Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help to prepare entries to make a books correct and complete use the words from list of account The cash account of Blossom

I need help to prepare entries to make a books correct and complete use the words from list of account

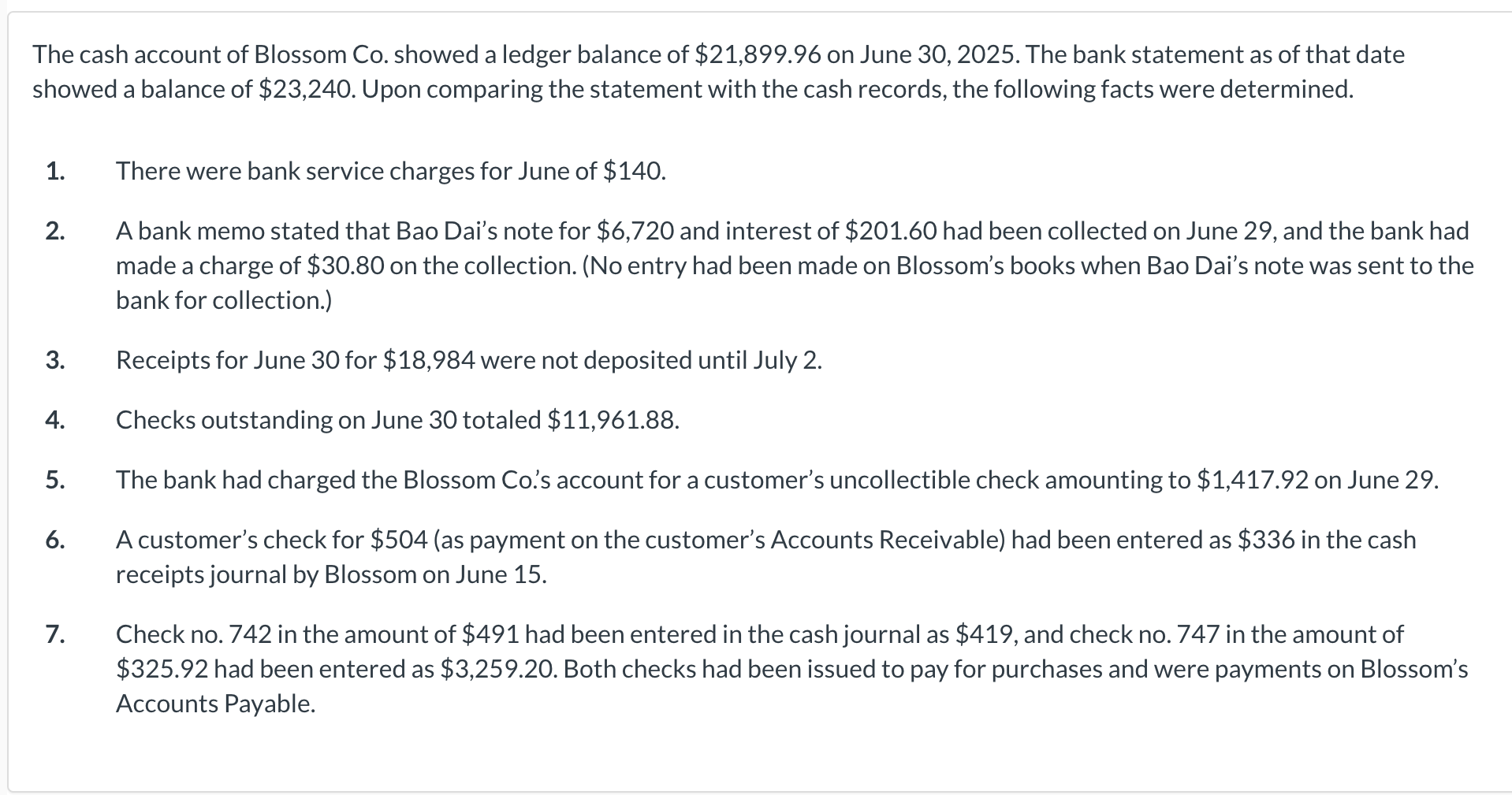

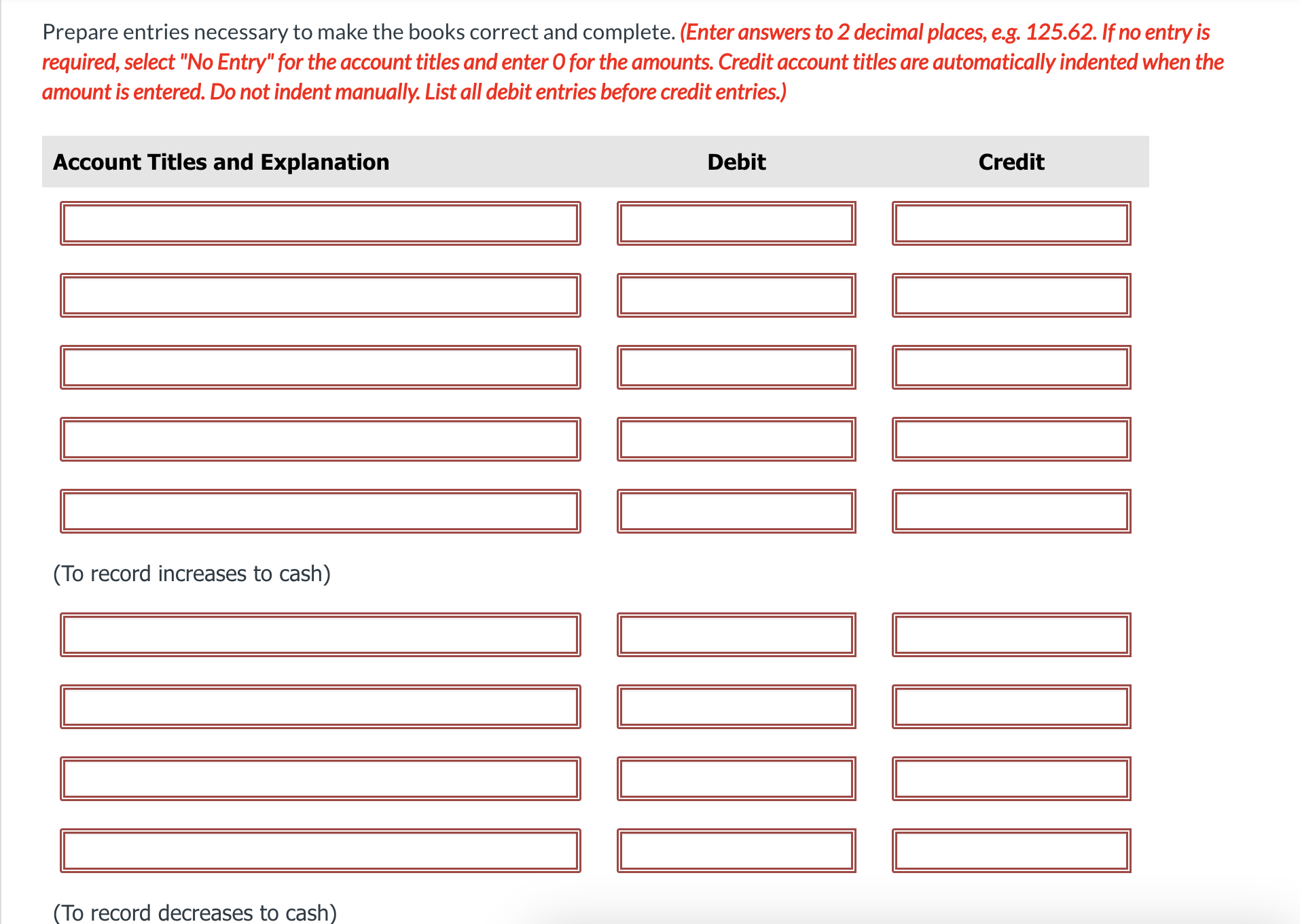

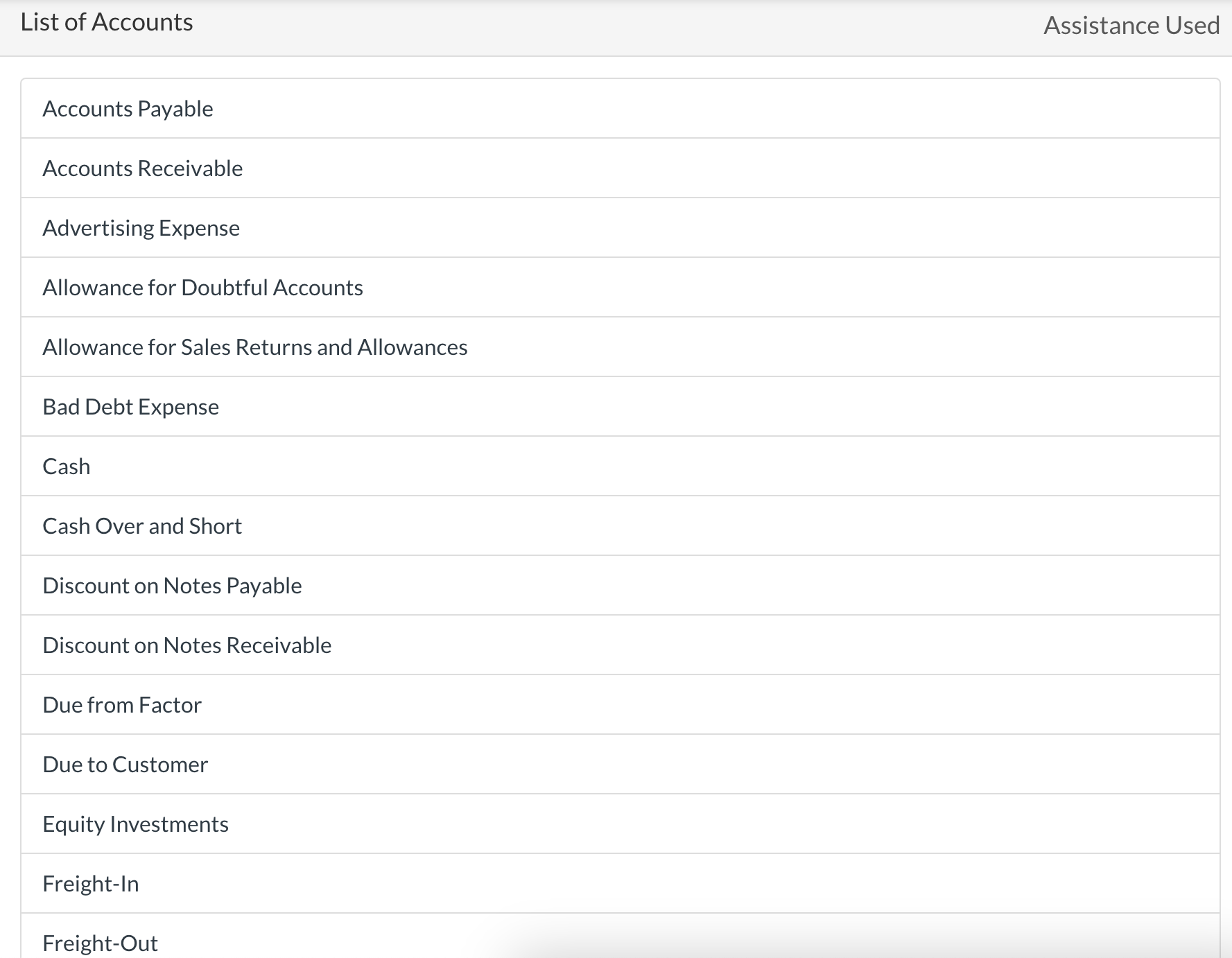

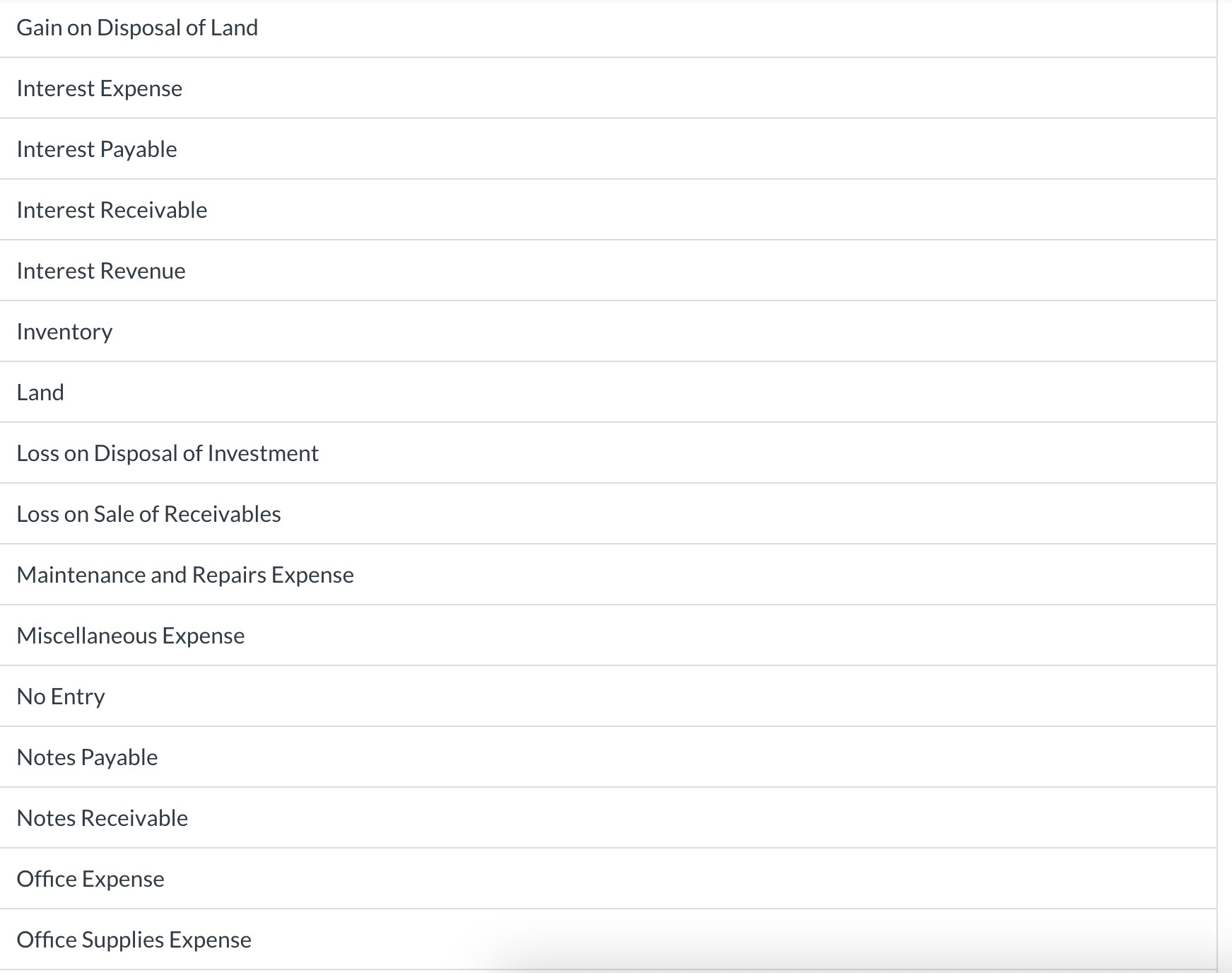

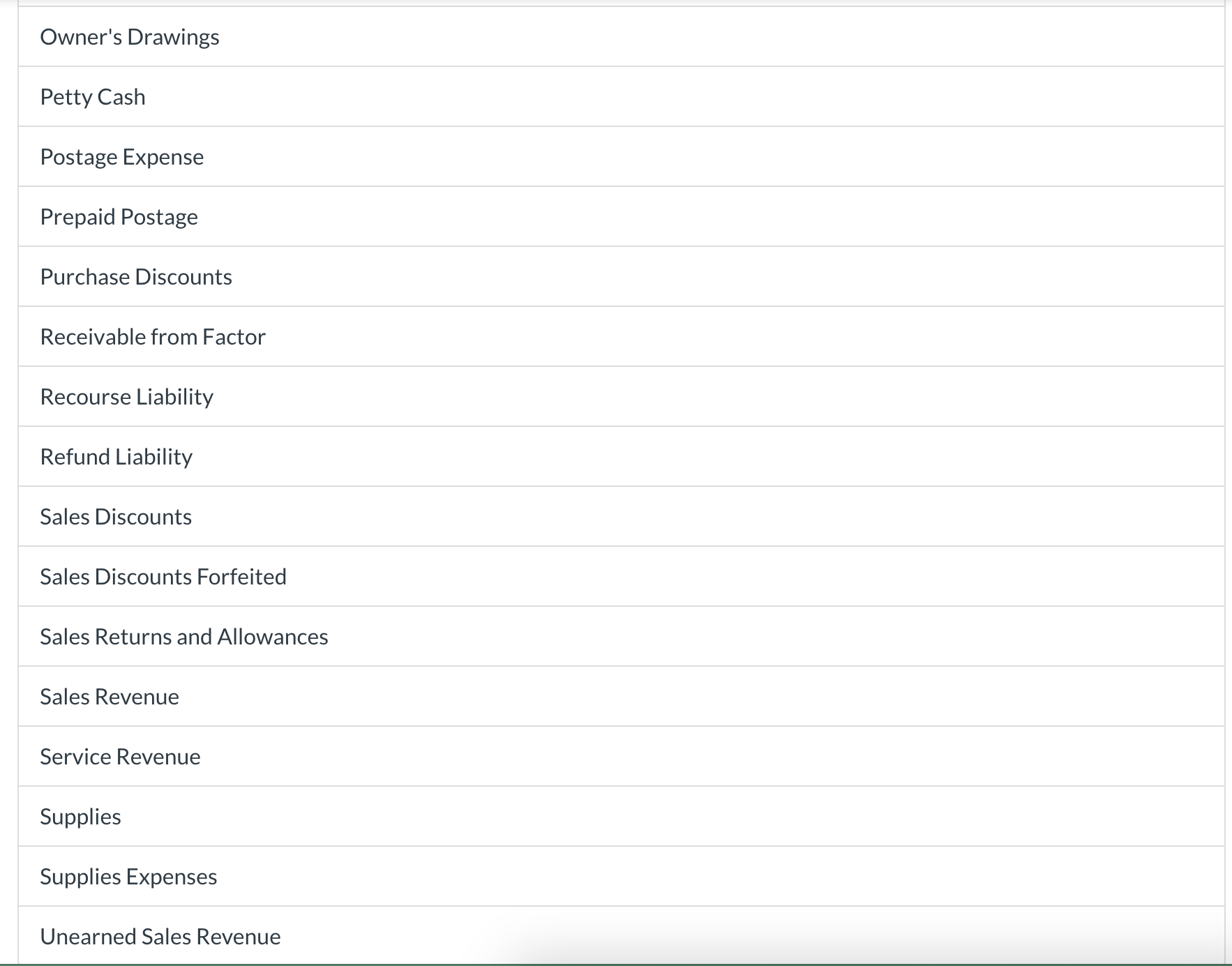

The cash account of Blossom Co. showed a ledger balance of $21,899.96 on June 30,2025 . The bank statement as of that date showed a balance of $23,240. Upon comparing the statement with the cash records, the following facts were determined. 1. There were bank service charges for June of $140. 