I need help with an Accounting 2 Chapter 13 exercise thank you, this is the same question from book and blank paper... 13-10 Excercise in book and paper

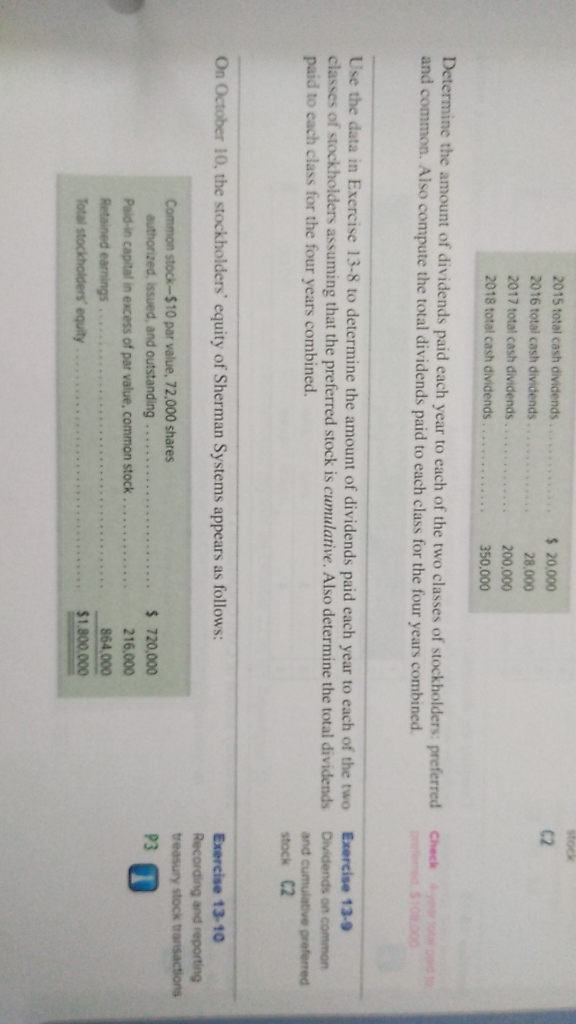

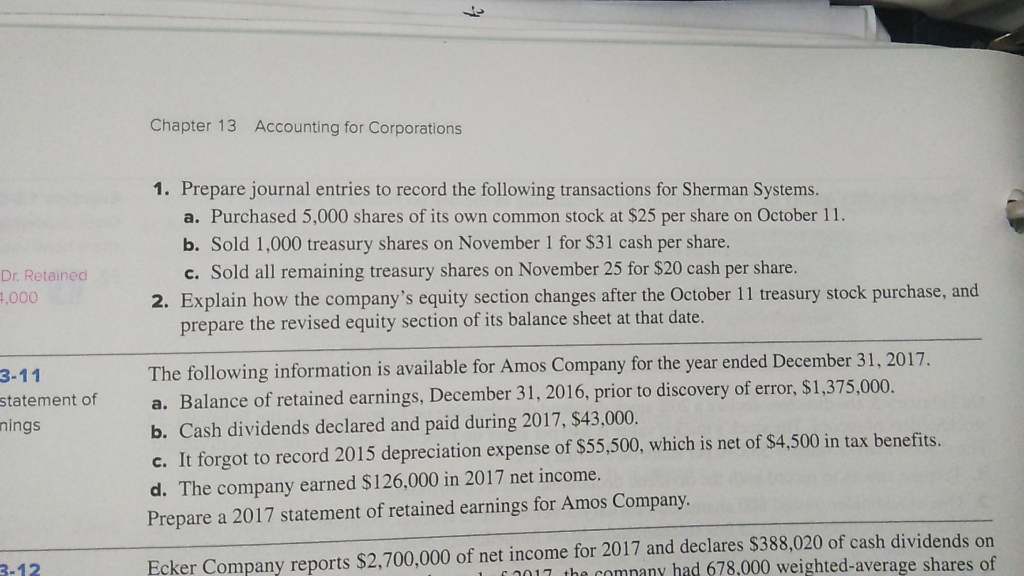

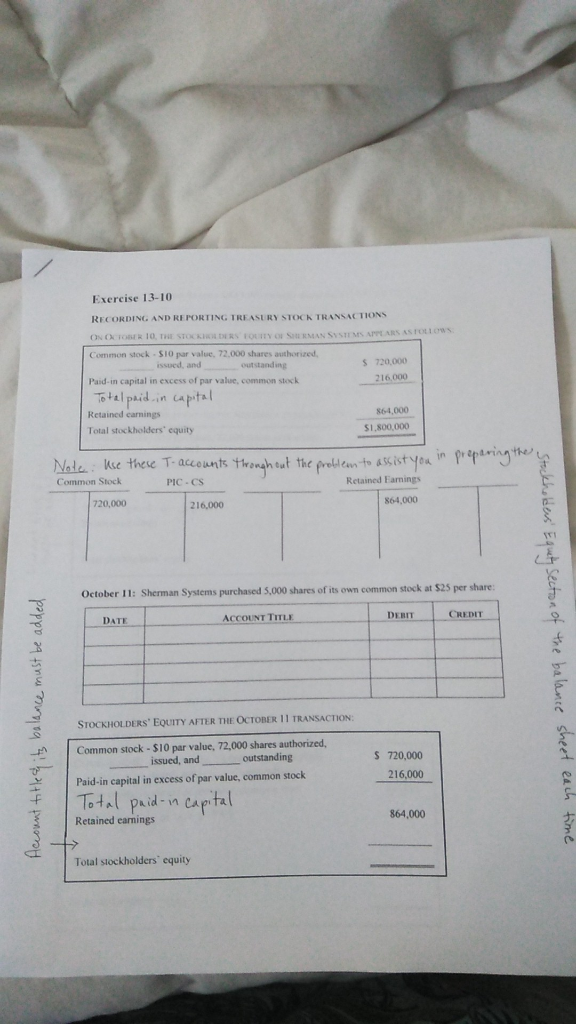

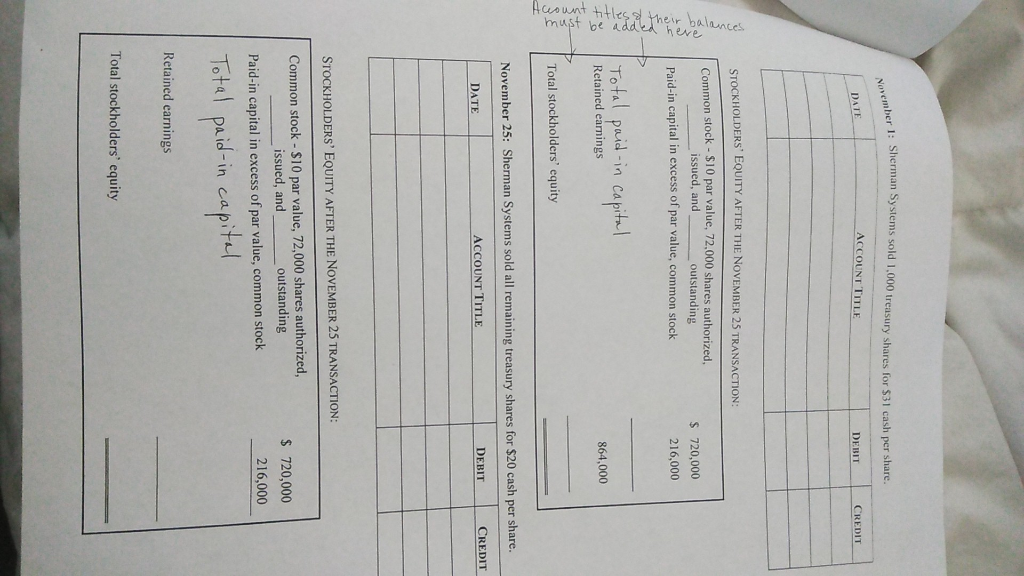

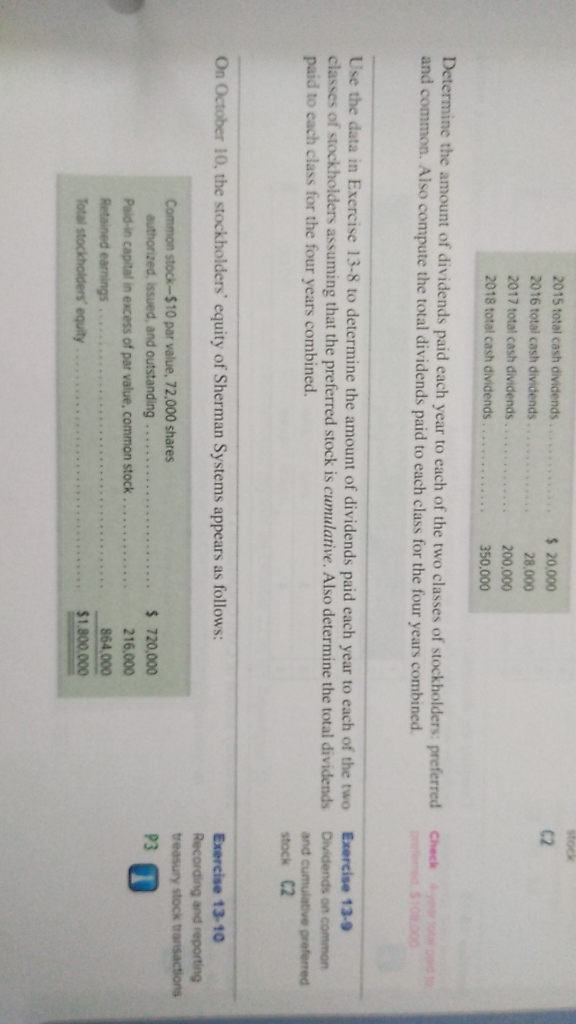

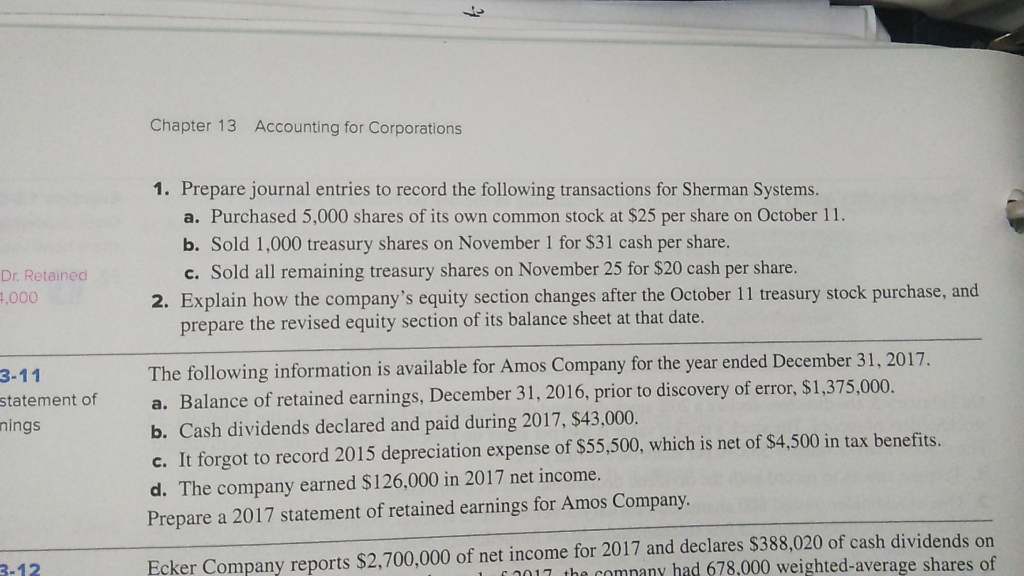

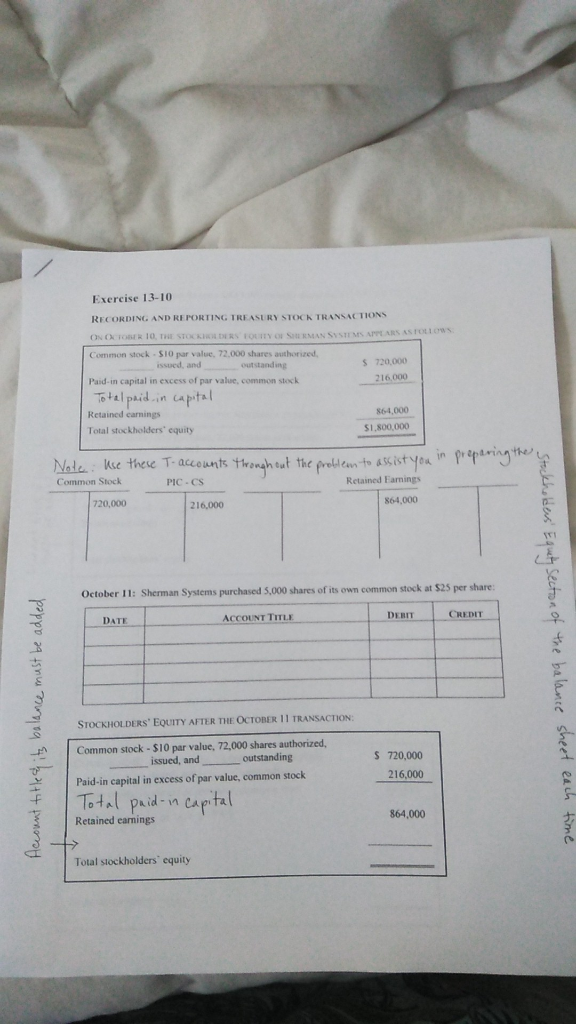

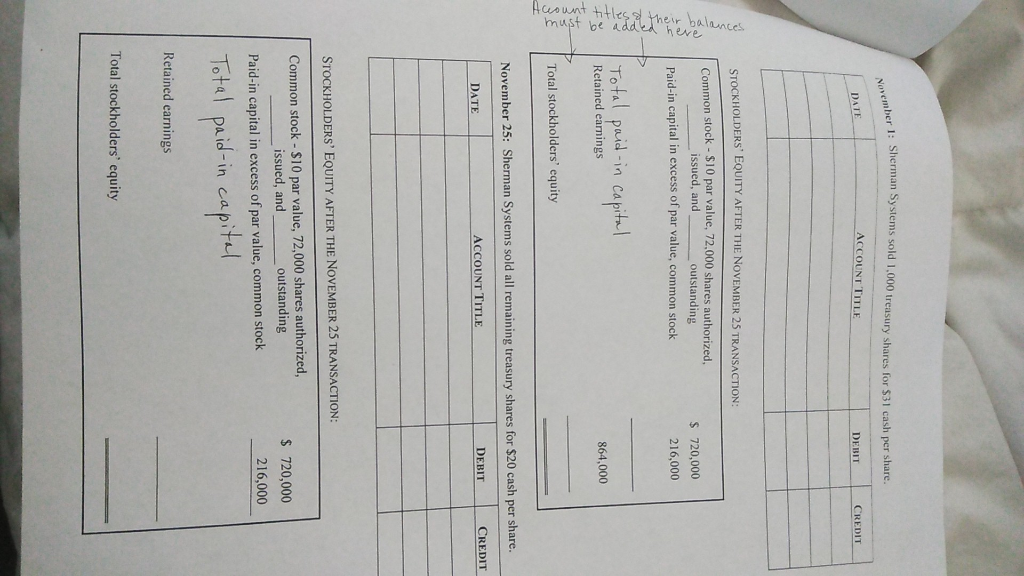

2015 total cash dividends 2016 total cash dividends 2017 total cash dividends 2018 total cash dividends. $ 20,000 28,000 200.000 350.000 Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. Check Use the data in Exercise 13-8 to determine the amount of dividends paid each year to each of the two classes of stockholders assuming that the preferred stock is cumulative. Also determine