I need help. I need to turn it in 20 minutes

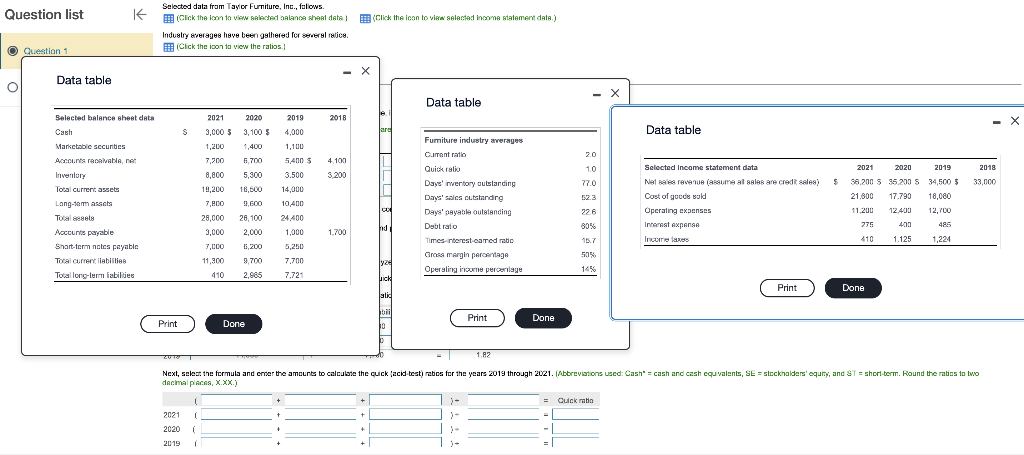

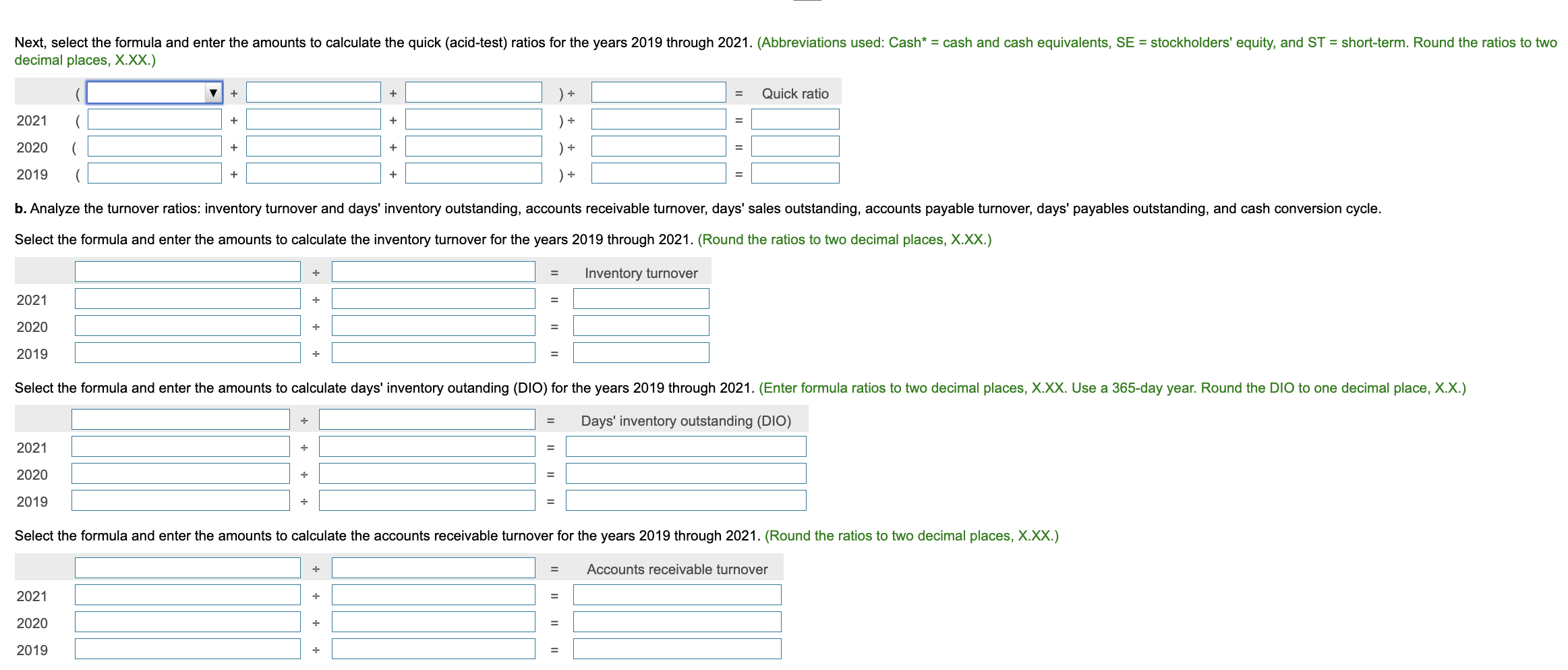

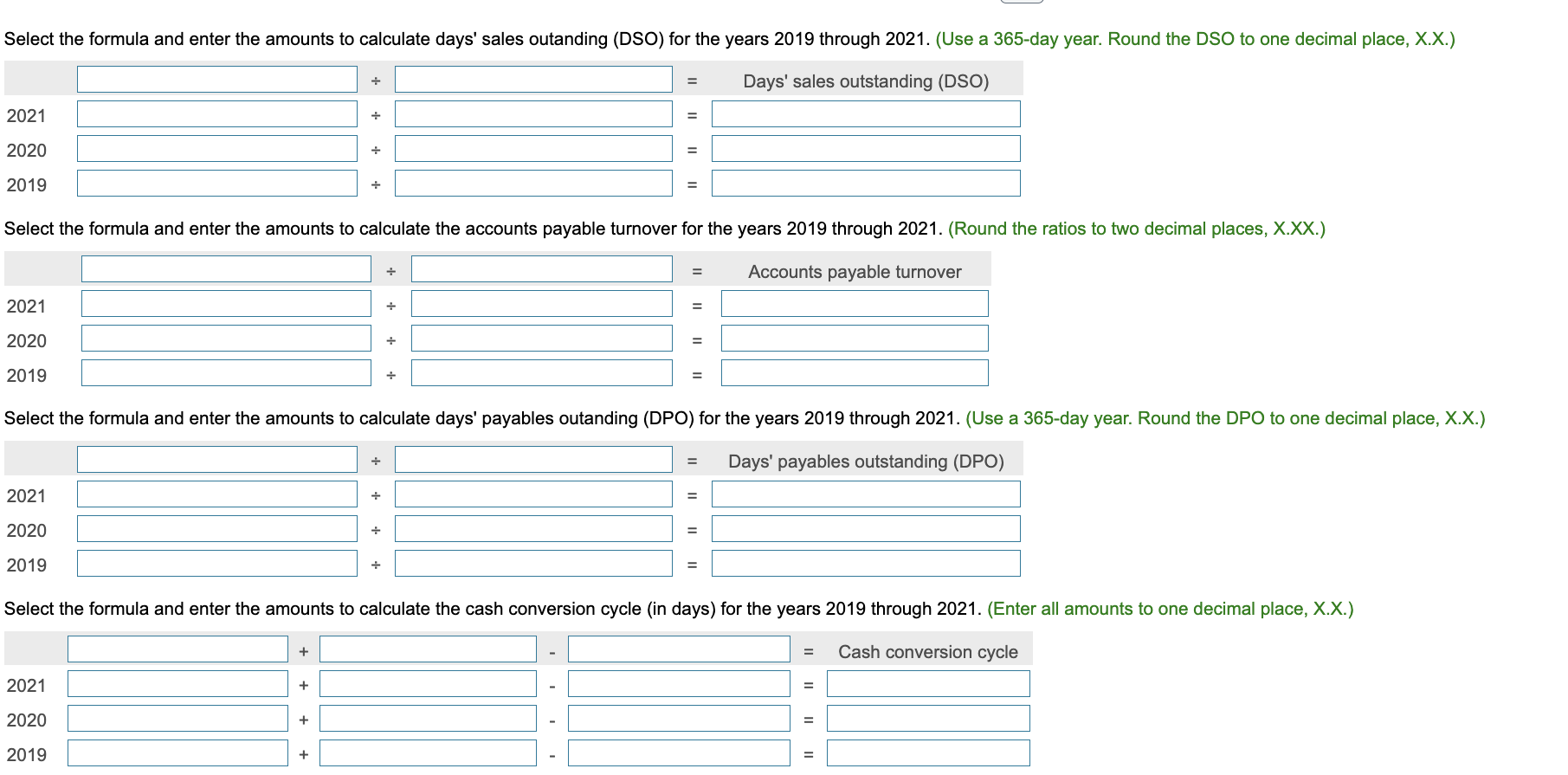

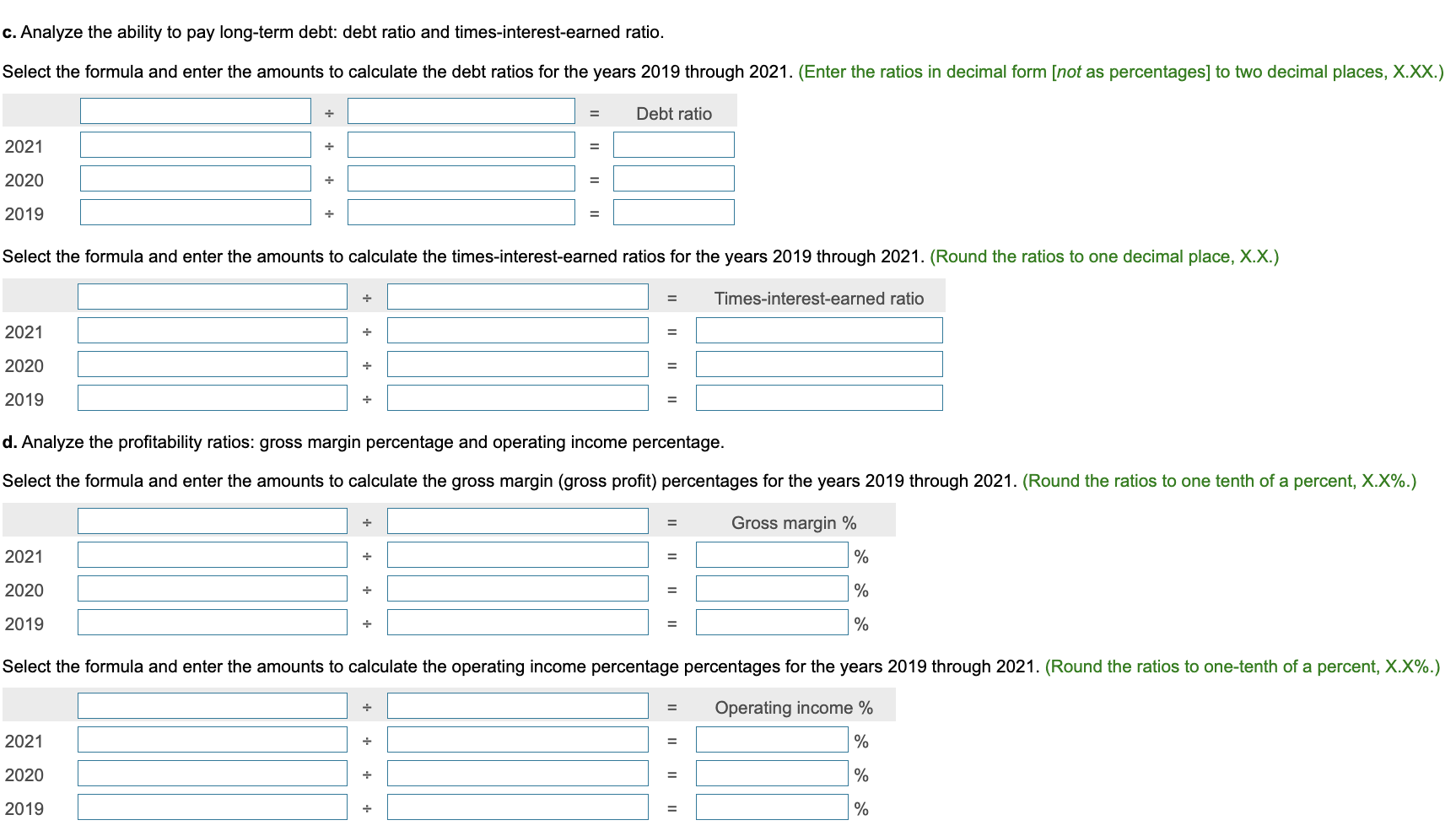

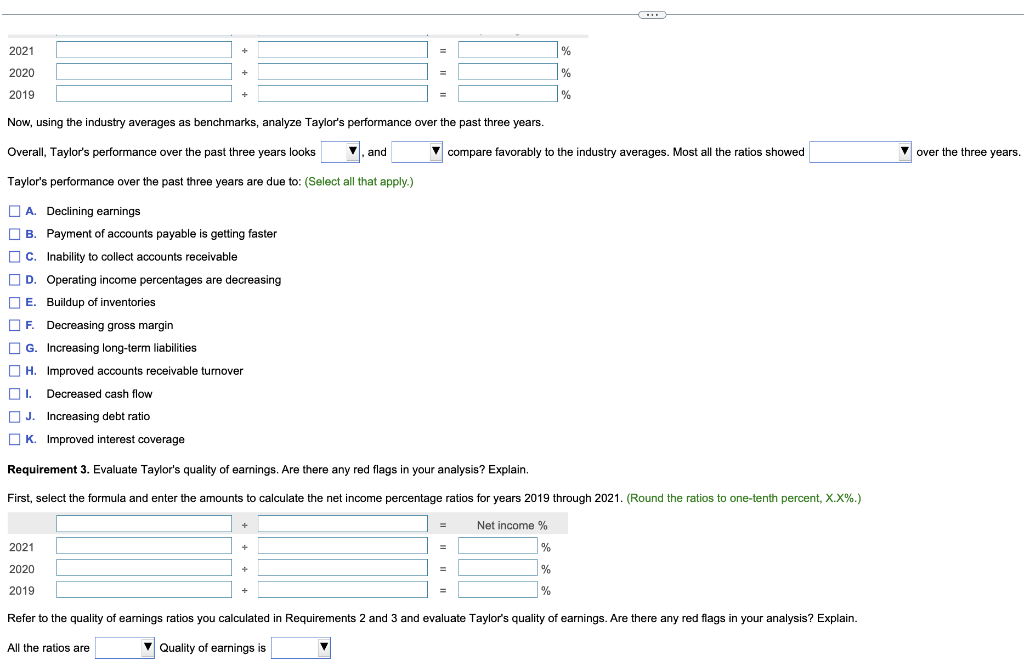

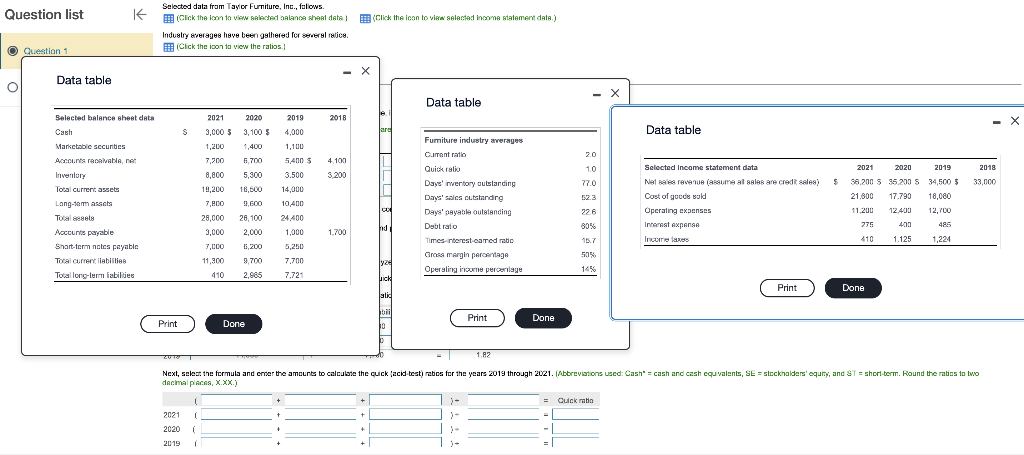

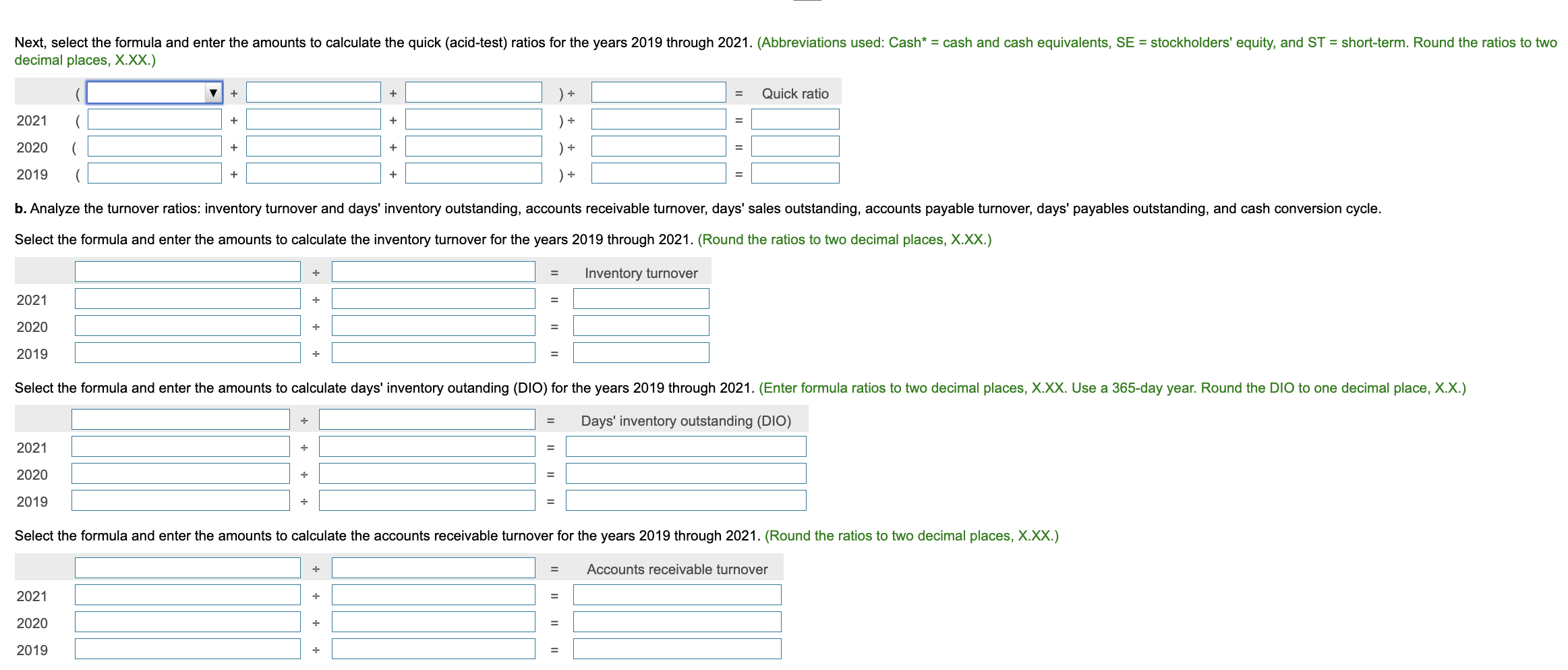

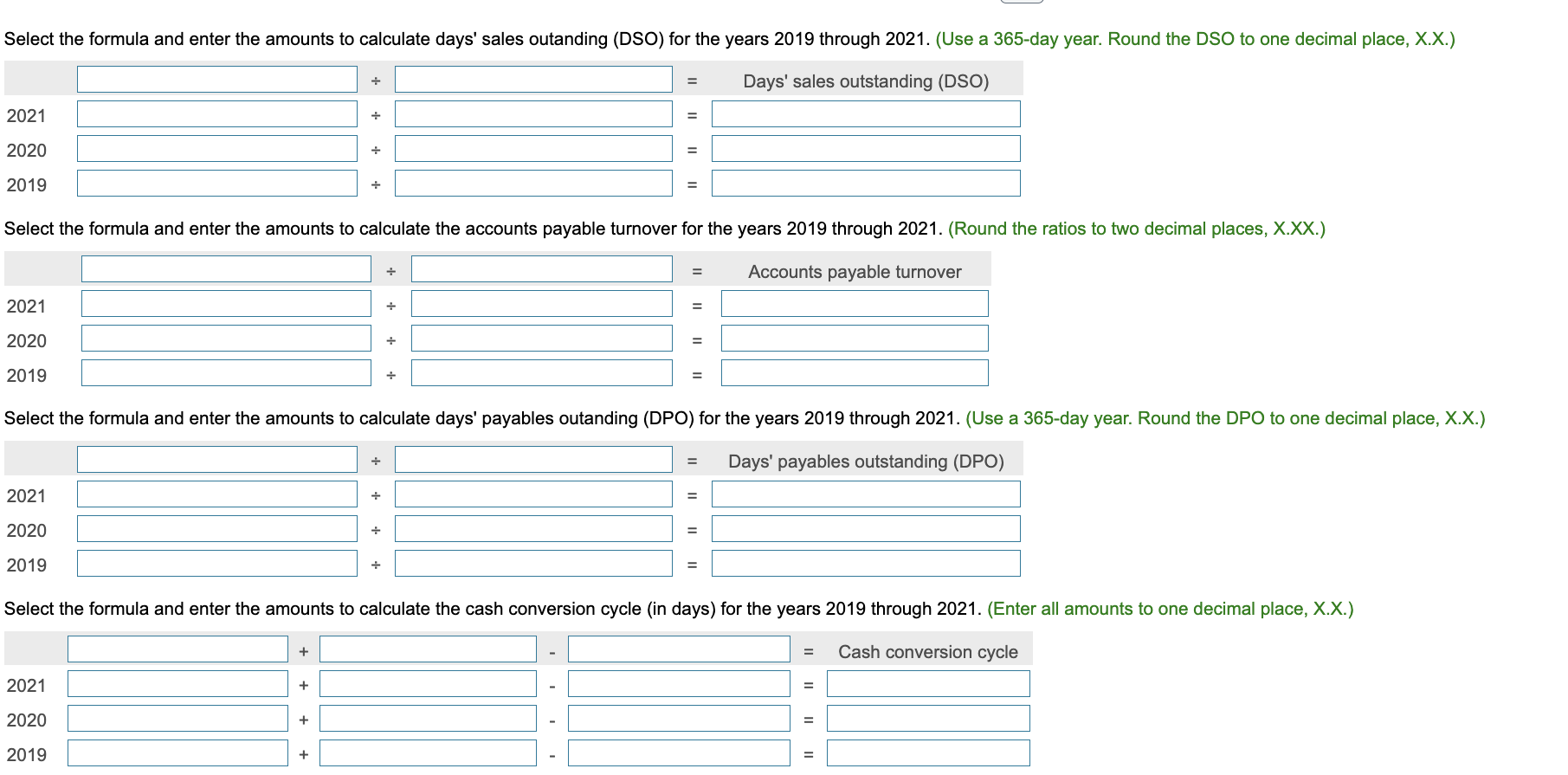

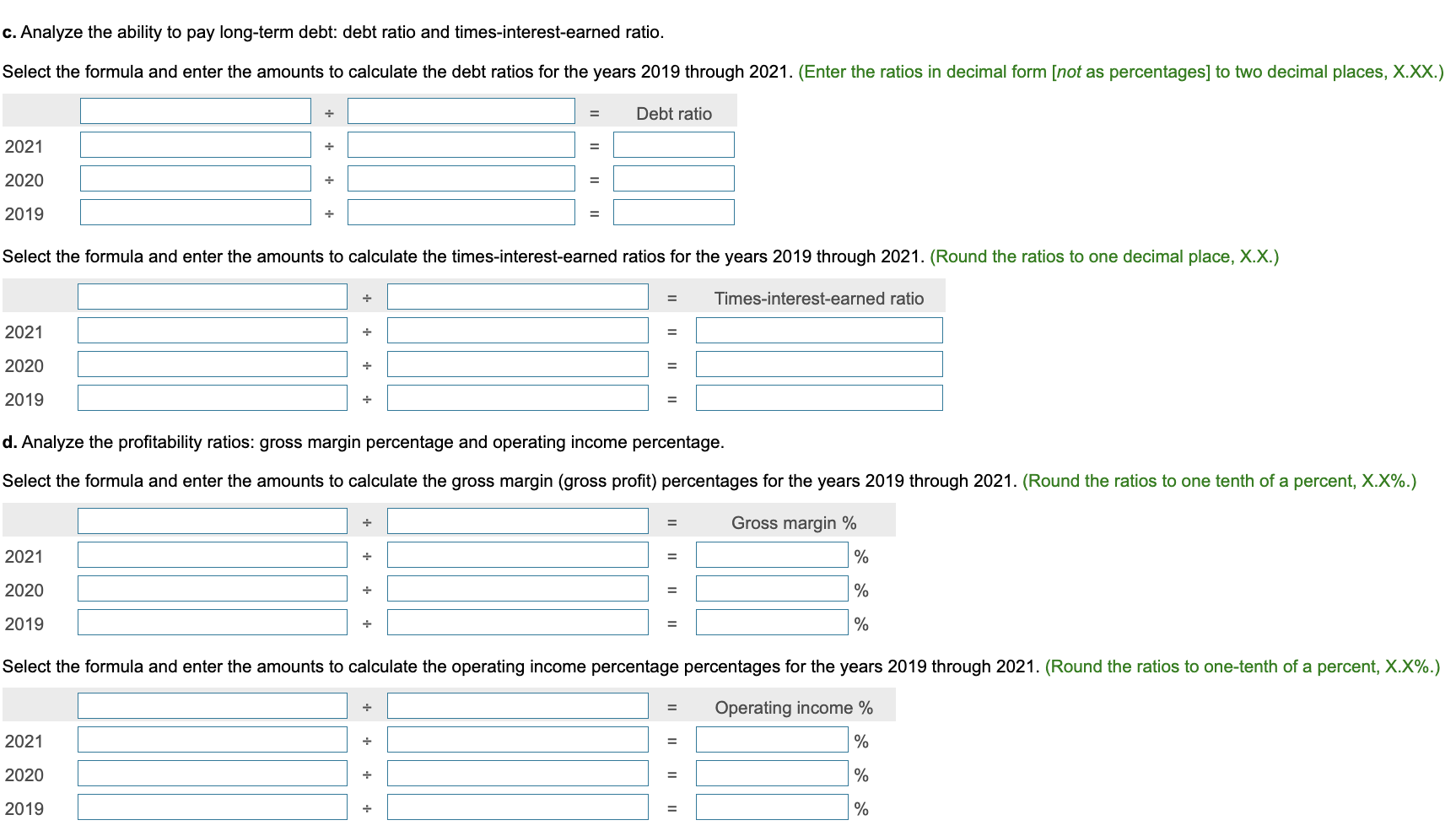

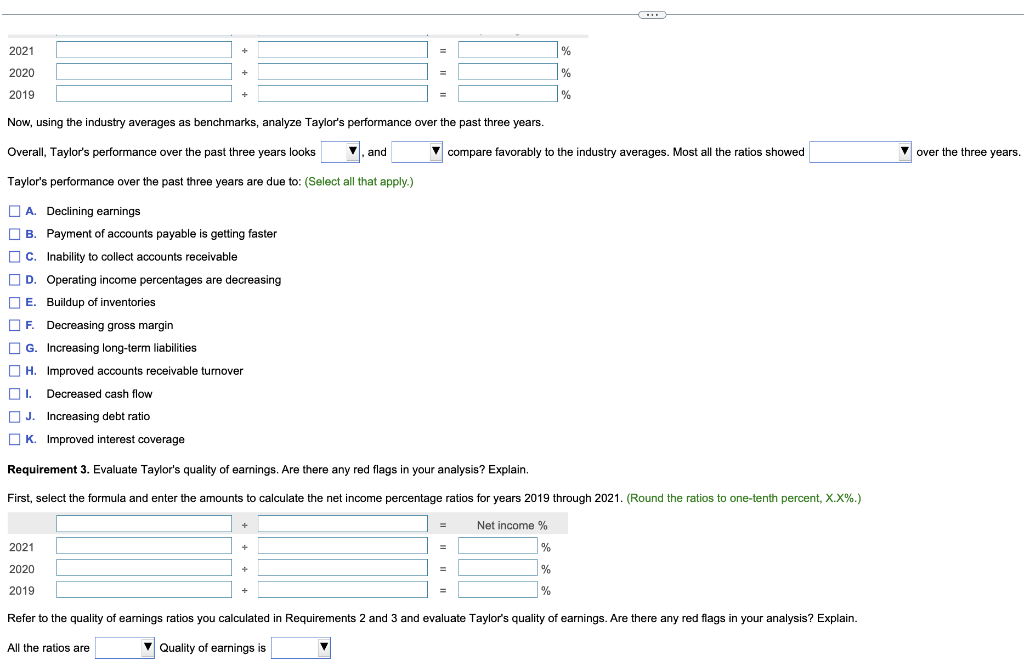

Data table Data table decimal places, X.XX. Select the formula and enter the amounts to calculate the inventory turnover for the years 2019 through 2021 . (Round the ratios to two decimal places, X.XX.) \begin{array}{l}= Days' inventory outstanding (DIO) \\ =1==\hline\end{array} Select the formula and enter the amounts to calculate