Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help making a budget for Willa using the Microsoft spread sheet. Here is the information needed to create this budget: Willa had barely

I need help making a budget for Willa using the Microsoft spread sheet. Here is the information needed to create this budget:

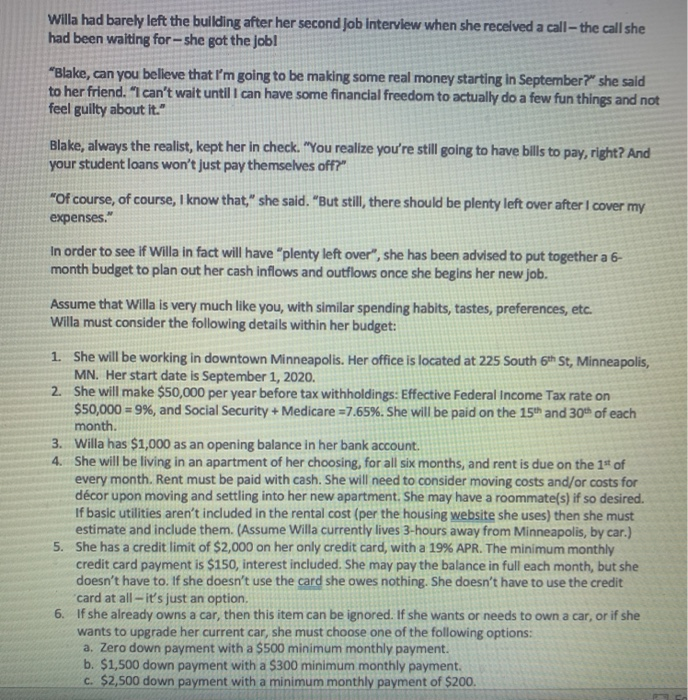

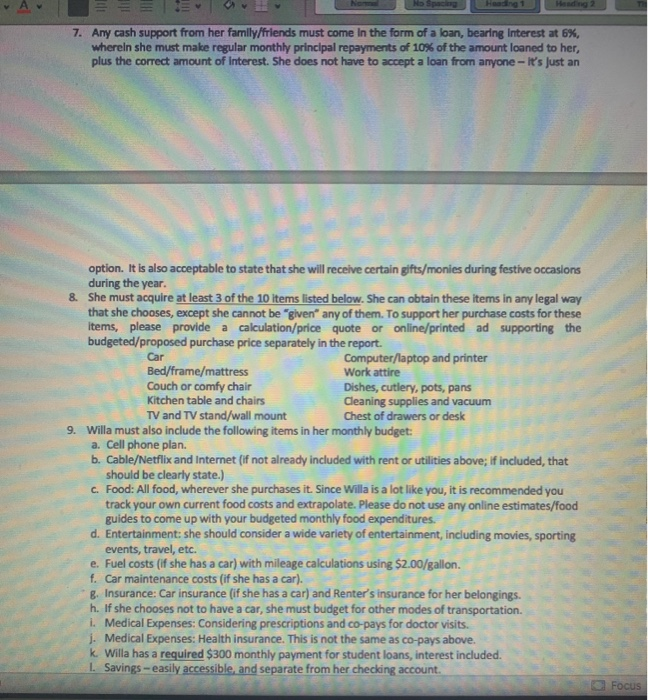

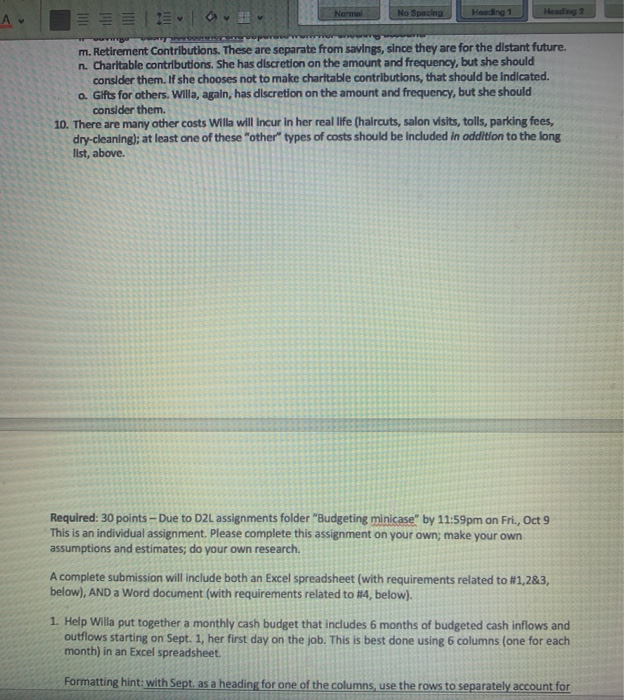

Willa had barely left the building after her second job interview when she received a call- the call she had been waiting for- she got the job! "Blake, can you believe that I'm going to be making some real money starting in September?" she said to her friend. "I can't wait until I can have some financial freedom to actually do a few fun things and not feel guilty about it." Blake, always the realist, kept her in check. "You realize you're still going to have bills to pay, right? And your student loans won't just pay themselves off?" "Of course, of course, I know that," she said. "But still, there should be plenty left over after I cover my expenses." In order to see if Willa in fact will have "plenty left over", she has been advised to put together a 6- month budget to plan out her cash inflows and outflows once she begins her new job. Assume that Willa is very much like you, with similar spending habits, tastes, preferences, etc. Willa must consider the following details within her budget: 1. She will be working in downtown Minneapolis. Her office is located at 225 South 6th St, Minneapolis, MN. Her start date is September 1, 2020. 2. She will make $50,000 per year before tax withholdings: Effective Federal Income Tax rate on $50,000 = 9%, and Social Security + Medicare =7.65%. She will be paid on the 15th and 30% of each month. 3. Willa has $1,000 as an opening balance in her bank account. 4. She will be living in an apartment of her choosing, for all six months, and rent is due on the 1st of every month. Rent must be paid with cash. She will need to consider moving costs and/or costs for dcor upon moving and settling into her new apartment. She may have a roommate(s) if so desired. If basic utilities aren't included in the rental cost (per the housing website she uses) then she must estimate and include them. (Assume Willa currently lives 3-hours away from Minneapolis, by car.) 5. She has a credit limit of $2,000 on her only credit card, with a 19% APR. The minimum monthly credit card payment is $150, interest included. She may pay the balance in full each month, but she doesn't have to. If she doesn't use the card she owes nothing. She doesn't have to use the credit card at all-it's just an option. 6. If she already owns a car, then this item can be ignored. If she wants or needs to own a car, or if she wants to upgrade her current car, she must choose one of the following options: a. Zero down payment with a $500 minimum monthly payment. b. $1,500 down payment with a $300 minimum monthly payment. C. $2,500 down payment with a minimum monthly payment of $200. 7. Any cash support from her family/friends must come in the form of a loan, bearing Interest at 6%, wherein she must make regular monthly principal repayments of 10% of the amount loaned to her, plus the correct amount of Interest. She does not have to accept a loan from anyone - It's just an option. It is also acceptable to state that she will receive certain gifts/monies during festive occasions during the year. 8. She must acquire at least 3 of the 10 items listed below. She can obtain these items in any legal way that she chooses, except