Answered step by step

Verified Expert Solution

Question

1 Approved Answer

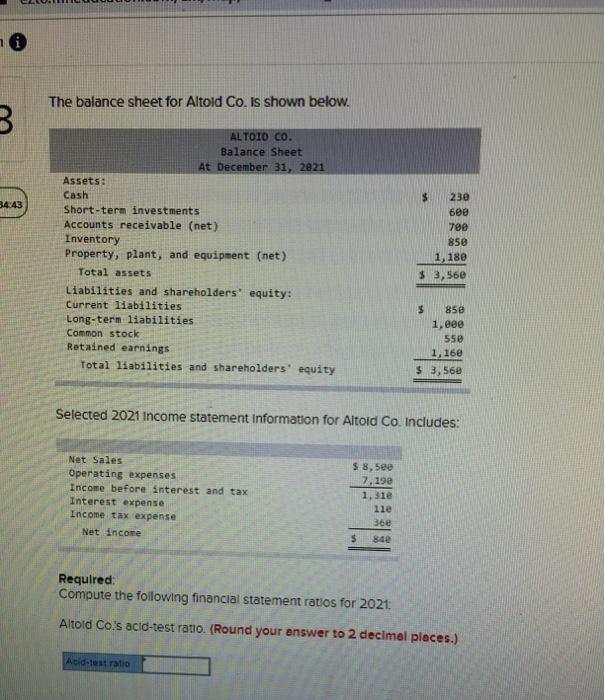

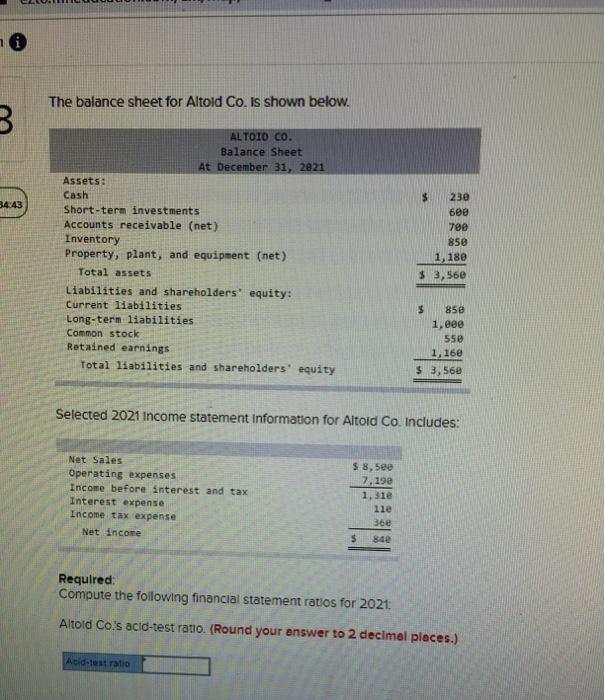

I need help on the following question The balance sheet for Altold Co. is shown below. B 34:43 ALTOID CO. Balance Sheet At December 31,