days' sales outanding (DSO) for the years 2019 through 2021. (Use a 365-day year. Round the DSO to one decimal place, X.X.) Select the formula and enter the amounts to calculate the accounts payable turnover for the years 2019 through 2021. (Round the ratios to two decimal places, X.XX.) 202120202019=====Accountspayableturnover Select the formula and enter the amounts to calculate days' payables outanding (DPO) for the years 2019 through 2021. (Use a 365-day year. Round the DPO to one decimal place, X.X.) Select the formula and enter the amounts to calculate the cash conversion cycle (in days) for the years 2019 through 2021. (Enter all amounts to one decimal place, X.X.) . Analyze the ability to pay long-term debt: debt ratio and times-interest-earned ratio. Select the formula and enter the amounts to calculate the debt ratios for the years 2019 through 2021. (Enter the ratios in decimal form [not as percentages] to two decimal places, X.XX.) Select the formula and enter the amounts to calculate the times-interest-earned ratios for the years 2019 through 2021. (Round the ratios to one decimal place, X.X.) Analyze the profitability ratios: gross margin percentage and operating income percentage. Select the formula and enter the amounts to calculate the gross margin (gross profit) percentages for the years 2019 through 2021 . (Round the ratios to one tenth of a percent, X.X\%.) 202120202019+[++1===%%% Now, using the industry averages as benchmarks, analyze Taylor's performance over the past three years. Overall, Taylor's performance over the past three years looks and compare