Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help in these questions fast . Please i have only 30 minutes 9, 10, 13, 16 A consultant provides consulting services for $750

I need help in these questions fast . Please i have only 30 minutes

9, 10, 13, 16

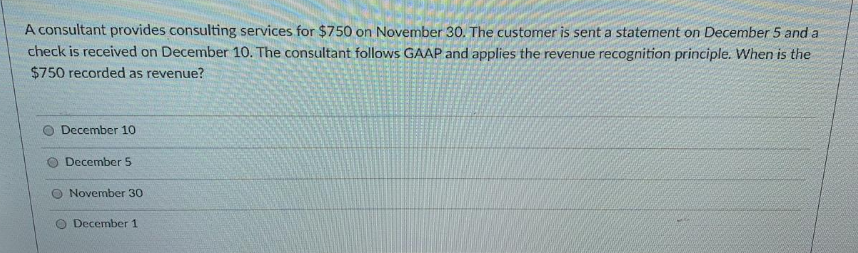

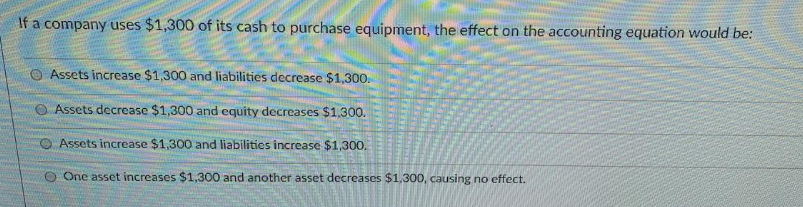

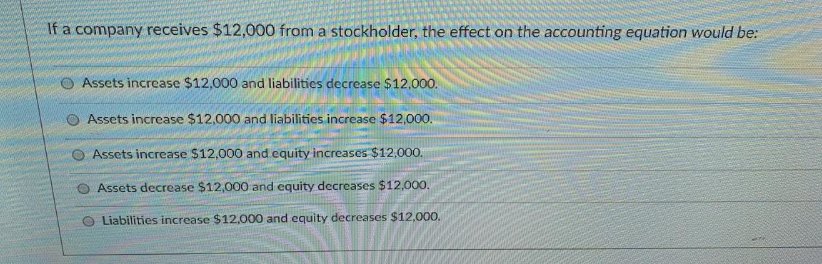

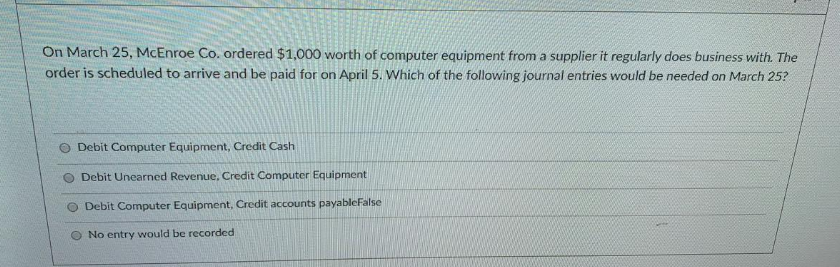

A consultant provides consulting services for $750 on November 30. The customer is sent a statement on December 5 and a check is received on December 10. The consultant follows GAAP and applies the revenue recognition principle. When is the $750 recorded as revenue? December 10 December 5 November 30 December 1 If a company uses $1,300 of its cash to purchase equipment, the effect on the accounting equation would be: Assets increase $1,300 and liabilities decrease $1,300. Assets decrease $1,300 and equity decreases $1.300. Assets increase $1,300 and liabilities increase $1,300. O One asset increases $1,300 and another asset decreases $1,300, causing no effect. If a company receives $12,000 from a stockholder, the effect on the accounting equation would be: Assets increase $12,000 and liabilities decrease $12.000. Assets increase $12,000 and liabilities increase $12,000. O Assets increase $12,000 and equity increases $12,000. Assets decrease $12,000 and equity decreases $12,000. Liabilities increase $12,000 and equity decreases $12,000. On March 25, McEnroe Co. ordered $1,000 worth of computer equipment from a supplier it regularly does business with. The order is scheduled to arrive and be paid for on April 5. Which of the following journal entries would be needed on March 25? Debit Computer Equipment, Credit Cash Debit Unearned Revenue, Credit Computer Equipment Debit Computer Equipment, Credit accounts payableFalse No entry would be recorded

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started