the total dividends paid to each class for the four years combined. Exercise 13-9 Dividends on common and cumulative preferred stock C2 On October 10, the stockholders' equity of Sherman Systems appears as follows: Exercise 13-10 Recording and reporting treasury stock transactions 23 Common stock-$10 par value, 72,000 shares authorized, issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings .... Total stockholders' equity $ 720,000 216.000 864,000 $1.800.000 Chapter 13 Accounting for Corporations 1. Prepare journal entries to record the following transactions for Sherman Systems. a. Purchased 5,000 shares of its own common stock at $25 per share on October 11. b. Sold 1,000 treasury shares on November 1 for $31 cash per share. c. Sold all remaining treasury shares on November 25 for $20 cash per share. 2. Explain how the company's equity section changes after the October 11 treasury stock purchase, and prepare the revised equity section of its balance sheet at that date. Dr. Retained 4,000 3-11 statement of nings The following information is available for Amos Company for the year ended December 31, 2017, a. Balance of retained earnings, December 31, 2016, prior to discovery of error, $1,375,000. b. Cash dividends declared and paid during 2017, $43,000. c. It forgot to record 2015 depreciation expense of $55,500, which is net of $4,500 in tax benefits. d. The company earned $126,000 in 2017 net income. Prepare a 2017 statement of retained earnings for Amos Company. 3-12 Ecker Company reports $2,700,000 of net income for 2017 and declares $388,020 of cash dividends on 1 2017 the comnany had 678,000 weighted average shares of Exercise 13-10 RECORDING AND REPORTING TREASURY STOCK TRANSACTIONS ONO ROBERTO THE TO R TLITY