favorably to the industry averages. Most all the ratios showed over the three years. Taylor's performance over the past three years are due to: (Select all that apply.) A. Declining earnings B. Payment of accounts payable is getting faster C. Inability to collect accounts receivable D. Operating income percentages are decreasing E. Buildup of inventories F. Decreasing gross margin G. Increasing long-term liabilities H. Improved accounts receivable tumover I. Decreased cash flow J. Increasing debt ratio K. Improved interest coverage Requirement 3. Evaluate Taylor's quality of earnings. Are there any red flags in your analysis? Explain. First, select the formula and enter the amounts to calculate the net income percentage ratios for years 2019 through 2021. (Round the ratios to one-tenth percent, X.X\%.) Refer to the quality of earnings ratios you calculated in Requirements 2 and 3 and evaluate Taylor's quality of earnings. Are there any red flags in your analysis? Explain. All the ratios are Quality of earnings is Data table Data table decimal places, X.XX. Select the formula and enter the amounts to calculate the inventory turnover for the years 2019 through 2021 . (Round the ratios to two decimal places, X.XX.) \begin{array}{l}= Days' inventory outstanding (DIO) \\ =1==\hline\end{array} Select the formula and enter the amounts to calculate days' sales outanding (DSO) for the years 2019 through 2021. (Use a 365-day year. Round the DSO to one decimal place, X.X.) Select the formula and enter the amounts to calculate the accounts payable turnover for the years 2019 through 