Answered step by step

Verified Expert Solution

Question

1 Approved Answer

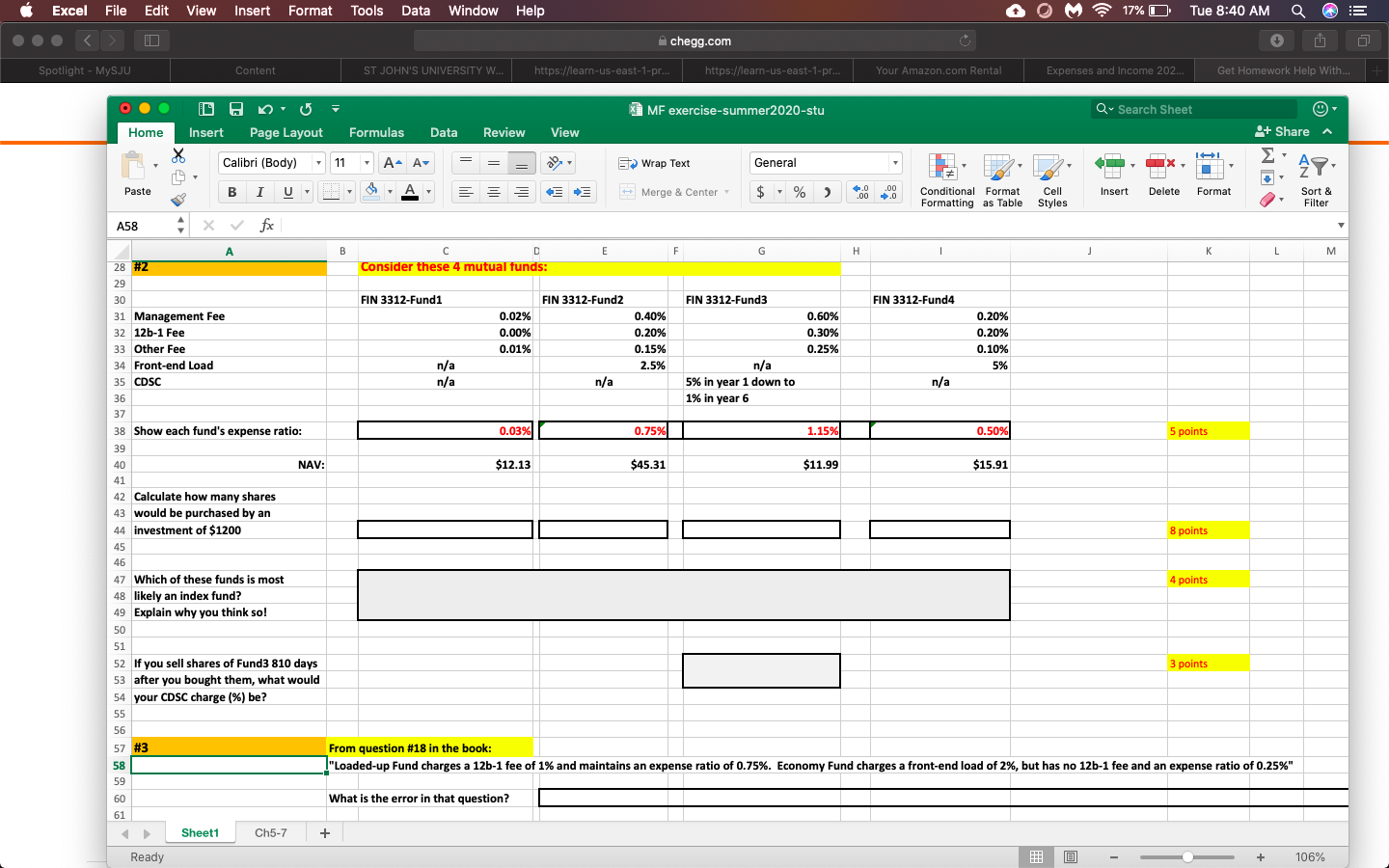

I need help on the question 2 that is in the excel file. I need to know the formula for finding out how many shares

I need help on the question 2 that is in the excel file. I need to know the formula for finding out how many shares would be purchased by the investment of 1,200. Also how can I tell which one is an index fund? And lastly if we sell stars of the fund 3, after 810 days of buying them, what would the CDSC charge (%) be?

