I need help in this question. Please do it correctly and 100% and do not make any mistake.

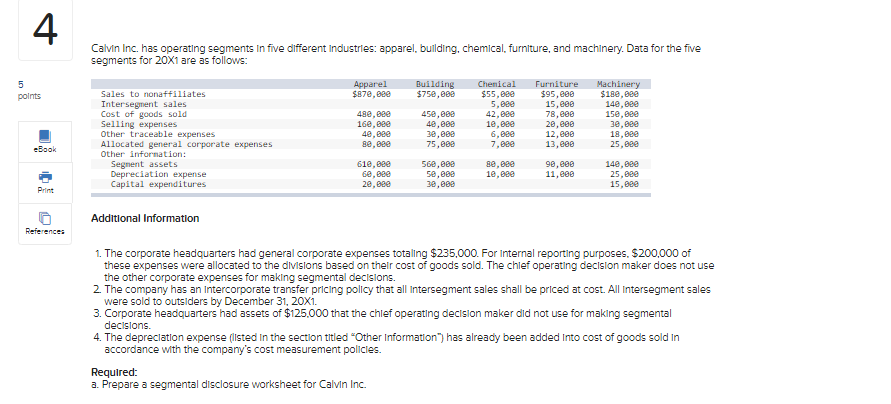

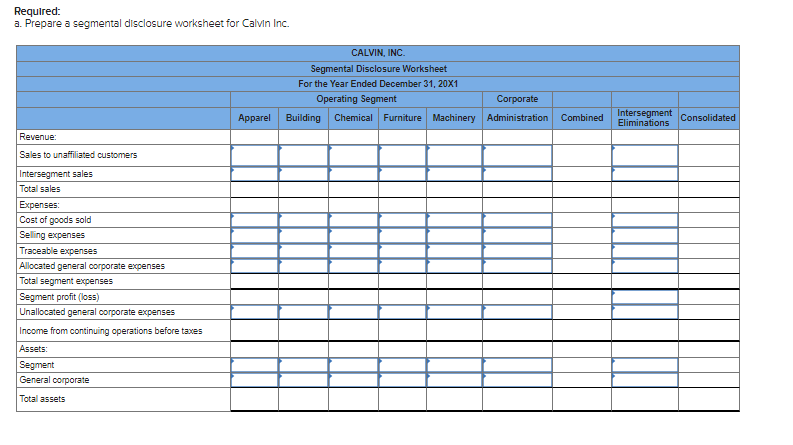

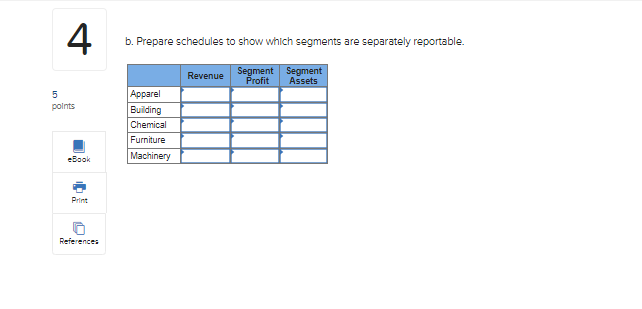

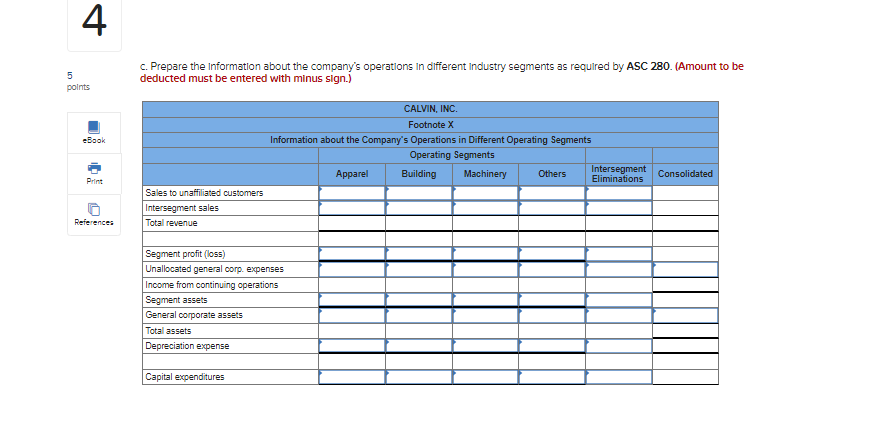

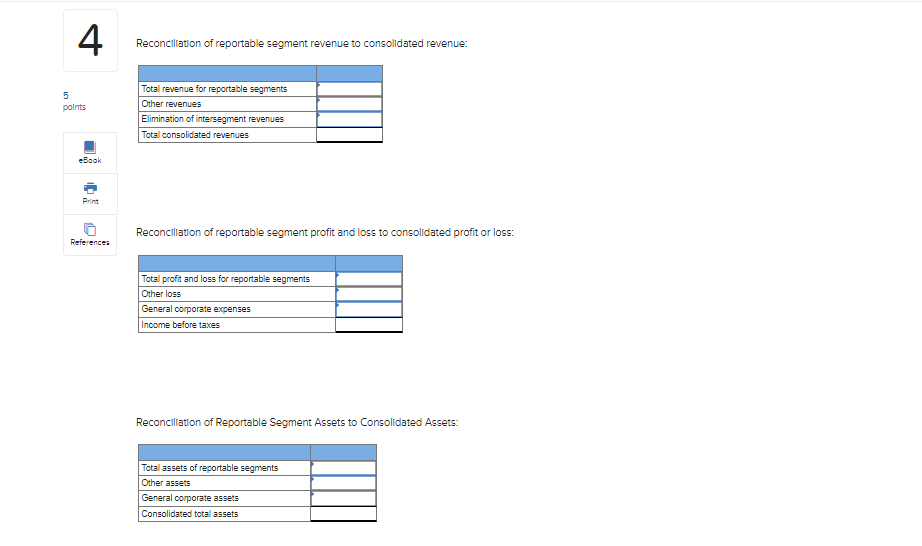

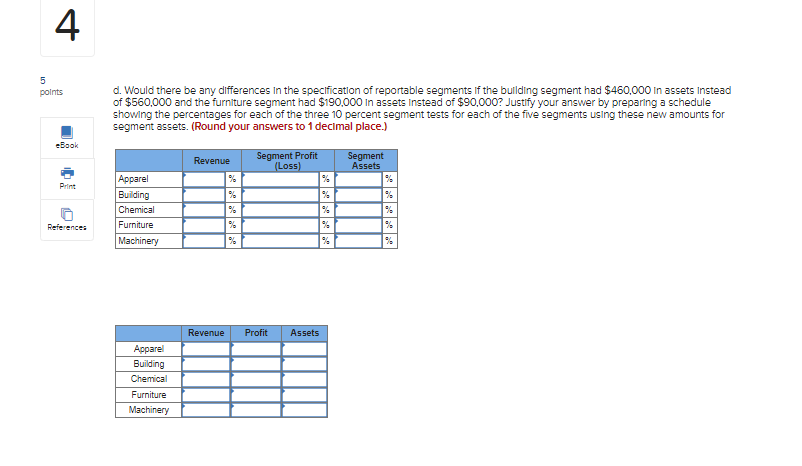

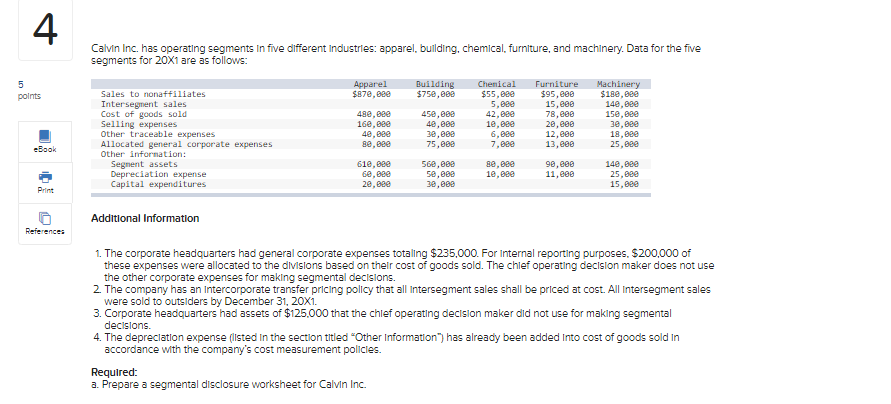

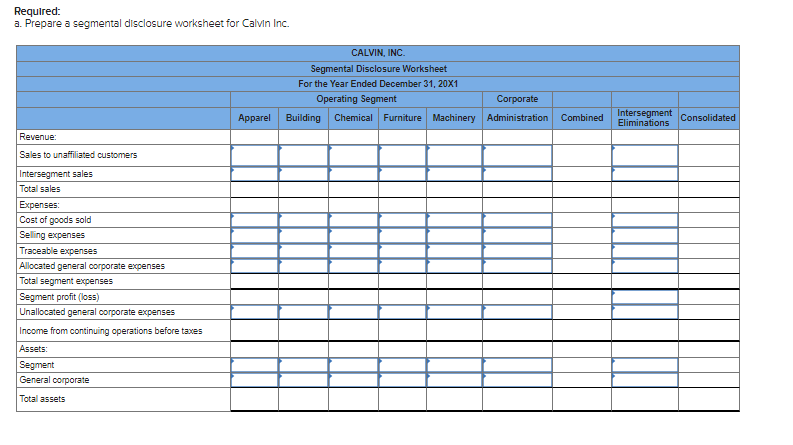

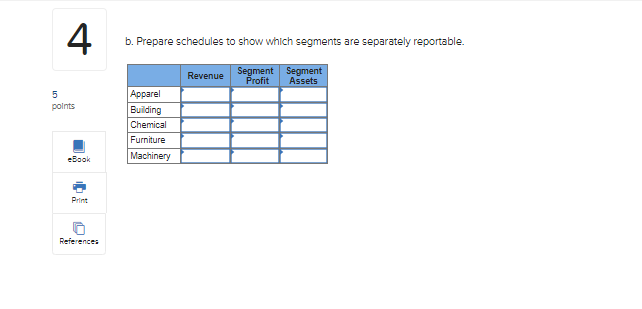

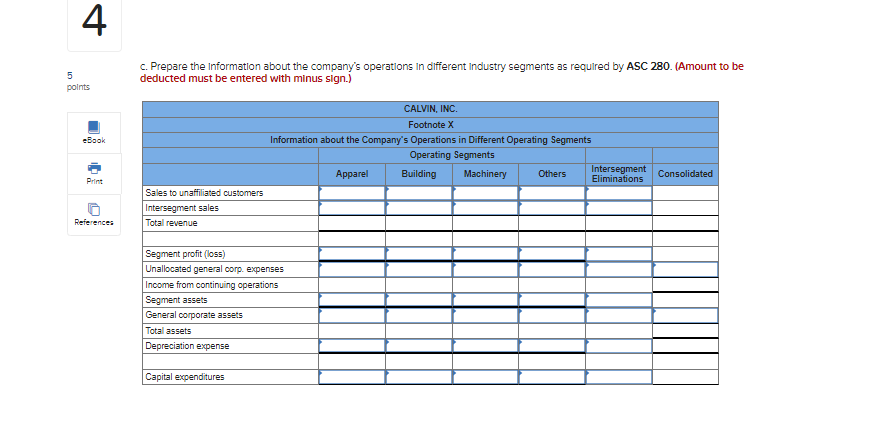

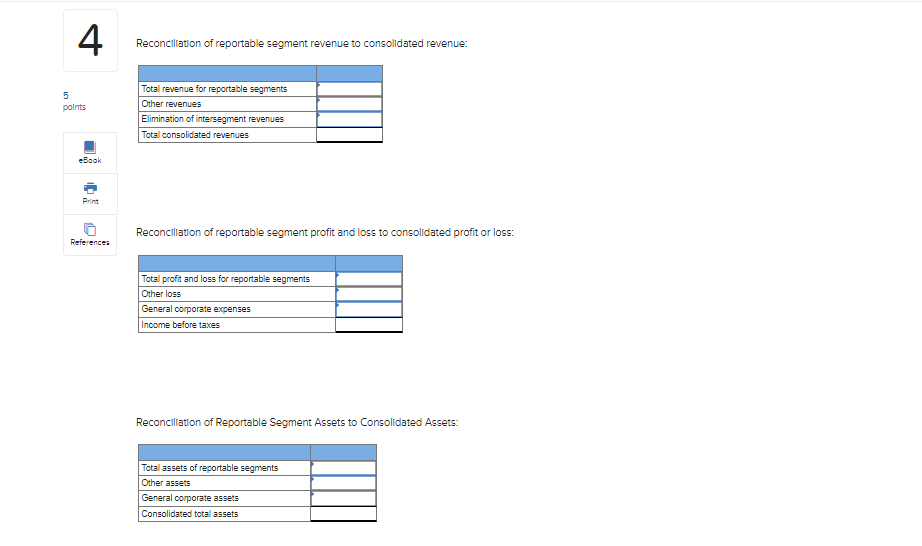

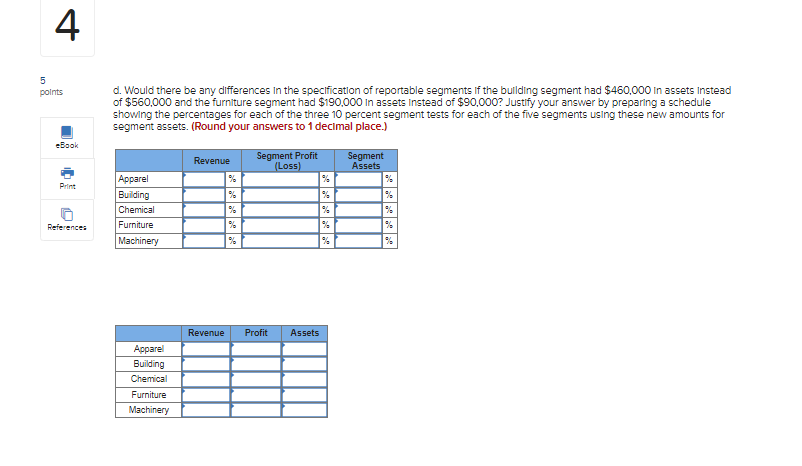

4 5 points Calvin Inc. has operating segments In five different Industries: apparel, building, chemical, furniture, and machinery. Data for the five segments for 20X1 are as follows: Apparel Building Chemical Furniture Sales to nonaffiliates Machinery $870,680 $750,00 $55,00 $95, eee $180,00 Intersegent sales 5,800 15,eee 140,880 Cost of goods sold 480, 450,000 42.Be 78,eee 150,00 Selling expenses 160,880 48,888 1e, 20, eee Other traceable expenses 30,880 40,00 30,000 6.000 12,eee 18,888 Allocated general corporate expenses 80,00 75,888 7,800 13,608 25,00 Other information: Segment assets 610,880 560,862 se.ee 90,eee 140,880 Depreciation