2. A bank memo stated that Bao Dai's note for $6,720 and interest of $201.60 had been collected on June 29 , and the bank had made a charge of $30.80 on the collection. (No entry had been made on Blossom's books when Bao Dai's note was sent to the bank for collection.) 3. Receipts for June 30 for $18,984 were not deposited until July 2 . 4. Checks outstanding on June 30 totaled $11,961.88. 5. The bank had charged the Blossom Co.'s account for a customer's uncollectible check amounting to $1,417.92 on June 29 . 6. A customer's check for $504 (as payment on the customer's Accounts Receivable) had been entered as $336 in the cash receipts journal by Blossom on June 15. 7. Check no. 742 in the amount of $491 had been entered in the cash journal as $419, and check no. 747 in the amount of $325.92 had been entered as $3,259.20. Both checks had been issued to pay for purchases and were payments on Blossom's Accounts Payable. Prepare entries necessary to make the books correct and complete. (Enter answers to 2 decimal places, e.g. 125.62. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) List of Accounts Assistance Used Accounts Payable Accounts Receivable Advertising Expense Allowance for Doubtful Accounts Allowance for Sales Returns and Allowances Bad Debt Expense Cash Cash Over and Short Discount on Notes Payable Discount on Notes Receivable Due from Factor Due to Customer Equity Investments Freight-In Freight-Out Gain on Disposal of Land Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Loss on Disposal of Investment Loss on Sale of Receivables Maintenance and Repairs Expense Miscellaneous Expense No Entry Notes Payable Notes Receivable Office Expense Office Supplies Expense Owner's Drawings Petty Cash Postage Expense Prepaid Postage Purchase