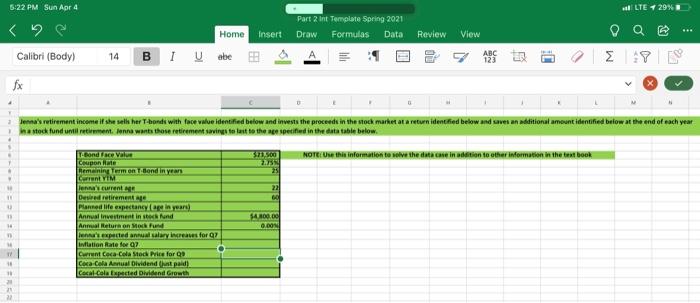

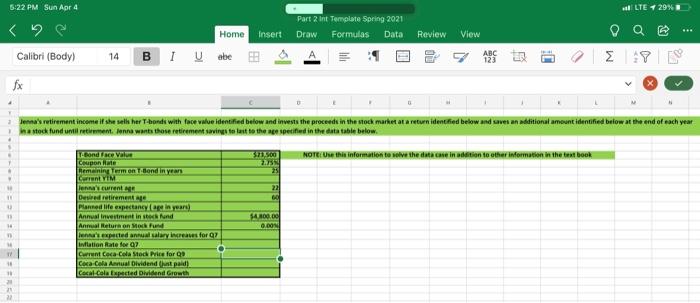

I need help knowing formulas to use for these! please and thank you

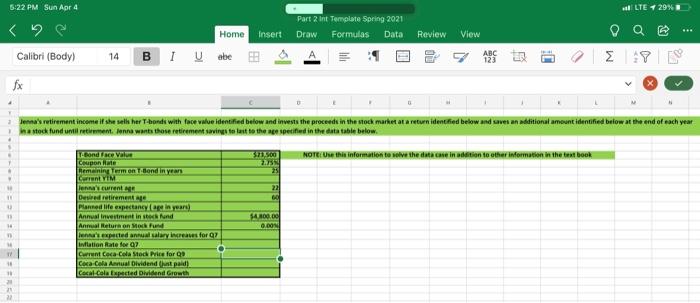

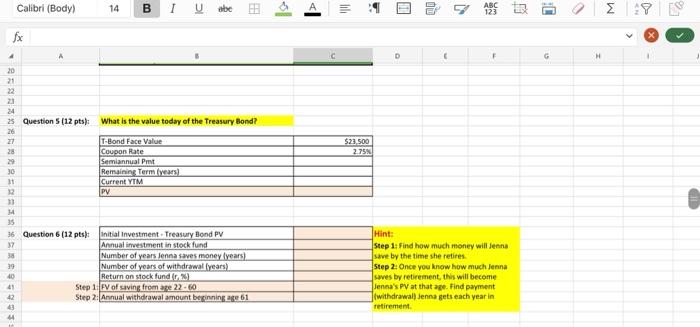

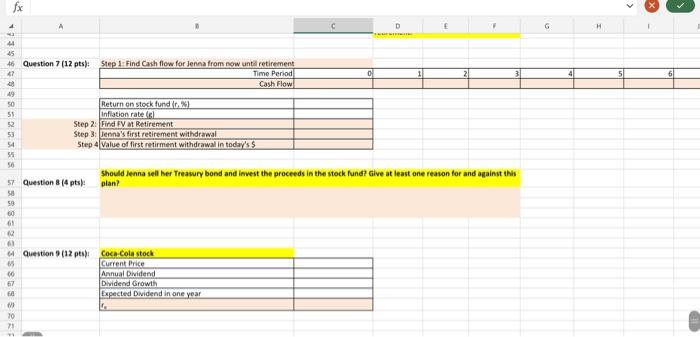

5:22 PM Sun Apr 4 4 LE 29 Review Part 2 int Template Spring 2021 Home Insert Draw Formulas Data BI Vabe B View Calibri (Body) 14 123 fx Jenna's retirement income il se sell her bonds with Face value identified below and invests the proceeds in the stock market at a return identified below and save an additional amount identified below at the end of each year ha stock fund until rement. Jenna wants those retirement savings to last to the specified in the datatable below. Bond Value 371.500 NOTE USB formation to solve the decide to other information in the text book Coupon emaining formen Blond in yean CEYIM Lennart 22 De retirement Planned life expectancy Care in years) Annual Investment inter and SA 200.00 Annual Return on Mock und 0.00 L'expected annual salary increases for a Inflation Rate for a Gut Coca-Cola Stad Price for Q Coca Cola Anual Dividend that pad Cocal cola Espected Dividend Growth Calibri (Body) 14 BI U be DD C fx 4 N 20 21 22 24 25 Question 5 (12 pts): 26 27 28 29 30 11 $23.500 2.75 What is the value today of the Treasury Bond? T-Bond Face Value Coupon Rate Semiannual Pmt Remaining Term (years) Current YTM PV 14 35 36 Question 6 (12 pts): Initial Investment Treasury Bond PV 37 Annual investment in stock fund 30 Number of years Jenna saves money years) 39 Number of years of withdrawal (years) 40 Return on stock fund 3) Step 1 FV of saving from age 22.60 Step 2: Annual withdrawal amount beginning age 61 Hint: Step 1: Find how much money will denna Save by the time she retires Step 2: Once you know how much Jenna saves by retirement, this will become Jenna's PV at that age. Find payment (withdrawal) Jenna gets each year in retirement > D G H 44 45 46 47 Question 7 (12 pts): Step 1: Find Cash flow for Jenna from now until retirement Time Period Cash Flow 0 Return on stock fund Ir. %) Inflation rate Step 2. Find FV at Retirement Step 3: Jenna's first retirement withdrawal Step 4 Value of first retirment withdrawal in today's Should Jenna sel her Treasury bond and invest the proceeds in the stock fund? Give at least one reason for and against this plan? 57 