she cannot be given any of them. To support her purchase costs for these Items, please provide a calculation/price quote or online/printed ad supporting the budgeted/proposed purchase price separately in the report. Car Computer/laptop and printer Bed/frame/mattress Work attire Couch or comfy chair Dishes, cutlery, pots, pans Kitchen table and chairs Cleaning supplies and vacuum TV and TV stand/wall mount Chest of drawers or desk 9. Willa must also include the following items in her monthly budget: a. Cell phone plan. b. Cable/Netflix and Internet (if not already included with rent or utilities above; if included, that should be clearly state.) c. Food: All food, wherever she purchases it. Since Willa is a lot like you, it is recommended you track your own current food costs and extrapolate. Please do not use any online estimates/food guides to come up with your budgeted monthly food expenditures. d. Entertainment: she should consider a wide variety of entertainment, including movies, sporting events, travel, etc. e. Fuel costs (if she has a car) with mileage calculations using $2.00/gallon. f. Car maintenance costs (if she has a car). 8. Insurance: Car insurance (if she has a car) and Renter's insurance for her belongings. h. If she chooses not to have a car, she must budget for other modes of transportation. 1. Medical Expenses: Considering prescriptions and co-pays for doctor visits. j. Medical Expenses: Health insurance. This is not the same as co-pays above. k Willa has a required $300 monthly payment for student loans, interest included. L. Savings - easily accessible, and separate from her checking account. Focus Normal No Spacing Heading 1 Hending 2 A m. Retirement Contributions. These are separate from savings, since they are for the distant future. n. Charitable contributions. She has discretion on the amount and frequency, but she should consider them. If she chooses not to make charitable contributions that should be indicated. 0. Gifts for others. Willa, again, has discretion on the amount and frequency, but she should consider them. 10. There are many other costs Willa will incur in her real life (haircuts, salon visits, tolls, parking fees, dry-cleaning); at least one of these "other" types of costs should be included in addition to the long list, above. Required: 30 points - Due to D2L assignments folder "Budgeting minicase" by 11:59pm on Fri., Oct 9 This is an individual assignment. Please complete this assignment on your own; make your own assumptions and estimates; do your own research. A complete submission will include both an Excel spreadsheet (with requirements related to #1,283, below), AND a Word document (with requirements related to #4, below). 1. Help Willa put together a monthly cash budget that includes 6 months of budgeted cash inflows and outflows starting on Sept. 1, her first day on the job. This is best done using 6 columns (one for each month) in an Excel spreadsheet. Formatting hint: with Sept. as a heading for one of the columns, use the rows to separately account for Normal No Spacing Heading 1 Houding 2 Formatting hint: with Sept. as a heading for one of the columns, use the rows to separately account for each expenditure that she will need to make throughout the month. It may be helpful to structure each month to account for the first half of the month first (the 1" through 14), before the first payday, and determine a subtotal at that point; and then continue on to the 2nd half of the month (the 15th through 30th), before the second payday, and determine a month-end balance at that point. Label each row according to the expenditure. 