Answered step by step

Verified Expert Solution

Question

1 Approved Answer

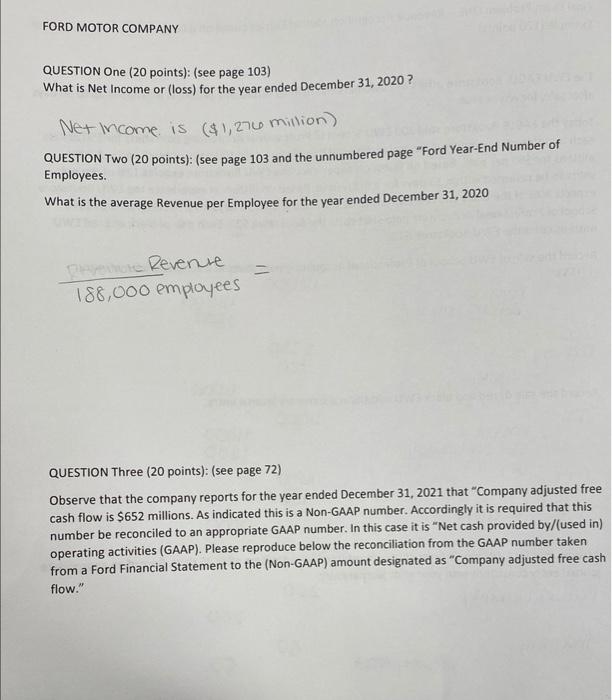

I need help on questions 2 & 3 FORD MOTOR COMPANY QUESTION One (20 points): (see page 103) What is Net Income or (loss) for

