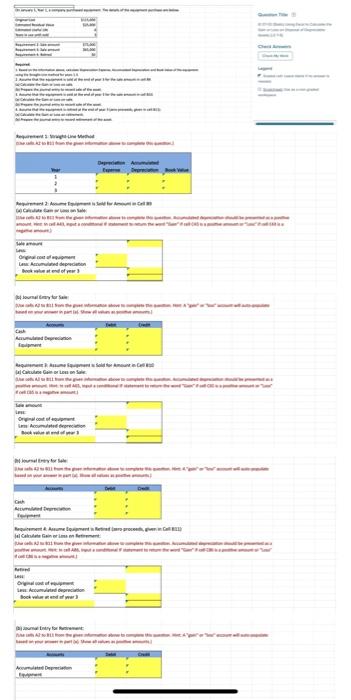

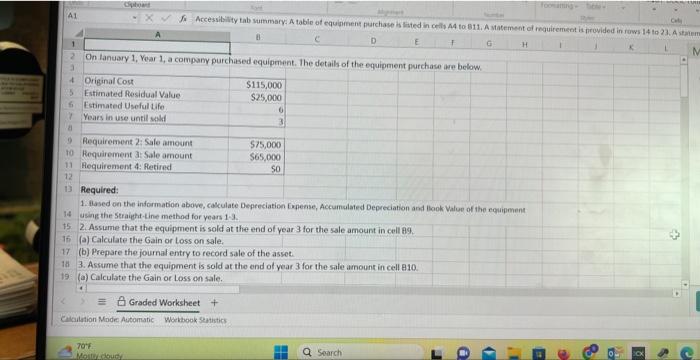

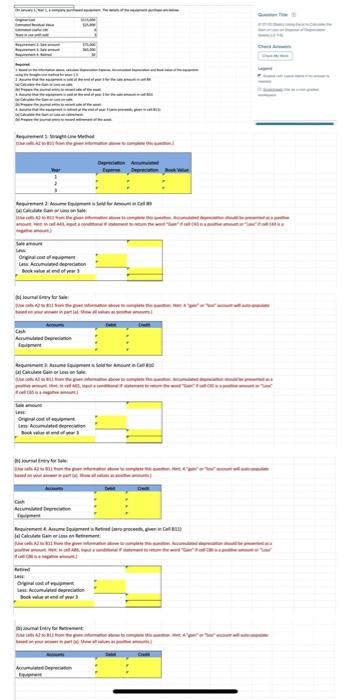

I need help on how to solve each! the depreciation expense, accumulated Depreciation, and book value.