2. Include supporting documentation / assumptions/estimates / calculations for all numbers. Formatting hint: In the same spreadsheet as your budget, but in a separate column, perhaps to the right of your monthly columns, make note of any and all assumptions/estimates/calculations used for each item in the budget (each row can reflect a different expenditure/transaction and should be properly labeled). Any and all calculations used to arrive at the numbers in your budget should be provided. Citations and screenshots may be used in support of online specials and price quotes from online sources. This documentation is required to verify your planned living arrangements: A photo and hyperlink of an actual apartment listing must be included, where cost is shown as well as amenities Included (if utilities are included, parking, etc.) 3. Provide a listing of Willa's total assets and total liabilities at the end of her 6-month budget period. A full balance sheet is not required; rather, provide just a straightforward listing of her budgeted assets and liabilities and their corresponding dollar values at the end of February 2021. This will help her Identify her personal financial position after six months of work. This can be included in the Excel spreadsheet. 4. In a typed paper using Word or similar word processing program, not more than 2 pages, describe the methodology you used to arrive at Willa's budgeted numbers. Since Willa is a lot like you, what goals did you accomplish in this budgeting process? Please also include commentary on the following: a. Which of these budgeted items are essential and which are discretionary? b. On February 28, 2021, Willa opens the mail and finds a $2,500 bill. The bill is due, in cash, in 30 days. Be very specific and identify how Willa would pay it. c. What are your insights/observations/conclusions as a result of completing this assignment? Willa had barely left the building after her second job interview when she received a call- the call she had been waiting for- she got the job! "Blake, can you believe that I'm going to be making some real money starting in September?" she said to her friend. "I can't wait until I can have some financial freedom to actually do a few fun things and not feel guilty about it." Blake, always the realist, kept her in check. "You realize you're still going to have bills to pay, right? And your student loans won't just pay themselves off?" "Of course, of course, I know that," she said. "But still, there should be plenty left over after I cover my expenses." In order to see if Willa in fact will have "plenty left over", she has been advised to put together a 6- month budget to plan out her cash inflows and outflows once she begins her new job. Assume that Willa is very much like you, with similar spending habits, tastes, preferences, etc. Willa must consider the following details within her budget: 1. She will be working in downtown Minneapolis. Her office is located at 225 South 6th St, Minneapolis, MN. Her start date is September 1, 2020. 2. She will make $50,000 per year before tax withholdings: Effective Federal Income Tax rate on $50,000 = 9%, and Social Security + Medicare =7.65%. She will be paid on the 15th and 30% of each month. 3. Willa has $1,000 as an opening balance in her bank account. 