I need help on questions 2 & 3

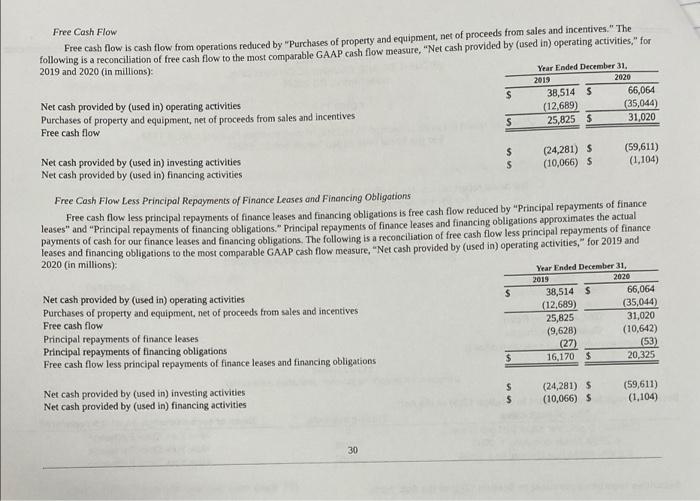

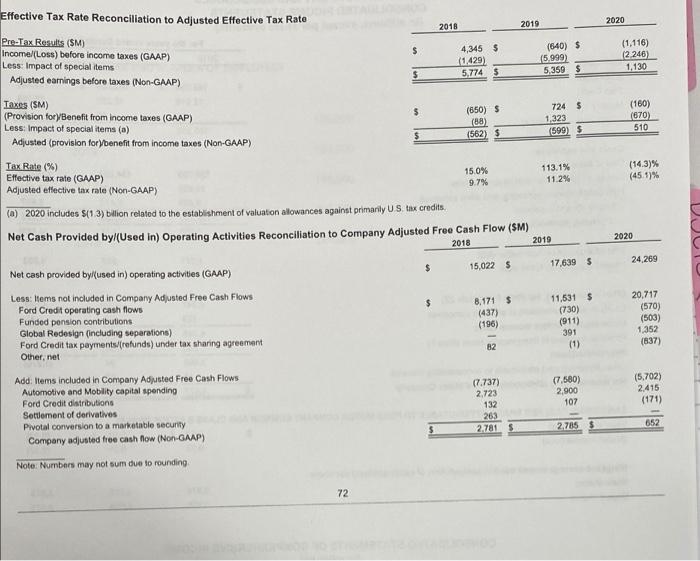

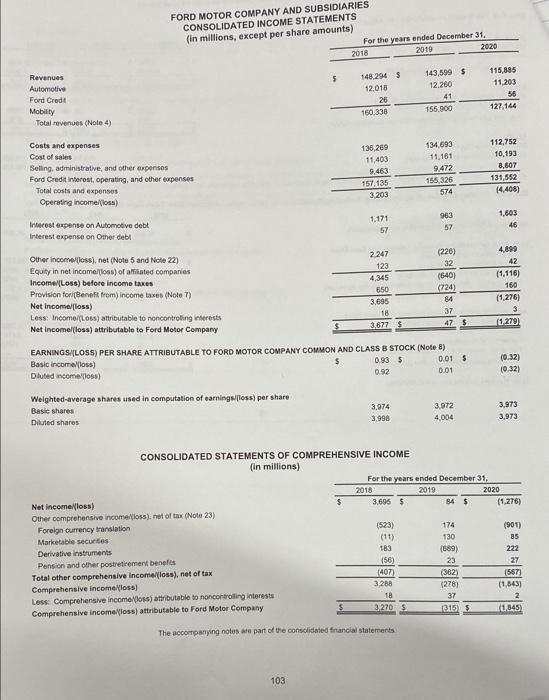

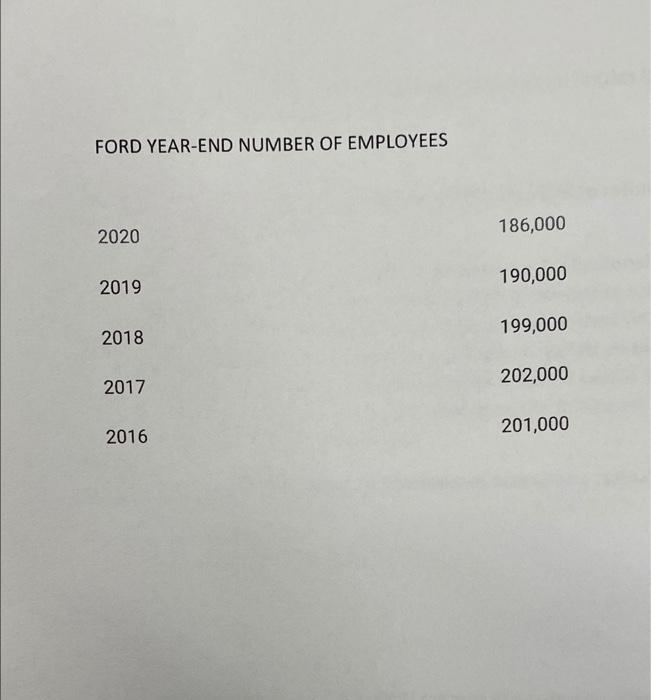

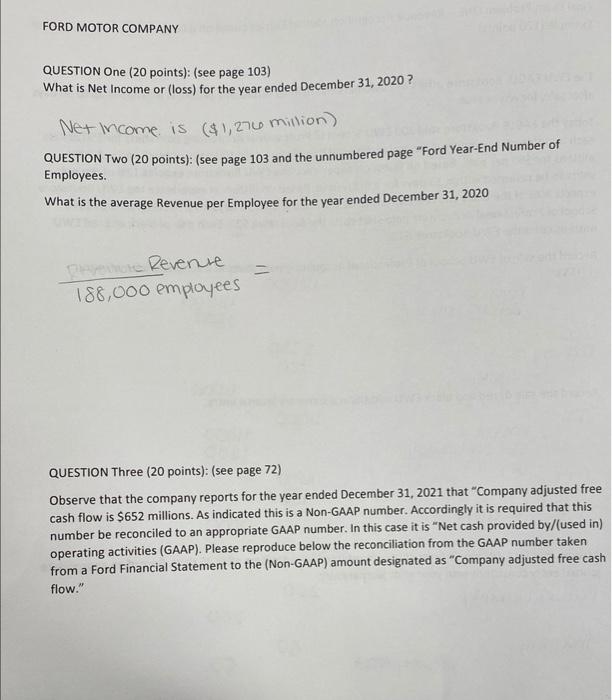

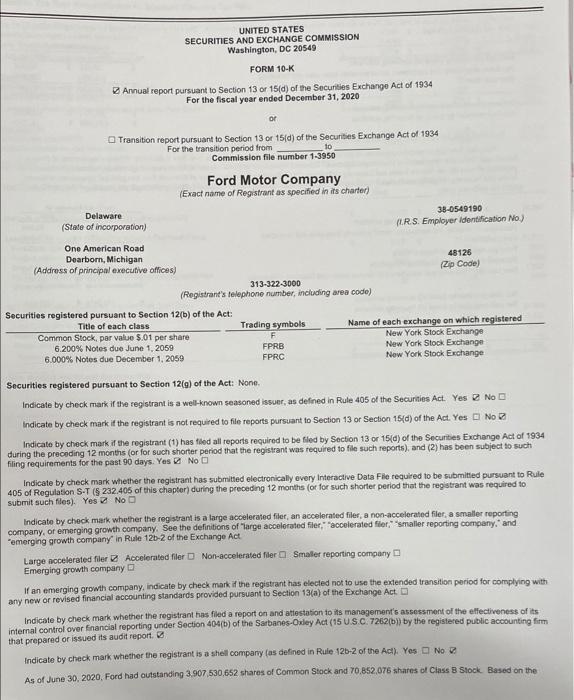

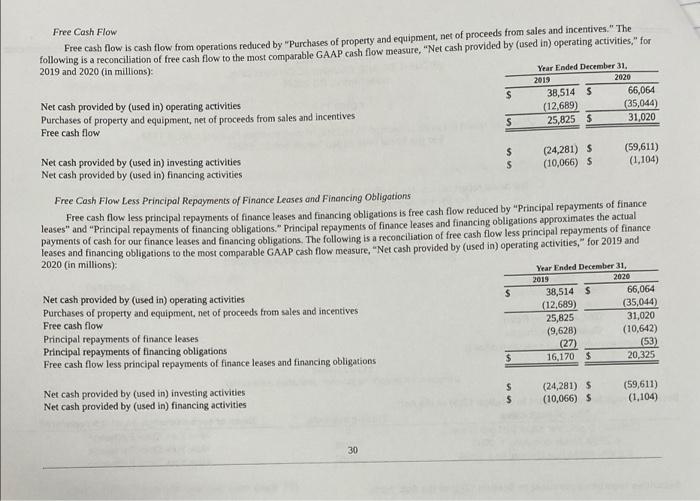

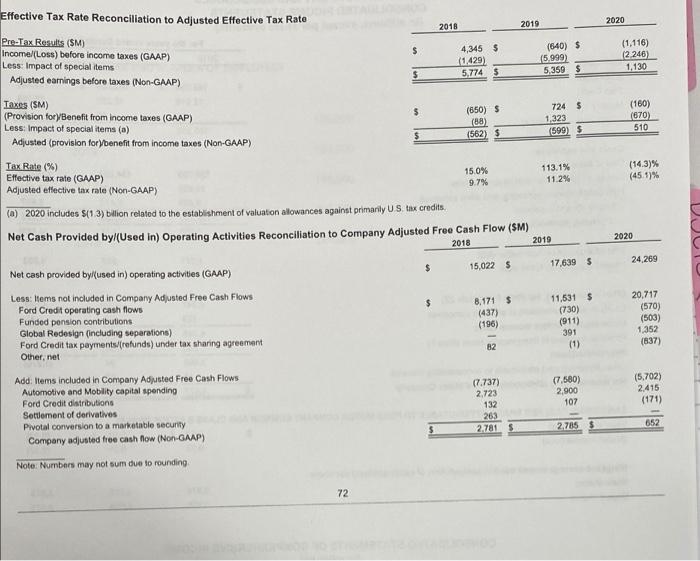

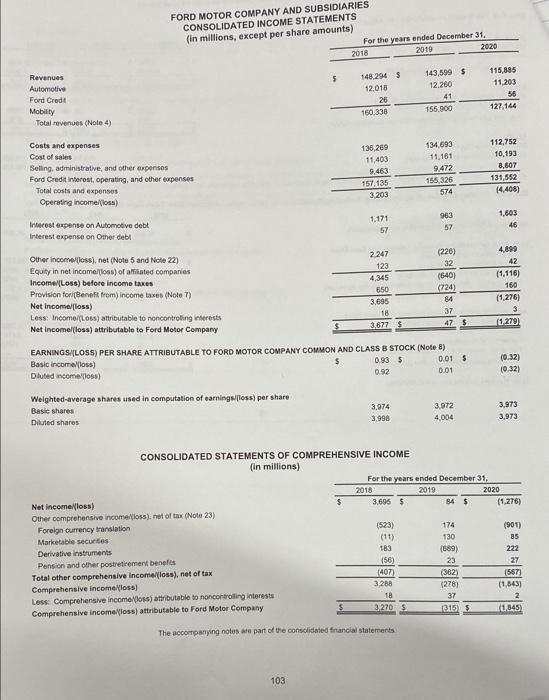

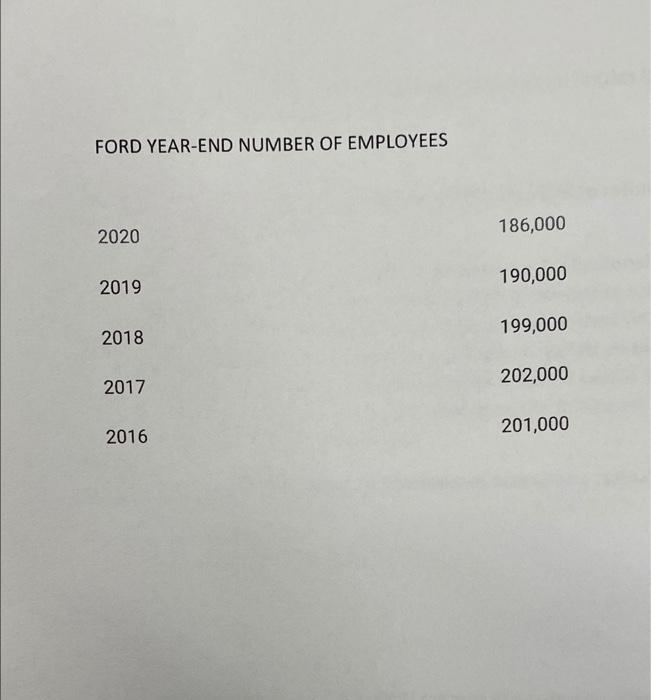

FORD MOTOR COMPANY QUESTION One (20 points): (see page 103) What is Net Income or (loss) for the year ended December 31, 2020? Net Income is ($1,276 million) QUESTION TWO (20 points): (see page 103 and the unnumbered page "Ford Year-End Number of Employees. What is the average Revenue per Employee for the year ended December 31, 2020 Prevenue Revenure 188,000 employees QUESTION Three (20 points): (see page 72) Observe that the company reports for the year ended December 31, 2021 that "Company adjusted free cash flow is $652 millions. As indicated this is a Non-GAAP number. Accordingly it is required that this number be reconciled to an appropriate GAAP number. In this case it is "Net cash provided by/(used in) operating activities (GAAP). Please reproduce below the reconciliation from the GAAP number taken from a Ford Financial Statement to the (Non-GAAP) amount designated as "Company adjusted free cash flow." UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2020 or Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from to Commission file number 1-3950 Ford Motor Company (Exact name of Registrant as specified in its charter) Delaware 38-0549190 (State of incorporation) LR.S. Employer identification No) One American Road Dearborn, Michigan 48126 (Address of principal executive offices) (Zip Code) 313-322-3000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbols Name of each exchange on which registered Common Stock par value $.01 per share F New York Stock Exchange 6.200% Notes due June 1, 2059 FPRB New York Stock Exchange 6.000% Notes due December 1, 2059 FPRC Now York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15{d) of the Act. Yes No Indicate by check mark if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (5 