Answered step by step

Verified Expert Solution

Question

1 Approved Answer

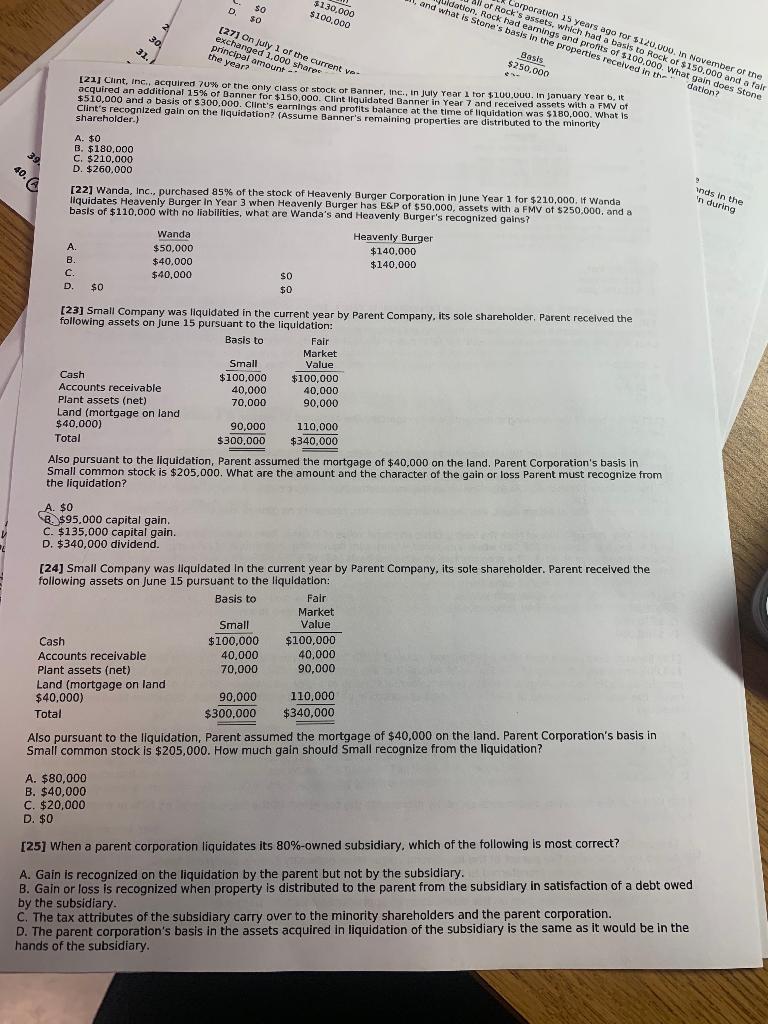

I need help with #21, #22, #24, and #25 please D. so $130.000 $200,000 Corporation 15 years ago for $120.000. In November of the all

I need help with #21, #22, #24, and #25 please

D. so $130.000 $200,000 Corporation 15 years ago for $120.000. In November of the all of Rock's assets, which had a basis to Rock of $150.000 and a fair dation, Rock had earrings and profits of $100.000. What gain does Stone and what is Stone's basis in the properties received in the dation? Basis $250,000 so 30. (27) On July 1 of the current ve- exchanged 2.000 shares principal amount -- the year? 31. [21] Clint, Inc., acquired 70% of the only class of stock of Banner, Inc., in July Tear 1 for $100.00U. In January Year b.it acquired an additional 15% of Banner for $150,000. Clint liquidated Banner in Year 7 and received assets with a FMV of $510,000 and a basis of $300.000. Clint's earnings and profits balance at the time of liquidation was $180,000. What is Clint's recognized gain on the liquidation? (Assure Banner's remaining properties are distributed to the minority shareholder.) 39. A. $0 B. $180,000 C. $210.000 D. $260,000 40. . Ynds in the in during [22] Wanda, Inc.. purchased 85% of the stock of Heavenly Burger Corporation in June Year 1 for $210,000. If Wanda liquidates Heavenly Burger in Year 3 when Heavenly Burger has E&P of $50,000, assets with a FMV of $250,000, and a basis of $110,000 with no liabilities, what are Wanda's and Heavenly Burger's recognized gains? Wanda Heavenly Burger A. $50,000 $140,000 B. $40,000 $140.000 C. $40,000 SO D. $0 $0 [23] Small Company was liquidated in the current year by Parent Company, its sole shareholder. Parent received the following assets on June 15 pursuant to the liquidation: Basis to Fair Market Small Value Cash $100,000 $100,000 Accounts receivable 40,000 40,000 Plant assets (net) 70,000 90,000 Land (mortgage on land $40,000) 90,000 110,000 Total $300,000 $340,000 = Also pursuant to the liquidation, Parent assumed the mortgage of $40,000 on the land. Parent Corporation's basis in Small common stock is $205,000. What are the amount and the character of the gain or loss Parent must recognize from the liquidation? A. $0 3. $95.000 capital gain. C. $135,000 capital gain. D. $340,000 dividend. [24) Small Company was liquidated in the current year by Parent Company, its sole shareholder. Parent received the following assets on June 15 pursuant to the liquidation: Basis to Fair Market Small Value Cash $100,000 $100,000 Accounts receivable 40,000 40,000 Plant assets (net) 70,000 Land (mortgage on land $40,000) 90,000 110,000 Total $300,000 $340,000 Also pursuant to the liquidation, Parent assumed the mortgage of $40,000 on the land. Parent Corporation's basis in Small common stock is $205,000. How much gain should Small recognize from the liquidation? 90,000 A. $80,000 B. $40,000 C. $20,000 D. $0 [25] When a parent corporation liquidates its 80%-owned subsidiary, which of the following is most correct? A. Gain is recognized on the liquidation by the parent but not by the subsidiary. B. Gain or loss is recognized when property is distributed to the parent from the subsidiary in satisfaction of a debt owed by the subsidiary. C. The tax attributes of the subsidiary carry over to the minority shareholders and the parent corporation. D. The parent corporation's basis in the assets acquired in liquidation of the subsidiary is the same as it would be in the hands of the subsidiaryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started