expense 60.ee 50,000 1e.ee 11,eee 25,880 Capital expenditures 20,880 30,880 15,000 eBook Print Additional Information References 1. The corporate headquarters had general corporate expenses totaling $235.000. For Internal reporting purposes. $200,000 of these expenses were allocated to the divisions based on their cost of goods sold. The chief operating decision maker does not use the other corporate expenses for making segmental decisions. 2 The company has an intercorporate transfer pricing policy that all intersegment sales shall be priced at cost. All Intersegment sales were sold to outsiders by December 31, 2oxi. 3. Corporate headquarters had assets of $125.000 that the chief operating decision maker did not use for making segmental decisions. 4. The depreciation expense (listed in the section titled "Other Information") has already been added into cost of goods sold in accordance with the company's cost measurement policies. Required: a. Prepare a segmental disclosure worksheet for Calvin Inc. Required: a. Prepare a segmental disclosure worksheet for Calvin Inc. CALVIN, INC. Segmental Disclosure Worksheet For the Year Ended December 31, 20X1 Operating Segment Corporate Building Chemical Furniture Machinery Administration Apparel Combined Intersegment Eliminations Consolidated Revenue: Sales to unaffiliated customers Intersegment sales Total sales Expenses: Cost of goods sold Selling expenses Traceable expenses Allocated general corporate expenses Total segment expenses Segment profit (loss) Unallocated general corporate expenses Income from continuing operations before taxes Assets: Segment General corporate Total assets 4. b. Prepare schedules to show which segments are separately reportable. Revenue Segment Segment Profit Assets 5 points Apparel Building Chemical Furniture Machinery eBook Print References 4 5 points c. Prepare the information about the company's operations in different Industry segments as required by ASC 280.(Amount to be deducted must be entered with minus sign.) eBook , CALVIN, INC. Footnote X Information about the Company's Operations in Different Operating Segments Operating Segments Apparel Building Machinery Intersegment Others Eliminations Consolidated Print Sales to unaffiliated customers Intersegment sales Total revenue Reference: Segment profit (loss) Unallocated general corp. expenses Income from continuing operations Segment assets General corporate assets Total assets Depreciation expense Capital expenditures 4 Reconciliation of reportable segment revenue to consolidated revenue: 5 points Total revenue for reportable segments Other revenues Elimination of intersegment revenues Total consolidated revenues eBook Print Reconciliation of reportable segment profit and loss to consolidated profit or loss: References Total profit and loss for reportable segments Other loss General corporate expenses Income before taxes Reconciliation of Reportable Segment Assets to consolidated Assets: Total assets of reportable segments Other assets General corporate assets Consolidated total assets 4 5 points d. Would there be any differences in the specification of reportable segments if the building segment had $460,000 in assets Instead of $560,000 and the furniture segment had $190,000 in assets instead of $90,000? Justify your answer by preparing a schedule showing the percentages for each of the three 10 percent segment tests for each of the five segments using these new amounts for segment assets. (Round your answers to 1 decimal place.) eBook Revenue Segment Profit (Loss) Segment Assets % % Print % Apparel Building Chemical Furniture Machinery % % % % % 1 References % Revenue Profit Assets Apparel Building Chemical Furniture Machinery