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes No indicate by check mark whether the registrant is a large accelerated filer, an accelerated files, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of large acolorated filer, accelerated filer" "smaller reporting company and "emerging growth company in Rule 12-2 of the Exchange Act Large accelerated filer Accelerated filer Non-accelerated filer Smaller reporting company Emerging growth company If an emerging growth company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b) by the registered public accounting firm that prepared or issued its audit report Indicate by check mark whether the registrant is a shell company (as defined in Rule 126-2 of the Act) Yes No As of June 30, 2020, Ford had outstanding 3.907.530,652 shares of Common Stock and 70,852.076 shares of Class 8 Stock. Based on the Free Cash Flow Free cash flow is cash flow from operations reduced by Purchases of property and equipment, net of proceeds from sales and incentives." The following is a reconciliation of free cash flow to the most comparable GAAP cash flow measure, "Net cash provided by (used in) operating activities," for 2019 and 2020 (in millions) Year Ended December 31, 2019 2020 Net cash provided by (used in) operating activities 38,514 5 66,064 Purchases of property and equipment, net of proceeds from sales and incentives (12,689) (35,044) Free cash flow s 25,8255 31,020 $ Net cash provided by (used in) investing activities $ (24,281) $ (59,611) Net cash provided by (used in) financing activities $ (10,066) S (1,104) Free Cash Flow Less Principal Repayments of Finance Leases and Financing Obligations Free cash flow less principal repayments of finance leases and financing obligations is free cash flow reduced by "Principal repayments of finance leases" and "Principal repayments of financing obligations." Principal repayments of finance leases and financing obligations approximates the actual payments of cash for our finance leases and financing obligations. The following is a reconciliation of free cash flow less principal repayments of finance leases and financing obligations to the most comparable GAAP cash flow measure, Net cash provided by (used in) operating activities," for 2019 