Answered step by step

Verified Expert Solution

Question

1 Approved Answer

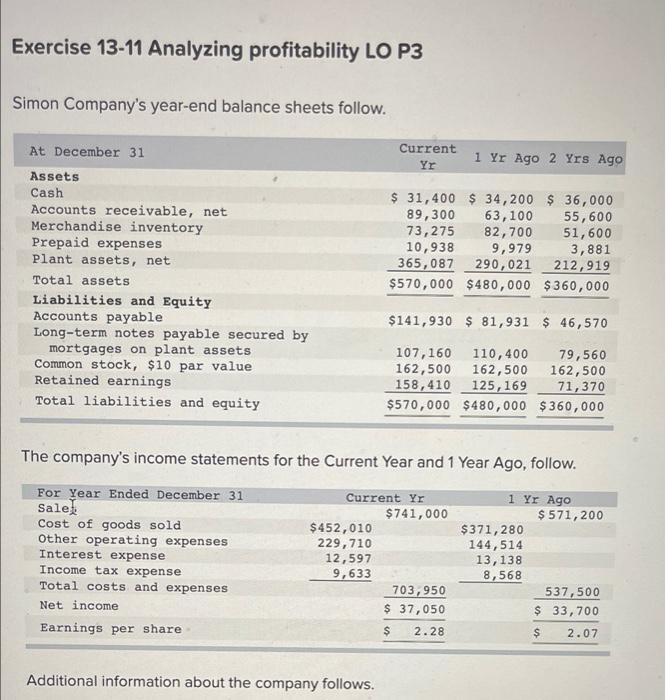

I need help please. Exercise 13-11 Analyzing profitability LO P3 Simon Company's year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2

I need help please.