I need help on the following question

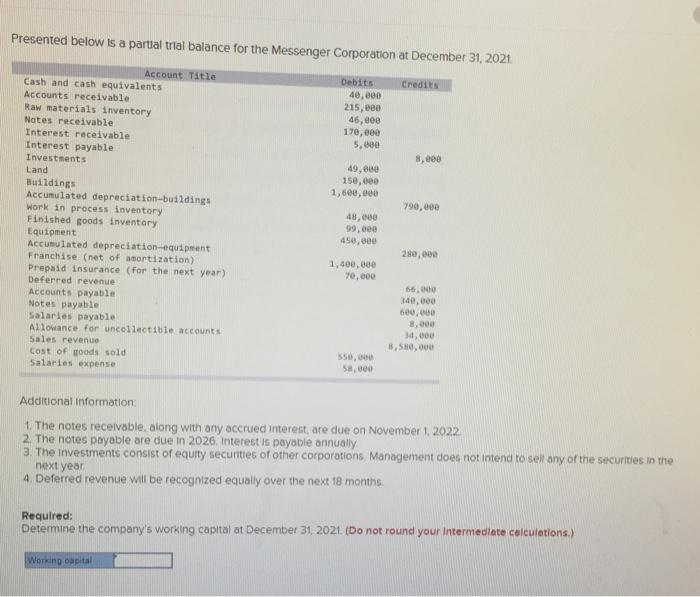

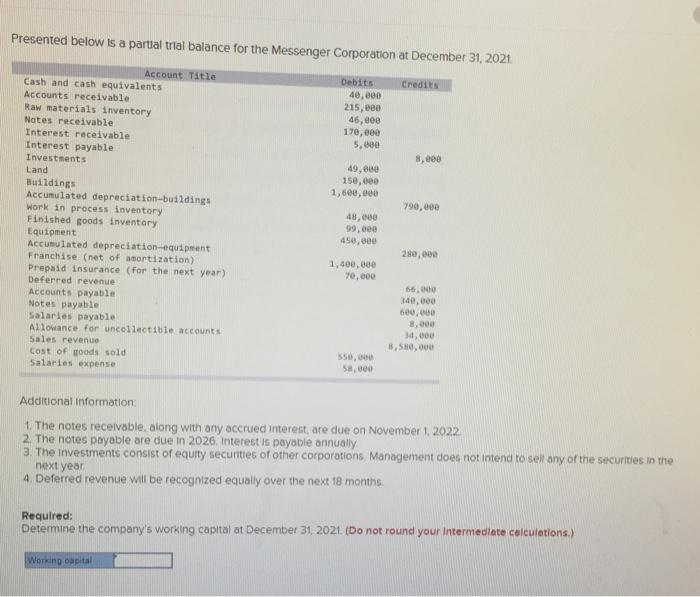

The balance sheet for Altold Co. is shown below. B 34:43 ALTOID CO. Balance Sheet At December 31, 2021 Assets: Cash Short-term investments Accounts receivable (net) Inventory Property, plant, and equipment (net) Total assets Liabilities and shareholders' equity: Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and shareholders' equity $ 230 600 790 850 1,180 $ 3,560 $ 850 1,000 55e 1, 16e $ 3,560 Selected 2021 Income statement Information for Altold Co. Includes: Net Sales Operating expenses Income before interest and tax Interest expense Income tax expense Net income $ 8, See 7. 190 1.310 11e 36e $ 84e Required Compute the following financial statement ratios for 2021 Altold Co.'s acid-test ratio. (Round your enswer to 2 decimel pieces.) Acid-test ratio Presented below is a partial trial balance for the Messenger Corporation at December 31, 2021 Credits Debits 40,000 215,000 46, eee 170,000 5,00 8,000 49,800 150,000 1,600,000 790,000 Account Title Cash and cash equivalents Accounts receivable Raw materials inventory Notes receivable Interest receivable Interest payable Investments Land Buildings Accumulated depreciation-buildings Work in process inventory Finished goods inventory Equipment Accumulated depreciation equipment Franchise (net of amortization) Prepaid insurance for the next year) Deferred revenue Accounts payable Notes payable Salaries payable Allowance for uncollectible accounts Sales revenue Cost of goods sold Salaries expense 48,00 99,000 450,000 280,000 1,400,000 70.000 66, 340.000 600,000 8,000 34,00 3,580,000 550, 58,000 Additional information 1. The notes receivable, along with any accrued interest, are due on November 1, 2022 2. The notes payable are due in 2026. Interest is payable annually 3. The investments consist of equity securities of other corporations Management does not intend to sell any of the securities in the next year 4. Deferred revenue will be recognized equally over the next 18 months Required: Determine the company's working capital at December 31, 2021. (Do not round your intermediate calculations.) Working capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started