I need help in this, please prepare form 941 for all employees.

This is information:

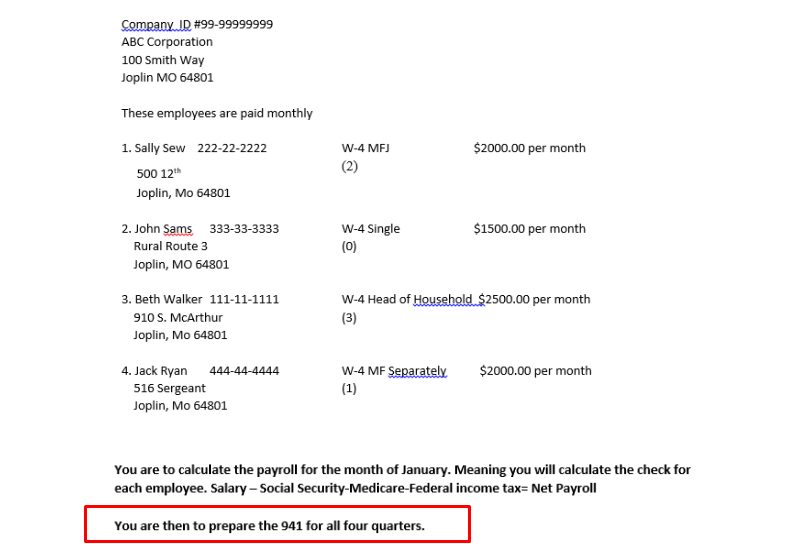

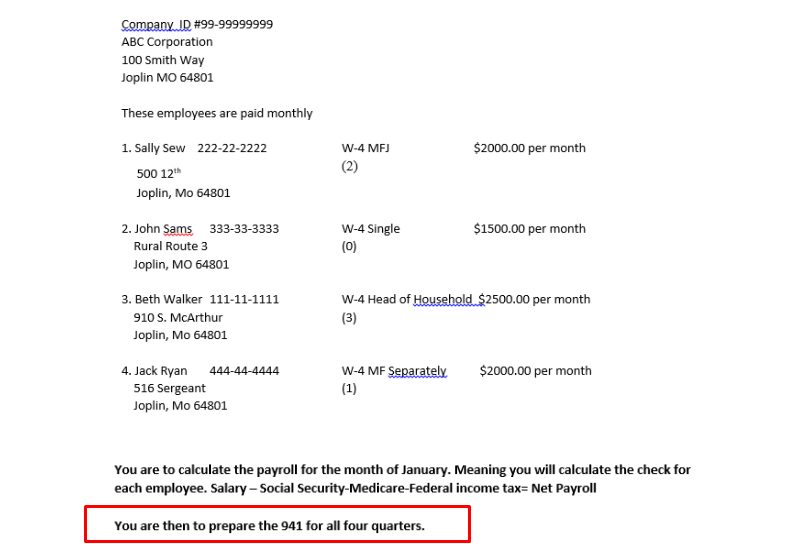

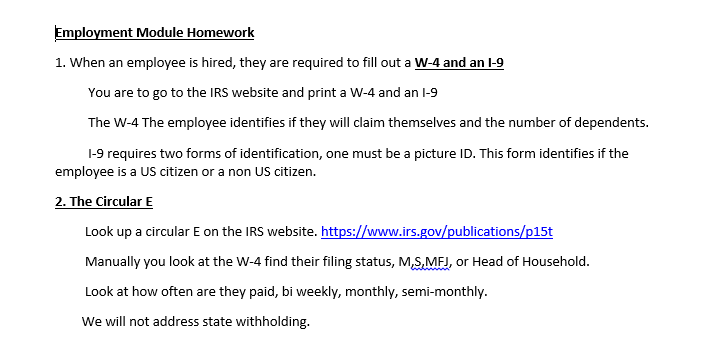

Company ID #99-99999999 ABC Corporation 100 Smith Way Joplin MO 64801 These employees are paid monthly W-4 MFJ $2000.00 per month 1. Sally Sew 222-22-2222 500 12th Joplin, MO 64801 W-4 Single $1500.00 per month 2. John Sams 333-33-3333 Rural Route 3 Joplin, MO 64801 W-4 Head of Household $2500.00 per month 3. Beth Walker 111-11-1111 910 S. McArthur Joplin, MO 64801 (3) W-4 MF Separately $2000.00 per month 4. Jack Ryan 444-44-4444 516 Sergeant Joplin, Mo 64801 You are to calculate the payroll for the month of January. Meaning you will calculate the check for each employee. Salary - Social Security-Medicare-Federal income tax= Net Payroll You are then to prepare the 941 for all four quarters. Employment Module Homework 1. When an employee is hired, they are required to fill out a W-4 and an 1-9 You are to go to the IRS website and print a W-4 and an 1-9 The W-4 The employee identifies if they will claim themselves and the number of dependents. 1-9 requires two forms of identification, one must be a picture ID. This form identifies if the employee is a US citizen or a non US citizen. 2. The Circular E Look up a circular E on the IRS website. https://www.irs.gov/publications/p15t Manually you look at the W-4 find their filing status, M,S,MF), or Head of Household. Look at how often are they paid, bi weekly, monthly, semi-monthly. We will not address state withholding. 3. Prepare the payroll check Gross wages x Social Security percentage (6.2%) Gross wages x Medicare percentage (1.45%) The two amounts added together = 7.65% This is the amount paid for by the employee........The employer is required to match this amount and this is done on the required payroll reports filed with the IRS. (Form 941). Gross wages-social security- Medicare percentage-federal withholding = net wages. 4. The Form 941 is filed every quarter (4) Go to the IRS website and print off a form 941. The deposit for a 941 can be made weekly, monthly, or quarterly. 5. The Form 940 is filed at the end of the year (1) However, if the deposit exceeds $100 in any quarter, the amount must be deposited. All deposits are made with the bank for the 940 and the 941. 6. End of Year: Requires the production of all W-2s The W-3 is the transmittal form for all the W-25 The last 941 The 940 form 10995 with a 1096 transmittal 7. Reconciliation All wages on 941 and ensure they match all the W-2 wages Add all federal withholding on 941s to ensure they match w-2s federal withholding Add all social security amounts from 941s take the amounts to see if they match the social security amounts on W-2s Add