Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help on #4 please. I promise to like! You are considering the purchase of an industrial building for $10,120,000 today. Below, you are

I need help on #4 please. I promise to like!

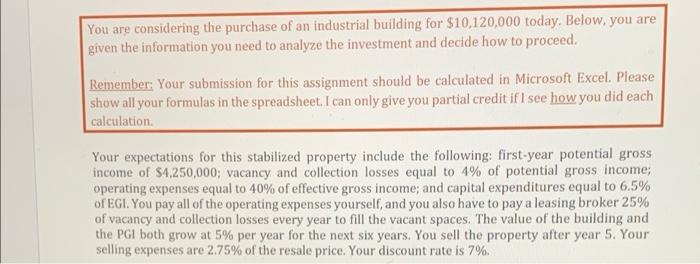

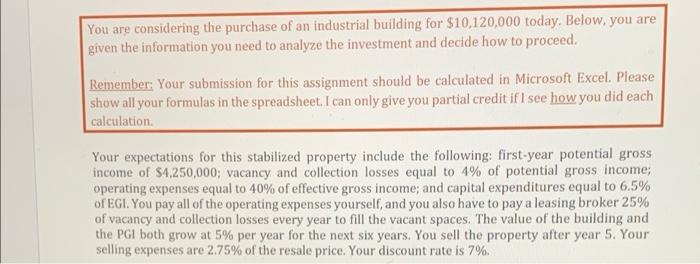

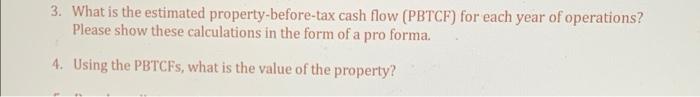

You are considering the purchase of an industrial building for $10,120,000 today. Below, you are given the information you need to analyze the investment and decide how to proceed. Remember: Your submission for this assignment should be calculated in Microsoft Excel. Please show all your formulas in the spreadsheet. I can only give you partial credit if I see how you did each calculation Your expectations for this stabilized property include the following: first-year potential gross income of $4,250,000; vacancy and collection losses equal to 4% of potential gross income; operating expenses equal to 40% of effective gross income; and capital expenditures equal to 6.5% of EGI. You pay all of the operating expenses yourself, and you also have to pay a leasing broker 25% of vacancy and collection losses every year to fill the vacant spaces. The value of the building and the PGA both grow at 5% per year for the next six years. You sell the property after year 5. Your selling expenses are 2.75% of the resale price. Your discount rate is 7%. 3. What is the estimated property-before-tax cash flow (PBTCF) for each year of operations? Please show these calculations in the form of a pro forma. 4. Using the PBTCFs, what is the value of the property? You are considering the purchase of an industrial building for $10,120,000 today. Below, you are given the information you need to analyze the investment and decide how to proceed. Remember: Your submission for this assignment should be calculated in Microsoft Excel. Please show all your formulas in the spreadsheet. I can only give you partial credit if I see how you did each calculation Your expectations for this stabilized property include the following: first-year potential gross income of $4,250,000; vacancy and collection losses equal to 4% of potential gross income; operating expenses equal to 40% of effective gross income; and capital expenditures equal to 6.5% of EGI. You pay all of the operating expenses yourself, and you also have to pay a leasing broker 25% of vacancy and collection losses every year to fill the vacant spaces. The value of the building and the PGA both grow at 5% per year for the next six years. You sell the property after year 5. Your selling expenses are 2.75% of the resale price. Your discount rate is 7%. 3. What is the estimated property-before-tax cash flow (PBTCF) for each year of operations? Please show these calculations in the form of a pro forma. 4. Using the PBTCFs, what is the value of the property

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started