4. She will be living in an apartment of her choosing, for all six months, and rent is due on the 1st of every month. Rent must be paid with cash. She will need to consider moving costs and/or costs for dcor upon moving and settling into her new apartment. She may have a roommate(s) if so desired. If basic utilities aren't included in the rental cost (per the housing website she uses) then she must estimate and include them. (Assume Willa currently lives 3-hours away from Minneapolis, by car.) 5. She has a credit limit of $2,000 on her only credit card, with a 19% APR. The minimum monthly credit card payment is $150, interest included. She may pay the balance in full each month, but she doesn't have to. If she doesn't use the card she owes nothing. She doesn't have to use the credit card at all-it's just an option. 6. If she already owns a car, then this item can be ignored. If she wants or needs to own a car, or if she wants to upgrade her current car, she must choose one of the following options: a. Zero down payment with a $500 minimum monthly payment. b. $1,500 down payment with a $300 minimum monthly payment. C. $2,500 down payment with a minimum monthly payment of $200. 7. Any cash support from her family/friends must come in the form of a loan, bearing Interest at 6%, wherein she must make regular monthly principal repayments of 10% of the amount loaned to her, plus the correct amount of Interest. She does not have to accept a loan from anyone - It's just an option. It is also acceptable to state that she will receive certain gifts/monies during festive occasions during the year. 8. She must acquire at least 3 of the 10 items listed below. She can obtain these items in any legal way that she chooses, except she cannot be given any of them. To support her purchase costs for these Items, please provide a calculation/price quote or online/printed ad supporting the budgeted/proposed purchase price separately in the report. Car Computer/laptop and printer Bed/frame/mattress Work attire Couch or comfy chair Dishes, cutlery, pots, pans Kitchen table and chairs Cleaning supplies and vacuum TV and TV stand/wall mount Chest of drawers or desk 9. Willa must also include the following items in her monthly budget: a. Cell phone plan. b. Cable/Netflix and Internet (if not already included with rent or utilities above; if included, that should be clearly state.) c. Food: All food, wherever she purchases it. Since Willa is a lot like you, it is recommended you track your own current food costs and extrapolate. Please do not use any online estimates/food guides to come up with your budgeted monthly food expenditures. d. Entertainment: she should consider a wide variety of entertainment, including movies, sporting events, travel, etc. e. Fuel costs (if she has a car) with mileage calculations using $2.00/gallon. f. Car maintenance costs (if she has a car). 8. Insurance: Car insurance (if she has a car) and Renter's insurance for her belongings. h. If she chooses not to have a car, she must budget for other modes of transportation. 1. Medical Expenses: Considering prescriptions and co-pays for doctor visits. j. Medical Expenses: Health insurance. This is not the same as co-pays above. k Willa has a required $300 monthly payment for student loans, interest included. L. Savings - easily accessible, and separate from her checking account. Focus Normal No Spacing Heading 1 Hending 2 A m. Retirement Contributions. These are separate from savings, since they are for the distant future. n. Charitable contributions. She has discretion on the amount and frequency, but she should consider them. If she chooses not to make charitable contributions that should be indicated. 