all the Medicare amounts from the 941s take / of the Medicare amounts to see if they match the W-2s amounts. Company ID #99-99999999 ABC Corporation 100 Smith Way Joplin MO 64801 These employees are paid monthly W-4 MFJ $2000.00 per month 1. Sally Sew 222-22-2222 500 12th Joplin, MO 64801 W-4 Single $1500.00 per month 2. John Sams 333-33-3333 Rural Route 3 Joplin, MO 64801 W-4 Head of Household $2500.00 per month 3. Beth Walker 111-11-1111 910 S. McArthur Joplin, MO 64801 (3) W-4 MF Separately $2000.00 per month 4. Jack Ryan 444-44-4444 516 Sergeant Joplin, Mo 64801 You are to calculate the payroll for the month of January. Meaning you will calculate the check for each employee. Salary - Social Security-Medicare-Federal income tax= Net Payroll You are then to prepare the 941 for all four quarters. Employment Module Homework 1. When an employee is hired, they are required to fill out a W-4 and an 1-9 You are to go to the IRS website and print a W-4 and an 1-9 The W-4 The employee identifies if they will claim themselves and the number of dependents. 1-9 requires two forms of identification, one must be a picture ID. This form identifies if the employee is a US citizen or a non US citizen. 2. The Circular E Look up a circular E on the IRS website. https://www.irs.gov/publications/p15t Manually you look at the W-4 find their filing status, M,S,MF), or Head of Household. Look at how often are they paid, bi weekly, monthly, semi-monthly. We will not address state withholding. 3. Prepare the payroll check Gross wages x Social Security percentage (6.2%) Gross wages x Medicare percentage (1.45%) The two amounts added together = 7.65% This is the amount paid for by the employee........The employer is required to match this amount and this is done on the required payroll reports filed with the IRS. (Form 941). Gross wages-social security- Medicare percentage-federal withholding = net wages. 4. The Form 941 is filed every quarter (4) Go to the IRS website and print off a form 941. The deposit for a 941 can be made weekly, monthly, or quarterly. 5. The Form 940 is filed at the end of the year (1) However, if the deposit exceeds $100 in any quarter, the amount must be deposited. All deposits are made with the bank for the 940 and the 941. 6. End of Year: Requires the production of all W-2s The W-3 is the transmittal form for all the W-25 The last 941 The 940 form 10995 with a 1096 transmittal 7. Reconciliation All wages on 941 and ensure they match all the W-2 wages Add all federal withholding on 941s to ensure they match w-2s federal withholding Add all social security amounts from 941s take the amounts to see if they match the social security amounts on W-2s Add all the Medicare amounts from the 941s take / of the Medicare amounts to see if they match the W-2s amounts