and 2020 (in millions): Year Ended December 31, 2019 2020 Net cash provided by (used in) operating activities $ 38,514 66,064 Purchases of property and equipment, net of proceeds from sales and incentives (12,689) (35,044) Free cash flow 25,825 31,020 Principal repayments of finance leases (9,628) (10,642) Principal repayments of financing obligations (27) (53) Free cash flow less principal repayments of finance leases and financing obligations 16,170 $ 20,325 s Net cash provided by (used in) investing activities Net cash provided by (used in) financing activities (24,281) $ (10,066) $ (59,611) (1,104) 30 Effective Tax Rate Reconciliation to Adjusted Effective Tax Rate 2018 2019 2020 $ Pre-Tax Results (SM) Income/(Loss) before income taxes (GAAP) Less Impact of special items Adjusted earnings before taxes (Non-GAAP) 4,345 $ (1.429) 5,774 (640) $ (5.999) 5,359 $ (1.116) (2246) 1,130 $ $ Taxes (SM) (Provision for Benefit from income taxes (GAAP) Less: Impact of special items (a) Adjusted (provision for benefit from income taxes (Non-GAAP) (650) $ (88) (562) $ 724 5 1,323 (599) $ (160) (670) 510 Tax Rate (%) Effective tax rate (GAAP) Adjusted effective tax rate (Non-GAAP) 15.0% 9.7% 113.1% 11.2% (14.3% (45.5% (a) 2020 includes $(13) billion related to the establishment of valuation allowances against primarily US tax credits Net Cash Provided by/(Used in) Operating Activities Reconciliation to Company Adjusted Free Cash Flow (SM) 2018 2019 2020 DUUU 24,269 17,6395 $ 15,022 $ $ Net cash provided byl(used in) operating activities (GAAP) Less: Items not included in Company Adjusted Free Cash Flows Ford Credit operating cash flows Funded pension contributions Global Redesign (including seperations) Ford Credit tax payments/ratunds) under tax sharing agreement Other, net 8,171 $ (437) (196) 11,531 $ (730) (911) 391 (1) 20,717 (570) (505) 1,352 (837) 82 (7.737) 2.723 132 263 2.781 $ (7.580) 2,900 107 (5,702) 2.415 (171) Add Items included in Company Adjusted Free Cash Flows Automotive and Mobility capital spending Ford Credit distributions Settlement of derivatives Pivotal conversion to a marketable security Company adjusted free cash flow (Non-GAAP) Note: Numbers may not sum due to rounding 27855 652 72 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENTS (in millions, except per share amounts) For the years ended December 31. 