MANSISTO RS AS FOLLOW Common stock - S10 par value, 72.000 shares authorized issued, and outstanding 5720000 Paid-in capital in excess of par value, common stock 216.000 Total paid in capital Retained carnings 864,000 Total stockholders' equity $1,800,000 Note: Use these T-accounts through out the problem to assist you in preparing the y Common Stock PIC-CS Retained Farnings 720,000 216,000 864,000 Stockholders' Equity section of the balance October 11: Sherman Systems purchased 5,000 shares of its own common stock at $25 per share DEBIT ACCOUNT TITLE CREDIT DATE Account title & its balance must be added STOCKHOLDERS' EQUITY AFTER THE OCTOBER 11 TRANSACTION S 720,000 216,000 Common stock - $10 par value, 72.000 shares authorized, issued, and outstanding Paid-in capital in excess of par value, common stock Total paid-in capital Retained earings sheet each 864,000 time Total stockholders' equity her 1: Sherman Systems sold 1,000 treasury shares for $31 cash per share. November 1: She DATE ACCOUNT TITLE DEBIT CREDIT STOCKHOLDERS' EQUITY AFTER THE NOVEMBER 25 TRANSACTION: Common stock - $10 par value, 72,000 shares authorized issued, and outstanding Paid-in capital in excess of par value, common stock $ 720,000 216,000 Account titles & their balances must be added here Total paid in capital Retained earnings 864.000 Total stockholders' equity November 25: Sherman Systems sold all remaining treasury shares for $20 cash per share. ACCOUNT TITLE DATE DEBIT CREDIT STOCKHOLDERS' EQUITY AFTER THE NOVEMBER 25 TRANSACTION: Common stock - $10 par value, 72,000 shares authorized, issued, and outstanding Paid-in capital in excess of par value, common stock Total paid-in capital $ 720,000 216,000 Retained earnings Total stockholders' equity