4,000 31-Jul 500 517 electricity expenses cash 500 31-Jul 313.dividend T cash 1,100 65,450 65,450 REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below. Peter's Pool Corporation Adjusted Trial Balance July 31 Account Title Account Number Balance Debit Credit Requirement #7: Prepare the financial statements for Peter's Pool Corporation as of July 31 in the space below. You will only be preparing the Income Statement, Statement of Retained Earnings, and the Balance Sheet. The Statement of Cash Flows is a required Financial Statement, but is not required for this project. Peter's Pool Corporation Income Statement For the Month Ending July 31 Peter's Pool Corporation Statement of Retained Earnings For the Month Ending July 31 Peter's Pool Corporation Balance Sheet July 31 Revenues: Pool Repair Revenue Total Revenue Retained Earnings, July 1 Add: Net Income Subtotal Less: Dividends Retained Earnings, July 31 Assets: Cash Repair Supplies Prepaid Insurance Repair Equipment Less: Accum. Dep - Repair Equipment. Total Assets Expenses: Store Rent Expense Telephone Expense Insurance Expense Repair Supplies Exp. Depreciation Exp. Income Tax Expense Electric Expense Total Expenses Liabilities and Stockholders' Equity Liabilities: Accounts Payable Income Taxes Payable Total Liabilities Net Income Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity Requirement #8: Prepare the closing entries at July 31 in the General Journal below. Hint: Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. Requirement #9: Post the closing entries to the T-Accounts on the General Ledger (Step 2) worksheet and compute ending balances. Just add to the adjusted balances already listed. General Journal Account Number from Chart of Accounts tab Account Title from Chart of Accounts tab Debit Credit See the Week 2 Lecture for how to complete closing entries. 00 Requirement #10: Prepare a post-closing trial balance as of July 31 in the space below. Peter's Pool Corporation Post-Closing Trial Balance July 31 Account Title Account Number Balance Debit T Credit

I need help finishing these sheets I have posted all of the steps. starting at step 4 & 5 its filled out but not sure if I started it right and the general ledger needs to be corrected please if someone could help.

I need help finishing these sheets I have posted all of the steps. starting at step 4 & 5 its filled out but not sure if I started it right and the general ledger needs to be corrected please if someone could help.