2018 2019 2020 $ Revenues Automotive Ford Credit Mobility Total revenues (Note 4) 148,294 5 12.018 26 160.338 143,599 $ 12.260 41 155.900 115,885 11,203 56 127,144 Costs and expenses Cost of sales Selling, administrative, and other expenses Ford Credit interest, operating, and other expenses Total costs and expenses Operating income (los) 136.269 11.403 9.463 157.135 3.203 134.693 11,161 9.472 155,326 112,752 10,193 8,607 131,552 (4.408) 574 1,171 57 983 57 1,603 46 Interest expense on Automotive debt Interest expense on Other debt 4,899 42 (1.116) 160 (1.276) (1279) Other income/loss), net (Note 5 and Note 22) 2.247 (220) Equity in net income foss) of affiliated companies 123 32 Income/Loss) before income taxes 4,345 (640) Provision for (Benetrom) income taxes (Note 7) 650 (724) Net Incomelloss) 3,695 84 Less: Income/(Loss) attributable to noncontroling interests 18 37 Net Incomelloss) attributable to Ford Motor Company 3.677 $ 47 EARNINGS/LOSS) PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK (Note 8) Basic income foss) 0.93 $ 0.01 $ Diluted incomallosa) 0.92 0.01 Weighted average shares used in computation of earnings/loss) per share Basic shares 3.974 3.972 Diluted shares 3.998 4,004 $ (0.32) (0.32) 3,973 3,973 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) For the years ended December 31, 2018 2019 2020 Net income foss) 3,696 5 845 (1.276) Other comprehensive income foss), net of tax (Note 23) Foreign currency translation (523) 174 (901) Marketable securities (11) 130 85 Derivative Instruments 183 (589) 222 Pension and other postretirement benefits (56) 23 27 Total other comprehensive Income/loss), net of tax (407) (362) (567) Comprehensive income foss) 3.288 (278) (1,8431 Loss: Comprehensive income foss attributable to non controlling interests 18 37 2. Comprehensive income foss) attributable to Ford Motor Company 3.270 1815 5 The accompanying notes are part of the consolidated financial statements 1.845) 103 FORD YEAR-END NUMBER OF EMPLOYEES 2020 186,000 190,000 2019 199,000 2018 2017 202,000 2016 201,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started