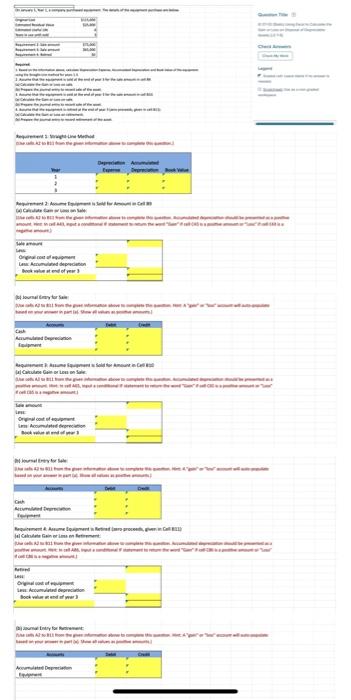

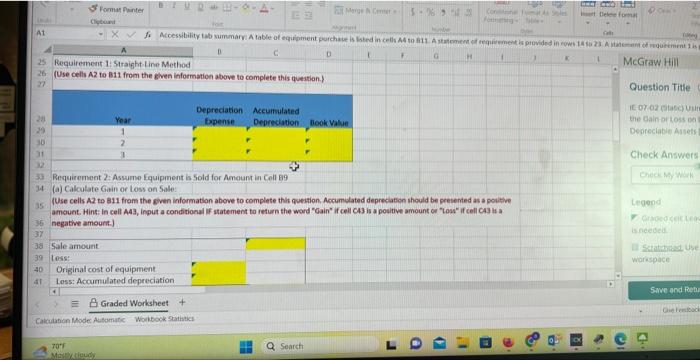

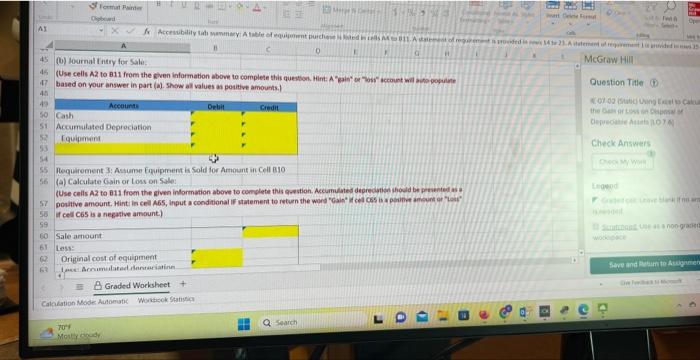

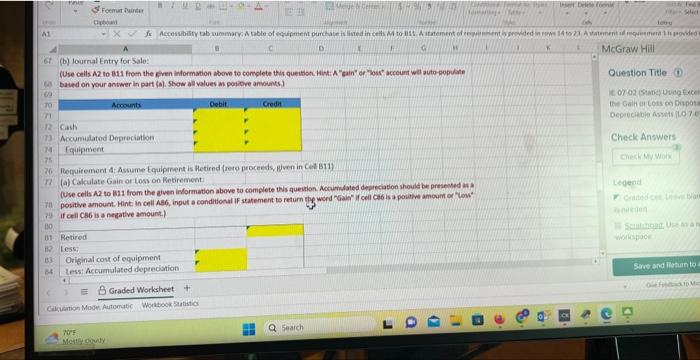

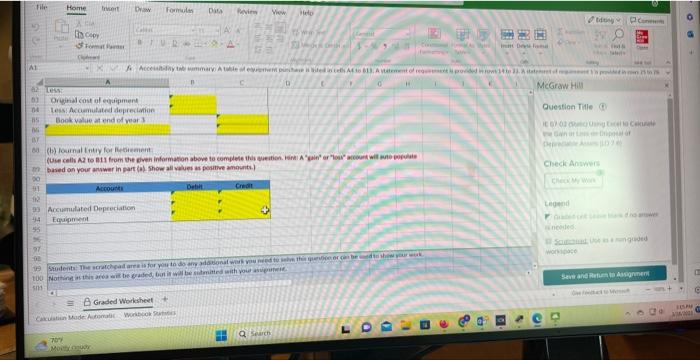

Whimentitriter lew D) avind inty for kntwent On Lanuary 1, Year 1, a compamy purchased equiptsent. The details of the equipment purchase are below. Required: 1. llased on the information above, calculate Depeeciation Eupense, Accumalaied Depreciation and llook Value of the equipment using the Straight-tine method for years 1-3. 2. Assume that the equipment is sold at the end of year 3 for the sale amount in cell B9. (a) Calculate the Gain or Loss on sale. (b) Prepare the joumak entry to record sale of the asset. 3. Assume that the equipment is sold at the end of year 3 for the sale amount in cell 810 . a) falrulatu tha Gain ne l aci an asla. (Use cells A2 to B11 from the given information above to complete this question.) Question Title Requirenent 2: Assume fquipment is Sold for Ameunt in Coll B9 (a) Calculate Gain or Loss on Sale: (Use cells A2 to B11 fram the Even information above to complete this question, Accumulated depreciabon should be presented as a pouthe amount. Hint: In cell A43, input a conditional If statement to return the word "Cain" if cell C43 is a pouitive amount on "Low" if cell Ca3 is a negative amourt.] (Use cells A2 to B11 from the given iaformation above to complete this queston. Hint: A "gain" of "oss" iccount wal anso poguiat based on your answer in part (a). show al values an positive amounts.) Question Title ciepeonite Aatato 7o N Check Answers Requirement 3: Astume Equipment is Sold for Amount in Cell B10 (a) Calculate Gisin or Losv on 5ale: (Use cells A2 to 811 from the given indormation above to complete this grestion. Accumdated deorecutige chowld be persented as a If cell 665 is a negative amount) (Use cells A2 to 811 from the even information above to complete thit quetton. Hist: A "cain" of "loss" acceunt wel auto-popline Ouestion Title based on your antwer in part (a), show all values an pontove amounts) t. or.02 (Siatict Uigg treet INet Galh all cots en ipata Oepaecubie Asrets fito 70 Check Answers Noquirement A: Assume tquipment is Hetirnd (rero proceeds, piven in Cet B11) (a) Cakculate Gain or Lows on Retirement (Use cells A2 to B11 from the aven inlormation above to complete tWis quevion. Accumdated depreciation should be presented ar? if cell cs6 is a negative amount.) (ib) louinal Intiy for lutaweinit: based an your anwwer in part (a) show all velues as porathe anosnts.) Whimentitriter lew D) avind inty for kntwent Whimentitriter lew D) avind inty for kntwent On Lanuary 1, Year 1, a compamy purchased equiptsent. The details of the equipment purchase are below. Required: 1. llased on the information above, calculate Depeeciation Eupense, Accumalaied Depreciation and llook Value of the equipment using the Straight-tine method for years 1-3. 2. Assume that the equipment is sold at the end of year 3 for the sale amount in cell B9. (a) Calculate the Gain or Loss on sale. (b) Prepare the joumak entry to record sale of the asset. 3. Assume that the equipment is sold at the end of year 3 for the sale amount in cell 810 . a) falrulatu tha Gain ne l aci an asla. (Use cells A2 to B11 from the given information above to complete this question.) Question Title Requirenent 2: Assume fquipment is Sold for Ameunt in Coll B9 (a) Calculate Gain or Loss on Sale: (Use cells A2 to B11 fram the Even information above to complete this question, Accumulated depreciabon should be presented as a pouthe amount. Hint: In cell A43, input a conditional If statement to return the word "Cain" if cell C43 is a pouitive amount on "Low" if cell Ca3 is a negative amourt.] (Use cells A2 to B11 from the given iaformation above to complete this queston. Hint: A "gain" of "oss" iccount wal anso poguiat based on your answer in part (a). show al values an positive amounts.) Question Title ciepeonite Aatato 7o N Check Answers Requirement 3: Astume Equipment is Sold for Amount in Cell B10 (a) Calculate Gisin or Losv on 5ale: (Use cells A2 to 811 from the given indormation above to complete this grestion. Accumdated deorecutige chowld be persented as a If cell 665 is a negative amount) (Use cells A2 to 811 from the even information above to complete thit quetton. Hist: A "cain" of "loss" acceunt wel auto-popline Ouestion Title based on your antwer in part (a), show all values an pontove amounts) t. or.02 (Siatict Uigg treet INet Galh all cots en ipata Oepaecubie Asrets fito 70 Check Answers Noquirement A: Assume tquipment is Hetirnd (rero proceeds, piven in Cet B11) (a) Cakculate Gain or Lows on Retirement (Use cells A2 to B11 from the aven inlormation above to complete tWis quevion. Accumdated depreciation should be presented ar? if cell cs6 is a negative amount.) (ib) louinal Intiy for lutaweinit: based an your anwwer in part (a) show all velues as porathe anosnts.) Whimentitriter lew D) avind inty for kntwent