2021. (Round the ratios to two decimal places, X.XX.) 202120202019=====Accountspayableturnover Select the formula and enter the amounts to calculate days' payables outanding (DPO) for the years 2019 through 2021. (Use a 365-day year. Round the DPO to one decimal place, X.X.) Select the formula and enter the amounts to calculate the cash conversion cycle (in days) for the years 2019 through 2021. (Enter all amounts to one decimal place, X.X.) . Analyze the ability to pay long-term debt: debt ratio and times-interest-earned ratio. Select the formula and enter the amounts to calculate the debt ratios for the years 2019 through 2021. (Enter the ratios in decimal form [not as percentages] to two decimal places, X.XX.) Select the formula and enter the amounts to calculate the times-interest-earned ratios for the years 2019 through 2021. (Round the ratios to one decimal place, X.X.) Analyze the profitability ratios: gross margin percentage and operating income percentage. Select the formula and enter the amounts to calculate the gross margin (gross profit) percentages for the years 2019 through 2021 . (Round the ratios to one tenth of a percent, X.X\%.) 202120202019+[++1===%%% Now, using the industry averages as benchmarks, analyze Taylor's performance over the past three years. Overall, Taylor's performance over the past three years looks and compare favorably to the industry averages. Most all the ratios showed over the three years. Taylor's performance over the past three years are due to: (Select all that apply.) A. Declining earnings B. Payment of accounts payable is getting faster C. Inability to collect accounts receivable D. Operating income percentages are decreasing E. Buildup of inventories F. Decreasing gross margin G. Increasing long-term liabilities H. Improved accounts receivable tumover I. Decreased cash flow J. Increasing debt ratio K. Improved interest coverage Requirement 3. Evaluate Taylor's quality of earnings. Are there any red flags in your analysis? Explain. First, select the formula and enter the amounts to calculate the net income percentage ratios for years 2019 through 2021. (Round the ratios to one-tenth percent, X.X\%.) Refer to the quality of earnings ratios you calculated in Requirements 2 and 3 and evaluate Taylor's quality of earnings. Are there any red flags in your analysis? Explain. All the ratios are Quality of earnings is