I need help solving this question

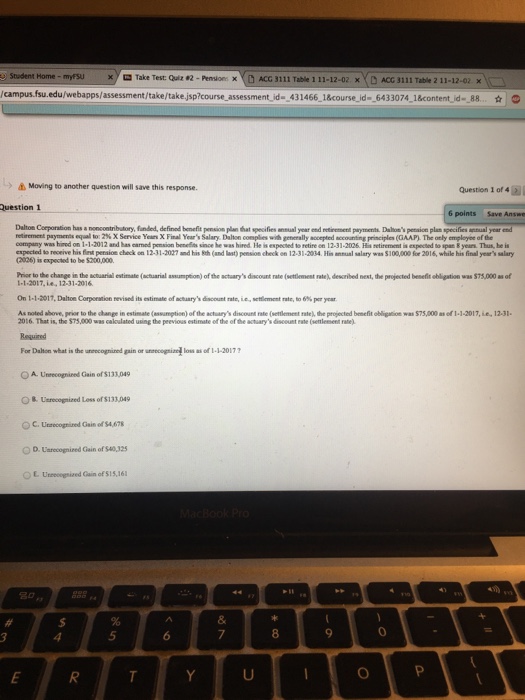

Take Test: Quz2-Pensions x ACG 3111 Table 1 11-12-02 xACG 3111 Table 2 11-12-02 x ampus.fsu.edu/webapps/assessment/take/takejsp?course assessment ide-431466_1&course ide 643 3074_1&content id.88 Stadent Home- myfSU Moving to another question will save this response. Question 1 of 411 uestion 1 6points Save Answe Deltoe Corporation has a noncontributory, fanded, defined benefit pension plan hat specifies ansual year end etirement payments Dahon's petaion plen specifies ual year end retrer ent payments equal to 2% X Service Yink Final Year's Salary Dalton comple-ith mnlye pied e u ing princ ple. (aAAn ne ely e pepe afbe company was hired on 1-1-2012 and has earned pension benelits since he was hired. He is expected to retire on 12-31-2026 His retirement in expected to span &years. Thus, he is espected to receive his fiest pension check on 12-31-2027 and his 8th (and last) pension check on 12-31-2034. His anual salery was $100,000 for 2016, while his final year's salary (2026) is expected to be $200,000 Prior to the change in the acouarial estimate (achuarial assumption) of the actuary's diacount rate (settlement rate), desoribed nest, the projected benefit obligation was $75,000 as of 1-1-2017, ie, 12-31-2016. On 1-1-2017, Dalton Corporation revised its estimate of.ctary'sdscout tate, ie.rtiment rate, to 6% per year As noted ahove, prior to the change in estimate (essumption) of the actuary's discount ratle (settlement rate), the projected benefit obligation was $75,000 as of 1-1-2017, ie, 12-31 2016. That is, the $75,000 was cakoulated using the peevious estimate of the of the actuary's discount eate (seleent a For Dalton what is the unecognined gain or uneecogsie loss as of 1-1-20177 A. Unrecognired Gain of$133,049 8. Utrecognized Loss of$133,049 OC. Uecognined Gain of $4,678 O D. Uarecognired Gain of $40,325 5 Take Test: Quz2-Pensions x ACG 3111 Table 1 11-12-02 xACG 3111 Table 2 11-12-02 x ampus.fsu.edu/webapps/assessment/take/takejsp?course assessment ide-431466_1&course ide 643 3074_1&content id.88 Stadent Home- myfSU Moving to another question will save this response. Question 1 of 411 uestion 1 6points Save Answe Deltoe Corporation has a noncontributory, fanded, defined benefit pension plan hat specifies ansual year end etirement payments Dahon's petaion plen specifies ual year end retrer ent payments equal to 2% X Service Yink Final Year's Salary Dalton comple-ith mnlye pied e u ing princ ple. (aAAn ne ely e pepe afbe company was hired on 1-1-2012 and has earned pension benelits since he was hired. He is expected to retire on 12-31-2026 His retirement in expected to span &years. Thus, he is espected to receive his fiest pension check on 12-31-2027 and his 8th (and last) pension check on 12-31-2034. His anual salery was $100,000 for 2016, while his final year's salary (2026) is expected to be $200,000 Prior to the change in the acouarial estimate (achuarial assumption) of the actuary's diacount rate (settlement rate), desoribed nest, the projected benefit obligation was $75,000 as of 1-1-2017, ie, 12-31-2016. On 1-1-2017, Dalton Corporation revised its estimate of.ctary'sdscout tate, ie.rtiment rate, to 6% per year As noted ahove, prior to the change in estimate (essumption) of the actuary's discount ratle (settlement rate), the projected benefit obligation was $75,000 as of 1-1-2017, ie, 12-31 2016. That is, the $75,000 was cakoulated using the peevious estimate of the of the actuary's discount eate (seleent a For Dalton what is the unecognined gain or uneecogsie loss as of 1-1-20177 A. Unrecognired Gain of$133,049 8. Utrecognized Loss of$133,049 OC. Uecognined Gain of $4,678 O D. Uarecognired Gain of $40,325 5

I need help solving this question

I need help solving this question