Discounts Receivable from Factor Recourse Liability Refund Liability Sales Discounts Sales Discounts Forfeited Sales Returns and Allowances Sales Revenue Service Revenue Supplies Supplies Expenses Unearned Sales Revenue

The cash account of Blossom Co. showed a ledger balance of $21,899.96 on June 30,2025 . The bank statement as of that date showed a balance of $23,240. Upon comparing the statement with the cash records, the following facts were determined. 1. There were bank service charges for June of $140. 2. A bank memo stated that Bao Dai's note for $6,720 and interest of $201.60 had been collected on June 29 , and the bank had made a charge of $30.80 on the collection. (No entry had been made on Blossom's books when Bao Dai's note was sent to the bank for collection.) 3. Receipts for June 30 for $18,984 were not deposited until July 2 . 4. Checks outstanding on June 30 totaled $11,961.88. 5. The bank had charged the Blossom Co.'s account for a customer's uncollectible check amounting to $1,417.92 on June 29 . 6. A customer's check for $504 (as payment on the customer's Accounts Receivable) had been entered as $336 in the cash receipts journal by Blossom on June 15. 7. Check no. 742 in the amount of $491 had been entered in the cash journal as $419, and check no. 747 in the amount of $325.92 had been entered as $3,259.20. Both checks had been issued to pay for purchases and were payments on Blossom's Accounts Payable. Prepare entries necessary to make the books correct and complete. (Enter answers to 2 decimal places, e.g. 125.62. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) List of Accounts Assistance Used Accounts Payable Accounts Receivable Advertising Expense Allowance for Doubtful Accounts Allowance for Sales Returns and Allowances Bad Debt Expense Cash Cash Over and Short Discount on Notes Payable Discount on Notes Receivable Due from Factor Due to Customer Equity Investments Freight-In Freight-Out Gain on Disposal of Land Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Loss on Disposal of Investment Loss on Sale of Receivables Maintenance and Repairs Expense Miscellaneous Expense No Entry Notes Payable Notes Receivable Office Expense Office Supplies Expense Owner's Drawings Petty Cash Postage Expense Prepaid Postage Purchase Discounts Receivable from Factor Recourse Liability Refund Liability Sales Discounts Sales Discounts Forfeited Sales Returns and Allowances Sales Revenue Service Revenue Supplies Supplies Expenses Unearned Sales Revenue Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started