Question (4 pts 50 60 61 2 Question 9 (12) 66 67 Coca Cola stock Current Price Annual Dividend Dividend Growth Expected Dividend in one year IN 5:22 PM Sun Apr 4 4 LE 29 Review Part 2 int Template Spring 2021 Home Insert Draw Formulas Data BI Vabe B View Calibri (Body) 14 123 fx Jenna's retirement income il se sell her bonds with Face value identified below and invests the proceeds in the stock market at a return identified below and save an additional amount identified below at the end of each year ha stock fund until rement. Jenna wants those retirement savings to last to the specified in the datatable below. Bond Value 371.500 NOTE USB formation to solve the decide to other information in the text book Coupon emaining formen Blond in yean CEYIM Lennart 22 De retirement Planned life expectancy Care in years) Annual Investment inter and SA 200.00 Annual Return on Mock und 0.00 L'expected annual salary increases for a Inflation Rate for a Gut Coca-Cola Stad Price for Q Coca Cola Anual Dividend that pad Cocal cola Espected Dividend Growth Calibri (Body) 14 BI U be DD C fx 4 N 20 21 22 24 25 Question 5 (12 pts): 26 27 28 29 30 11 $23.500 2.75 What is the value today of the Treasury Bond? T-Bond Face Value Coupon Rate Semiannual Pmt Remaining Term (years) Current YTM PV 14 35 36 Question 6 (12 pts): Initial Investment Treasury Bond PV 37 Annual investment in stock fund 30 Number of years Jenna saves money years) 39 Number of years of withdrawal (years) 40 Return on stock fund 3) Step 1 FV of saving from age 22.60 Step 2: Annual withdrawal amount beginning age 61 Hint: Step 1: Find how much money will denna Save by the time she retires Step 2: Once you know how much Jenna saves by retirement, this will become Jenna's PV at that age. Find payment (withdrawal) Jenna gets each year in retirement > D G H 44 45 46 47 Question 7 (12 pts): Step 1: Find Cash flow for Jenna from now until retirement Time Period Cash Flow 0 Return on stock fund Ir. %) Inflation rate Step 2. Find FV at Retirement Step 3: Jenna's first retirement withdrawal Step 4 Value of first retirment withdrawal in today's Should Jenna sel her Treasury bond and invest the proceeds in the stock fund? Give at least one reason for and against this plan? 57 Question (4 pts 50 60 61 2 Question 9 (12) 66 67 Coca Cola stock Current Price Annual Dividend Dividend Growth Expected Dividend in one year IN