I need help on the question 2 that is in the excel file. I need to know the formula for finding out how many shares would be purchased by the investment of 1,200. Also how can I tell which one is an index fund? And lastly if we sell stars of the fund 3, after 810 days of buying them, what would the CDSC charge (%) be?

And by any chance if question #3 can be explained to me what is the error in that question.

Thank you!

Excel File Edit View Insert Format Tools Data Window Help 17%O Tue 8:40 AM chegg.com Spotlight - MySJU Content ST JOHN'S UNIVERSITY W... https://learn-us-east-1-pr... https://learn-us-east-1-pr.. Your Amazon.com Rental Expenses and Income 202... Get Homework Help With... X MF exercise-summer2020-stu Q- Search Sheet Home Insert Page Layout Formulas Data Review View + Share Calibri (Body) = 11 A- A- = Wrap Text General Y H Paste B I U A Merge & Center $ % > .00 1.0 Insert Delete ,00 Conditional Format Formatting as Table Format Cell Styles Sort & Filter A58 X fx - M 0.25% n/a A B D E F G H J K L 28 #2 Consider these 4 mutual funds: 29 30 FIN 3312-Fund1 FIN 3312-Fund2 FIN 3312-Fund3 FIN 3312-Fund4 31 Management Fee 0.02% 0.40% 0.60% 0.20% 32 12b-1 Fee 0.00% 0.20% 0.30% 0.20% 33 Other Fee 0.01% 0.15% 0.10% 34 Front-end Load n/a 2.5% n/a 5% 35 CDSC n/a n/a 5% in year 1 down to 36 1% in year 6 37 38 Show each fund's expense ratio: 0.03% 0.75% 1.15% 0.50% 5 points 39 40 NAV: $12.13 $45.31 $11.99 $15.91 41 42 Calculate how many shares 43 would be purchased by an 44 investment of $1200 8 points 45 46 47 Which of these funds is most 4 points 48 likely an index fund? 49 Explain why you think so! 50 51 52 If you sell shares of Fund3 810 days 3 points 53 after you bought them, what would 54 your CDSC charge (%) be? 55 56 57 #3 From question #18 in the book: 58 "Loaded-up Fund charges a 12b-1 fee of 1% and maintains an expense ratio of 0.75%. Economy Fund charges a front-end load of 2%, but has no 12b-1 fee and an expense ratio of 0.25%" 59 60 What is the error in that question? 61 Sheet1 Ch5-7 + Ready @ + 106% Excel File Edit View Insert Format Tools Data Window Help 17%O Tue 8:40 AM chegg.com Spotlight - MySJU Content ST JOHN'S UNIVERSITY W... https://learn-us-east-1-pr... https://learn-us-east-1-pr.. Your Amazon.com Rental Expenses and Income 202... Get Homework Help With... X MF exercise-summer2020-stu Q- Search Sheet Home Insert Page Layout Formulas Data Review View + Share Calibri (Body) = 11 A- A- = Wrap Text General Y H Paste B I U A Merge & Center $ % > .00 1.0 Insert Delete ,00 Conditional Format Formatting as Table Format Cell Styles Sort & Filter A58 X fx - M 0.25% n/a A B D E F G H J K L 28 #2 Consider these 4 mutual funds: 29 30 FIN 3312-Fund1 FIN 3312-Fund2 FIN 3312-Fund3 FIN 3312-Fund4 31 Management Fee 0.02% 0.40% 0.60% 0.20% 32 12b-1 Fee 0.00% 0.20% 0.30% 0.20% 33 Other Fee 0.01% 0.15% 0.10% 34 Front-end Load n/a 2.5% n/a 5% 35 CDSC n/a n/a 5% in year 1 down to 36 1% in year 6 37 38 Show each fund's expense ratio: 0.03% 0.75% 1.15% 0.50% 5 points 39 40 NAV: $12.13 $45.31 $11.99 $15.91 41 42 Calculate how many shares 43 would be purchased by an 44 investment of $1200 8 points 45 46 47 Which of these funds is most 4 points 48 likely an index fund? 49 Explain why you think so! 50 51 52 If you sell shares of Fund3 810 days 3 points 53 after you bought them, what would 54 your CDSC charge (%) be? 55 56 57 #3 From question #18 in the book: 58 "Loaded-up Fund charges a 12b-1 fee of 1% and maintains an expense ratio of 0.75%. Economy Fund charges a front-end load of 2%, but has no 12b-1 fee and an expense ratio of 0.25%" 59 60 What is the error in that question? 61 Sheet1 Ch5-7 + Ready @ + 106%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started