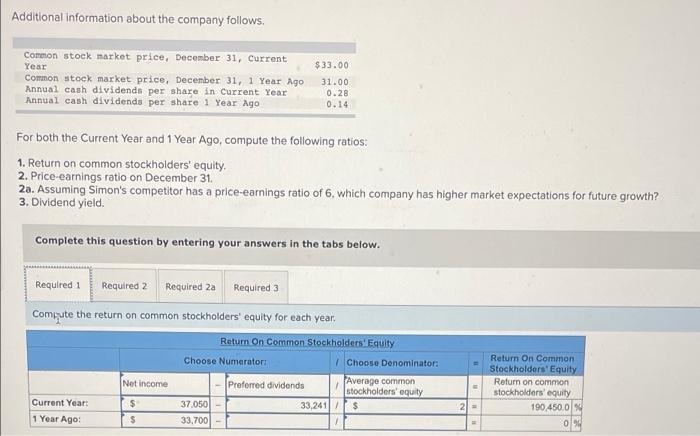

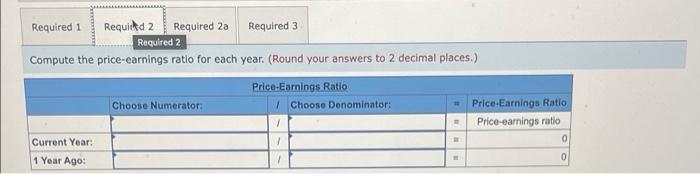

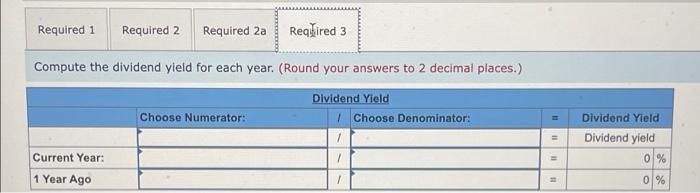

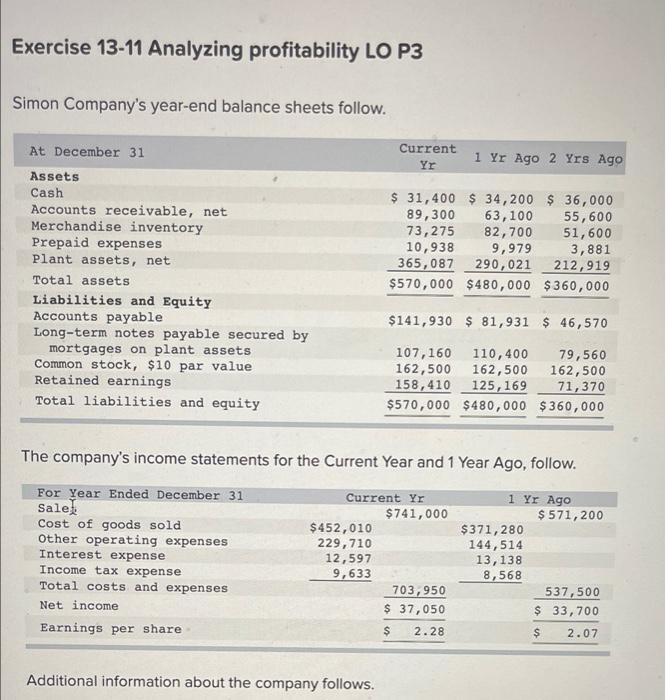

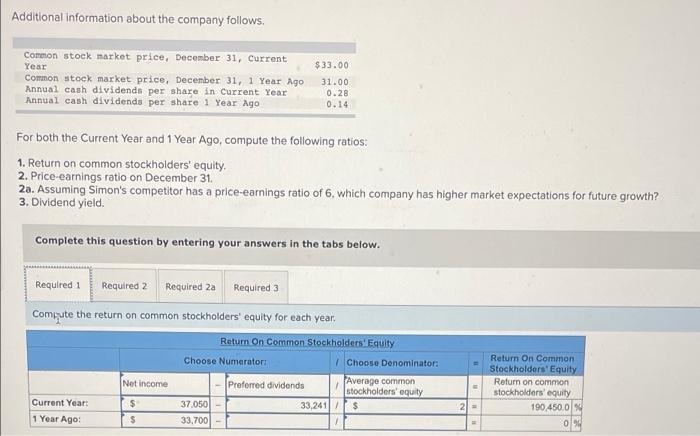

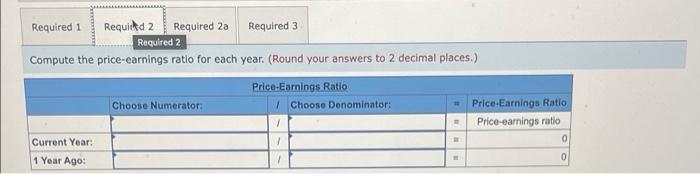

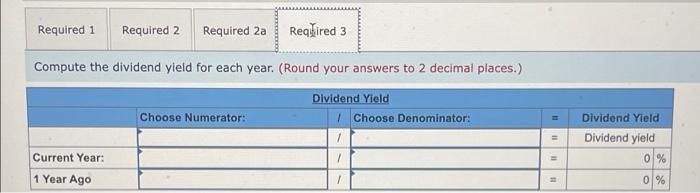

Exercise 13-11 Analyzing profitability LO P3 Simon Company's year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago Assets Cash $ 31,400 $ 34,200 $ 36,000 89,300 63,100 55,600 Accounts receivable, net Merchandise inventory 73,275 82,700 51,600 10,938 9,979 3,881 Prepaid expenses Plant assets, net 365,087 290,021 212,919 Total assets $570,000 $480,000 $360,000 Liabilities and Equity Accounts payable $141,930 $81,931 $ 46,570 Long-term notes payable secured by mortgages on plant assets 107,160 110,400 79,560 Common stock, $10 par value 162,500 162,500 162,500 Retained earnings 158,410 125,169 Total liabilities and equity 71,370 $480,000 $360,000 $570,000 The company's income statements for the Current Year and 1 Year Ago, follow. Current Yr 1 Yr Ago For Year Ended December 31 Sale! $741,000 Cost of goods sold $452,010 $371,280 Other operating expenses 229,710 144,514 Interest expense 13,138 Income tax expense 12,597 9,633 8,568 Total costs and expenses 703,950 Net income $ 37,050 Earnings per share $ 2.28 Additional information about the company follows. $ 571,200 537,500 $ 33,700 $ 2.07 Additional information about the company follows. Common stock market price, December 31, Current Year $33.00 31.00 Common stock market price, December 31, 1 Year Ago. Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago 0.28 0.14 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31. 2a. Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expectations for future growth? 3. Dividend yield. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the return on common stockholders' equity for each year. Return On Common Stockholders' Equity Choose Numerator: Return On Common Stockholders' Equity Return on common stockholders' equity Net income Preferred dividends Current Year: $ 37,050 190,450.0 % 0 1 Year Ago: $ 33,700 - 33,241/ 1 Choose Denominator: Average common stockholders' equity $ M 2 = = Required 1. Required 2 Required 2a Required 3 Required 2 Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Price-Earnings Ratio Choose Numerator: /Choose Denominator: Current Year: 7 1 Year Ago: 1 Price-Earnings Ratio Price-earnings ratio 0 0 Required 1 Required 2 Required 2a Required 3 Compute the dividend yield for each year. (Round your answers to 2 decimal places.) Dividend Yield Choose Numerator:: /Choose Denominator: 1 = Current Year: 1 = 1 Year Ago 11 Dividend Yield Dividend yield 0% 0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started