0. Gifts for others. Willa, again, has discretion on the amount and frequency, but she should consider them. 10. There are many other costs Willa will incur in her real life (haircuts, salon visits, tolls, parking fees, dry-cleaning); at least one of these "other" types of costs should be included in addition to the long list, above. Required: 30 points - Due to D2L assignments folder "Budgeting minicase" by 11:59pm on Fri., Oct 9 This is an individual assignment. Please complete this assignment on your own; make your own assumptions and estimates; do your own research. A complete submission will include both an Excel spreadsheet (with requirements related to #1,283, below), AND a Word document (with requirements related to #4, below). 1. Help Willa put together a monthly cash budget that includes 6 months of budgeted cash inflows and outflows starting on Sept. 1, her first day on the job. This is best done using 6 columns (one for each month) in an Excel spreadsheet. Formatting hint: with Sept. as a heading for one of the columns, use the rows to separately account for Normal No Spacing Heading 1 Houding 2 Formatting hint: with Sept. as a heading for one of the columns, use the rows to separately account for each expenditure that she will need to make throughout the month. It may be helpful to structure each month to account for the first half of the month first (the 1" through 14), before the first payday, and determine a subtotal at that point; and then continue on to the 2nd half of the month (the 15th through 30th), before the second payday, and determine a month-end balance at that point. Label each row according to the expenditure. 2. Include supporting documentation / assumptions/estimates / calculations for all numbers. Formatting hint: In the same spreadsheet as your budget, but in a separate column, perhaps to the right of your monthly columns, make note of any and all assumptions/estimates/calculations used for each item in the budget (each row can reflect a different expenditure/transaction and should be properly labeled). Any and all calculations used to arrive at the numbers in your budget should be provided. Citations and screenshots may be used in support of online specials and price quotes from online sources. This documentation is required to verify your planned living arrangements: A photo and hyperlink of an actual apartment listing must be included, where cost is shown as well as amenities Included (if utilities are included, parking, etc.) 3. Provide a listing of Willa's total assets and total liabilities at the end of her 6-month budget period. A full balance sheet is not required; rather, provide just a straightforward listing of her budgeted assets and liabilities and their corresponding dollar values at the end of February 2021. This will help her Identify her personal financial position after six months of work. This can be included in the Excel spreadsheet. 4. In a typed paper using Word or similar word processing program, not more than 2 pages, describe the methodology you used to arrive at Willa's budgeted numbers. Since Willa is a lot like you, what goals did you accomplish in this budgeting process? Please also include commentary on the following: a. Which of these budgeted items are essential and which are discretionary? b. On February 28, 2021, Willa opens the mail and finds a $2,500 bill. The bill is due, in cash, in 30 days. Be very specific and identify how Willa would pay it. c. What are your insights/observations/conclusions as a result of completing this assignment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

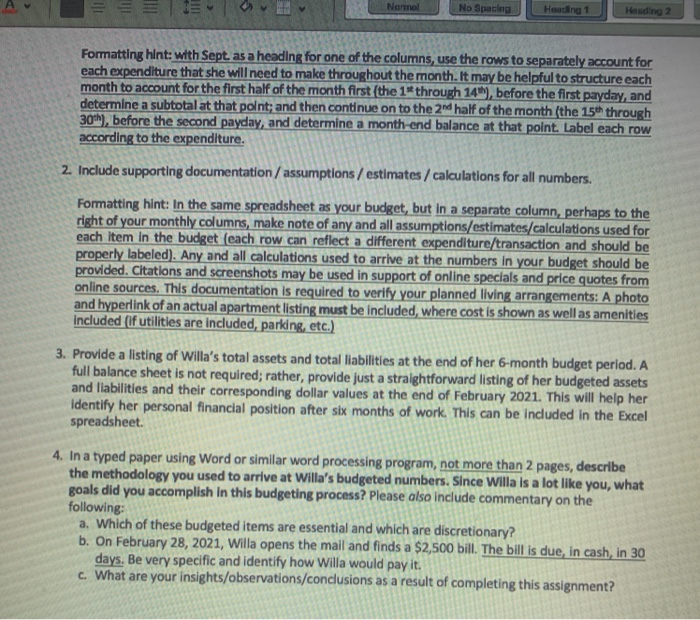

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started