i need help on ch 6 for 2,3,7,9,10

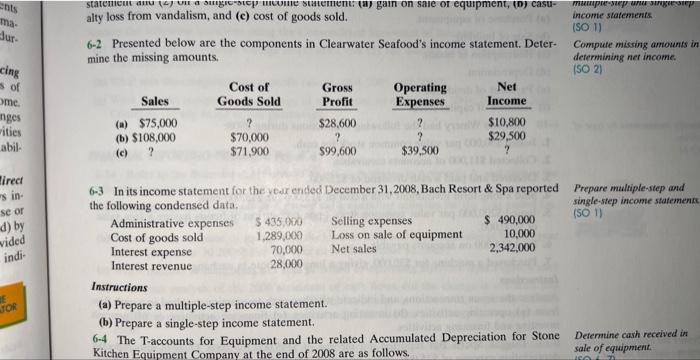

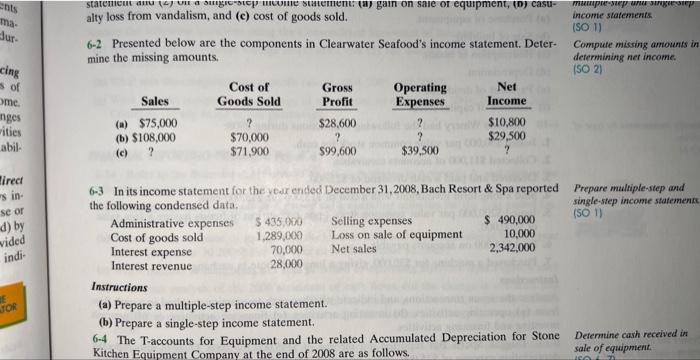

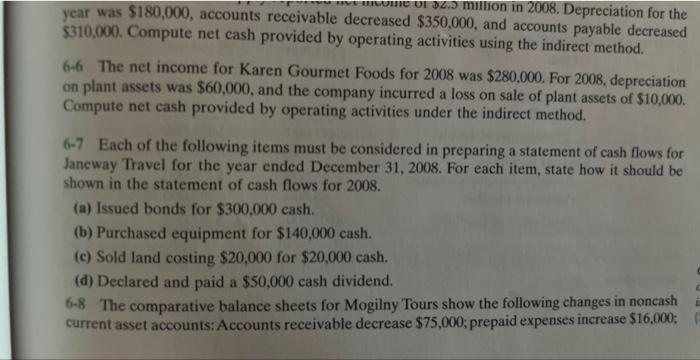

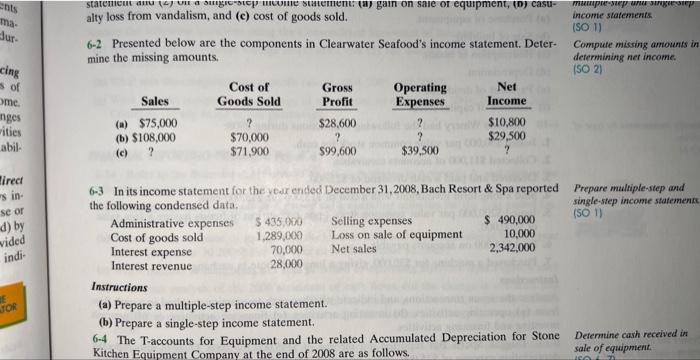

alty loss from vandalism, and (c) cost of goods sold. income statements. (SO 1) 6-2 Presented below are the components in Clearwater Seafood's income statement. Deter- Compute missing amounts in mine the missing amounts. determining net income. (50 2) 6-3 In its income statement for the year ended December 31,2008, Bach Resort \& Spa reported Prepare multiple-step and the followine condensed data. single-step income statemenk (50 1) Instructions (a) Prepare a multiple-step income statement. (b) Prepare a single-step income statement. 6-4 The T-accounts for Equipment and the related Accumulated Depreciation for Stone Determine cash received in Kitchen Eouinment Company at the end of 2008 are as follows. sale of equipment. \$310.000. Compute net cash provided by operating activities using the indirect method. 6-6 The net income for Karen Gourmet Foods for 2008 was $280,000. For 2008, depreciation on plant assets was $60,000, and the company incurred a loss on sale of plant assets of $10,000. Compute net cash provided by operating activities under the indirect method. 6-7 Each of the following items must be considered in preparing a statement of cash flows for Janeway Travel for the year ended December 31, 2008. For each item, state how it should be shown in the statement of cash flows for 2008. (a) Issued bonds for $300,000cash. (b) Purchased equipment for $140,000 cash. (c) Sold land costing $20,000 for $20,000 cash. (d) Declared and paid a $50,000 cash dividend. 6-8 The comparative balance sheets for Mogilny Tours show the following changes in noncash current asset accounts: Accounts receivable decrease $75,000; prepaid expenses increase $16,000; indirect method, assuming that net income is $250,000. 6-9 Classify the following items as an operating, an investing, or a financing activity. Assume all items involve cash unless there is information to the contrary. (a) Purchase of equipment. (b) Sale of building. (c) Redemption of bonds. (d) Depreciation. (e) Payment of dividends. (f) Issuance of capital stock. 6-13 The finane book. Instructions Answer the follo (a) What was tt from 2005 ts (b) What was th (c) What was th usactions by type of 6-10 Antoine Winery had the following transactions during 2008: 1. Issued $50,000 par value common stock for cish. 2. Collected $11,000 of accounts receivable. 3. Declared and paid a eash dividend of $25,000. 4. Sold a long-term investment with a cost of $15,000 for $15,000 cash. Comment or 5. Issued $200,000 par value common stock upon conversion of bonds having a face value of $200,000. 6. Paid $14,000 on accounts payable. 7. Purchased a machine for $30,000, giving a long-term note in exchange. Insiructions FINANCIAL. REPC 6-14 Refer to t following questic (a) What was the cember 30,20 What was the ended Decem (c) Which metho Analyze the seven transactions, and indicate whether each transaction resulted in a cash flow from (a) operating activities, (b) investing activities, (c) financing activities, or (d) noncash investing and financing activities. (d) From your notes cash? cash