Answered step by step

Verified Expert Solution

Question

1 Approved Answer

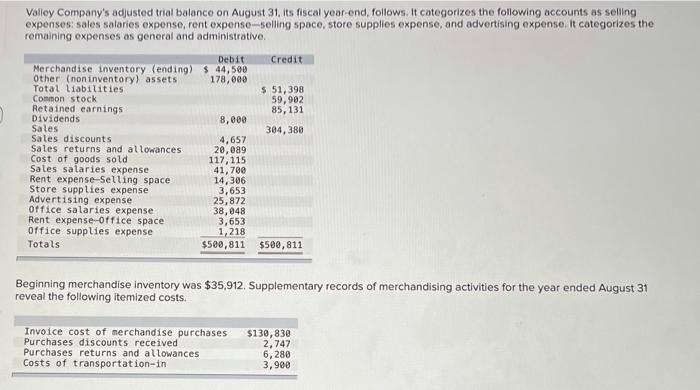

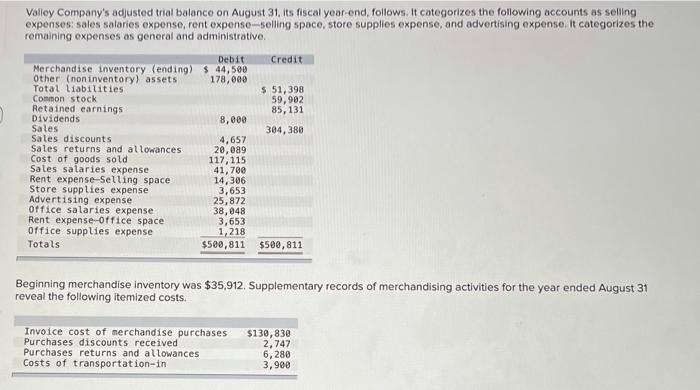

i need help Volley Company's adjusted trial balance on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries

i need help

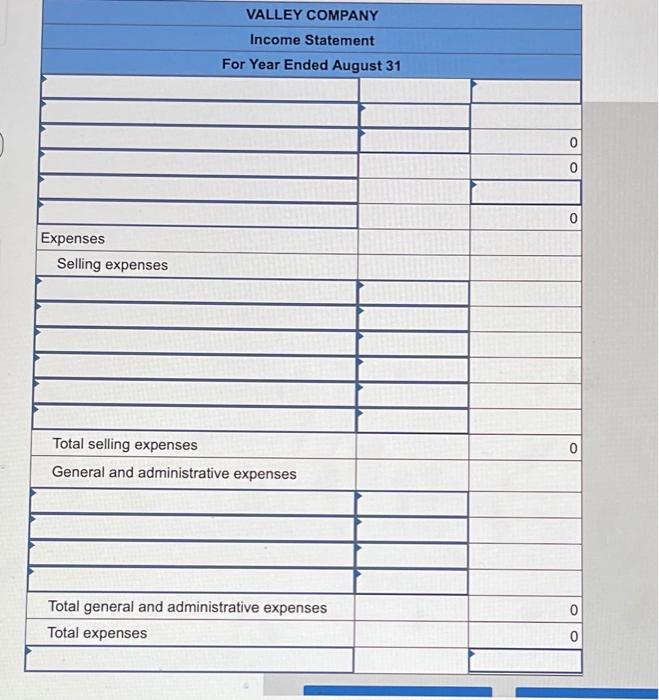

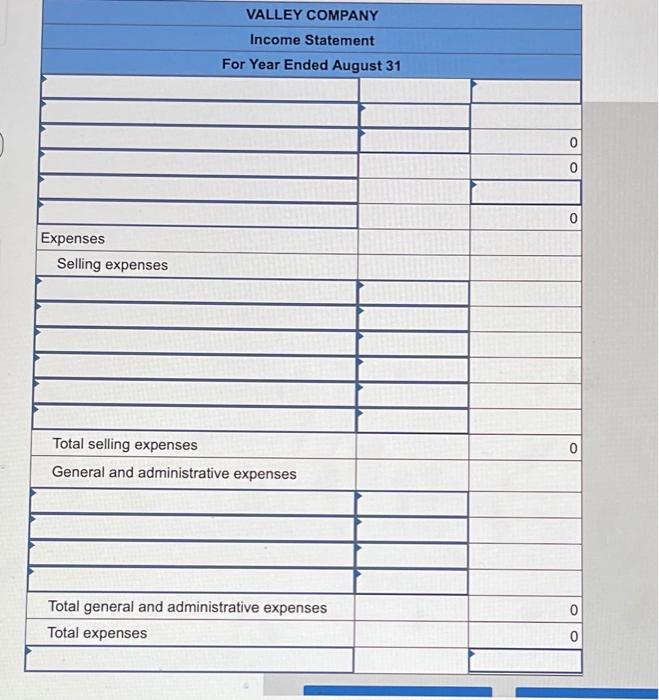

Volley Company's adjusted trial balance on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Credit $ 51,398 59,902 85,131 384,380 Debit Merchandise inventory (ending) $ 44,500 Other (non inventory) assets 178,000 Total liabilities Common stock Retained earnings Dividends 8,000 Sales Sales discounts 4,657 Sales returns and allowances 20,089 Cost of goods sold 117, 115 Sales salaries expense 41,700 Rent expense-Selling space 14,306 Store supplies expense 3,653 Advertising expense 25,872 Office salaries expense 38,048 Rent expense-office space 3,653 office supplies expense 1,218 Totals $500,811 $500,811 Beginning merchandise inventory was $35,912. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Invoice cost of merchandise purchases Purchases discounts received Purchases returns and allowances Costs of transportation-in $130,830 2,747 6,280 3,900 reveu 1. Compute the company's net sales for the year 2. Compute the company's total cost of merchandise purchased for the year 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. VALLEY COMPANY Income Statement For Year Ended August 31 0 0 o 0 Expenses Selling expenses o Total selling expenses General and administrative expenses 0 Total general and administrative expenses Total expenses 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started